Yesterday, we put out our annual Big Ideas 2021 report.

Fintech also is in there.

For a closer look at the 4th section of the report - Digital Wallets - read below: https://twitter.com/ARKInvest/status/1354194905229369345

Fintech also is in there.

For a closer look at the 4th section of the report - Digital Wallets - read below: https://twitter.com/ARKInvest/status/1354194905229369345

We think of digital wallets as apps on your phone that enable you to access a number of financial and commercial products and services - bank branches your pocket/handbag.

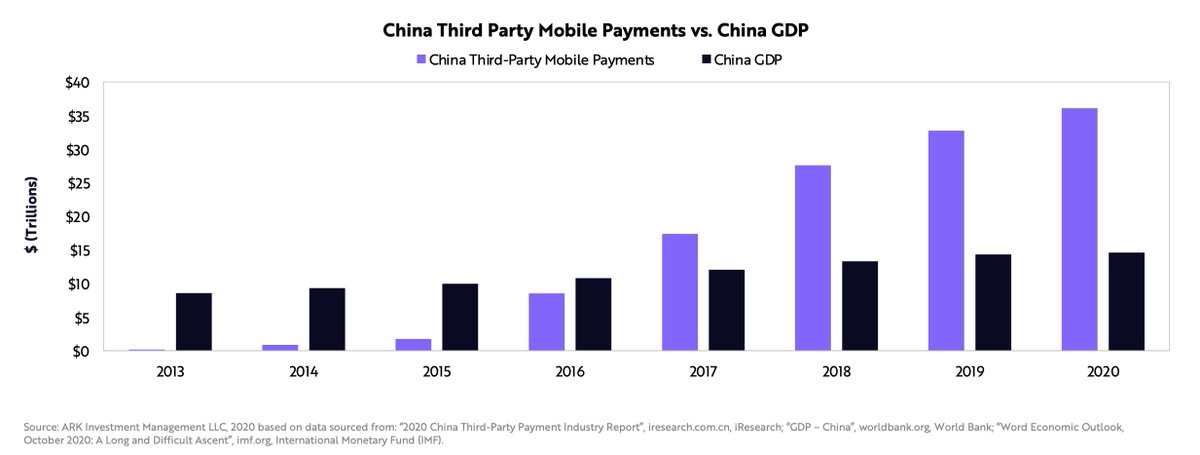

The story starts with WeChat Pay and Alipay in China, where mobile payments have grown to 2.5x China's GDP.

The story starts with WeChat Pay and Alipay in China, where mobile payments have grown to 2.5x China's GDP.

Note that the third party payments (Alipay and WeChat Pay control ~90%) chart above includes unmonetized transactions.

Despite the failed Ant IPO, these two applications are deeply intertwined with people's lives.

Deeper dive into China mobile payments: https://twitter.com/mfriedrichARK/status/1304443171670306816

Despite the failed Ant IPO, these two applications are deeply intertwined with people's lives.

Deeper dive into China mobile payments: https://twitter.com/mfriedrichARK/status/1304443171670306816

For more context around Alipay and Ant, see this thread from last year - before Ant's unsuccessful IPO: https://twitter.com/mfriedrichARK/status/1300791752375390212

Ant's business model already was impacted by stricter regulations put forth by the Chinese government, but many of the points in the thread still hold.

Ant's business model already was impacted by stricter regulations put forth by the Chinese government, but many of the points in the thread still hold.

