When you're young, you can afford to take risks and that's how I've created passive wealth.

Learn personal finance & investment instruments, understand the power of compounding.

(A Thread on my #PersonalFinance )

)

#Investment #PersonalFinance #Trading #wallstreetbets

Learn personal finance & investment instruments, understand the power of compounding.

(A Thread on my #PersonalFinance

)

)

#Investment #PersonalFinance #Trading #wallstreetbets

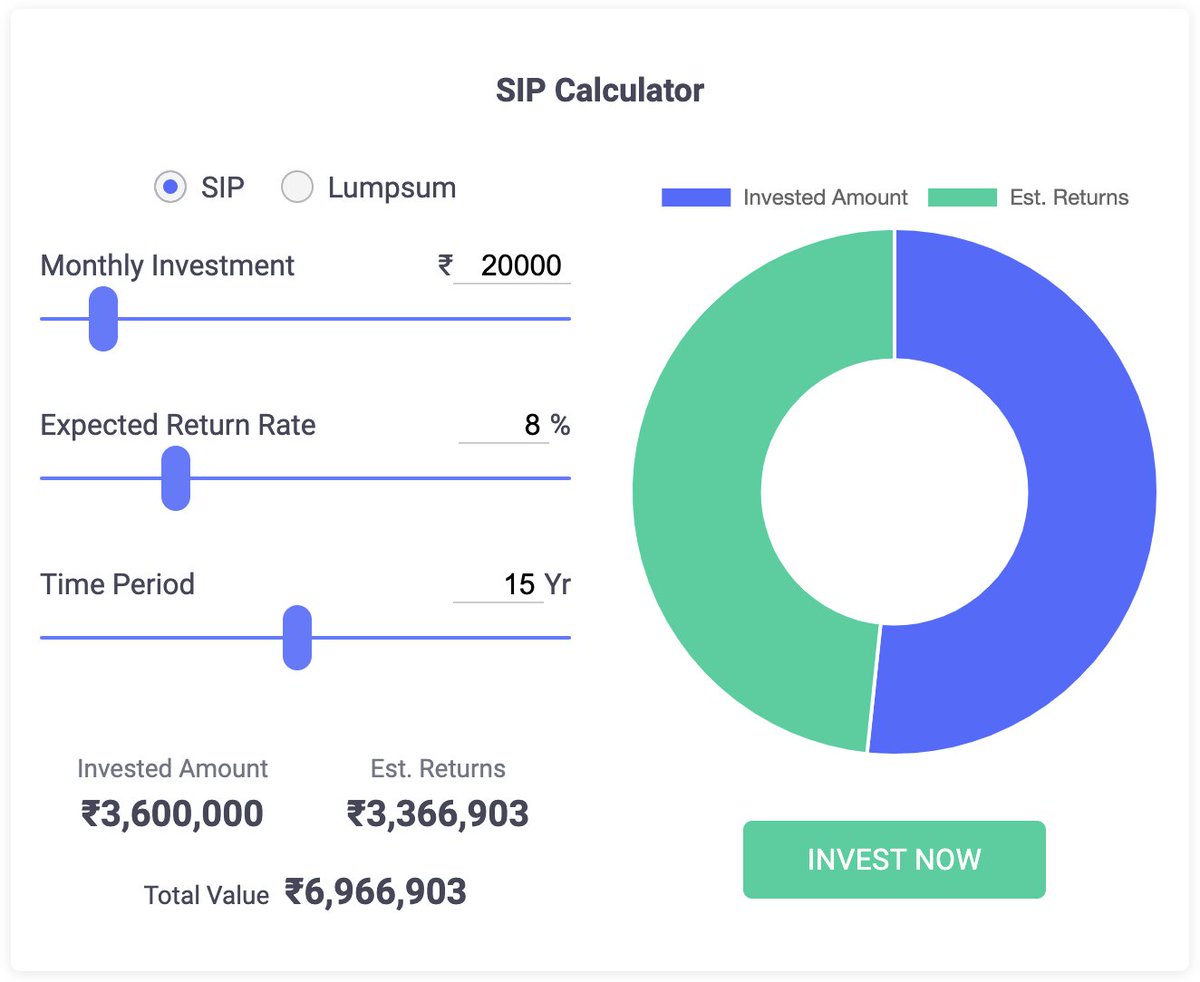

SIP - Systematic Investment Plan

Started 6 years back with a very little amount, never paused and my average CAGR has been around 14% across 5 Funds. Currently investing in -

