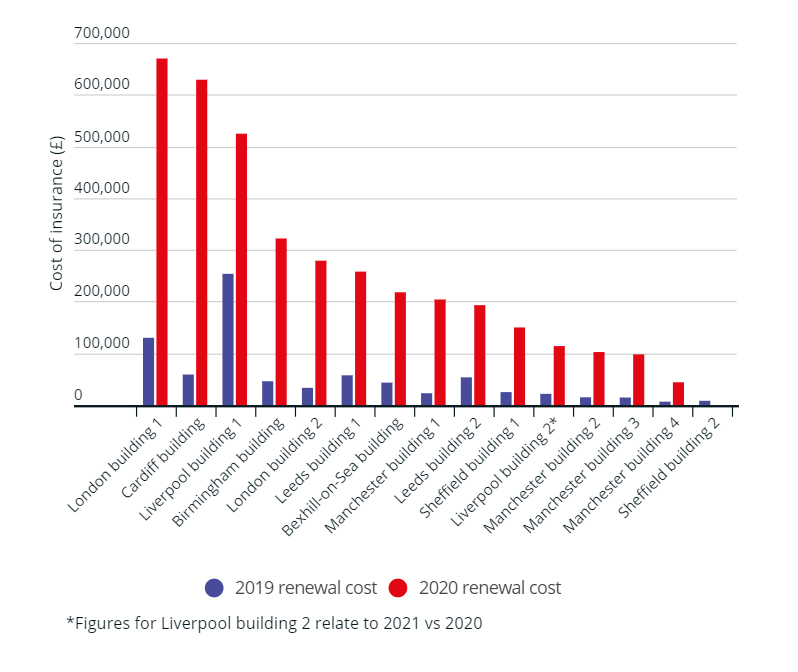

Our latest #claddingscandal research reveals buildings insurance premiums skyrocketing by more than 1000%

→ http://whi.ch/cladding

1/8

→ http://whi.ch/cladding

1/8

We’ve heard from leaseholders across the country who have seen their buildings insurance premiums skyrocket after unsafe building materials were found during post-Grenfell fire safety surveys.

Some leaseholders are now paying upwards of £3,000 a year each for insurance that used to cost them just a fraction of that price.

For many, this is heaped on top of hundreds of pounds per month for round-the-clock fire wardens because their buildings are deemed unsafe. https://www.which.co.uk/news/2020/12/cladding-scandal-latest-homeowners-forced-to-spend-millions-on-24-hour-fire-patrols/?utm_campaign=whichmoney&utm_medium=social&utm_source=twitter&utm_content=claddingscandal_270121&utm_term=twnews

And looming remediation bills that could leave leaseholders bankrupt or homeless if unpaid. https://conversation.which.co.uk/home-energy/royal-artillery-quays-cladding-remediation/?utm_campaign=whichmoney&utm_medium=social&utm_source=twitter&utm_content=claddingscandal_270121&utm_term=twnews

Wicker Riverside wasn’t even fortunate enough to secure the privilege of paying through the nose for insurance. When its policy came up for renewal, it was unable to secure cover from any insurer.

Leaseholders will have to pay for any damage to the building themselves.

Leaseholders will have to pay for any damage to the building themselves.

"It’s just too much for people to be able to handle. When you can’t get insurance at all it adds to the stress. Everything feels heightened because it’s a case of, well, if something goes wrong I lose absolutely everything in one go." - Jenni

Read on Twitter

Read on Twitter