Aadhaar Housing Finance is a low-cost housing finance company in India that is doing its IPO. This is a thread on what PK can learn from it & move away from a pro-rich & banking/financing bias & catalyze 'actual' low-cost housing financing rather than societies for the rich

1/

1/

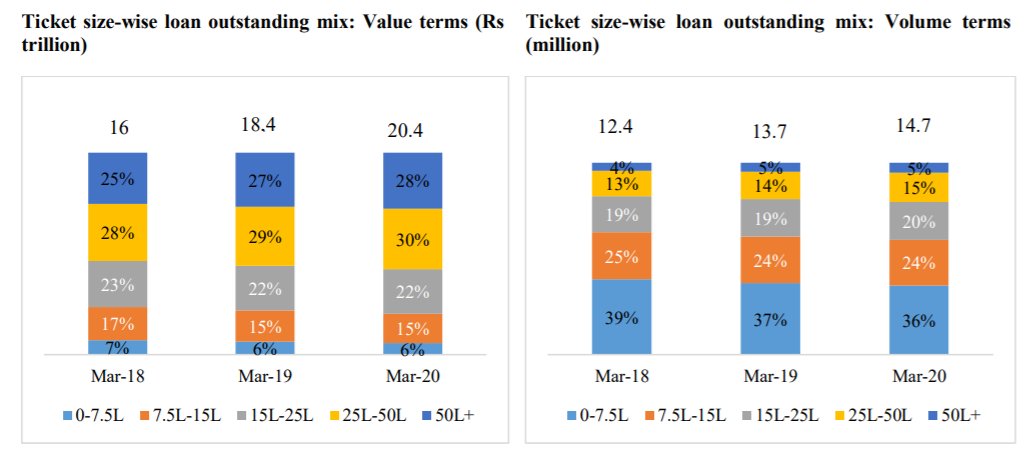

India’s mortgage market is 2 segments -- ticket size of more than INR 1.5m is 'normal' & ticket size of less than INR 1.5m is 'affordable', generally in outskirts of cities, in semi-urban & rural areas. Overall size of affordable housing finance market is INR 4 trillion

2/

2/

Aadhar is solely focused on the small ticket size segment. PK does not have any such entity which specifically focuses on financing of affordable segment. Banks do not have an incentive, nor the will to move into this segment. They are also mostly stuck with 'formal' segment

3/

3/

54.5% of borrowers from Aadhar are formal 'salary' customers, 10.3% are informal salaried customers, 17.9% are formal self-employed & 17.3% are informal self-employed customers. In context of PK, majority is 'formal salary', thereby excluding significant chunk of population

4/

4/

Almost 50% of mortgage applications are in the INR 1.5m, followed by another 25% in the INR 1.5-2.5m range -- even though in value they make up 43% of total outstanding. In PK context, half of mortgages are to bank employees (low credit risk), remaining have high ticket size

5/

5/

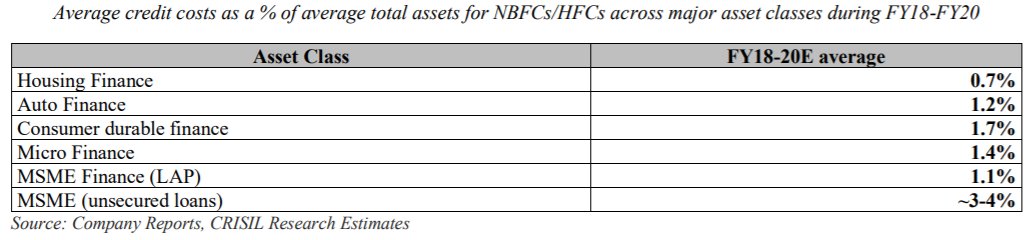

The above data is something that the SBP can work on monitoring, to really understand how much low-cost housing financing is actually being done, rather than self-congratulating on Dolmen Grove. Housing finance has also the lowest credit costs. In PK context, it is at 10%+

6/

6/

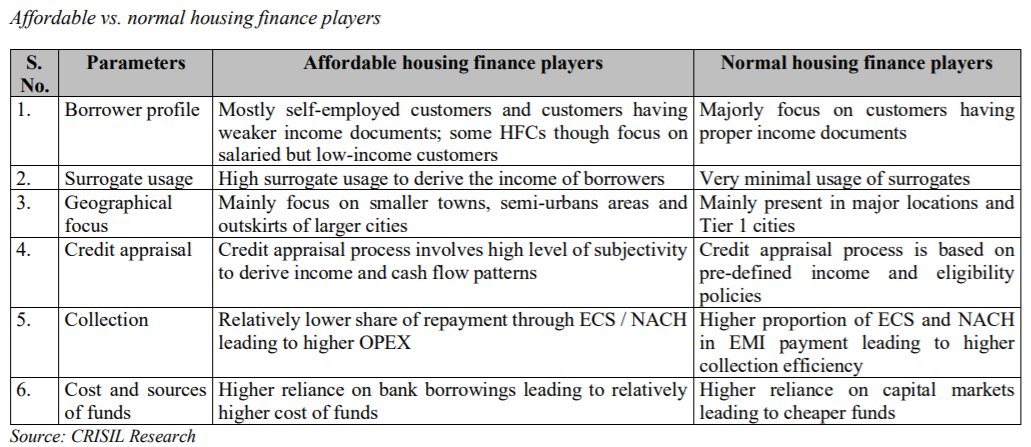

This is a good breakdown of the difference between affordable and normal housing players. Affordable housing is mostly focused on utilizing non-conventional means to estimate income, in local context we are not doing. Most low-cost target market does not have salary slips

