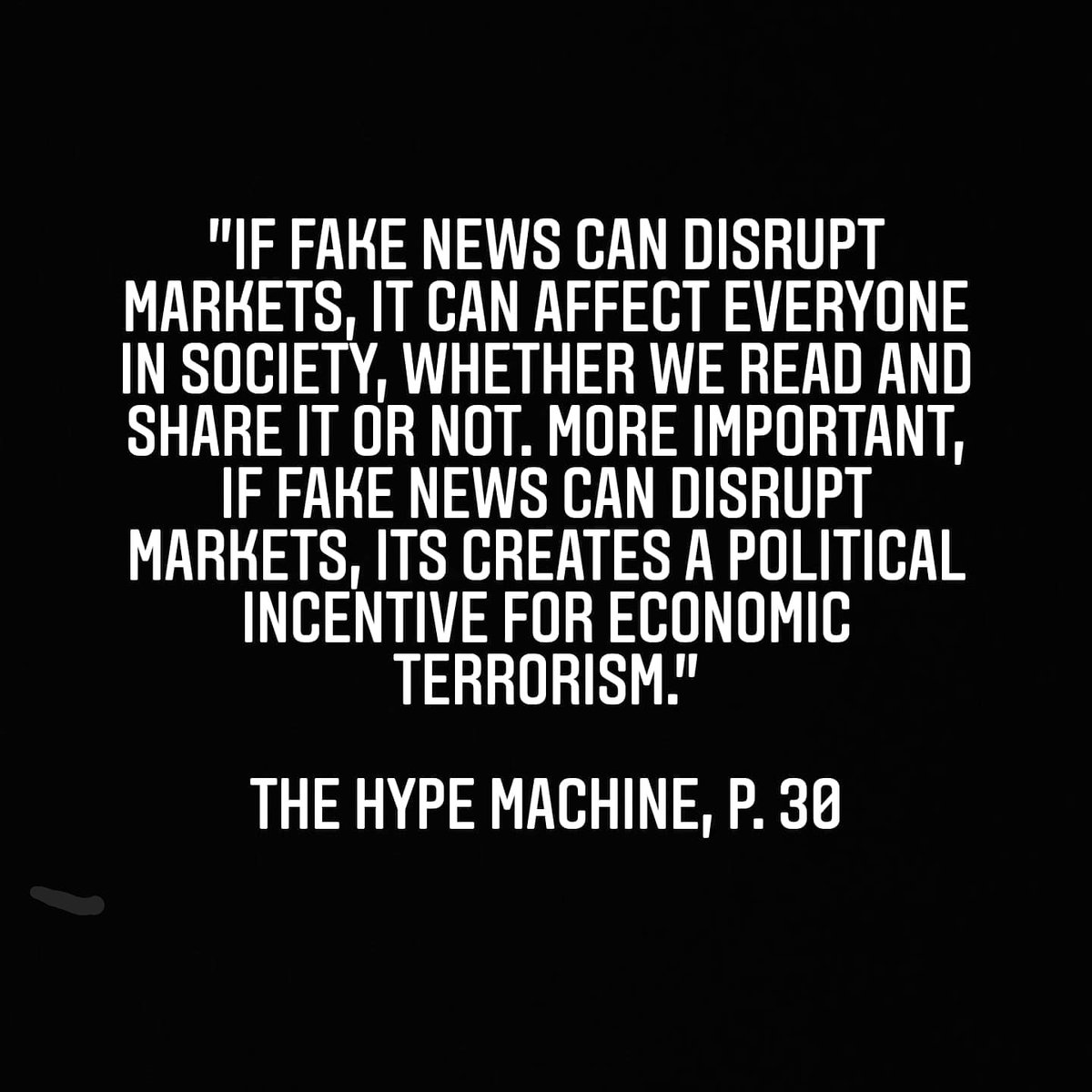

[ #GameStop Thread] This week, social media coordination created a spike in the @GameStop stock that rose over 1700% as retail investors coordinated over information on @reddit and other social media to pump the stock. 1/8

Millions of small investors, egged on by social media, employed a classic Wall Street tactic to put the squeeze — on Wall Street, especially short sellers. 2/8 https://www.nytimes.com/2021/01/27/business/gamestop-wall-street-bets.html

