The "China is back" narrative has become gospel truth. But China’s own numbers as well as independently collected data don't tell the story of a blockbuster rebound. Instead, they show a full-year recession hiding in plain sight. @barronsonline

THREAD https://www.barrons.com/articles/the-great-chinese-rebound-not-so-fast-51611622798

THREAD https://www.barrons.com/articles/the-great-chinese-rebound-not-so-fast-51611622798

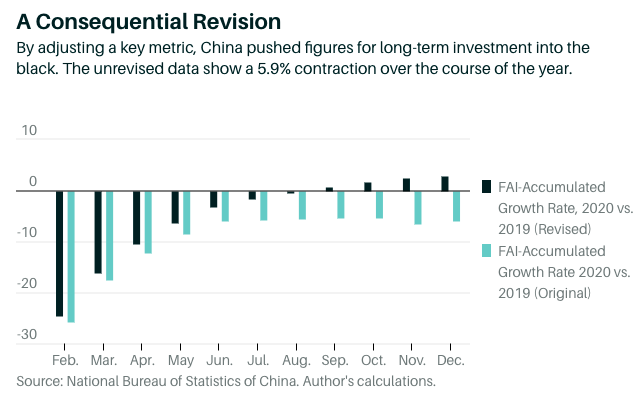

A close look at official statistics reveals key economic numbers have been wildly inflated through downward revisions to 2019 baselines. Start w/ FAI: NBS cut aggregate 2019 FAI by 4.7+ trillion yuan (~$720b).

H/t @nickm4rro for first flagging this. https://twitter.com/nickm4rro/status/1318222658052317186

H/t @nickm4rro for first flagging this. https://twitter.com/nickm4rro/status/1318222658052317186

By changing the baseline China masked what was in fact a year-long contraction in investment spending. The unadjusted data show 2020 FAI shrinking roughly 5.9% YoY BUT the revised data helped Beijing create the illusion of a V-shaped recovery in investment spending.

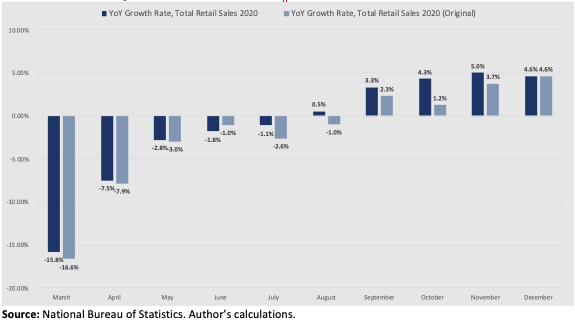

Total retail sales was similarly revised down, showing positive on-year growth each month since August 2020. But unrevised numbers show retail sales growing from Sep and at a slower rate for the remainder of the year.

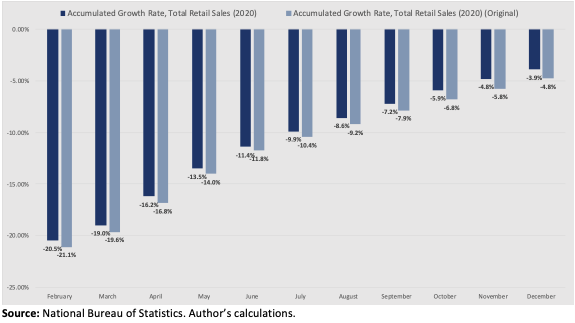

Moreover, unrevised data show aggregate total retail sales contracted 4.8% y/y or ~1.97 trillion yuan in 2020. (Even based on revised data they fell by 3.9%.)

No matter how you slice the official numbers China is not seeing a broad-based recovery that includes Chinese consumers.

No matter how you slice the official numbers China is not seeing a broad-based recovery that includes Chinese consumers.

Official stats are routinely revised. So why the skepticism here?

1. NBS's cherry-picking sampling: it drops firms from surveys if their revenues fall below a threshold & cuts their data from historical series. The resulting revised numbers are obv not representative of the econ.

1. NBS's cherry-picking sampling: it drops firms from surveys if their revenues fall below a threshold & cuts their data from historical series. The resulting revised numbers are obv not representative of the econ.

2. No transparency: NBS doesn't meaningfully explain why numbers were adjusted OR publish the new series. It also scrubbed 2019-20 nominal FAI from its online database.

Hard but to conclude these revisions are aimed at distorting reality not giving a more accurate economic read.

Hard but to conclude these revisions are aimed at distorting reality not giving a more accurate economic read.

Further, private data also don't show the economy at pre-Covid levels. @ChinaBeigeBook's Q4 data showed China continuing to recover but each of our key performance metrics, sectors, and regions posted a fourth consecutive quarter of y/y contraction -- a first in 10 years!

Read on Twitter

Read on Twitter