Equity (Large Cap and Multi-Cap)

Debt

Index

US Opportunities

#Investment #MutualFunds #SIP #Stock

Started 6 years back with a very little amount, never paused and my average CAGR has been around 14% across 5 Funds. Currently investing in -

Equity (Large Cap and Multi-Cap)

Debt

Index

US Opportunities

#Investment #MutualFunds #SIP #Stock

But #SIP is not just limited to #MutualFunds, you can systematically invest in Gold, PSU Bonds, ETFs, RDs, etc but consistency is important in order to enjoy the wealth creation and compounding.

#Investment #Compounding #Finance #Stock

#Investment #Compounding #Finance #Stock

Stock Investing

Invest in the businesses you understand and let them make money for you, my current portfolio includes -

• ITC

• IRCTC

• Reliance

• HDFC Bank

• IDFC First Bank

• SBI Card

• United Spirits

#Investment #Stock #Finance #Trading

Invest in the businesses you understand and let them make money for you, my current portfolio includes -

• ITC

• IRCTC

• Reliance

• HDFC Bank

• IDFC First Bank

• SBI Card

• United Spirits

#Investment #Stock #Finance #Trading

This is not a recommendation, Do your own research and pick your bets. Don’t let your friends or social media influence you. It’s extremely risky but rewarding too. Patience pays really well.

Hint - Debt Free, Market Leader Stocks

#Investment #Stock #Finance #Trading

Hint - Debt Free, Market Leader Stocks

#Investment #Stock #Finance #Trading

Gold/SGB

I’m extremely bullish on gold and love to hold them on paper, Sovereign Gold Bond(s) are backed by #RBI and helps you earn 2.5% interest p.a. too.

You can purchase from Banks/Brokers and can be held in paper or Demat form. On maturity, you will get the value of Gold

I’m extremely bullish on gold and love to hold them on paper, Sovereign Gold Bond(s) are backed by #RBI and helps you earn 2.5% interest p.a. too.

You can purchase from Banks/Brokers and can be held in paper or Demat form. On maturity, you will get the value of Gold