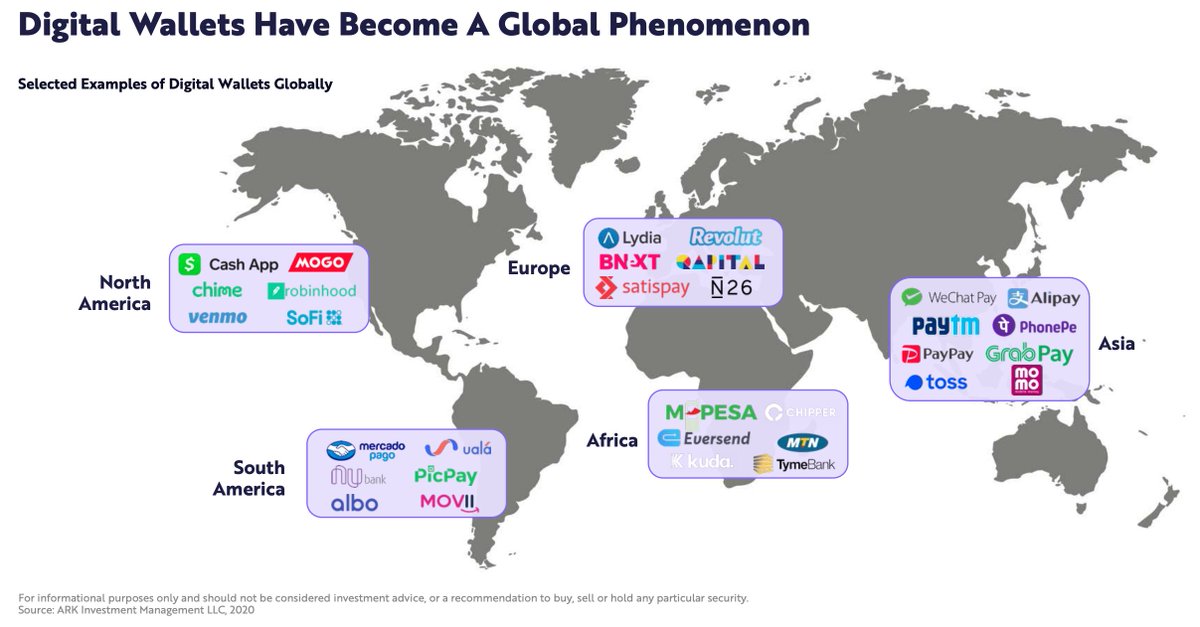

The model pioneered by Alipay and WeChat Pay in China since has spread all around the world.

Digital wallets expand especially quickly in emerging markets, where there is little existing financial services infrastructure and (often un(der)banked) consumer are easy to acquire.

Digital wallets expand especially quickly in emerging markets, where there is little existing financial services infrastructure and (often un(der)banked) consumer are easy to acquire.

Even in Europe, where we saw dozens of challenger banks initially mostly offering checking accounts with debit cards, the space seems to consolidating towards a full of financial and commercial services offering: https://twitter.com/mfriedrichARK/status/1339987416023707650

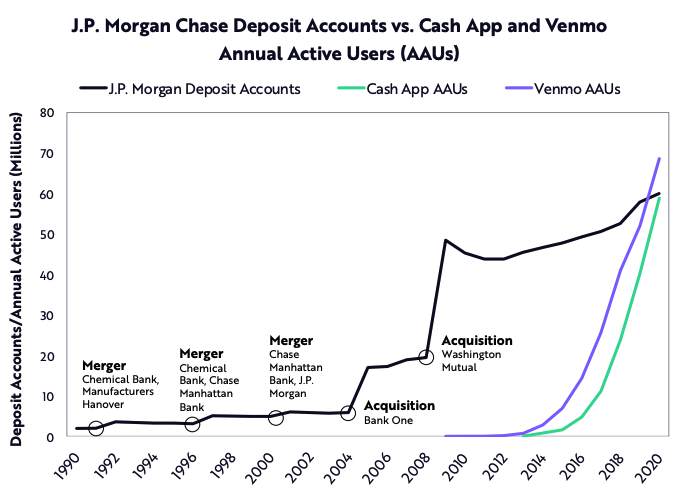

In the US, Square’s Cash App and PayPal’s Venmo - fueled by peer-to-peer payments - each amassed roughly 60 million active users organically in the last 7 and 10 years, respectively, a milestone that took J.P. Morgan more than 30years and five acquisitions to reach.

Today, does each Cash App and Venmo user generate as much revenue as a JPMC depositor? No, but Square's Cash App has grown revenue from essentially zero in 2016 to a run rate of $1.7B in 2020 - And we think further monetization is coming (more below). https://twitter.com/mfriedrichARK/status/1325871359885533184

