#ARB $ARBKF

Been working out a forecast for BTC (equiv) mined, and subsequent mining revenue, margin, and therefore 2021 earnings based on what we know about @ArgoBlockchain plans and some assumptions which I lay out below.

[Long thread, sorry]

1/11

Been working out a forecast for BTC (equiv) mined, and subsequent mining revenue, margin, and therefore 2021 earnings based on what we know about @ArgoBlockchain plans and some assumptions which I lay out below.

[Long thread, sorry]

1/11

#ARB $ARBKF

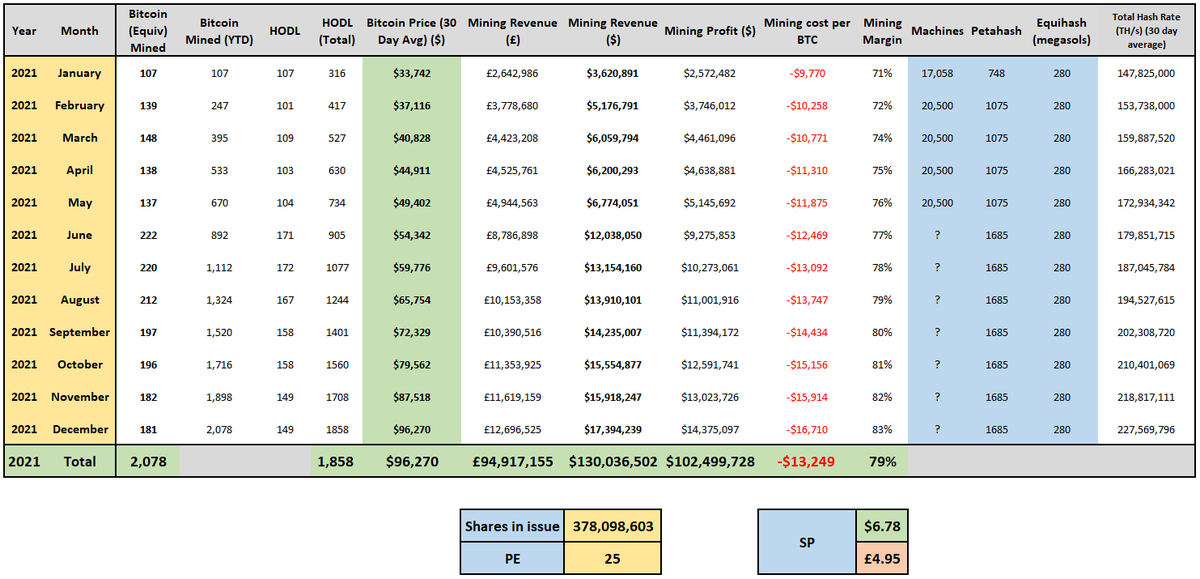

I've done 2 versions:

- Scenario 1 (BTC bull run to $96K EOY)

- Scenario 2 ($30K bitcoin)

In Scenario 1 I reach total 2021 mining revenue of $130M, with 79% margin giving earnings of $102.5M. PE of 25 gives a SP of $6.78 (£4.95).

2/11

I've done 2 versions:

- Scenario 1 (BTC bull run to $96K EOY)

- Scenario 2 ($30K bitcoin)

In Scenario 1 I reach total 2021 mining revenue of $130M, with 79% margin giving earnings of $102.5M. PE of 25 gives a SP of $6.78 (£4.95).

2/11

#ARB $ARBKF

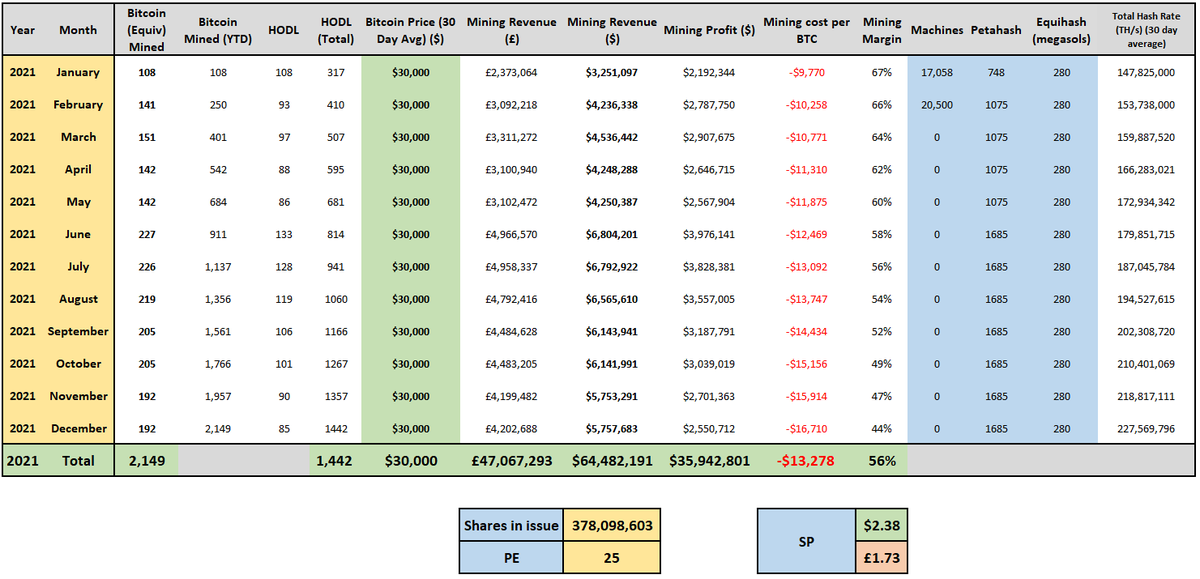

In Scenario 2 I reach total 2021 mining revenue of $64.5M, with 56% margin giving earnings of $35.9M. PE of 25 gives a SP of $2.38 (£1.73).

