I know this is a photography page, but I have been paying close attention to the financial trends that have put us in today’s situation.

The institutions only have this much control over us because of the currency we use.

And Crypto is the answer.

Here’s why.

A THREAD (1/18)

The institutions only have this much control over us because of the currency we use.

And Crypto is the answer.

Here’s why.

A THREAD (1/18)

The most powerful institution in this country is not our Congress or the White House. It’s the Federal Banks. The Federal Banks have the power to freely pump and remove as much money from the economy as they see fit. This includes bailouts for massive corporations.

The Federal Reserve printed $9 TRILLION dollars in 2020. That’s 22% of the current circulating US Dollar. That’s enough for $43,000 PER ADULT in America.

Then why did we only see $1,800 that entire year? Because that money wasn’t for us. It was for Wall Street and the big Corps

Then why did we only see $1,800 that entire year? Because that money wasn’t for us. It was for Wall Street and the big Corps

The Banks aren’t your friend and never will be. The Federal Reserve refuses to release details about who it cooperates with to pump value into the stock market.

Many of the richest people in the world are all working together to keep themselves rich at any cost.

Many of the richest people in the world are all working together to keep themselves rich at any cost.

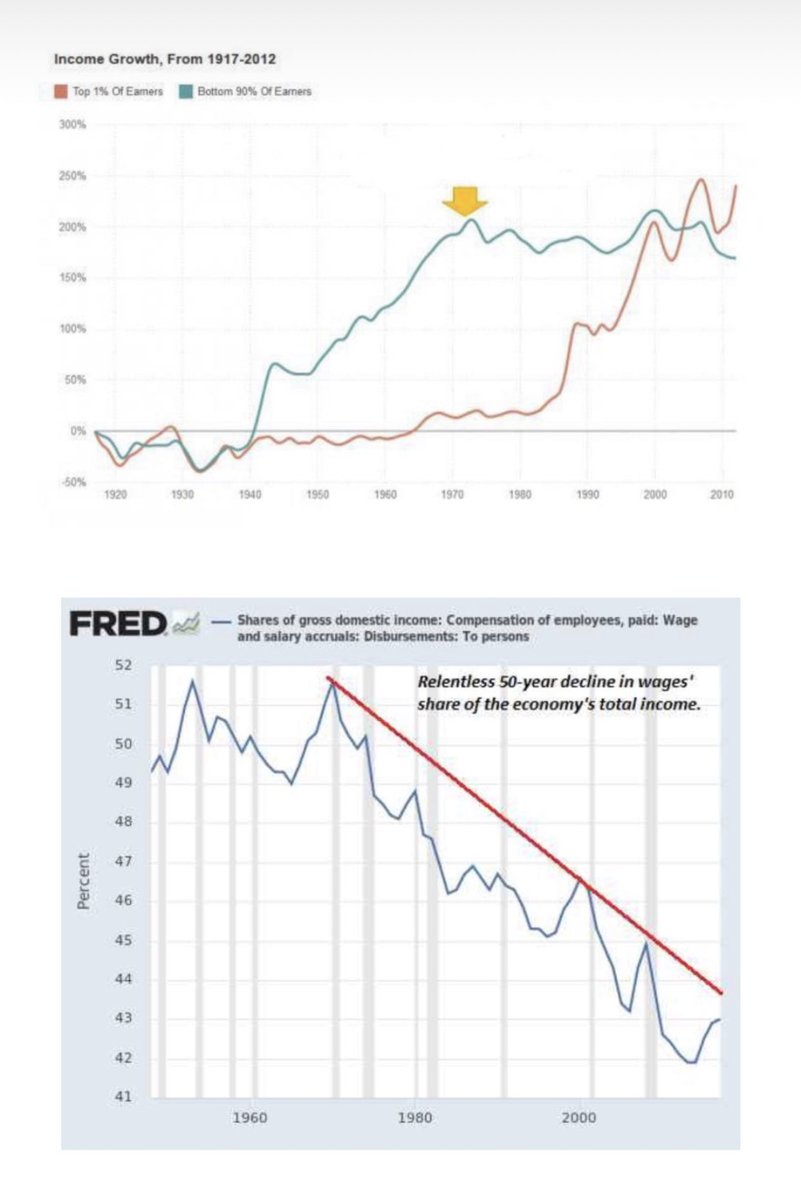

The rich are only rich in comparison to the general public. If the general public suddenly makes more money - they don’t have as much buying power over the people anymore. That’s Economics 101.