I covered this possibility in detail in my book The Hype Machine  . In Chapter 2 "The End of Reality" I discussed how social media memes could be used to inflate stock prices and cause bubbles. 3/8 http://www.sinanaral.io/books

. In Chapter 2 "The End of Reality" I discussed how social media memes could be used to inflate stock prices and cause bubbles. 3/8 http://www.sinanaral.io/books

. In Chapter 2 "The End of Reality" I discussed how social media memes could be used to inflate stock prices and cause bubbles. 3/8 http://www.sinanaral.io/books

. In Chapter 2 "The End of Reality" I discussed how social media memes could be used to inflate stock prices and cause bubbles. 3/8 http://www.sinanaral.io/books

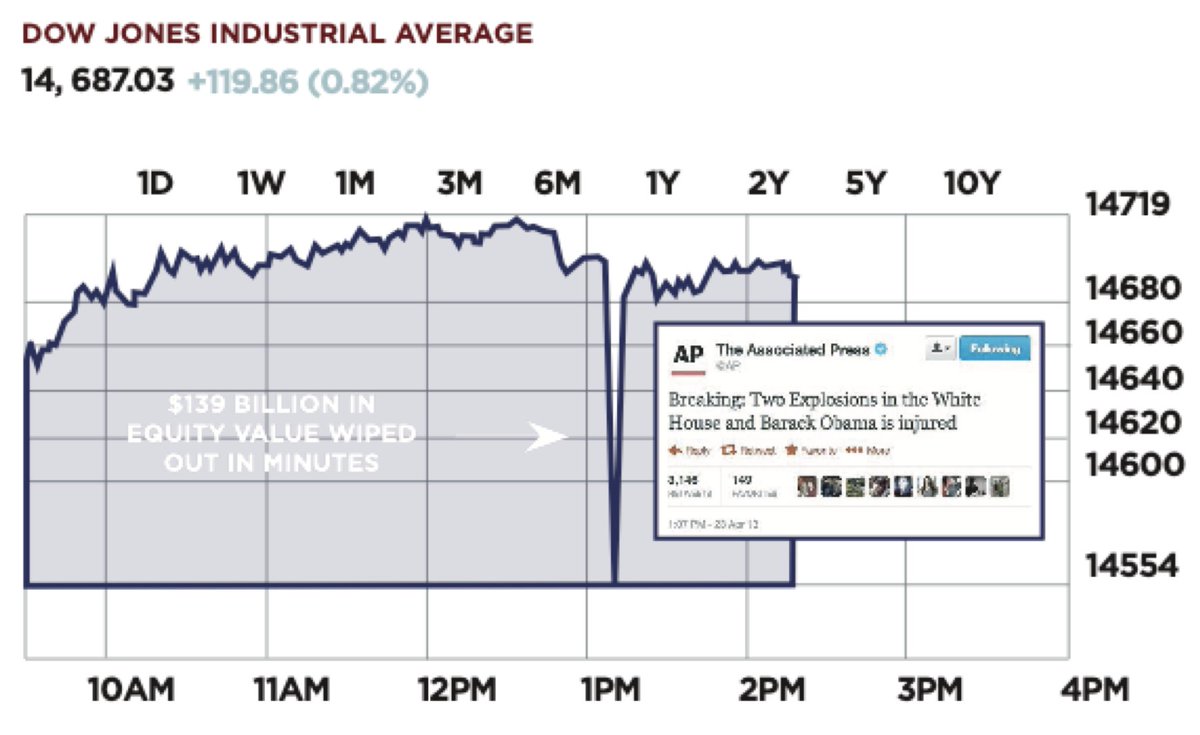

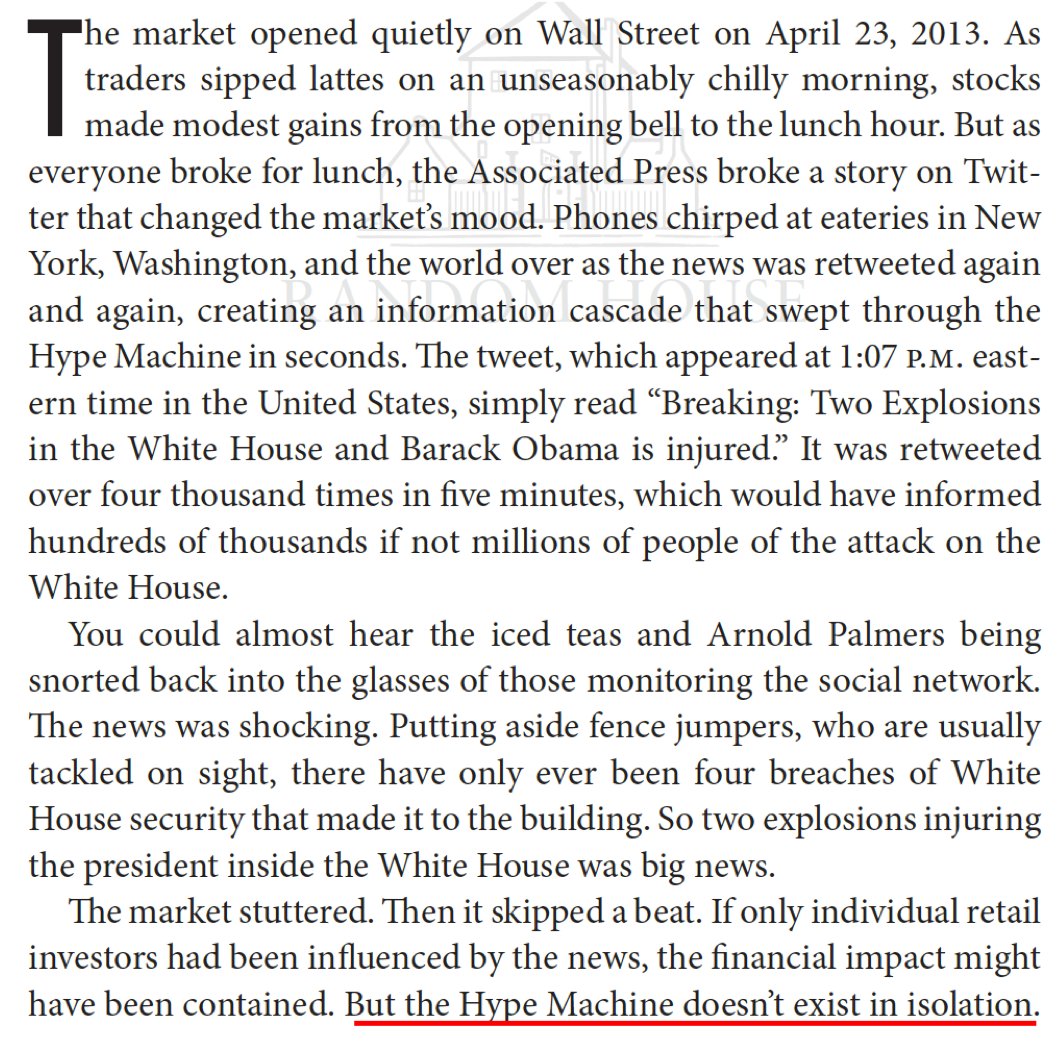

For example, I described the Hack Crash of 2013 in which a viral false news tweet by Syrian hackers who had infiltrated the AP News twitter handle wiped out $140B in equity value in a matter of minutes.  4/8