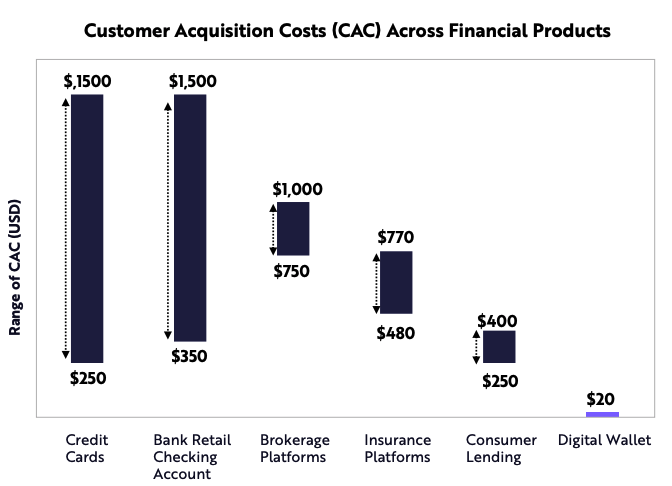

The key to rapid user growth? Low customer acquisition costs. Especially for digital wallets utilizing peer to peer payments and network effects, CAC stands at ~$20 in our view, challenger banks sometimes in triple digits, traditional banks at multiples.

https://twitter.com/mfriedrichARK/status/1339987405739347968

https://twitter.com/mfriedrichARK/status/1339987405739347968

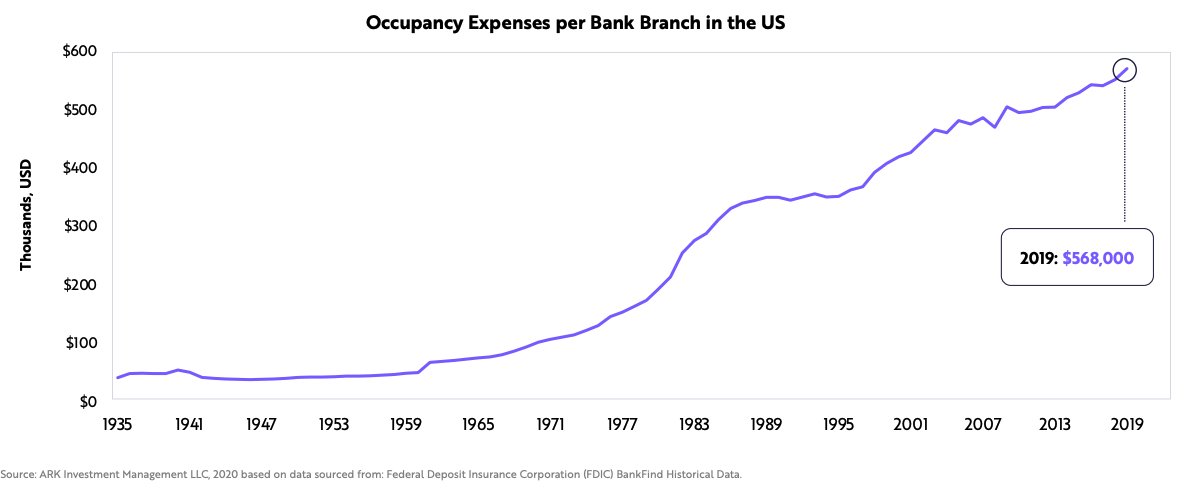

Talking about traditional banks - While consumers are abandoning them for better, faster, cheaper digital offerings, expenses per bank branch have skyrocketed, likely a result of fewer branches and higher technology investments in the branches banks are doubling down on.

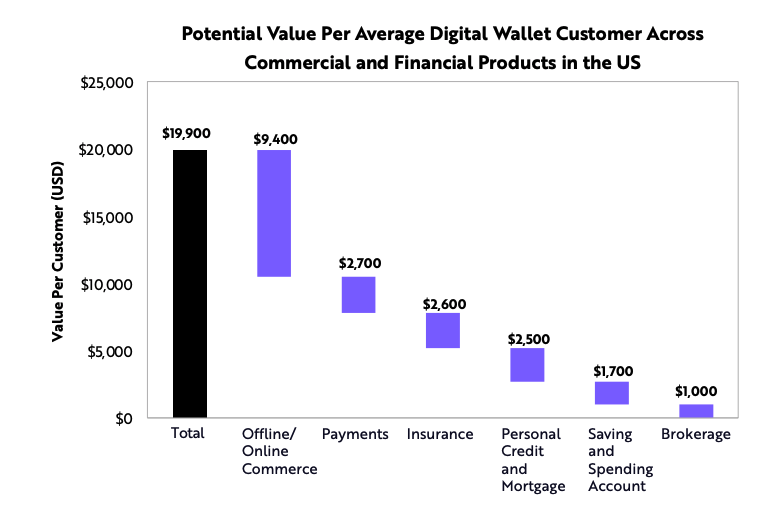

What's the opportunity? We think across financial and commercial spending, each US customer is worth roughly $20,000. That's what's 'up for grabs', of which digital wallets, traditional banks, big tech (think Google Pay or recent Walmart fintech announcement) want to take a bite.

