1/7

What’s the easiest way to tokenize Bitcoin to use it on Ethereum DeFi?

Use the Bridge from Ren Project, which is what I focused on in my new research piece. https://www.theblockcrypto.com/genesis/92696/ren-cross-chain-swaps

What’s the easiest way to tokenize Bitcoin to use it on Ethereum DeFi?

Use the Bridge from Ren Project, which is what I focused on in my new research piece. https://www.theblockcrypto.com/genesis/92696/ren-cross-chain-swaps

2/7

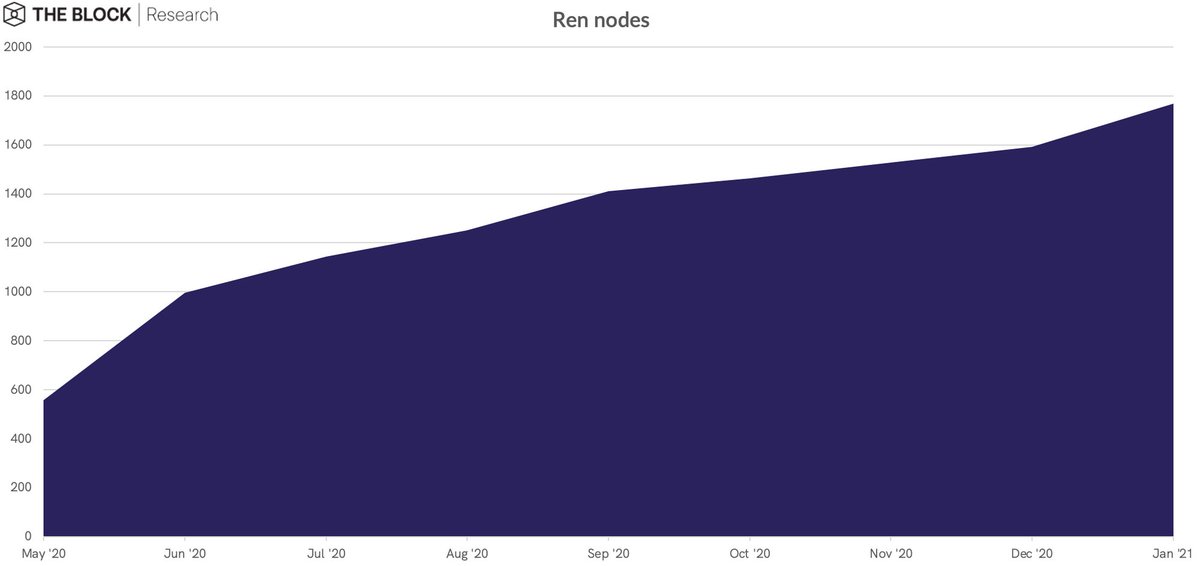

Ren is a kind of a blockchain, whose main task is the coordination of actions for the security deposit of assets in one’s chains and the release of their tokenized versions on others.

For this work, network nodes that stake 100k REN receive a fee.

Ren is a kind of a blockchain, whose main task is the coordination of actions for the security deposit of assets in one’s chains and the release of their tokenized versions on others.

For this work, network nodes that stake 100k REN receive a fee.

3/7

This month’s fee has exceeded $1M, which is a record high for Ren.

However, due to a large number of nodes, each one earns about $550 this month.

At the same time, each of them staked about $56k REN.

This month’s fee has exceeded $1M, which is a record high for Ren.

However, due to a large number of nodes, each one earns about $550 this month.

At the same time, each of them staked about $56k REN.

4/7

Interestingly, 99% of assets minted with Ren are the tokenized version of BTC — renBTC.

Using renBTC, users can turn their bitcoins into the most liquid bitcoin token — WBTC, without KYC.

Interestingly, 99% of assets minted with Ren are the tokenized version of BTC — renBTC.

Using renBTC, users can turn their bitcoins into the most liquid bitcoin token — WBTC, without KYC.

5/7

For this reason, it’s not surprising that the renBTC mints peak falls precisely on The Summer of DeFi.

Also, don’t forget that in the last few DeFi exploits, renBTC was used to cash out into Bitcoin.

For this reason, it’s not surprising that the renBTC mints peak falls precisely on The Summer of DeFi.

Also, don’t forget that in the last few DeFi exploits, renBTC was used to cash out into Bitcoin.

6/7

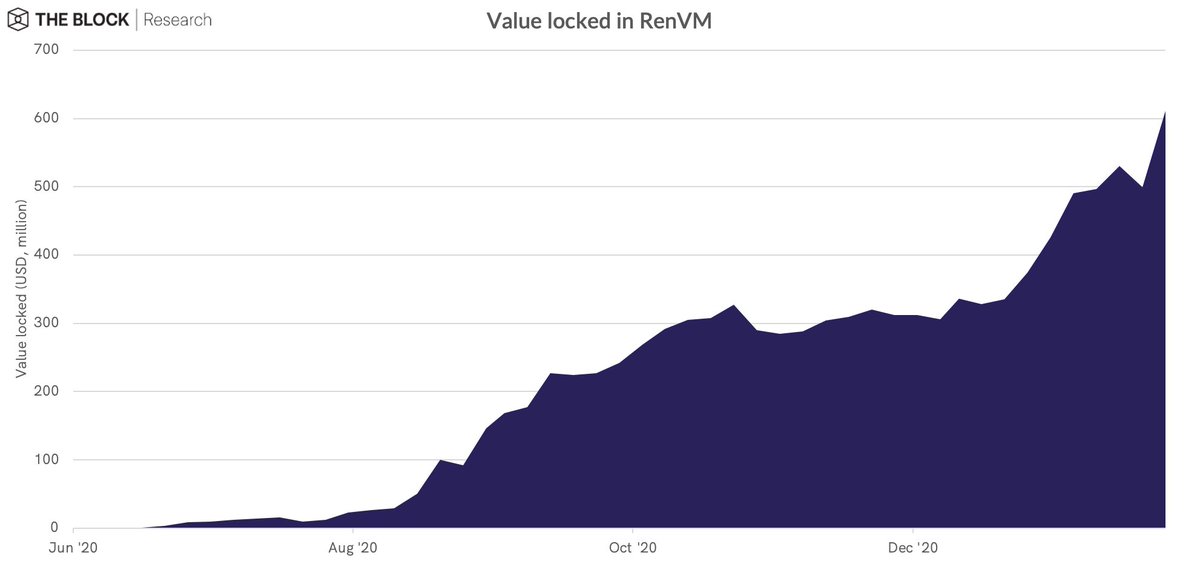

Ren’s main issue is its centralization since all the $600M of collateral is controlled by the nodes managed by the Ren team right now.

Because of this, there is no understanding of whether the project will work successfully after decentralization or not.

Ren’s main issue is its centralization since all the $600M of collateral is controlled by the nodes managed by the Ren team right now.

Because of this, there is no understanding of whether the project will work successfully after decentralization or not.

Read on Twitter

Read on Twitter