The poorer the people, the wealthier the rich are.

The poorer the people, the wealthier the rich are.

That’s why they are trying so hard to stop us now, and the only reason they are able to do so is because they have full control over our centralized currency.

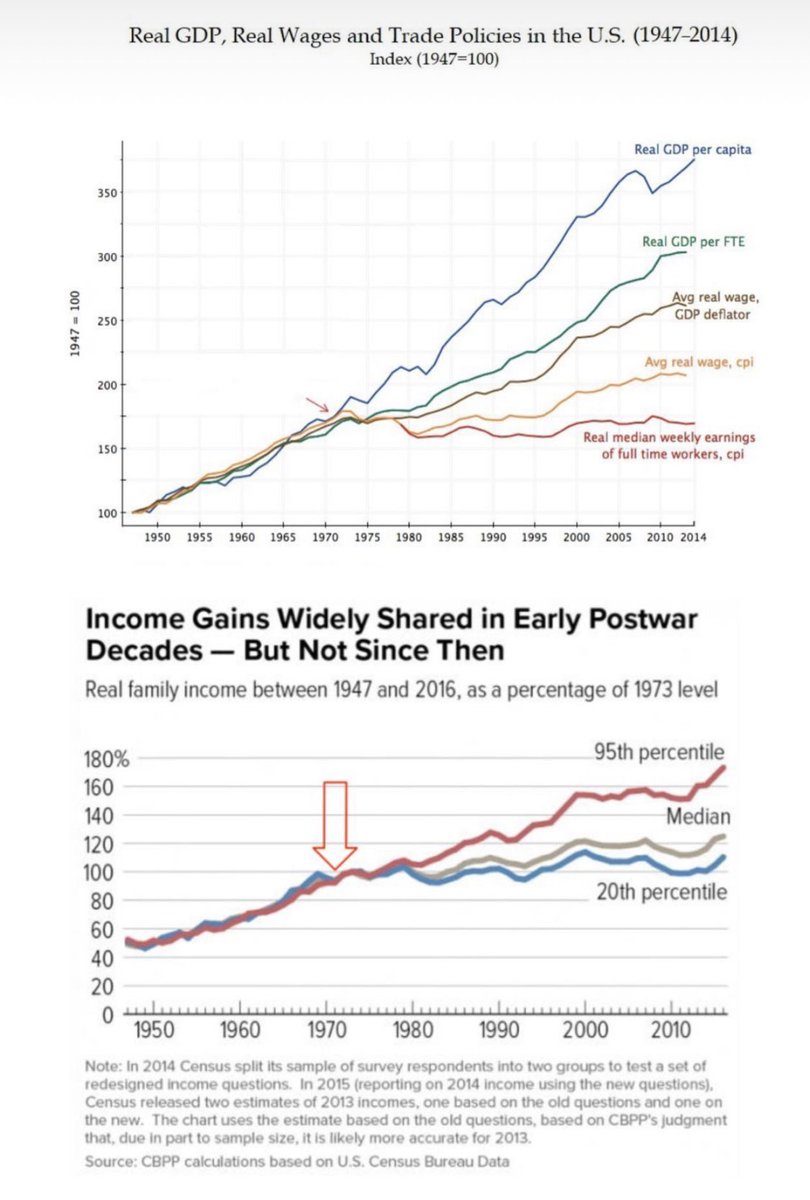

Decentralization is the future, for general public’s sake. If we do not move away from the USD, current trends of -

Decentralization is the future, for general public’s sake. If we do not move away from the USD, current trends of -

- financial inequality will only get worse.

So what caused this financial mess we are currently in?

So what caused this financial mess we are currently in?

This little thing called the Nixon Shock.

(Shoutout to @francistogram for providing the following info to me)

Here’s Wiki’s definition of the Nixon Shock

(Shoutout to @francistogram for providing the following info to me)

Here’s Wiki’s definition of the Nixon Shock

“The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation...

... of the direct international convertibility of the United States dollar to gold.”

So what does this mean?

