Many saying valuations make no sense & investors dont care about fundamentals

May be true in certain areas of the mkt where speculation appears rampant but just bc something sells for a high multiple doesnt mean its overvalued & investors arent considering future fundamentals /1

May be true in certain areas of the mkt where speculation appears rampant but just bc something sells for a high multiple doesnt mean its overvalued & investors arent considering future fundamentals /1

I recently started listening to @exponentfm from the beginning in 2014 bc for some reason I find listening to nearly decade old tech dynamics in my free time fun. Anyways, in 2015 they had a podcast discussing whether what looked like frothy "tech" valuations were in bubble. /2

Their conclusion was that "this time was actually different" than the dotcom bubble. "People always try to compare bubbles to 1999, but today's world is completely & utterly different." /3 https://podcasts.apple.com/us/podcast/exponent/id826420969?i=1000339694049

"Many of these companies are poised to reshape their industries & are sound investments" even at what seemed to be frothy valuations. /4

This inspired me to look back at some of the tech valuations that many believed "completely parted from their fundamentals" to see what happened.

Here are some interesting charts...

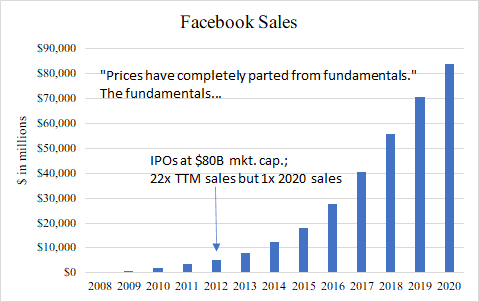

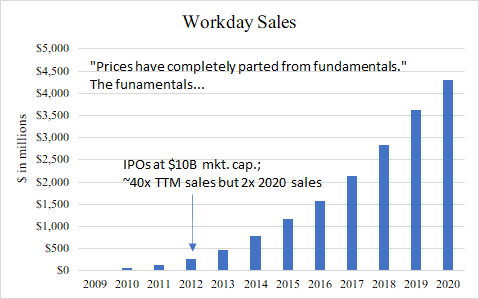

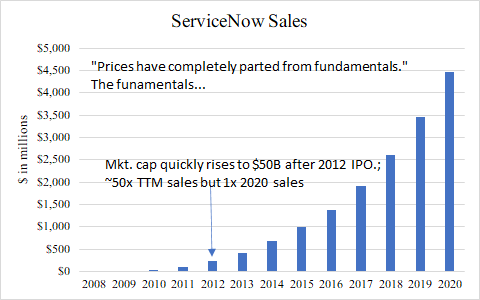

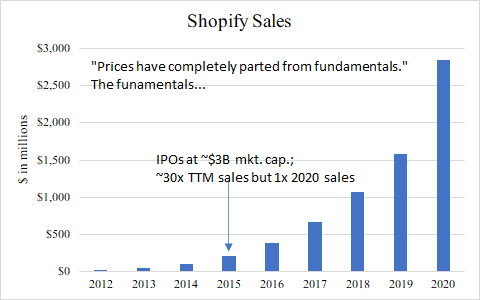

/5

/5

Here are some interesting charts...

/5

/5

$GOOGL price quickly rose to ~$50B mkt. cap. after IPO; 34x TTM sales but 0.3x 2020 sales. /6

$FB IPOs at ~$80B mkt. cap.; 22x TTM sales but 1x 2020 sales. /7

$WDAY IPOs at ~$10B mkt. cap.; ~40x TTM sales but 2x 2020 sales. /8

$NOW mkt. cap quickly rises to $50B after 2012 IPO.; ~50x TTM sales but 1x 2020 sales. /9

$SHOP IPOs at ~$3B mkt. cap.; ~30x TTM sales but 1x 2020 sales. /10

There is a ton of survivorship bias by looking back at the successful companies and ignoring the many that failed but I think the broader point is that high multiples do not necessarily mean a company is overvalued or not connected to its future intrinsic value. /11

1 of my favorite pts from the podcast was that these are largely "winner take all markets" which also means they are "most take none markets". There arent many companies that have these extremely attractive scalable economics meaning be cautious w/ having optimistic forecasts /12

Yes picking the token few winners beforehand is difficult w/o the help of hindsight but if u do find one u have strong conviction is the winner in a winner take most mkt, w/ a scalable model, in a very large mkt, it just might make sense to pay a higher multiple. /13

Couldnt recommend getting a @stratechery subscription highly enough. It was one of the resources that helped me make the mental paradigm shift to better understand the internet dynamics that are impacting every industry across the economy. Thank you @benthompson for your work!/14

Read on Twitter

Read on Twitter