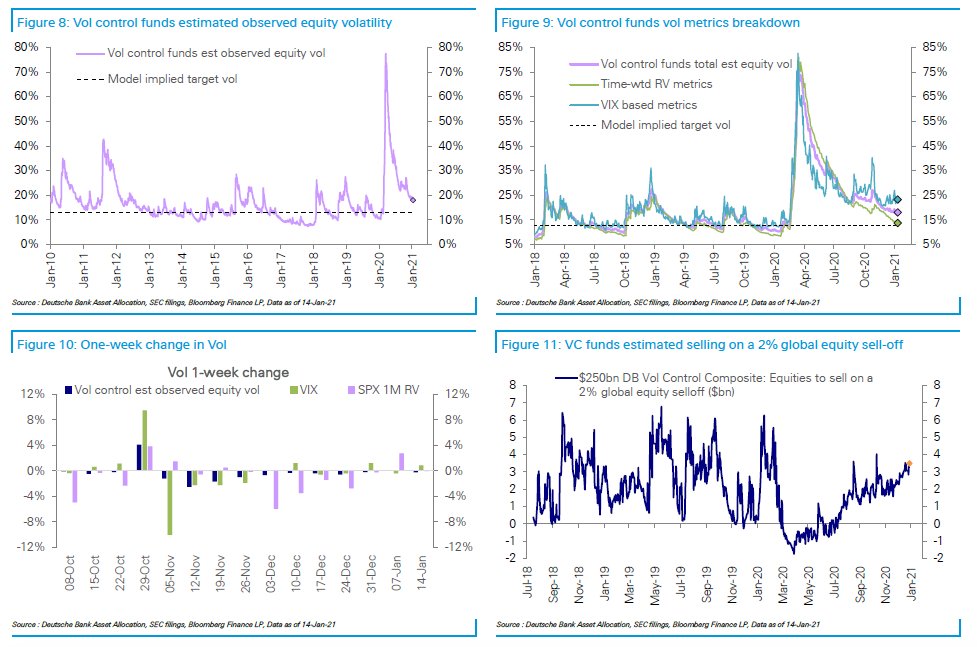

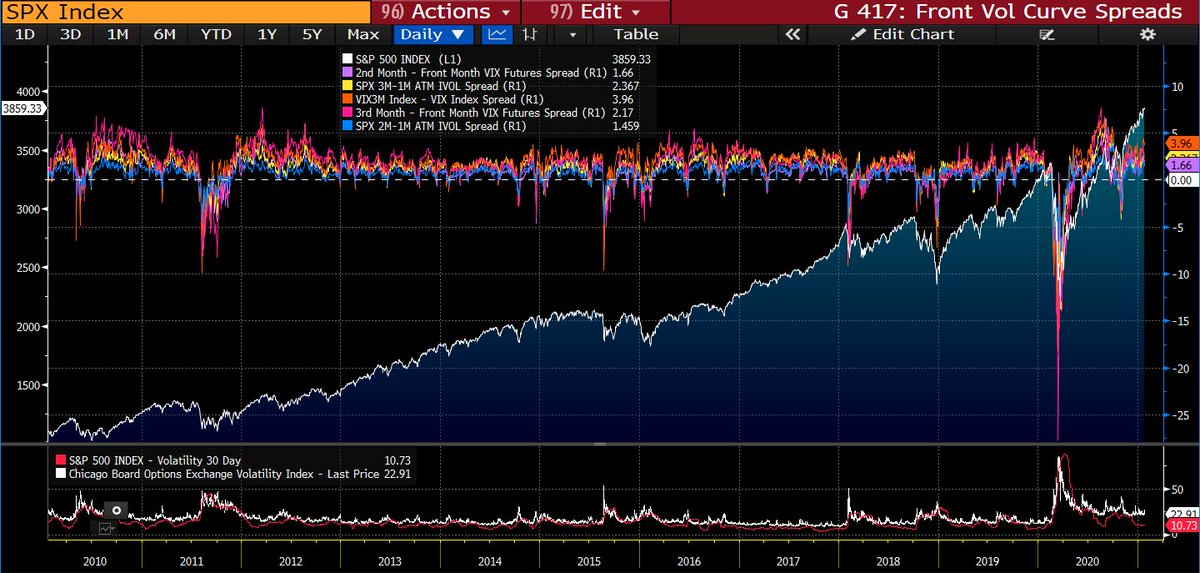

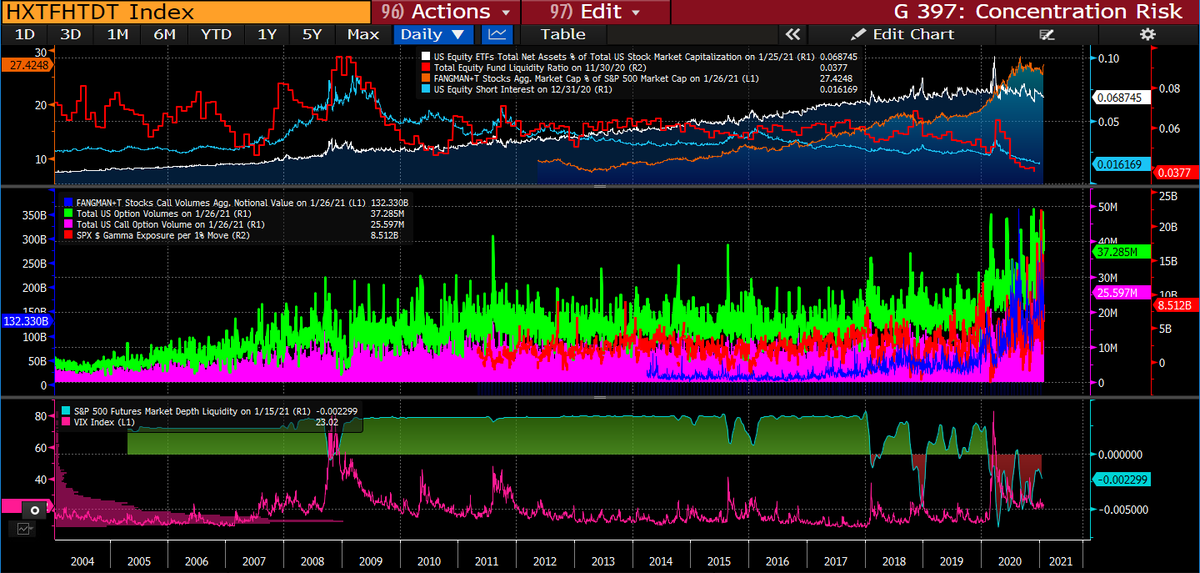

1/x) Equity Vols have remained elevated following the March 2020 crash, as we continuously hear about $VIX remaining elevated. The common notion is that this is mostly attributed to hedging demand. However, I've argued that elevated front-end vols are more due to a lack of supply

