Did Citadel force Robinhood to stop allowing people to buy $GME and effectively tank the market?

Who's manipulating the market? Here's the squeeze 1/9

1/9

Who's manipulating the market? Here's the squeeze

1/9

1/9

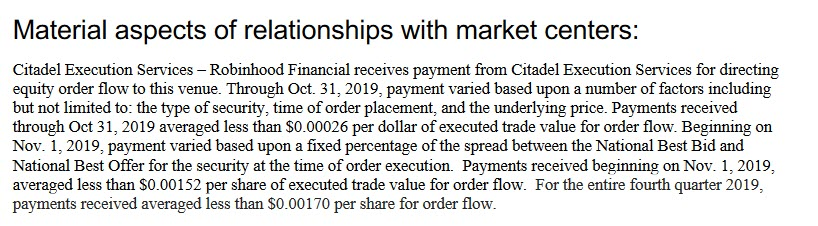

Robinhood's financial arrangement with Citadel. 2/9

https://twitter.com/zerohedge/status/1271889673330311168?s=20

https://twitter.com/zerohedge/status/1271889673330311168?s=20

Robinhood's Q3 report shows the majority of their order flow goes to Citadel. 3/9

https://cdn.robinhood.com/assets/robinhood/legal/RHS%20SEC%20Rule%20606a%20and%20607%20Disclosure%20Report%20Q3%202020.pdf

https://cdn.robinhood.com/assets/robinhood/legal/RHS%20SEC%20Rule%20606a%20and%20607%20Disclosure%20Report%20Q3%202020.pdf

GameStop $GME was one of the most shorted of all publicly traded companies. Other companies include AMC Theatres, Bed Bath & Beyond and Blockbuster.

And then GameStop became the source of a short squeeze. 4/9

https://www.nbcnews.com/business/business-news/gamestop-reddit-explainer-what-s-happening-stock-market-n1255922

And then GameStop became the source of a short squeeze. 4/9

https://www.nbcnews.com/business/business-news/gamestop-reddit-explainer-what-s-happening-stock-market-n1255922

Melvin Capital's most recent SEC filing showed it held 5.4 million puts on GameStop $GME, valued at more than $55 million. Melvin also held a big short on $BBBY 5/9

https://www.sec.gov/Archives/edgar/data/1628110/000090571820001111/0000905718-20-001111-index.htm

https://www.sec.gov/Archives/edgar/data/1628110/000090571820001111/xslForm13F_X01/infotable.xml

https://www.sec.gov/Archives/edgar/data/1628110/000090571820001111/0000905718-20-001111-index.htm

https://www.sec.gov/Archives/edgar/data/1628110/000090571820001111/xslForm13F_X01/infotable.xml

Over the last few weeks r/wallstreetbets noticed that $GME had 139% of its shares sold short. Retail investors bought and held which continued to drive up the price. 6/9 https://www.institutionalinvestor.com/article/b1q8swwwtgr7nt/Buried-in-Reddit-the-Seeds-of-Melvin-Capital-s-Crisis

Retail investors were primarily using Robinhood to buy $GME which drove the price from 7/9 https://www.cnbc.com/2021/01/27/robinhood-ceo-says-most-customers-are-buy-and-hold-amid-gamestop-trading-frenzy.html

Today, Robinhood announced that it has halted buys on $AAL, $AMC, $BB, $BBBY, $CTRM, $EXPR, $GME, $KOSS, $NAKD, $NOK, $SNDL, $TR, and $TRVG, many of which Melvin Capital held shorts.

Which tanked GME from a high of 482.85 to 112.25 w/in hours. 8/9 https://blog.robinhood.com/news/2021/1/28/keeping-customers-informed-through-market-volatility

Which tanked GME from a high of 482.85 to 112.25 w/in hours. 8/9 https://blog.robinhood.com/news/2021/1/28/keeping-customers-informed-through-market-volatility

Was Citadel losing money by being involved with Melvin Capital? Is it fair to deduce that Robinhood was forced to stop allowing GME buys due to their relationship with Citadel? 9/9

On Jan 25th Citadel made a $2 Billion investment into Melvin Capital to help cover their short on $GME 10/9 https://finance.yahoo.com/news/citadel-point72-invest-2-75-224458821.html

Read on Twitter

Read on Twitter