S1 summary table in the image below - there's a lot more that feeds into it but would be impossible to clearly display.

3/11

In Scenario 2 I reach total 2021 mining revenue of $64.5M, with 56% margin giving earnings of $35.9M. PE of 25 gives a SP of $2.38 (£1.73).

S1 summary table in the image below - there's a lot more that feeds into it but would be impossible to clearly display.

3/11

#ARB $ARBKF

In either scenario, with a PE of 25 (the Alpha article used PE of 25-30) Argo is materially undervalued with the current SP of $0.99 - far below the $30K bitcoin SP of $2.38 and Bull run SP of $6.78. TBH I don't think $96K #BTC is the ceiling, look at forecasts!

is the ceiling, look at forecasts!

5/11

In either scenario, with a PE of 25 (the Alpha article used PE of 25-30) Argo is materially undervalued with the current SP of $0.99 - far below the $30K bitcoin SP of $2.38 and Bull run SP of $6.78. TBH I don't think $96K #BTC

is the ceiling, look at forecasts!

is the ceiling, look at forecasts!5/11

#ARB $ARBKF

I'll list my assumptions below, I would appreciate any input or alternative views that would sway this forecast either way:

- #BTC mining forecasts = ARB % share of total #BTC

mining forecasts = ARB % share of total #BTC  hash power x an "efficiency" value determined by historic performance with improvements

hash power x an "efficiency" value determined by historic performance with improvements

6/11

I'll list my assumptions below, I would appreciate any input or alternative views that would sway this forecast either way:

- #BTC

mining forecasts = ARB % share of total #BTC

mining forecasts = ARB % share of total #BTC  hash power x an "efficiency" value determined by historic performance with improvements

hash power x an "efficiency" value determined by historic performance with improvements6/11

#ARB $ARBKF

... based on the new machines being much more powerful than the current.

- Total #BTC hash power increasing 4% MoM (227M TH/s Dec 21)

hash power increasing 4% MoM (227M TH/s Dec 21)

- Mining cost per #BTC increasing 5% MoM (£16.7K Dec 21)

increasing 5% MoM (£16.7K Dec 21)

- 30 day avg #BTC price increase by 10% MoM ($96K Dec 21) (Bull)

price increase by 10% MoM ($96K Dec 21) (Bull)

7/11

... based on the new machines being much more powerful than the current.

- Total #BTC

hash power increasing 4% MoM (227M TH/s Dec 21)

hash power increasing 4% MoM (227M TH/s Dec 21)- Mining cost per #BTC

increasing 5% MoM (£16.7K Dec 21)

increasing 5% MoM (£16.7K Dec 21)- 30 day avg #BTC

price increase by 10% MoM ($96K Dec 21) (Bull)

price increase by 10% MoM ($96K Dec 21) (Bull)7/11

#ARB $ARBKF

- or fixed $30K #BTC price on Scenario 2

price on Scenario 2

- Argo increasing Petahash to 1075 for Feb to May, and to 1685 from June onwards (no phasing in)

- Equihash remains at 280ms

- GBP (£) to USD ($) remains at 1.37

- 280ms = 5% total ZEC mining capacity

8/11

- or fixed $30K #BTC

price on Scenario 2

price on Scenario 2- Argo increasing Petahash to 1075 for Feb to May, and to 1685 from June onwards (no phasing in)

- Equihash remains at 280ms

- GBP (£) to USD ($) remains at 1.37

- 280ms = 5% total ZEC mining capacity

8/11

#ARB $ARBKF

- 5% MoM ZEC price increase ($146 Dec 21)

- ZEC #BTC equivalent = ZEC mining revenue/ #BTC

equivalent = ZEC mining revenue/ #BTC  price

price

- No #BTC sold in January, and minimum sold for rest of the year to cover mining costs only

sold in January, and minimum sold for rest of the year to cover mining costs only

9/11

- 5% MoM ZEC price increase ($146 Dec 21)

- ZEC #BTC

equivalent = ZEC mining revenue/ #BTC

equivalent = ZEC mining revenue/ #BTC  price

price- No #BTC

sold in January, and minimum sold for rest of the year to cover mining costs only

sold in January, and minimum sold for rest of the year to cover mining costs only9/11

#ARB $ARBKF

I'm concerned that the mining margin is high in the bull run example, however, this is based on LY data - considering the start of Jan 70%+ and the more efficient equipment being installed. I have factored in increased difficulty due to growing total hash power.

10/11

I'm concerned that the mining margin is high in the bull run example, however, this is based on LY data - considering the start of Jan 70%+ and the more efficient equipment being installed. I have factored in increased difficulty due to growing total hash power.

10/11

#ARB $ARBKF

Would appreciate your thoughts, but I think both scenarios demonstrate just how undervalued @ArgoBlockchain is - without considering the bubble around the competition!

11/11

Would appreciate your thoughts, but I think both scenarios demonstrate just how undervalued @ArgoBlockchain is - without considering the bubble around the competition!

11/11

Read on Twitter

Read on Twitter