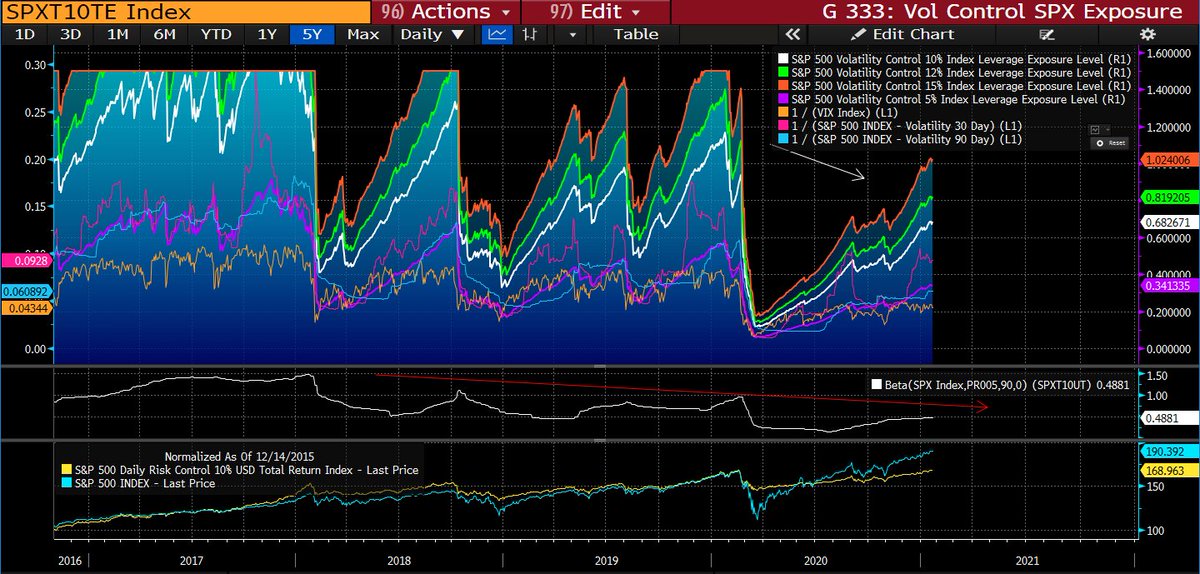

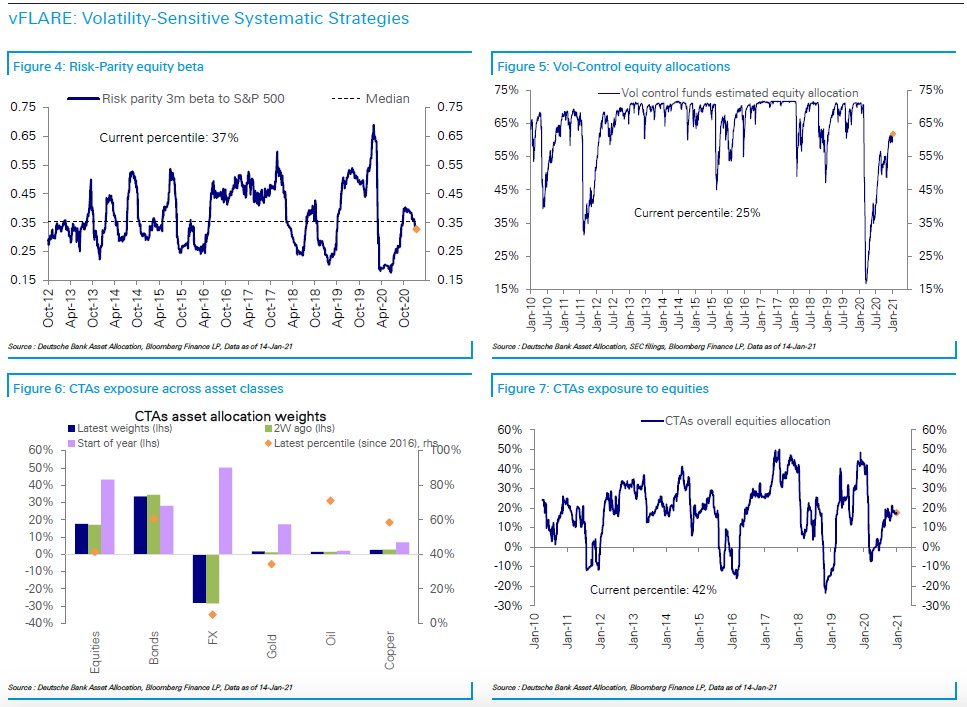

