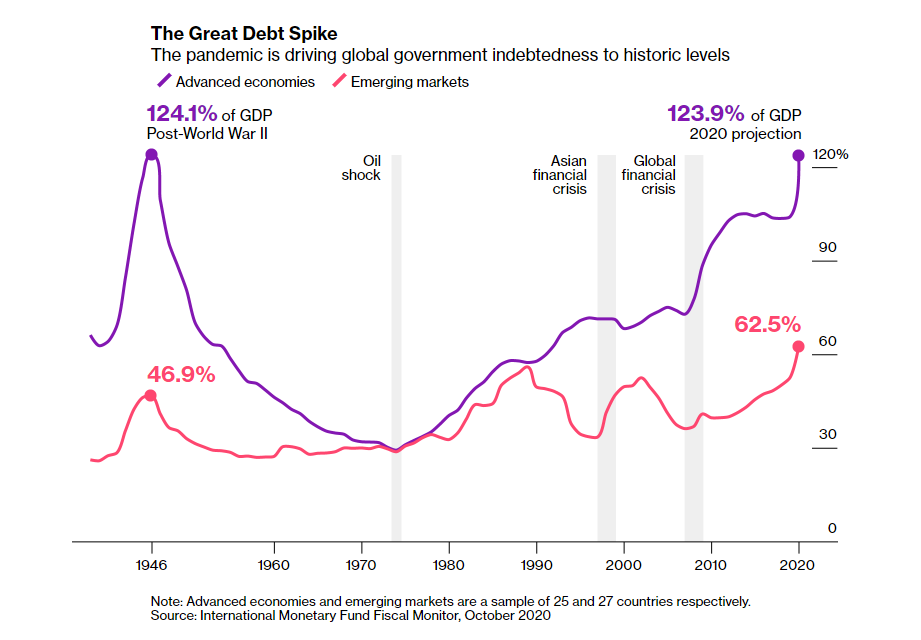

In the battle against Covid-19, governments around the globe are on the cusp of becoming more indebted than at any point in modern history, surpassing even World War II (THREAD) https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

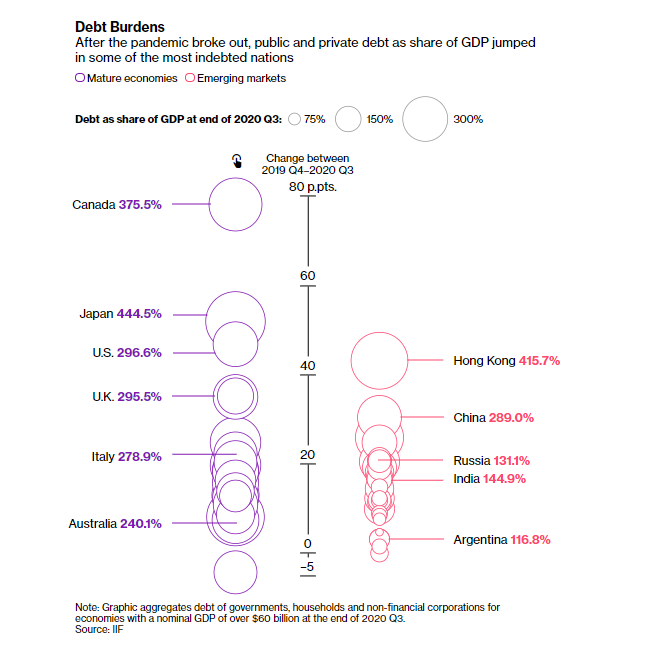

From Germany to Japan, Canada to China, fiscal authorities have spent vast sums protecting their people and defending their economies from the colossal toll of the pandemic https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

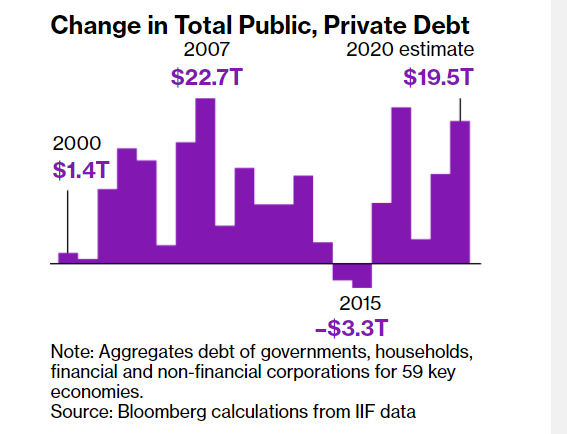

At the same time corporations, emboldened by unprecedented government support for markets, are selling bonds like never before https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

