Advocates for eliminating WV's income tax seem to be a little hesitant to explain how it would be paid for, so I took a crack at it. https://wvpolicy.org/how-do-you-pay-for-a-2-1-billion-tax-cut/

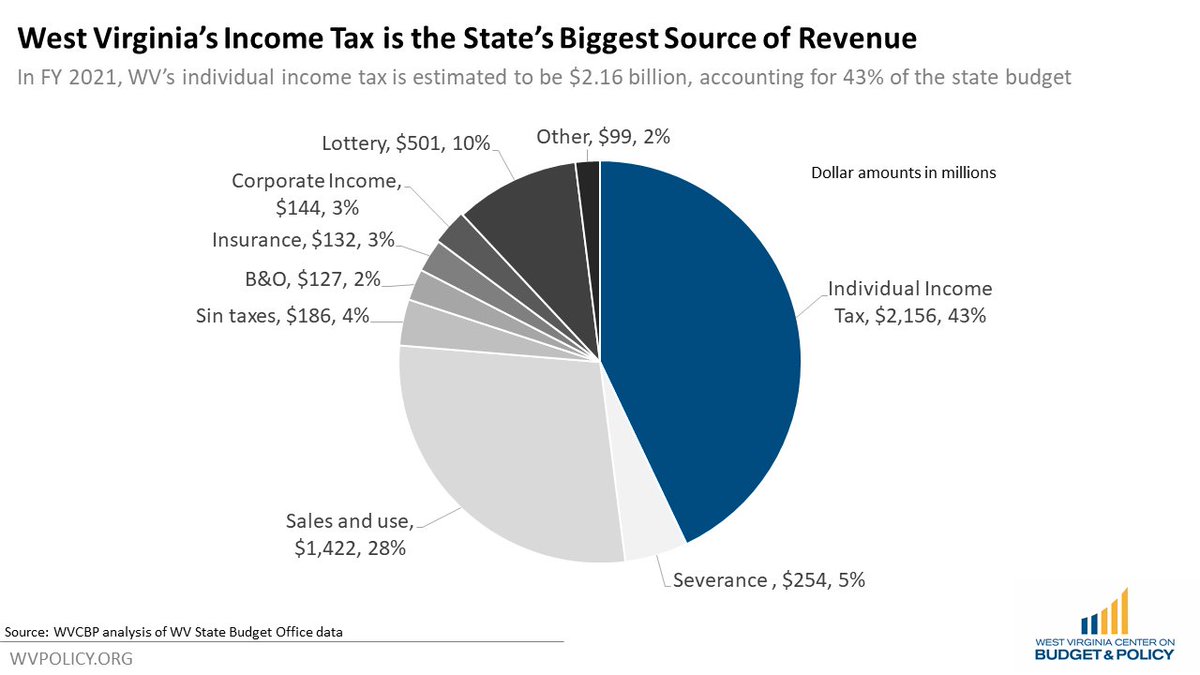

The income tax is estimated to be about $2.16 billion for FY 2021, or 43% of the base budget, so that is our starting point.

State's without income taxes typically have higher sales taxes. If WV wanted to get about $1 billion of that $2.16 billion back, it would need a sales tax rate over 10% https://wvpolicy.org/eliminating-the-income-tax-benefits-the-wealthy-while-undermining-important-public-investments/

Eliminating the income tax and adding a sales tax of 10.3% would be an overall tax increase for 60% of West Virginians, with taxpayers earning less than $55k seeing an overall tax increase.

So more of a tax shift than a tax cut, but that's how it works.

So more of a tax shift than a tax cut, but that's how it works.

But even with a 10% sales tax, you still would need to another $1.16 billion.

So let's start cutting the budget.

So let's start cutting the budget.

