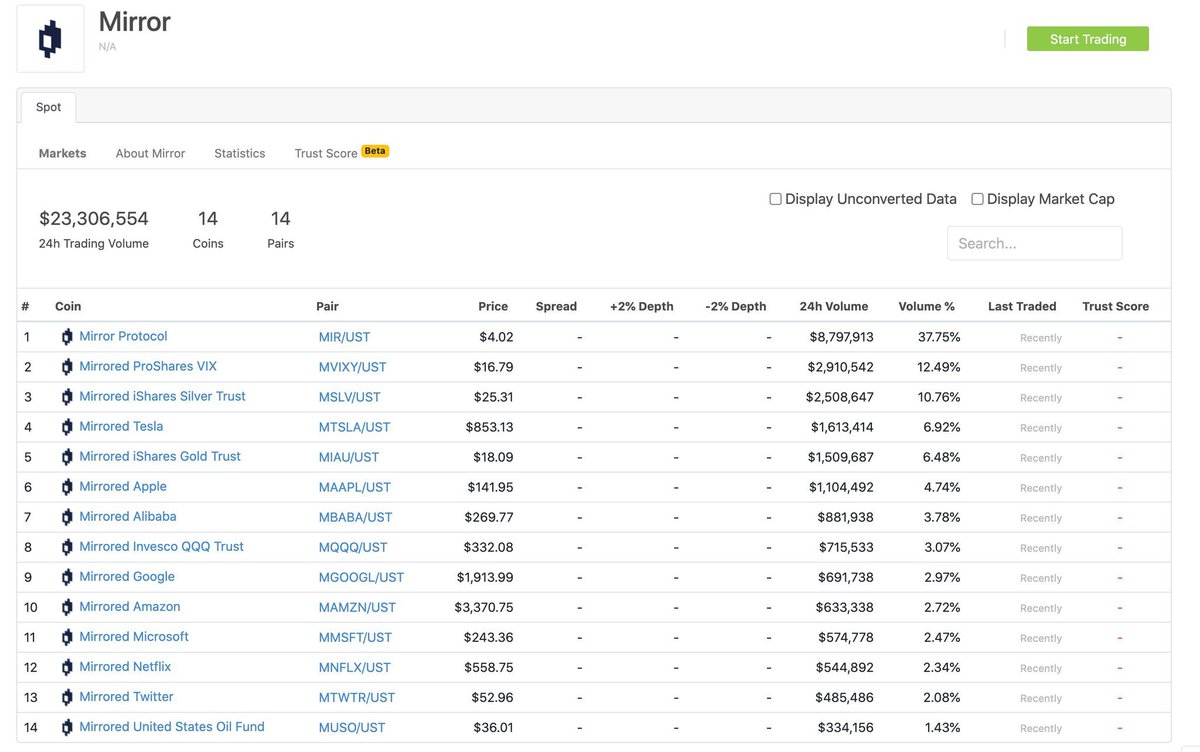

Why @mirror_protocol will be unicorn and $MIR will hit $100 and beyond.

We can compare mirror with famous trading app Robinhood which has $11.2 Billion valuation last summer

$ETH $BTC $LUNA $UST $OCEAN $VET $SNX $RSR https://www.google.com.tr/amp/s/www.forbes.com/sites/sergeiklebnikov/2020/08/17/robinhood-valuation-soars-to-112-billion-with-new-funding-and-record-growth/amp/

We can compare mirror with famous trading app Robinhood which has $11.2 Billion valuation last summer

$ETH $BTC $LUNA $UST $OCEAN $VET $SNX $RSR https://www.google.com.tr/amp/s/www.forbes.com/sites/sergeiklebnikov/2020/08/17/robinhood-valuation-soars-to-112-billion-with-new-funding-and-record-growth/amp/

There are a ton of features that we offer which Robinhood doesn’t

24*7 live markets (Robinhood markets open and close in line with timings on NASDAQ/NYSE)

1) Global accessibility (Robinhood is not available for use in many countries including India)

24*7 live markets (Robinhood markets open and close in line with timings on NASDAQ/NYSE)

1) Global accessibility (Robinhood is not available for use in many countries including India)

2) No KYC/Non-custodial (When you are holding stocks on Mirror, you hold the stocks; so there is no fees for holding the stocks; in case of Robinhood, its a third party appointed by Robinhood that holds stock for you)

3) Most importantly: Leveraged stocks (Go 5X long TSLA by borrowing UST or USDC on Terra/Unilend),

4) Yield on stocks -- hold TSLA stocks and lend it on Terra or Unilend to earn USD

4) Yield on stocks -- hold TSLA stocks and lend it on Terra or Unilend to earn USD

5) Gift stocks to your buddies: Stop gifting Amazon gift cards to your friends, gift them Amazon stock with Mirror.

Best part is mirror is full decentralized and run by community

Sounds amazing right?

@terra_money $LUNA changed THE defi game.

DYOR folks.

Best part is mirror is full decentralized and run by community

Sounds amazing right?

@terra_money $LUNA changed THE defi game.

DYOR folks.

Btw, don’t miss this folks:

How Robinhood free commissions are a farce! They sell user order flow data to hedge funds like Citadel who use it their bots to front-run user trades!

@mirror_protocol fix this $MIR https://twitter.com/toxic/status/1353890766800621569?s=21

How Robinhood free commissions are a farce! They sell user order flow data to hedge funds like Citadel who use it their bots to front-run user trades!

@mirror_protocol fix this $MIR https://twitter.com/toxic/status/1353890766800621569?s=21

@mirror_protocol allows global access to any asset class starting with US equities

#chai and #mempay makes settlements faster and cheaper to include those marginalized by trad payments

@anchor_protocol will soon allow households to earn a real yield on their savings

$LUNA $MIR

#chai and #mempay makes settlements faster and cheaper to include those marginalized by trad payments

@anchor_protocol will soon allow households to earn a real yield on their savings

$LUNA $MIR

Here is MIR trading fee distribution:

UST collected from CDP redemption are used for market buying MIR to distribute to MIR stakers.

- UST collected as a commission when trading on terraswap pool (0.3%) are redistributed to LPs of the pools according to their weight in the pool.

UST collected from CDP redemption are used for market buying MIR to distribute to MIR stakers.

- UST collected as a commission when trading on terraswap pool (0.3%) are redistributed to LPs of the pools according to their weight in the pool.

- UST collected as a fee when trading on terraswap are redistributed to Luna stakers.

- UST collected for staking/unstaking LP tokens and claiming MIR rewards are redistributed to Luna stakers.

- UST collected for staking/unstaking LP tokens and claiming MIR rewards are redistributed to Luna stakers.

- UST collected for transferring any asset from a Terra wallet to another (even cross chain transactions) are redistributed to Luna stakers

- MIR collected from refused proposals are redistributed to MIR stakers

- MIR collected from refused proposals are redistributed to MIR stakers

If you have or want to know $MIR @mirror_protocol you must read this:

https://crypto-ama.herokuapp.com/messages_mirror.html

https://crypto-ama.herokuapp.com/messages_mirror.html

Read on Twitter

Read on Twitter