The stock market has always been a place retail could have phenomenal success. The key is spend less than you earn & save in order to get rich slow. This is one of my favorite stories: https://www.nytimes.com/2018/05/06/nyregion/secretary-fortune-donates.html

This whole "retail" narrative is silly & scary. It's a dangerous place once you think of it as a "get rich fast" scheme.

& to hear billionaires like Chamath pile into that populist narrative is utter nonsenes. If you wanna preach, talk discipline and responsibility first.

Why do I care? I'm gonna get a little personal here. I'm the son of an immigrant mom who left Poland as a political refugee and a dad whose father was a Holocaust survivor and never really got his fur business back together.

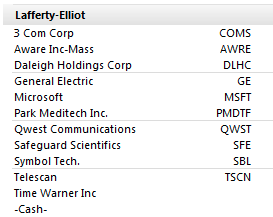

My parents were average middle class dentists who found lightning in a bottle in the stock market as the dot com boom got roaring. We all thought we were geniuses & we went from ordering "coke with no ice" at restaurants to save money to feeling wealthy.

And we lost literally everything when dot com blew up. These were formative years for me. I turned 18 as the bubble peaked. The financial turmoil was catalytic in breaking my family apart.

The arrogance I see from the WSB and billionaire cheerleaders like Chamath is deeply disturbing and they know it's wrong. This isn't a game. People don't realize the risk they're taking & they won't know until their lives are wrecked. I know. I've been there.

To tie it all together, it might seem like billionaire hedge funds are getting blown up right now, this is true, but every single short squeeze ends exactly the same way for a reason and it looks like this: https://twitter.com/ElliotTurn/status/1354528768069660672

The reason is that there is no buyer on the other side b/c who in their right mind wants to legitimately own Gamestop for anything more than a fraction of what it's trading it right now? Who owns all that Gamestop right now? It's retail!

Without a buyer to pass the hot potato to, it's retail that's going to be holding the bag. Sure there might be some winners, but in aggregate, it's not the HF losses that have happened which bother me, it's the retail losses that will happen which hit me in the gut and hurt.

Gamestop is gonna lose 90% of its value and it doesn't matter what Robinhood does or doesn't do now. Trading dynamic have nothing it do with value in the short-term but value always imposes gravity in the end.

If you're asking for freedom to buy gamestop, yes you should have it, but you're also asking for freedom to get run over so don't complain on the flip side.

And if you're a hero populist right now fighting for freedom, just acknowledge the logic here. You are fighting for retailers to get smoked. It's gross grandstanding that'll cost avg people a lot of money.

If you truly are interested in learning how to invest, I strongly recommen reading "More than You Know" by Michael Mauboussin https://www.amazon.com/More-Than-You-Know-Unconventional/dp/0231143729

The book is fun, interesting and accessible and you were learn a lot. I was once a dorm room stock enthusiast thinking I could beat Wall Street, but you need to know how Wall Street works.

Mauboussin shares the traits the best investors all have in common, with a key one being they are NOT "Wall Street"

Why? What does Wall Street want you to do? Wall Street makes money on fees. They do not want you to buy and hold stocks-they love this "trading" b/c everytime you buy or sell something on Robinhood, there are fees to be earned (even if you're paying $0 commissions).

If you truly want to beat Wall Street, think different, focus on value, not price and always try to learn more. Be smarter tomorrow than you are today. Stay humble. Internalize every lesson. The only guarantee is that there will be painful mistakes along the way.

Read on Twitter

Read on Twitter