There is short manipulation in the market.

Just not by who you expect.

Thread time

Just not by who you expect.

Thread time

In a recorded video, Jim Cramer openly admitted to circulating false rumors to drive his shorts down and said “everybody does it.” https://twitter.com/StockJabber/status/1354784794207379456

In 2006, SAC Capital was sued for allegedly drafting and delaying negative research on a pharma company to benefit their short position.

SAC went on to pay a $1.8 billion fine for insider trading.

SAC went on to pay a $1.8 billion fine for insider trading.

In 2016, @gmorgenson published a great piece outlining allege failures of Goldman to properly borrow stock and facilitate legal short sales:

“Goldman’s failure meant that some of its clients were unknowingly breaching this important rule.” https://www.nytimes.com/2016/01/31/business/case-sheds-light-on-goldmans-role-as-lender-in-short-sales.html

“Goldman’s failure meant that some of its clients were unknowingly breaching this important rule.” https://www.nytimes.com/2016/01/31/business/case-sheds-light-on-goldmans-role-as-lender-in-short-sales.html

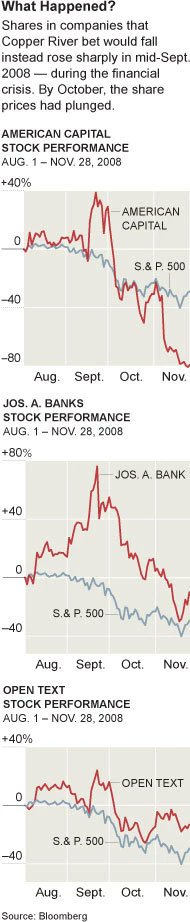

Also, when Goldman shut down the Copper River short hedge fund, they allegedly leaked the positions before covering.

This caused the positions to skyrocket, which meant massive losses for the fund and massive gains for friends of Goldman.

This caused the positions to skyrocket, which meant massive losses for the fund and massive gains for friends of Goldman.

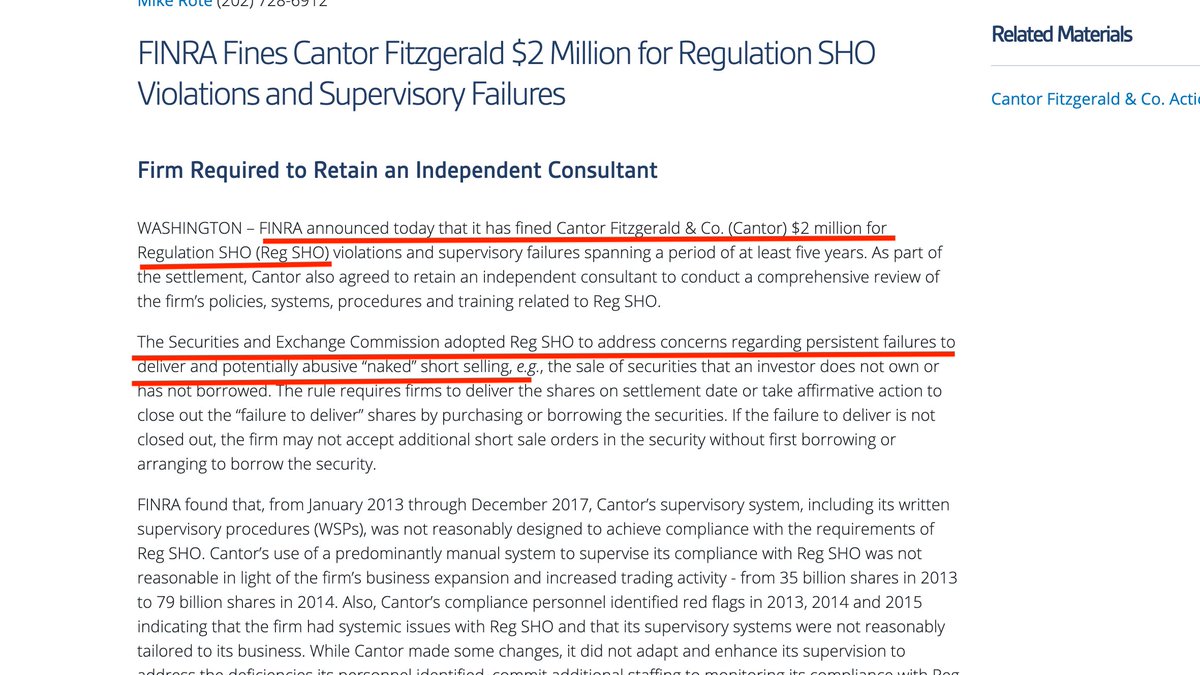

In 2019, Cantor Fitzgerald paid a $2 million fine over “concerns regarding persistent failures to deliver and potentially abusive ‘naked’ short selling.”

Three months ago, Morgan Stanley paid a $5 million fine “for violations of Regulation SHO, the regulatory framework governing short sales.”

Day in and day out bad actors on Wall Street behave unethically and illegally.

Yet the one time the public starts making money at the expense of Wall Street they get restricted.

Prosecute all bad actors, but keep the markets open to all.

Yet the one time the public starts making money at the expense of Wall Street they get restricted.

Prosecute all bad actors, but keep the markets open to all.

Short-sellers also do tremendous good for the markets by uncovering wrongdoing, acting as whistleblowers, and serving as a counterbalance to overenthusiastic markets.

But if shorting 150% of the float blows up in your face, then tough luck.

But if shorting 150% of the float blows up in your face, then tough luck.

If you want to learn more about fraud, finance, and short-selling please consider joining my newsletter.

I will give an in-depth review of the Reddit & Robinhood situation on Monday https://thebearcave.substack.com/

https://thebearcave.substack.com/

I will give an in-depth review of the Reddit & Robinhood situation on Monday

https://thebearcave.substack.com/

https://thebearcave.substack.com/

Read on Twitter

Read on Twitter