4/8

4/8

4/8

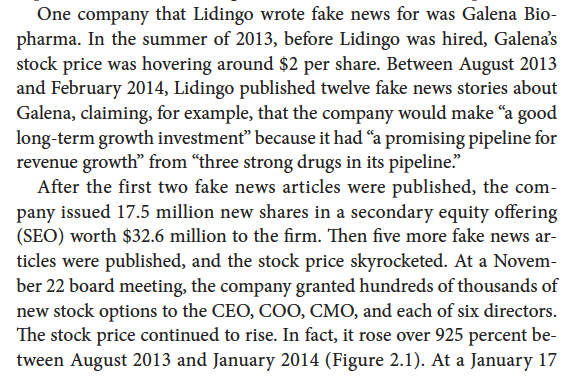

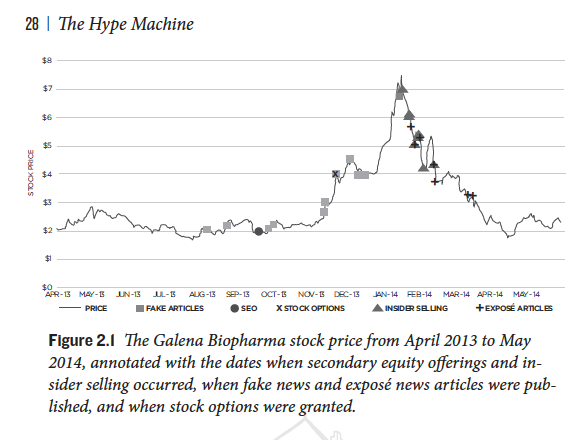

But, more relevant to the #GameStop story, I discussed, in detail, how coordinate news propagated over social media can support 'pump and dump' schemes that inflate the price of stock artificially.  5/8

5/8

5/8

5/8

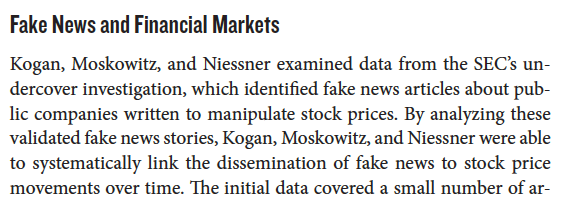

I also described the large scale statistical evidence for the impact of social media on financial markets. 6/8

6/8

6/8

6/8

I'm glad people are coming around to the threat of the "meme-stock bubble"...  (But I can't say I didn't warn us). 7/8 https://marker.medium.com/gamestop-proves-were-in-a-meme-stock-bubble-b3f39163a77f

(But I can't say I didn't warn us). 7/8 https://marker.medium.com/gamestop-proves-were-in-a-meme-stock-bubble-b3f39163a77f

(But I can't say I didn't warn us). 7/8 https://marker.medium.com/gamestop-proves-were-in-a-meme-stock-bubble-b3f39163a77f

(But I can't say I didn't warn us). 7/8 https://marker.medium.com/gamestop-proves-were-in-a-meme-stock-bubble-b3f39163a77f

The next question is "what do we do?" *Stay tuned*... On the heals of "The Hype Machine" book, in which I tried to address solutions to our social media crisis in detail, we're preparing a big announcement at the @mitide to move this us further down the road toward solutions. 8/8

The GameStop effect is extending to AMC. The theater chain soared 300% at the open to the highest since 2018 https://trib.al/YJeie4b 9/

Note my coverage in the book of the way the Hype Machine is coupled to automated systems that analyze and amplify these types of stock movements. I predict an autopsy will reveal the same thing going on here with #GameStop and #amcstock  10/

10/

10/

10/

Robinhood blocks purchase of GameStop, AMC, and BlackBerry stock https://www.theverge.com/2021/1/28/22254102/robinhood-gamestop-bloc-stock-purchase-amc-reddit-wsb

Not sure people understand all the perverse incentives here, either on the retail side or the institutional side. It will be interesting to see what the inevitable SEC investigation turns up.

It will be interesting to see what the inevitable SEC investigation turns up.

Robinhood raised $1 billion after halting GameStop purchases. https://www.cnn.com/2021/01/29/investing/robinhood-gamestop-reddit/index.html

It will be interesting to see what the inevitable SEC investigation turns up.

It will be interesting to see what the inevitable SEC investigation turns up.Robinhood raised $1 billion after halting GameStop purchases. https://www.cnn.com/2021/01/29/investing/robinhood-gamestop-reddit/index.html

Robinhood’s Customers Are Hedge Funds Like Citadel, Its Users Are the Product https://www.vice.com/en/article/qjpnz5/robinhoods-customers-are-hedge-funds-like-citadel-its-users-are-the-product

The plot thickens: Google is salvaging Robinhood’s one-star rating by deleting nearly 100,000 negative reviews. https://www.theverge.com/2021/1/28/22255245/google-deleting-bad-robinhood-reviews-play-store

A real life Robinhood story (one that might not end well) https://www.bostonglobe.com/2021/01/29/business/real-life-robinhood-story-one-that-might-not-end-well/

Robinhood explains its decision to block buying on #gamestop @ChrisCuomo pushes back. HT/ @tomeckles https://twitter.com/CNN/status/1355173784764952581?s=09