7/

7/

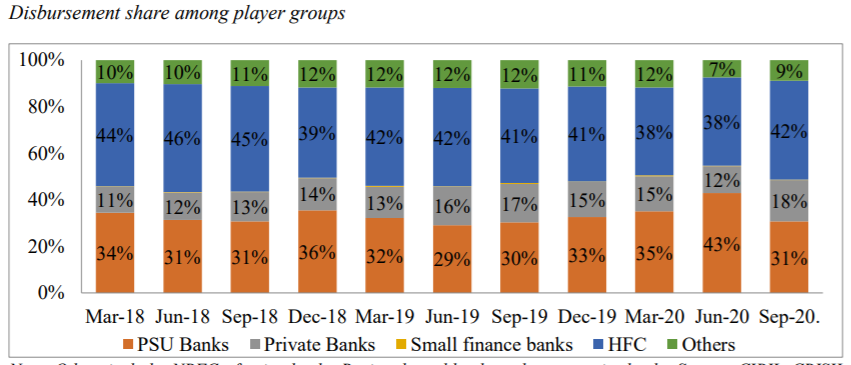

Dedicated housing finance companies (>75 in #) have the largest share of disbursement, along with Public Sector banks. In local context we do not have any housing finance companies, other than ESBL which charges extorionate interest rates for Bahria Town Karachi

8/

8/

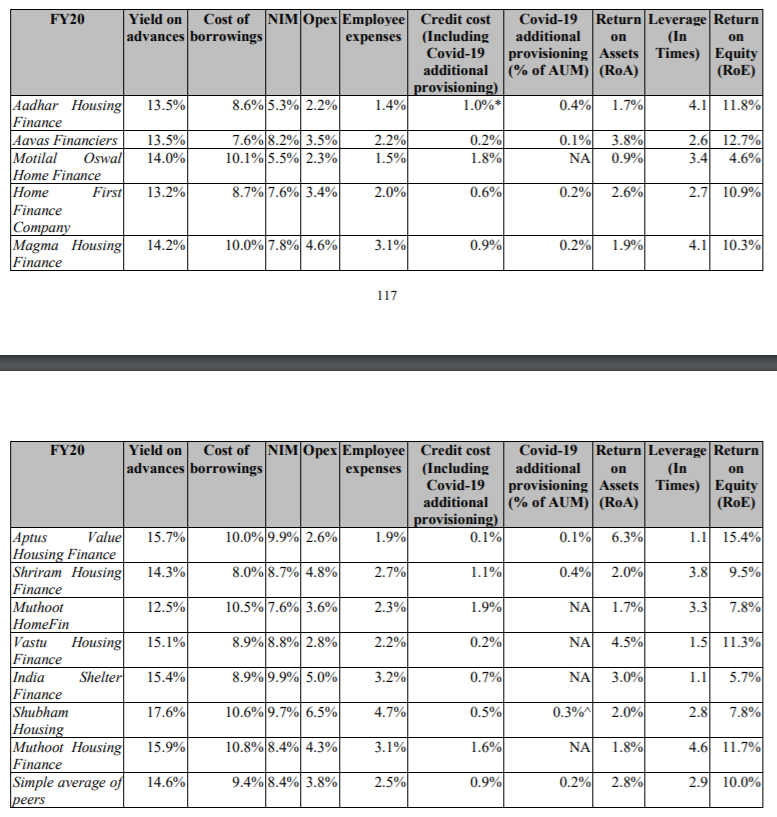

Yield on advances seems to be a median of 13%, which is higher than current rates in local context, but even at these rates it is possible to do housing finance, as long as ticket sizes are low & there is a focus on impact rather than financing one big house in F6 Islamabad

9/

9/

What needs to be done to push low-cost housing finance locally, rather than pushing mortgages for Dolmen Grove:

- Move towards low ticket sizes

- Move towards non-conventional income sources (move away from salary slips)

- Incentivize dedicated housing finance co.

10/

- Move towards low ticket sizes

- Move towards non-conventional income sources (move away from salary slips)

- Incentivize dedicated housing finance co.

10/

- Figure out how where low-cost housing demand is, in katch abadis (cc @MahimMaher ), in outskirts, in industrial zones --Banks don't like working here. Someone needs to.

- Develop targeted low-cost financing products, not products targeting rich people

11/

- Develop targeted low-cost financing products, not products targeting rich people

11/

What we are doing is not low-cost housing. It is an amnesty scheme for grey capital pushing housing for the rich. Banks are yet to push any low-cost funding, nor have they developed credit scoring, or products for low-cost housing.

It is time we suspend the anti-poor bias

/12

It is time we suspend the anti-poor bias

/12

Detailed prospectus is available here, for whoever wants to read through 389 pages of regulatory filing

https://www.sebi.gov.in/filings/public-issues/jan-2021/aadhar-housing-finance-limited_48869.html

https://www.sebi.gov.in/filings/public-issues/jan-2021/aadhar-housing-finance-limited_48869.html

Read on Twitter

Read on Twitter