How do we arrive these numbers? E.g., for commerce and payments, we take retail spend per adult and apply a 5% lead gen fee (commerce) or cap exempt debit interchange fee (payments), apply an EBITDA margin and EV/EBITDA multiple. For the other categories, we look at industry..

.. comp numbers, often excluding fee based revenue because we think digital players likely will cut fees, then same methodology. More info also on slide 35 of the Big Ideas 2021 deck.

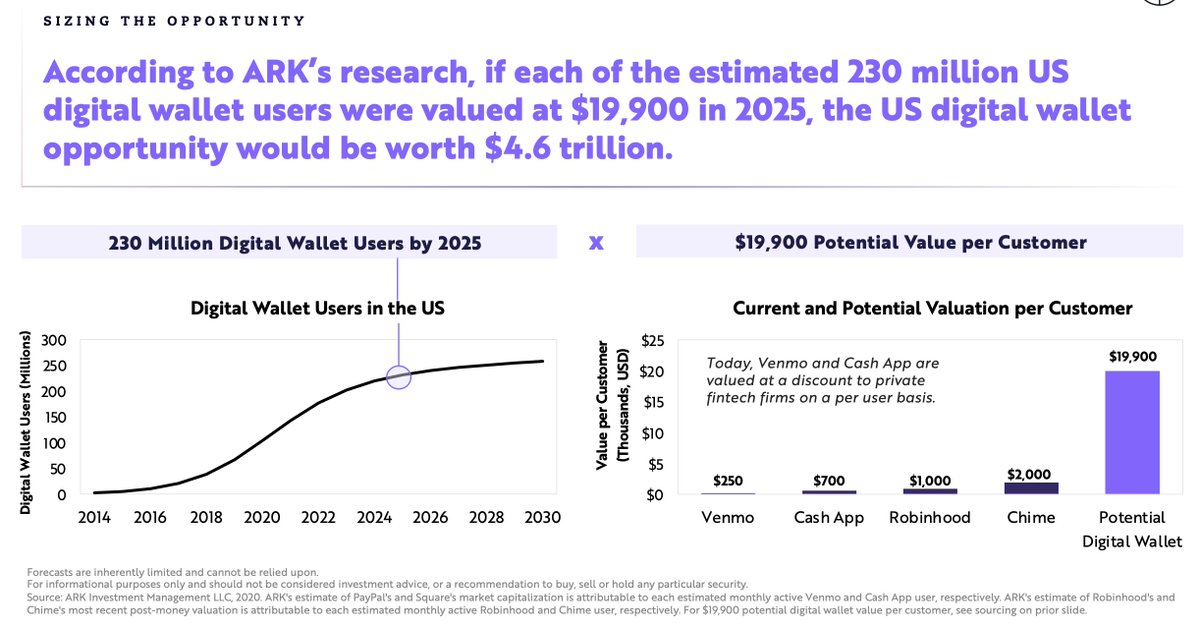

If customer acquisition continues to be consistent with current rate/our forecast, with 230 million digital wallet users by 2025, this represents a $4.6 trillion opportunity in the US-- at full monetization. Many different players will take a stab at this opportunity..

.. and it will be fascinating to see how it will play out.

Find the full Big Ideas 2021 deck here: https://ark-invest.com/big-ideas-2021/

Great team effort by our marketing and compliance team + all ARK analysts @TashaARK @skorusARK @aurmanARK @sbarnettARK @jwangARK @GrousARK @yassineARK

Find the full Big Ideas 2021 deck here: https://ark-invest.com/big-ideas-2021/

Great team effort by our marketing and compliance team + all ARK analysts @TashaARK @skorusARK @aurmanARK @sbarnettARK @jwangARK @GrousARK @yassineARK

Read on Twitter

Read on Twitter