Keith Gill Drove the GameStop Reddit Mania. The trader known as "DeepF—ingValue" on the WallStreetBets forum told the @WSJ “I didn’t expect this.” https://www.wsj.com/articles/keith-gill-drove-the-gamestop-reddit-mania-he-talked-to-the-journal-11611931696

His risky bet made him a millionaire on paper. It could've gone very differently. https://www.cnn.com/videos/business/2021/01/29/trader-millionaire-gamestop-stock-orig.cnn

Untethering markets from economic reality is a recipe for economic instability

Opinion piece by @scmallaby in The Washington Post: The good guys in the GameStop story? It’s the hedge funds and short sellers.. https://www.washingtonpost.com/opinions/2021/01/30/good-guys-gamestop-story-its-hedge-funds-short-sellers/

Opinion piece by @scmallaby in The Washington Post: The good guys in the GameStop story? It’s the hedge funds and short sellers.. https://www.washingtonpost.com/opinions/2021/01/30/good-guys-gamestop-story-its-hedge-funds-short-sellers/

Now its spread to #silversqueeze: https://finance.yahoo.com/news/silver-prices-miners-surge-retail-233525218.html

As exoected, #GameStop #AMC and Silver Tumble... https://www.wsj.com/livecoverage/gamestop-amc-silver-stock-market

This was so predictable  . And not yesterday or Friday, but early last week.

. And not yesterday or Friday, but early last week.

As GameStop stock crumbles, newbie traders reckon with heavy losses. https://www.washingtonpost.com/technology/2021/02/02/gamestop-stock-plunge-losers/

. And not yesterday or Friday, but early last week.

. And not yesterday or Friday, but early last week.As GameStop stock crumbles, newbie traders reckon with heavy losses. https://www.washingtonpost.com/technology/2021/02/02/gamestop-stock-plunge-losers/

The Sharks arrive at the GameStop party... https://finance.yahoo.com/news/hedge-funds-mudrick-silverlake-point72-gamestop-party-morning-brief-110406546.html

My OPED in @wapo on this  https://www.washingtonpost.com/opinions/2021/01/31/gamestop-signals-new-destabilizing-collision-between-social-media-real-world/

https://www.washingtonpost.com/opinions/2021/01/31/gamestop-signals-new-destabilizing-collision-between-social-media-real-world/

https://www.washingtonpost.com/opinions/2021/01/31/gamestop-signals-new-destabilizing-collision-between-social-media-real-world/

https://www.washingtonpost.com/opinions/2021/01/31/gamestop-signals-new-destabilizing-collision-between-social-media-real-world/

As #GameStop plunges, Volkswagen's 2008 short squeeze gives an idea of how painful it will get. https://www.cnbc.com/2021/02/02/as-gamestop-plunges-volkswagens-2008-short-squeeze-gives-an-idea-of-how-painful-it-will-get.html

Also described in detail in my book (Chp 2), how Wall Street senses, mines and profits from social media sentiment...

Wall Street is keeping very close tabs on WallStreetBets. Here's how. https://www.cnn.com/2021/02/03/investing/wall-street-reddit-hedge-funds/index.html

Wall Street is keeping very close tabs on WallStreetBets. Here's how. https://www.cnn.com/2021/02/03/investing/wall-street-reddit-hedge-funds/index.html

Hedge funds emerge mostly unscathed from Reddit trader drama. https://www.aljazeera.com/economy/2021/2/2/hedge-funds-live-to-see-another-day-after-last-weeks-stock-drama

The latest GameStop stock dip looks like the end of the line. https://www.theverge.com/2021/2/4/22266684/gamestop-stock-gme-down-dip-falling-wallstreetbets-reddit

Yellen and Regulators Met Amid GameStop Frenzy to Discuss Market Volatility. https://www.nytimes.com/2021/02/04/business/economy/yellen-gamestop.html

[Sly Goliath] #GameStop wasn't the retail trader rebellion it was perceived to be. It wasn't in the 10 most bought stocks by retailer investors last week and data show "institutional investors were big drivers of the wild price action on the way up." https://www.cnbc.com/2021/02/05/gamestop-mania-may-not-have-been-the-retail-trader-rebellion-it-was-perceived-to-be-data-shows.html

Read on Twitter

Read on Twitter