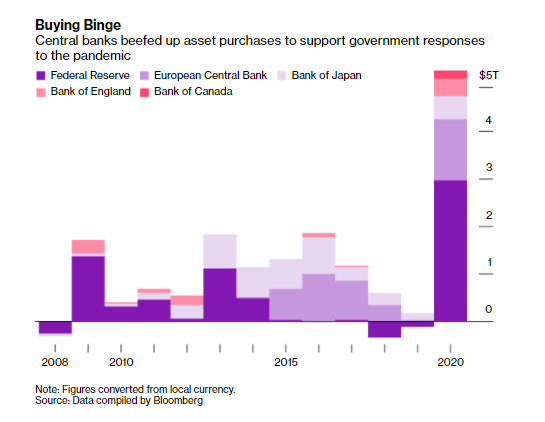

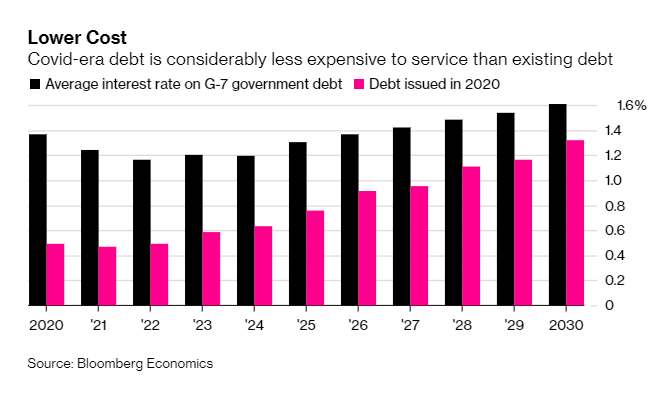

If government borrowing is a bridge to recovery, central banks are the supports. By slashing interest rates and buying more than $5 trillion of assets, they have allowed countries to borrow at a breakneck pace https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

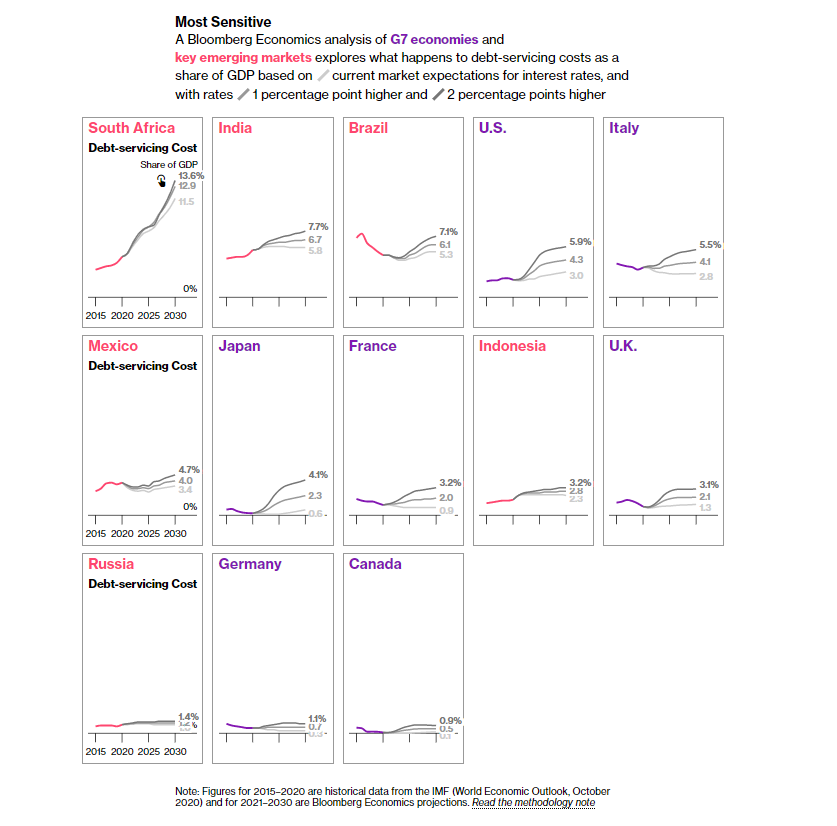

An analysis by Bloomberg Economics shows that even as debt for the G-7 rose from 85% of GDP in 2005 to 140% now, the cost of servicing that debt has fallen. Projections out to 2030 show that for many countries, costs are expected to stay manageable https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

Yet as the recovery gathers steam, the balance of risks will change. Central banks may face tough trade-offs between managing inflation and maintaining supportive policies in the years ahead https://www.bloomberg.com/graphics/2021-coronavirus-global-debt

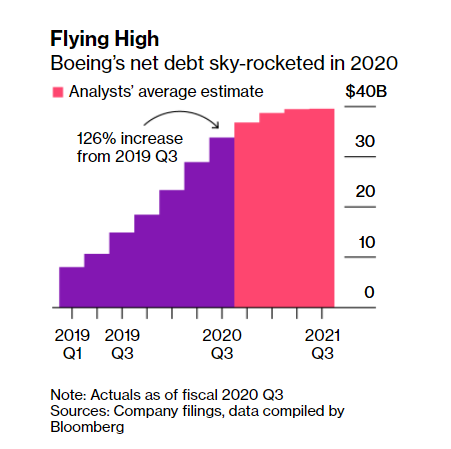

Credit markets were also bolstered, helping companies sell a record $4.4 trillion of bonds in 2020. Nearly every corner of the market was lifted, allowing struggling firms to tap much needed financing while providing top-rated issuers access to some of the cheapest funding ever

Perhaps no company was a bigger beneficiary than Boeing. After initially asking Washington for a $60B bailout for itself & its suppliers, Boeing was able to sell nearly $30B of bonds in 2020, underscoring the extent government policies rebuilt confidence in credit markets

“Massive stimulus is the best, indeed the only possible response to the Covid-19 recession,” says @JMurray804. “Extremely low interest rates mean the immediate cost is basically zero. That doesn’t mean stimulus is free” https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

Read the full story (via @mccormickliz, @ctorresreporter & @pogkas) here: https://www.bloomberg.com/graphics/2021-coronavirus-global-debt/

Read on Twitter

Read on Twitter