The first place any person should look for fraud are in the financial filings of the companies involved. They contain key filing information along with reports (of varying degrees) from auditors who discuss the company, their risks, their money, and how legit their math is.

Robinhood is a private company (i.e. you cannot buy their stock on a market exchange), so they are exempt from certain reporting requirements. One of which is the need to publish financial statements in any way shape or form. If you are private, you can keep everything covered.

However, most choose not to keep *everything* covered, because they know there are banks, lenders, and any entities who can extend loans/credit who like to know financial information about their customers. A bank won't loan $10M to someone who only has $10K in their account.

One way to instill confidence in lenders - and the public - is by allowing some auditors in your building and do a "little" audit. More of a check-up. Just to make sure there is a real building with people who work there. There isn't a ton of heavy review done, but it counts.

This little audit check-up is called an Auditor's Report. The most the auditors are examining the financial statements for is if things are presently fairly in accordance to current law. They make suggestions, but the company doesn't have to follow them - they are private.

Anyway, here is Robinhood's most recent public filing with the SEC, from the SEC website:

https://sec.gov/Archives/edgar/data/0001561014/000162828020002275/0001628280-20-002275-index.htm

That's a lot of lasagna. How about we go straight to the PDF filing of their filing - the Annual Report from Feb 2020?

https://sec.gov/Archives/edgar/data/1561014/000162828020002275/fy19rhfshortfinal.pdf

https://sec.gov/Archives/edgar/data/0001561014/000162828020002275/0001628280-20-002275-index.htm

That's a lot of lasagna. How about we go straight to the PDF filing of their filing - the Annual Report from Feb 2020?

https://sec.gov/Archives/edgar/data/1561014/000162828020002275/fy19rhfshortfinal.pdf

There's a lot going on, but go to page 3. "Report of Independent Registered Public Accounting Firm." This is where the auditors, an outside party, detail their findings on the company. The auditor is EY (my former employer, lol).

One quick check for collusion, fraud, and corruption is to see the auditors for all the companies involved in a situation. If two different companies are audited by the same auditor, then it is more likely that the auditor could compare notes and facilitate faulty reporting.

The only reason an auditor would promote this activity is b/c they are paid by the customer. That's right. They are paid to tell a company whether or not their reporting is good or dogshit. A conflict of interest exists here, as an auditor wants to maintain their clients, right?

Luckily, there doesn't seem to be any overt signs of fraud risk from the auditors. In Citadel's financial filings, they report their auditor as Pricewaterhouse Coopers, or PwC, who is different than Robinhood's auditor, EY. A lotta letters there.

If that concern is alleviated, then let's dive into the Auditor's Report that EY published about Robinhood:

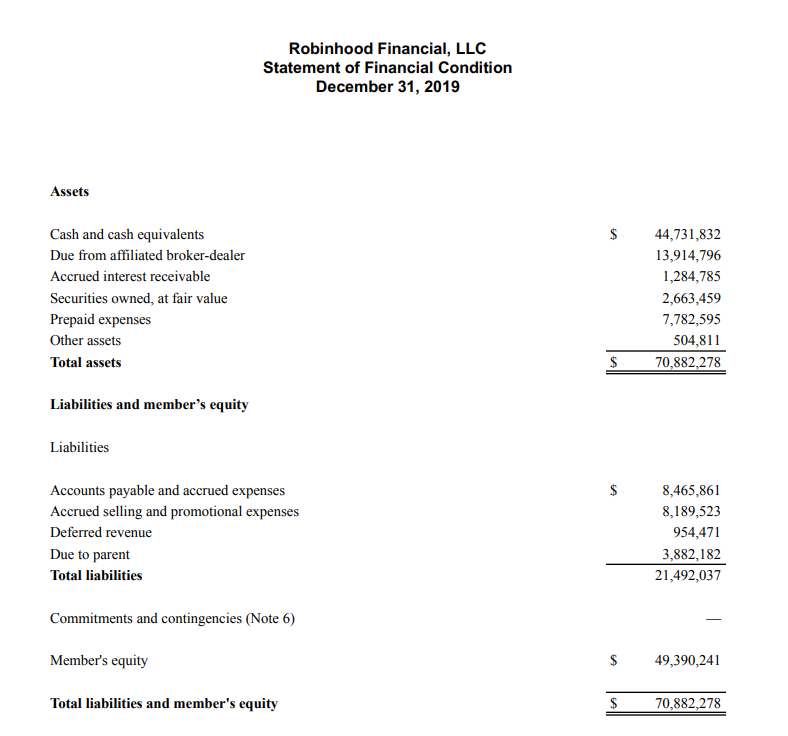

This is as of 12/31/19. At the time, Robinhood had just over $70 million in assets. That's it. $70M.

This is as of 12/31/19. At the time, Robinhood had just over $70 million in assets. That's it. $70M.

This is where I have a weakness: the debt load they currently have, which is about $21M...I'm not sure if that is considered high, medium, or low for a company in this industry. Seems reasonable. But also, these are lightly audited reports. I can never FULLY rely on these.

