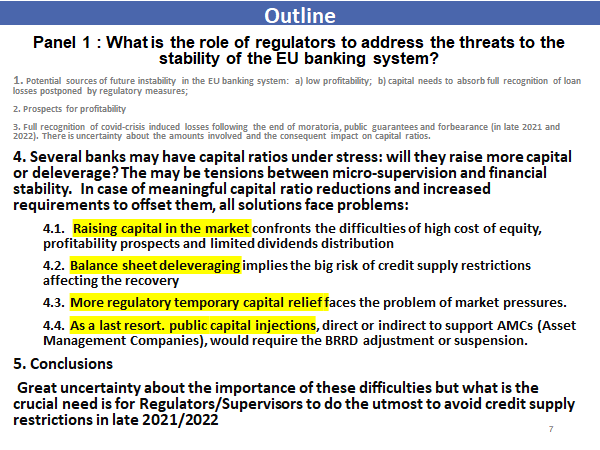

I participated in a webinar organised by the CFA Institute and CFA Society Portugal. My panel was about "Ensuring financial stability in Covid-19 times: what is the role of regulators to address the threats to the stability of the EU banking system?" I reproduce some of my slides

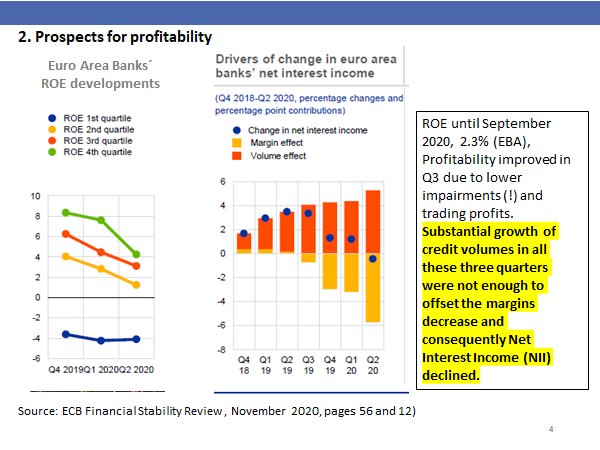

According to ECB and EBA data ROE of European banks after being 0.4% in the first half of last year went up in Q3 so that for the whole that period ROE was 2.3%. An increase due to lower impairment costs (which is counter-intuitive) and trading gains. However: 4/

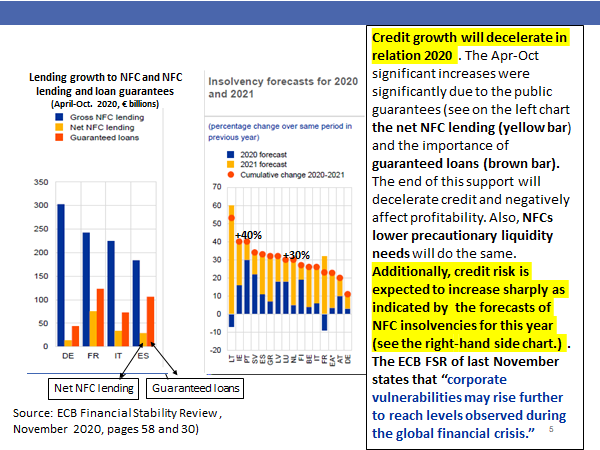

Credit volume growth was substantial last year, but that should decelerate visibly in late 2021/2022 after the ending of public guarantees and of firms´ lower needs of precautionary liquidity which fed credit growth in H1 2020. Also credit risk and NPLs are bound to increase 5/

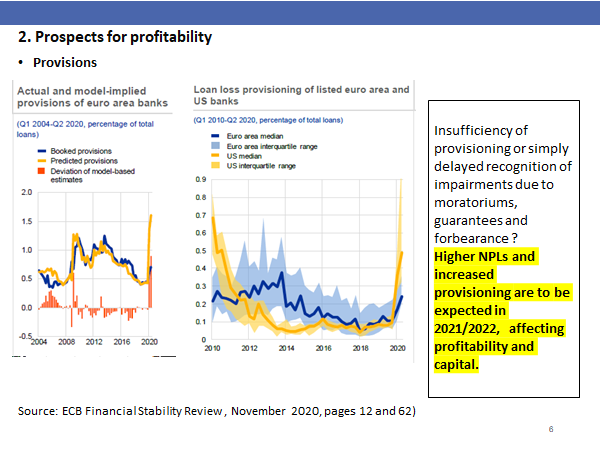

However, provisions done by European banks have been lower than the predictions of reasonable models in view of the recession, and have also been below those done by US banks. Increases in the near future are to be expected 6/

Read on Twitter

Read on Twitter