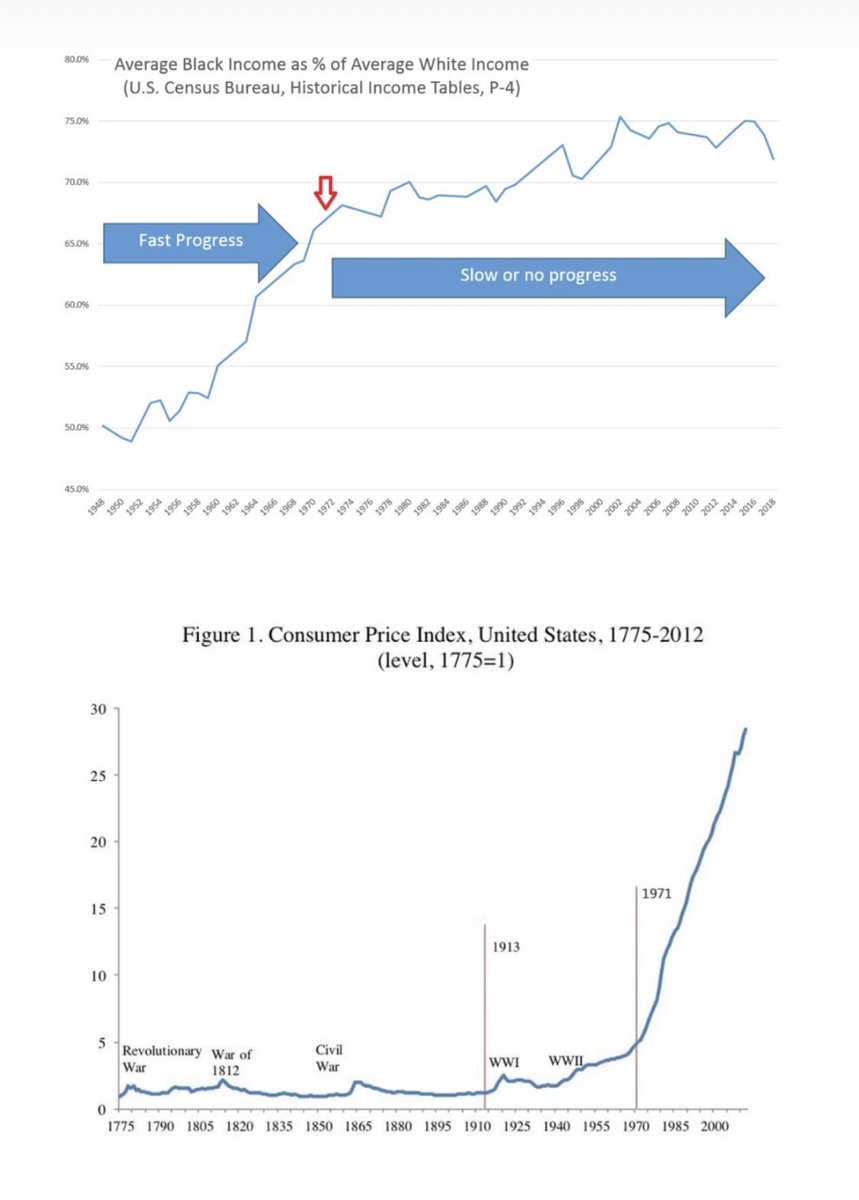

In 1971 we were taken off the gold standard and moved towards the USD that we use today - a fiat currency.

What’s the problem with fiat currency?

So what does this mean?

In 1971 we were taken off the gold standard and moved towards the USD that we use today - a fiat currency.

What’s the problem with fiat currency?