Unless a company is fully public on a stock exchange and under the umbrella of rules that the SEC demands for such companies, then you have no obligation to disclose more than you have to as far as the quality and consistency of your financial reporting.

Back on topic. We see that Robinhood is only carrying $70M in assets. How well is their business conducted? Well, based on this SEC presser, probably not all that efficiently: https://www.sec.gov/news/press-release/2020-321

This was published on December 17th of LAST YEAR

This was published on December 17th of LAST YEAR

It says the SEC said RH failed "to seek the best reasonably available terms to execute customer orders." That means, concluded in the presser, that the "zero commission" you are charged doesn't save you money, b/c RH can't place the orders at a good price.

Interestingly, the presser notes the offense listed in my tweet, among other nuancities to the matter, occurred "during the time in which it was growing rapidly." As from the Auditor's Report, they were only $70M in assets as of last year.

To me, that implies they could have had anywhere from 20% to 300% growth over the past year. That range is purely based on what I think the tone of voice in that SEC presser is, but I think it is a reasonable range.

Another highlight in that SEC Presser is how RH's largest source of revenue, stated on RH's FAQ page, comes from fees, "namely, payments from trading firms in exchange for Robinhood sending its customer orders to those firms for execution, also known as 'payment for order flow.'”

Time to connect some dots.

RH's biggest revenue source - payments from trading firms like Citadel - is highlighted as a credit risk in the Auditor's Report. (Pulled from https://www.sec.gov/Archives/edgar/data/1561014/000162828020002275/fy19rhfshortfinal.pdf)

RH's biggest revenue source - payments from trading firms like Citadel - is highlighted as a credit risk in the Auditor's Report. (Pulled from https://www.sec.gov/Archives/edgar/data/1561014/000162828020002275/fy19rhfshortfinal.pdf)

Considering Robinhood only holds $70M in assets as of 12/31/19, and not even $50M tied up in equity for the internal shareholders for RH during that time, that means it isn't entirely implausible that Citadel had a considerable business implication for Robinhood.

As for the "why can Robinhood stop trades" question, I have dug up some legal malarkey on that too. From the Auditor's Report ( https://www.sec.gov/Archives/edgar/data/1561014/000162828020002275/fy19rhfshortfinal.pdf), it says that RH is under SEC and FINRA regulation. FINRA is a big deal, they are a legitimate regulatory force for the markets.

But see that paragraph at the bottom? Where it says RH is exempt from SEC Rule 15c3-3? Pursuant to subparagraph (k)(2)(ii)? Yeah. Lemme break that egg apart. It is pretty significant to the events of today.

Here is Rule 15c3-3: https://www.finra.org/sites/default/files/SEA.Rule_.15c3-3.pdf

An absolute nightmare of a rule to understand. I read 15c3-3 and (k)(2)(ii). They sucked. I didn't really get it. But I found some summary websites that cleaned it up for me. It will for you too.

An absolute nightmare of a rule to understand. I read 15c3-3 and (k)(2)(ii). They sucked. I didn't really get it. But I found some summary websites that cleaned it up for me. It will for you too.

Here is a summary page for Rule 15c3-3 (I have no real verification on how good this website is, but it seems well-thought out).

https://www.bkd.com/alert-article/2020/02/introducing-broker-dealers-claiming-dual-exemption-maintaining-special#:~:text=To%20qualify%2C%20a%20broker%2Ddealer,activities%20as%20a%20broker%2Ddealer.&text=(k)(2)(ii,on%20a%20fully%20disclosed%20basis.

https://www.bkd.com/alert-article/2020/02/introducing-broker-dealers-claiming-dual-exemption-maintaining-special#:~:text=To%20qualify%2C%20a%20broker%2Ddealer,activities%20as%20a%20broker%2Ddealer.&text=(k)(2)(ii,on%20a%20fully%20disclosed%20basis.

Also this guy helped me understand it pretty decently as well: https://smartasset.com/investing/sec-rule-15c33#:~:text=Securities%20and%20Exchange%20Commission%20(SEC,to%20work%20to%20uphold%20it.

The conclusion I drew?

- RH is exempted from Rule 15c3-3

- If RH had to follow Rule 15c3-3, they would be required to uphold all customer requests to withdraw assets from their accounts

- RH doesn't have to do that, b/c they are exempt

- Thus why RH could freeze accounts

- RH is exempted from Rule 15c3-3

- If RH had to follow Rule 15c3-3, they would be required to uphold all customer requests to withdraw assets from their accounts

- RH doesn't have to do that, b/c they are exempt

- Thus why RH could freeze accounts

This (k)(2)(ii) part from the one article that explains why RH was allowed to be exempt. "This exemption is for a broker-dealer that does all business through a clearing agent on a fully disclosed basis." It was known that Robinhood had a relationship with Citadel.

Read on Twitter

Read on Twitter