the $GME story is pretty amazing.

the $GME story is pretty amazing. TLDR: billion dollar hedge-funds borrow shares of GameStop, a videogame store ($GME), and sell them. They expect the share price to go down so they can buy them back on the cheap when they have to give them back later.

People on Reddit decide to buy $GME shares and the price goes up. Now the hedge-funds have to buy the shares back for more than they sold them, and this actually increases the price further.

People on Reddit decide to buy $GME shares and the price goes up. Now the hedge-funds have to buy the shares back for more than they sold them, and this actually increases the price further.

Turns out they actually borrowed so many shares (they borrow from A, sell to B, then borrow from B and sell to C) that they need more shares than there are actually available.. plus the People on Reddit refuse to sell them any, price goes through the roof

Turns out they actually borrowed so many shares (they borrow from A, sell to B, then borrow from B and sell to C) that they need more shares than there are actually available.. plus the People on Reddit refuse to sell them any, price goes through the roof

hedge-funds get angry. Start calling their friends. One of which is Robinhood, the app that many people use to buy $gme shares. Robinhood’s company mission is litteraly “Democratizing Finance” — but not this time, they won’t allow anyone to buy more shares, only to sell.

hedge-funds get angry. Start calling their friends. One of which is Robinhood, the app that many people use to buy $gme shares. Robinhood’s company mission is litteraly “Democratizing Finance” — but not this time, they won’t allow anyone to buy more shares, only to sell.

While the hedge-funds accuse Reddit people of market manipulation, it actually feels like they + Robinhood are the ones really manipulating the market here.

While the hedge-funds accuse Reddit people of market manipulation, it actually feels like they + Robinhood are the ones really manipulating the market here. Reddit was all in the open, for all to see. The first user actually started buying $gme in 2019.

Really curious to see how this plays out.

Really curious to see how this plays out.In the mean time I’m really hoping that no normal trader is left holding the bag and going into debt.

Feels like hedge-funds were caught with their pants down, but do convince me otherwise

There will be lawsuits and investigations, that’s for sure.

There will be lawsuits and investigations, that’s for sure.Even @tedcruz agrees with @AOC

https://twitter.com/aoc/status/1354830697459032066

https://twitter.com/aoc/status/1354830697459032066

Looks like the reason @RobinhoodApp blocked buying of $gme might be more complex https://techcrunch.com/2021/01/28/the-somewhat-boring-reason-it-appears-that-robinhood-yanked-trading-on-some-securities/

Looks like the reason @RobinhoodApp blocked buying of $gme might be more complex https://techcrunch.com/2021/01/28/the-somewhat-boring-reason-it-appears-that-robinhood-yanked-trading-on-some-securities/

Whyyyy Google? https://twitter.com/verge/status/1354949524700205066

Whyyyy Google? https://twitter.com/verge/status/1354949524700205066

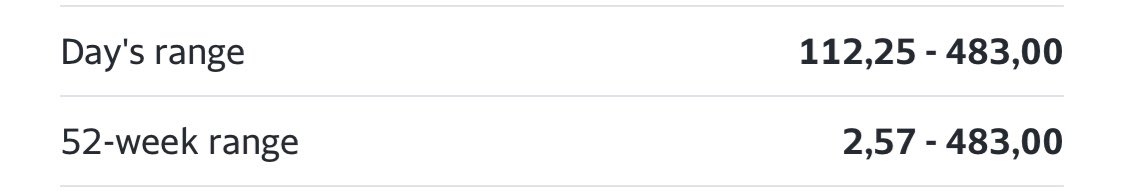

trading is about to start. $gme up 100% pre-market. Close to $400

trading is about to start. $gme up 100% pre-market. Close to $400

To illustrate how

this is. The stock was $2 just last year.

this is. The stock was $2 just last year.

Read on Twitter

Read on Twitter