A 10% cut to all executive branch departments, including the Governor’s Office, Auditor, Treasurer, Agriculture, Attorney General, and Secretary of State:

$4.1 million

$4.1 million

A 10% cut to the Legislature:

$2.5 million

$2.5 million

A 10% cut to the Supreme Court and court system:

$13.5 million

$13.5 million

A 20% cut to the Department of Administration, which includes General Services and the Public Defender offices:

$16.8 million

$16.8 million

A 20% cut to the Department of Commerce, including the Development Office, and the Divisions of Natural Resources, Forestry, Rehabilitation Services, and Tourism:

$18 million

$18 million

A 20% cut to the Department of Environmental Protection:

$1.3 million

$1.3 million

A 20% cut to the Department of Military Affairs and Public Safety, including Homeland Security, all correctional facilities, the State Police, and the Division of Juvenile Services:

$89.4 million

$89.4 million

Eliminate the Department of Veterans Assistance:

$12 million

$12 million

Eliminate the Department of Education and the Arts, including the Division of Culture and History, the Library Commission, public broadcasting, and all fairs and festivals:

$26.3 million

$26.3 million

From the State Board of Education, eliminate funding for safe schools, Governor’s Honors Academy, early literacy, and 21st Century learners and technology grants and programs:

$25.6 million

$25.6 million

A 20% cut to remaining State Board of Education:

$13.9 million

$13.9 million

A 20% cut to the Education Vocational Division, Aid for Exceptional Children, and School for the Deaf and Blind:

$16.8 million

$16.8 million

From the Division of Health, eliminate funding for state aid for local health services, the safe drinking water program, emergency medical services support, early intervention, maternal health clinics, and Health Right free clinics:

$33.6 million

$33.6 million

A 20% cut to the remaining Division of Health:

$8.5 million

$8.5 million

A 20% cut to Social Services/foster care:

$45.3 million

$45.3 million

From the Division of Human Services, eliminate funding for child care development, family preservation, family resource networks, domestic violence legal services and prevention funds, in-home family education, and indigent burials:

$11.9 million

$11.9 million

20 percent cut to the remaining Division of Human Services, except Medicaid/CHIP/TANF, but including the child welfare system, child support enforcement, and Child Protective Services (CPS) case workers:

$23.2 million

$23.2 million

A 20% cut to the Consolidated Medical Services Fund, including substance abuse continuum care, behavioral health programs, and state hospitals and institutions:

$44.9 million

$44.9 million

Eliminate the PROMISE scholarship:

$47 million

$47 million

Eliminate the Higher Education and Higher Education Adult Part-Time Student (HEAPS) grant programs:

$45.6 million

$45.6 million

A 20% cut to all community and technical colleges and the Council for Community and Technical College Education:

$15.9 million

$15.9 million

A 30% cut to all colleges and universities and the Higher Education Policy Commission:

$88.1 million

$88.1 million

Make all of these cuts, AND increase the sales tax to 10.3%, and guess what?

You still would have to find another $578 million in further cuts or tax increases.

You still would have to find another $578 million in further cuts or tax increases.

Cutting state k-12 education funding by 20% could get you another $244 million, but would likely be unconstitutional and would require major cuts to teacher pay and PEIA.

But you're still not there.

But you're still not there.

Bringing back the grocery tax could get $60-$125 million depending on the rate, but again that's more tax increases for low and middle income families, in order to pay for tax cuts for the wealthy.

Expanding the sales tax to professional and personal services could get $173 million, but isn't very popular and and isn't without issues https://wvpolicy.org/expanding-the-sales-tax-to-more-services-sound-policy/

We could increase the severance tax on coal and natural gas, and get $75-$100 million, depending on energy prices. But that's a declining source of revenue. Plus the industry seems a little emotionally fragile right now.

Legalizing and taxing marijuana is a good idea on its own, but a bad plan to help pay for tax cuts for the wealthy. A 37% retail tax, like in Washington state, would be about $60 million.

The bottom line is, WV has spent the past 15 years cutting taxes, substantially, with little to show for it beyond less investment in education, public health, and infrastructure.

There's no way around it. Eliminating the income tax will mean shifting taxes away from the wealthy and onto the low and middle income families, while still requiring major cuts to and elimination of public services.

Read on Twitter

Read on Twitter