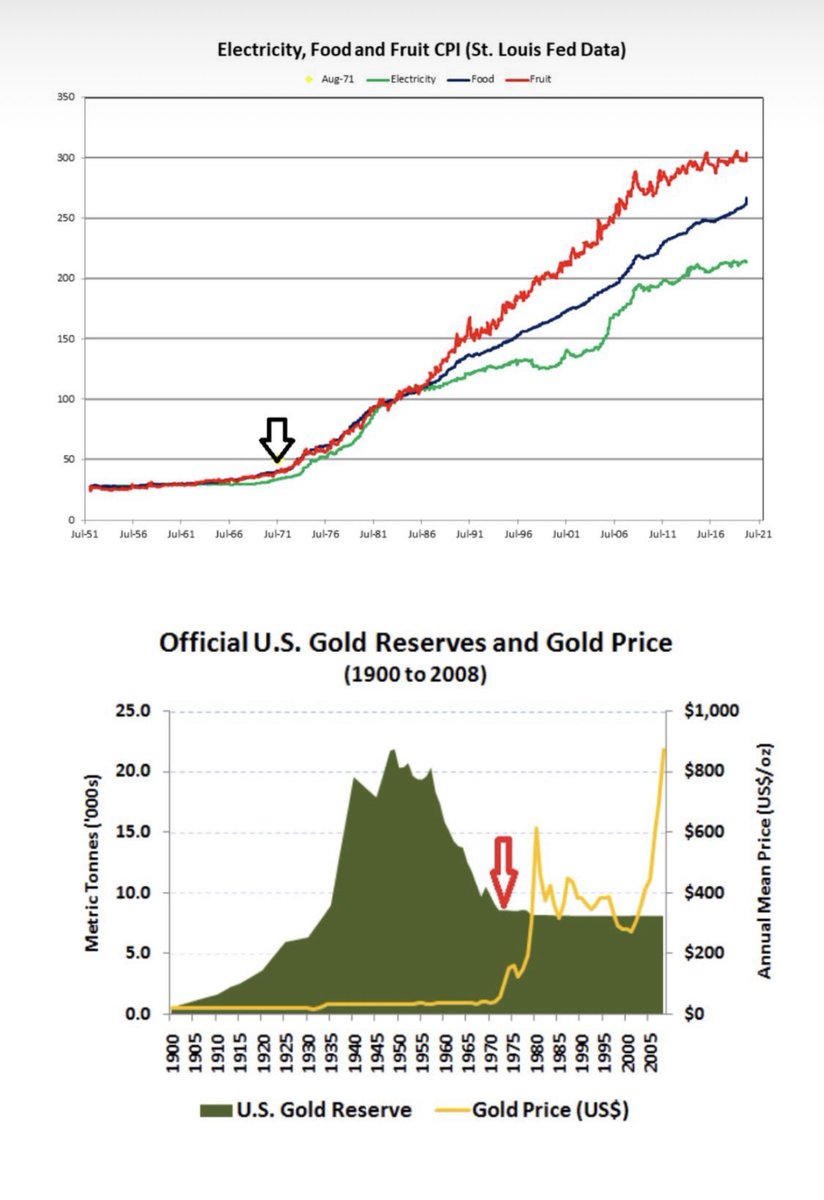

Fiat currency has no intrinsic value to it, and no use value (like a utility.) It only has value because the Feds say it has value, and two parties agreeing to an exchange agree it as value.

Because the USD is no longer backed by Gold, there is nothing limiting...

Because the USD is no longer backed by Gold, there is nothing limiting...

...the USD to how much can exist. This means the Federal Reserve can print as much as they want with zero repercussions on their behalf.

