The GameStop $GME news is too funny not to write a thread about.

It's also the most interesting intersection of psychology and politics going on.

It's also the most interesting intersection of psychology and politics going on.

I think the best overview of what's happening is this NYT article: https://www.nytimes.com/2021/01/27/business/gamestop-wall-street-bets.html

Basically, some large companies bet that GameStop stock would go down. To most financial people, this would seem like a good bet: most video games are sold online now and physical stores are especially hurt by the pandemic. Video game stores aren't looking great.

Redditors caught wind of this and decided they liked GameStop and not the firms who bet against it. They decided to buy the stock and hold it, making the stock price go up, against the bets of large financial firms.

Because of how these bets actually work, when the stock goes up, say, 10x, that also costs those who bet against it 10x. So if a company bet 1 billion dollars that GameStop would go down, and instead it went up 10x, they'd owe 10 billion.

And GameStop's peak from a few months ago is more like 100x.

(As you could imagine, it's quite a bit more complicated because those "bets" involve paying interest and blah blah.)

What the redditors and other investors did ended up costing one firm, Melvin Capital, probably billions of dollars. They had to be bailed out by other hedge funds. https://nymag.com/intelligencer/2021/01/reddit-gamestop-share-price-explained-wallstreetbets-melvin-capital.html

Part of why this happened is that information about Melvin's bets against GameStop became public, and reddit's wallstreetbets noticed that some large firms stood to lose a lot if they were wrong.

What I think is especially funny is that the redditors really don't appear to be in it for the money. In fact, many at least report holding a lot of stock just to cause pain to hedge funds because it keeps the stock price high.

It's like those behavioral economic experiments where people -- apparently essentially universally -- will pay to punish others -- they'll give up money just to hurt someone they view as acting too unfairly. @JoHenrich https://science.sciencemag.org/content/312/5781/1767.abstract

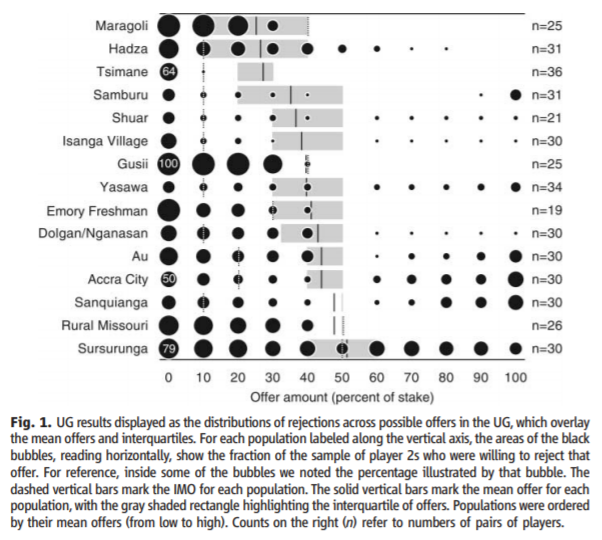

These experiments use the "ultimatum game" where one person is asked to divide a chunk of cash between themselves and another player. The second player can accept the offer or reject it. If it's rejected, nobody gets any money.

That's a cute game/experiment because, the second player won't ever lose money, and most of the time will make *something*. Isn't some money better than none? Why would they ever reject?

It turns out people across diverse cultures will reject offers that are perceived as too unfair. If you take too much for yourself, screw you, NEITHER of us gets any.

This behavior has got to be about something deep in people because you get these results even when people only interact once! So you're not teaching them something useful for when you interact into the future. It's just that... You. Can't. Stand. It. https://twitter.com/KevinFarzad/status/1354554496169299970?s=20

What's fun about GameStop is how baffled the financial commentators are. They act like this is illegal or gaming the system, when it literally is the system they wanted! A free market means anyone can buy or sell for whatever reason they want. @chamath https://twitter.com/itsavibe/status/1354484760115081217?s=20

The second part is good too https://twitter.com/itsavibe/status/1354486276494393346?s=20

Of course, anger at the stock market and the rich people it makes richer is a time-honored tradition. Here's folk singer Malvina Reynolds--ahem, Berkeley alum--about a financial news story she read in the @sfchronicle

"Why not you and I" indeed https://twitter.com/RBReich/status/1354665451838574592?s=20

It's probably no accident that this is taking place on investing apps like @RobinhoodApp which claimed to bring investing to anyone. But, Robinhood is no friend of these investors. It shut down its users ability to buy more GameStop. https://twitter.com/Zakariyasl/status/1354805729509613569?s=20

The memes almost write themselves https://twitter.com/ComfortablySmug/status/1354817994950537219?s=20

And now wall street analysts are talking about regulation. Free market was the only "moral" thing when investment firms destroyed people's pensions and savings; when the hedge funds start to loose because of collective individual decisions, regulation please!

My hope is that this display of the power of individuals will be a model for progressive causes.

The utter inability of financial analysts to model, anticipate, or understand a tiny bit of non-selfishness by individual investors signals that people have real strength in numbers against a financial sector that doesn't serve them.

Read on Twitter

Read on Twitter