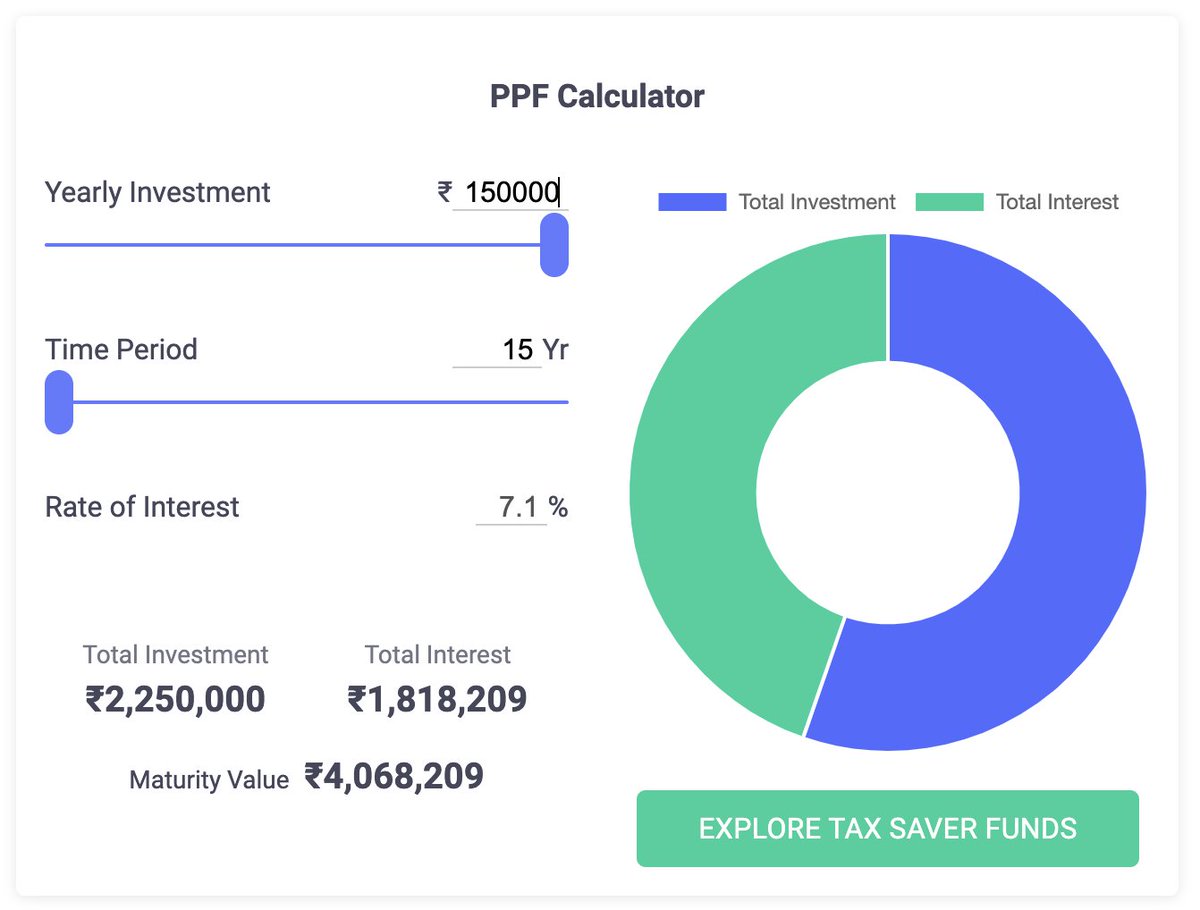

PPF- Public Provident Fund

Minimum 1000 and Maximum 1.5L can be invested in a financial year and can be opened in any bank. (80C Benefits)

You get the awesome interest and the maturity amount is completely Tax-Free. Refer to the magical numbers -

#PPF #Investing #Finance

Minimum 1000 and Maximum 1.5L can be invested in a financial year and can be opened in any bank. (80C Benefits)

You get the awesome interest and the maturity amount is completely Tax-Free. Refer to the magical numbers -

#PPF #Investing #Finance

LIC/Insurance

I just hate mixing insurance with the investment so don't let your relative/uncle agree you buy a LIC policy.

Instead, get a nice Term and Health Insurance with a PPF account. Leverage real compounding with Tax benefits.

#Investment #Insurance #LIC

I just hate mixing insurance with the investment so don't let your relative/uncle agree you buy a LIC policy.

Instead, get a nice Term and Health Insurance with a PPF account. Leverage real compounding with Tax benefits.

#Investment #Insurance #LIC

Fixed/Recurring Deposit -

Good and safe for people who don't wish to invest in stocks/MFs.

Low risk, low returns.

(Note - Only up to 5L is insured by the RBI doesn’t matter what's your bank deposit/savings amount.)

Personally, I don't like them.

Good and safe for people who don't wish to invest in stocks/MFs.

Low risk, low returns.

(Note - Only up to 5L is insured by the RBI doesn’t matter what's your bank deposit/savings amount.)

Personally, I don't like them.

Savings/Salary Account

Very important but most ignorant by people, currently IDFC First/IndusInd Bank offers 6-7% interest on the savings account where HDFC/SBI is offering 2.5-3%.

You don't realize this sh*t unless you get some real money as interest in your account.

#Banking

Very important but most ignorant by people, currently IDFC First/IndusInd Bank offers 6-7% interest on the savings account where HDFC/SBI is offering 2.5-3%.

You don't realize this sh*t unless you get some real money as interest in your account.

#Banking

Cryptocurrency

Extremely risky and volatile - I've invested in #Bitcoin #Ethereum, recently made some profits with #dogecoin and #EnjinCoin.

#Ethereum, recently made some profits with #dogecoin and #EnjinCoin.

So you may pick some digital coins with the money you can afford to lose in case if something goes wrong.

#Investment #Finance

Extremely risky and volatile - I've invested in #Bitcoin

#Ethereum, recently made some profits with #dogecoin and #EnjinCoin.

#Ethereum, recently made some profits with #dogecoin and #EnjinCoin.So you may pick some digital coins with the money you can afford to lose in case if something goes wrong.

#Investment #Finance

I hope you enjoyed reading this thread. Checking out for now and please RT and follow for further posts.

Happy to help/answer any queries.

Happy Money Making

Happy to help/answer any queries.

Happy Money Making

Read on Twitter

Read on Twitter