Today, the #JPMCInstitute released a new report examining the cash flows of small businesses that received Paycheck Protection Program (PPP) loans in May and July through Chase and other lenders. 1/ https://jpmorganchase.com/institute/research/small-business/paycheck-protection-program-small-business-balances-revenues-and-expenses-weeks-after-loan-disbursement/?jp_cmp=social_=cwtwitter_=ppp

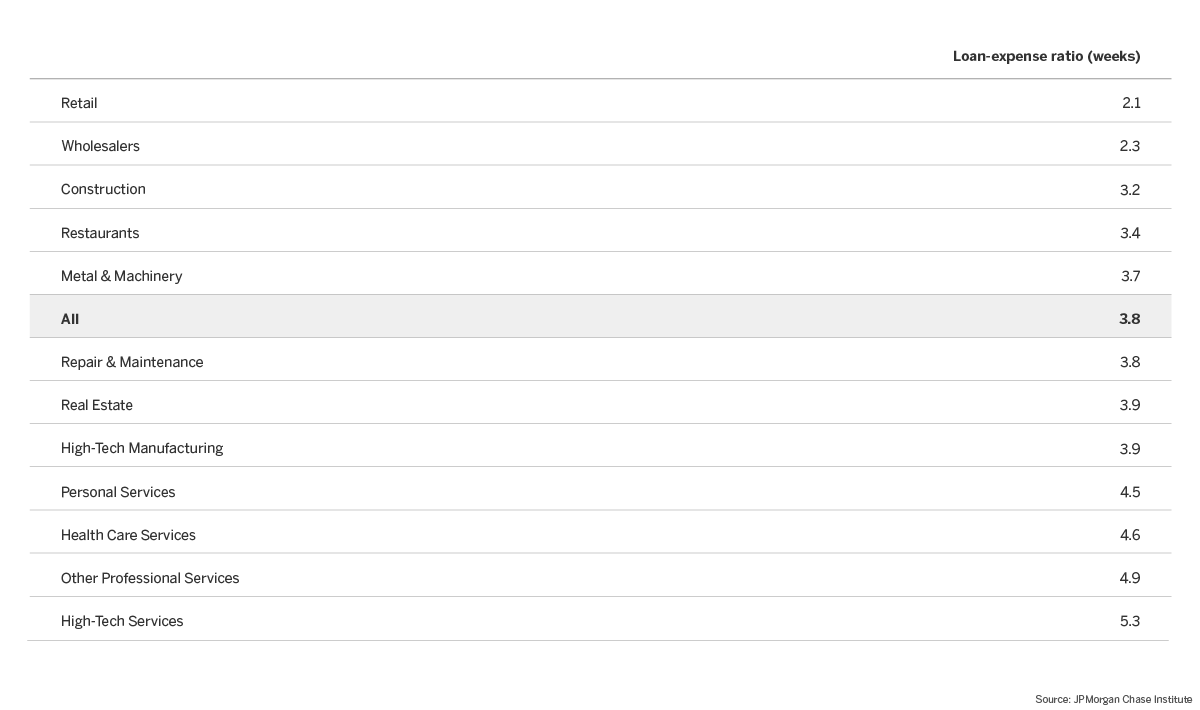

We found that the typical PPP loan covered nearly 4 weeks of total business expenses. If payroll was one third of expenses, the loan could cover 11 weeks of only payroll. 2/

Loans covered the fewest number of weeks of expenses for businesses in the retail industry (2.1 weeks). Restaurants could also cover fewer weeks of expenses (3.4 weeks) than the typical business. 3/

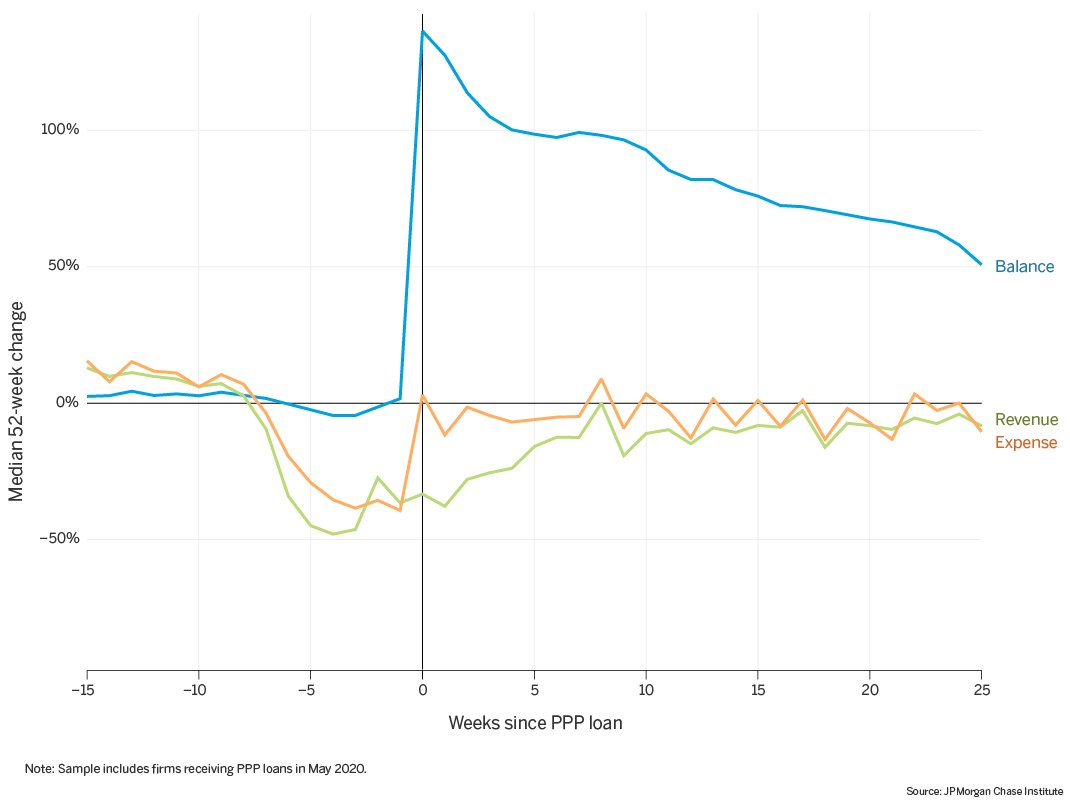

The typical small business’s cash balances increased 136% upon receipt of the PPP loan, supporting an immediate increase in expenses and more than doubling balances relative to the prior year. 4/

While PPP supported payroll as intended, policymakers should note that payroll is just one of the many expenses small businesses face and consider that relief for small businesses, especially the vast majority which are nonemployers, may require more flexibility. 5/

Read on Twitter

Read on Twitter