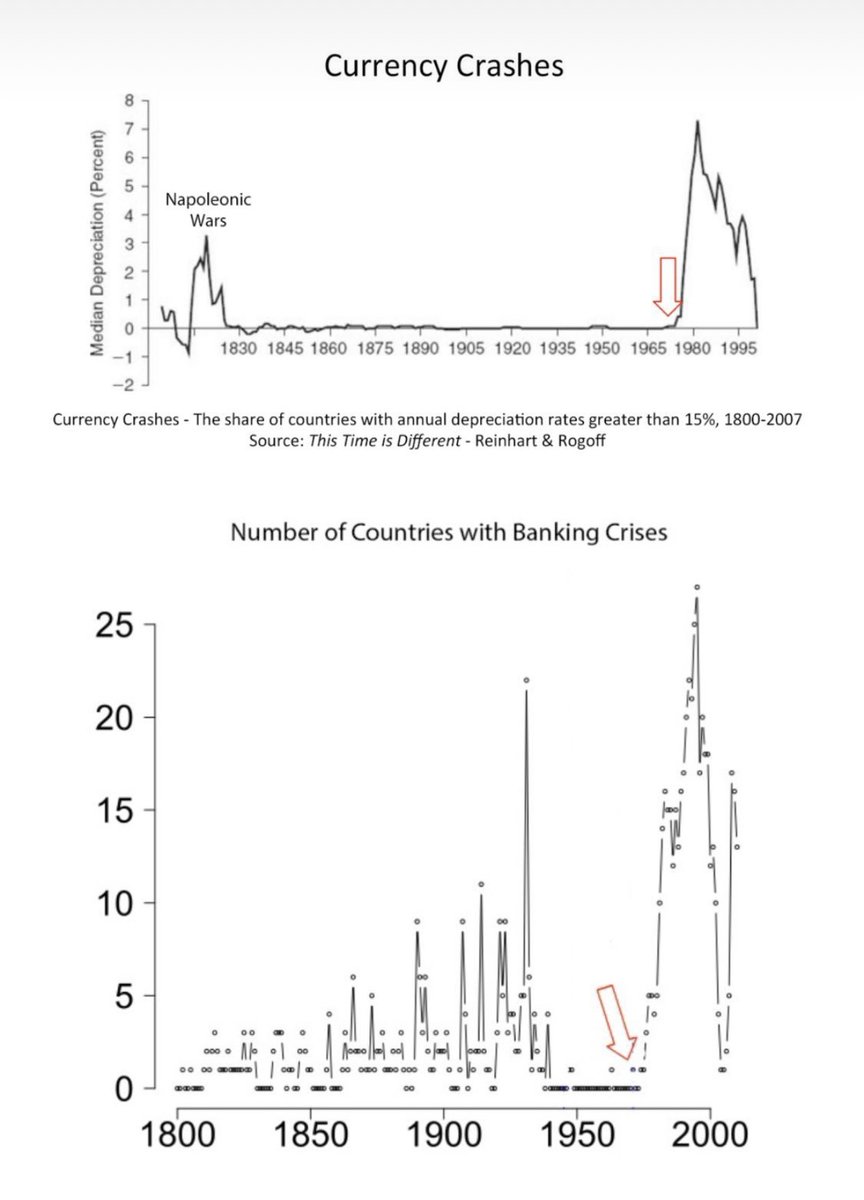

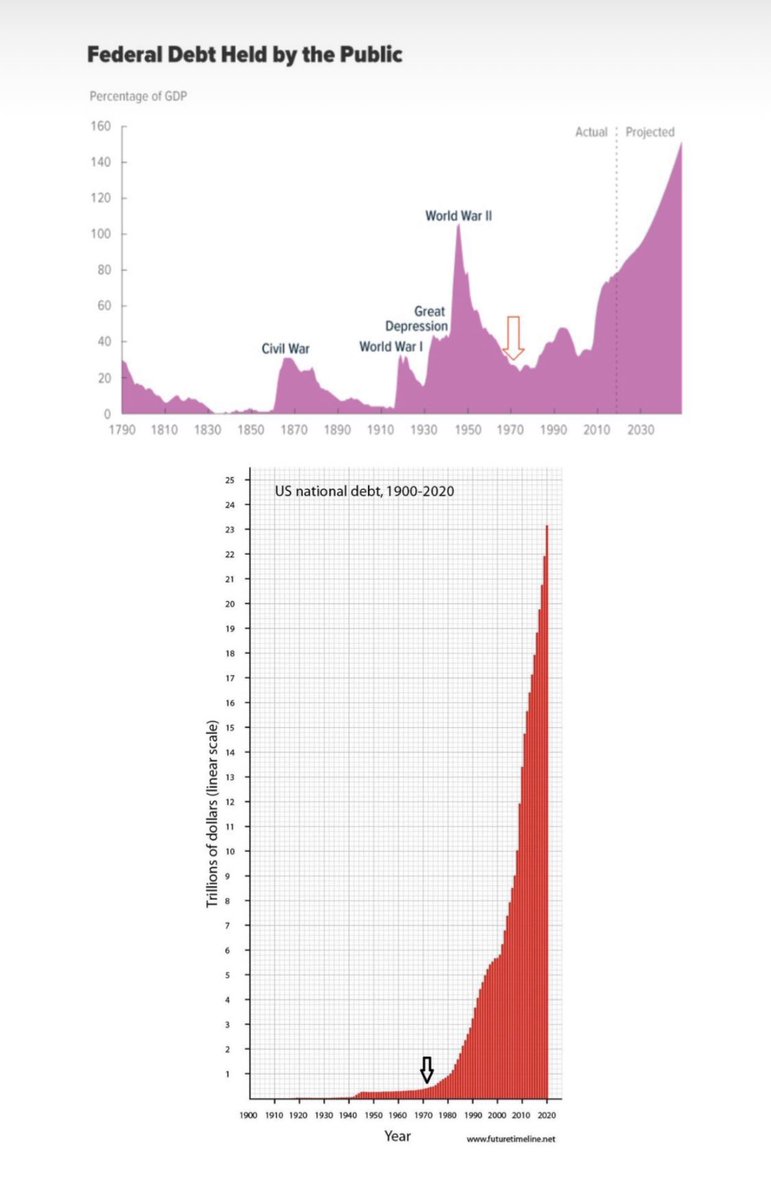

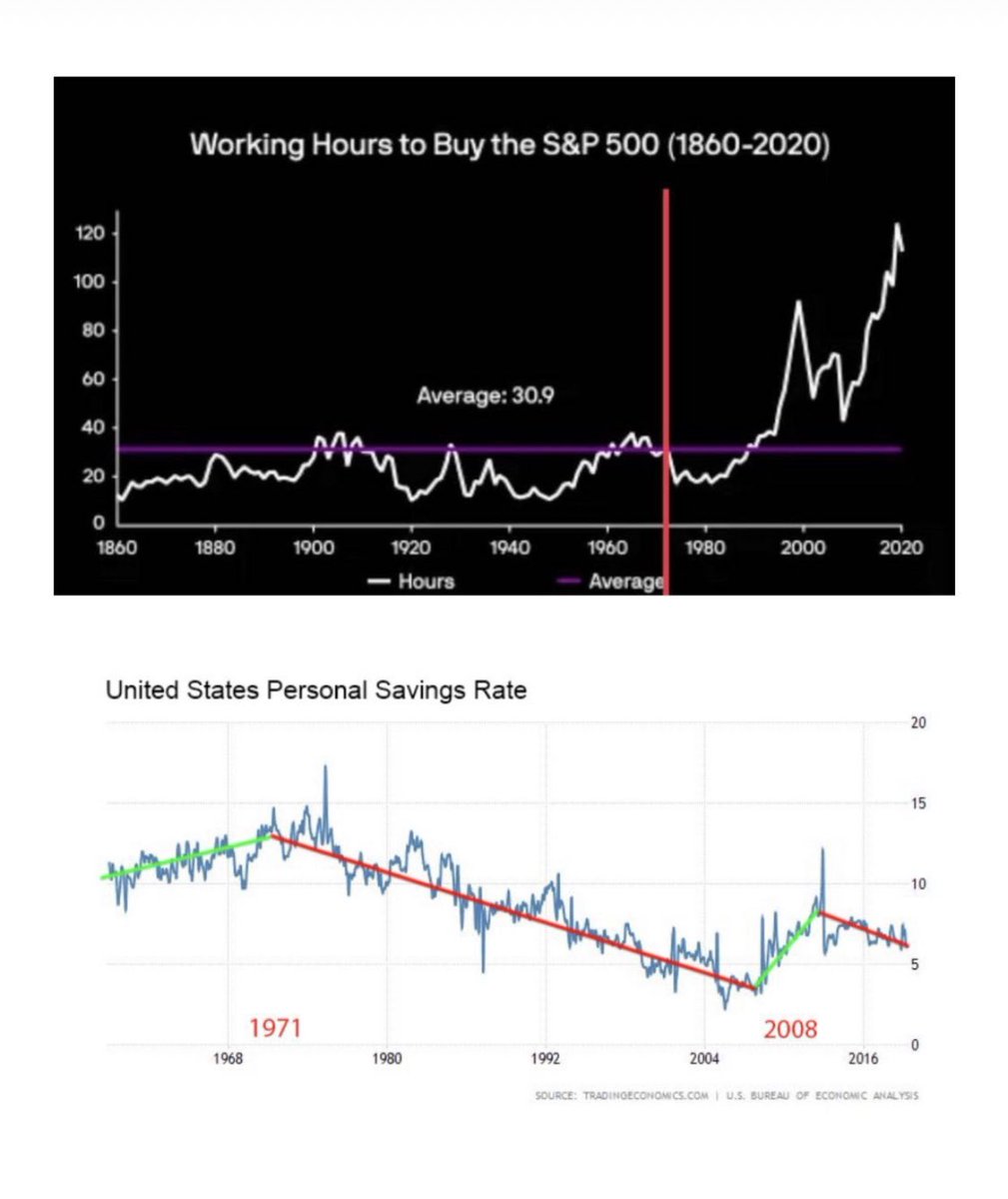

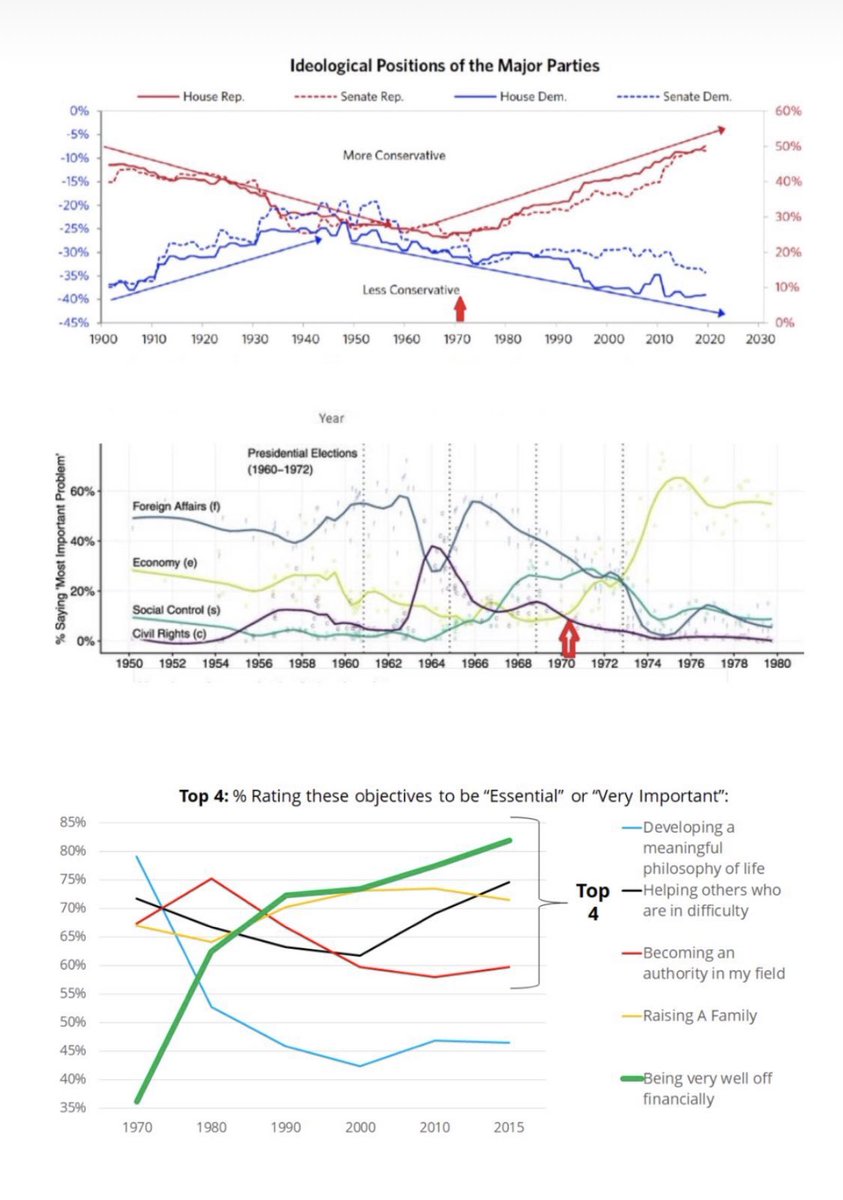

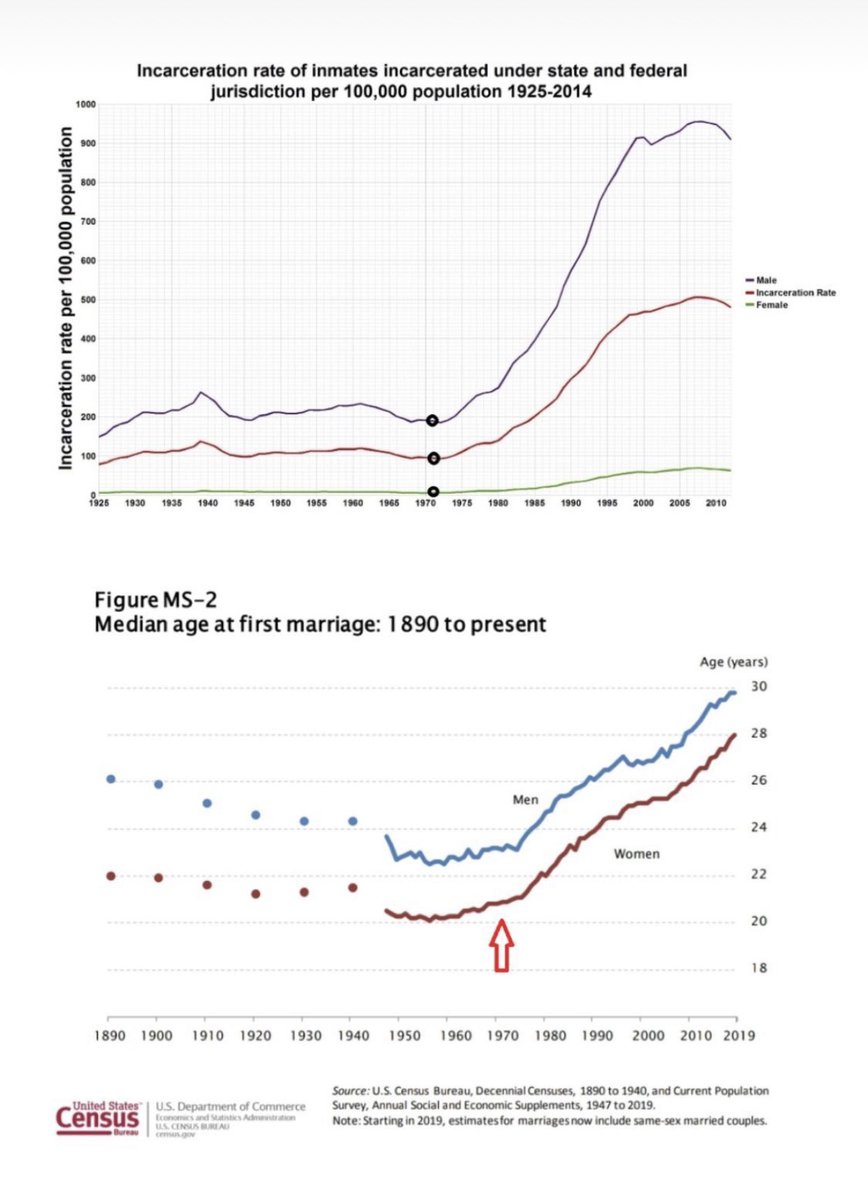

Let’s take a look at some trends since 1970, shall we? (these are screenshots from @francistogram ‘s IG story)

Let’s take a look at some trends since 1970, shall we? (these are screenshots from @francistogram ‘s IG story)

This change in currency has literally affected every single aspect of our lives, and many of us never realized the root of the issue.

If we do not take steps to decentralize the currency we use we will see our quality of life diminish.

If we do not take steps to decentralize the currency we use we will see our quality of life diminish.

The USD will continue to lose buying power as the Federal Banks print more and more money for their friends.

This is why decentralized finance (Cryptocurrency) is the future. Because there is a finite amount of BTC, it is resistant to the inflation that...

This is why decentralized finance (Cryptocurrency) is the future. Because there is a finite amount of BTC, it is resistant to the inflation that...

...has put us in the situation we are in today.

AND because it is decentralized, you can use it anywhere in the world - and it will hold the same value no matter the country. Many countries and businesses have already began to embrace Bitcoin. The US gov’t will be the last.

AND because it is decentralized, you can use it anywhere in the world - and it will hold the same value no matter the country. Many countries and businesses have already began to embrace Bitcoin. The US gov’t will be the last.

The beauty of Bitcoin is that the more people that buy it, the more value it has - so get on it now - because there is no stopping this transition. This transition is coming and the worldwide economy will massively change by the end of the decade. Get ahead of the curve.

Read on Twitter

Read on Twitter