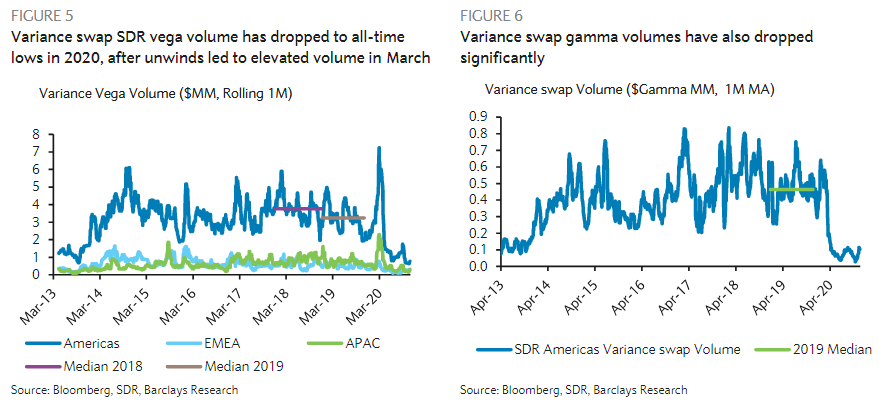

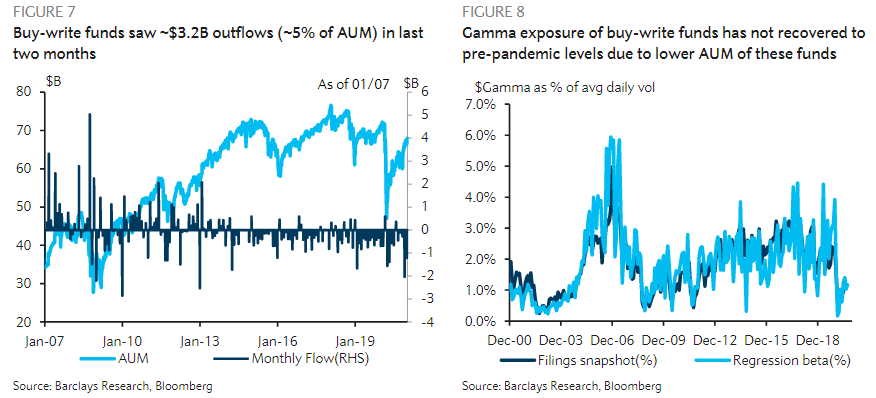

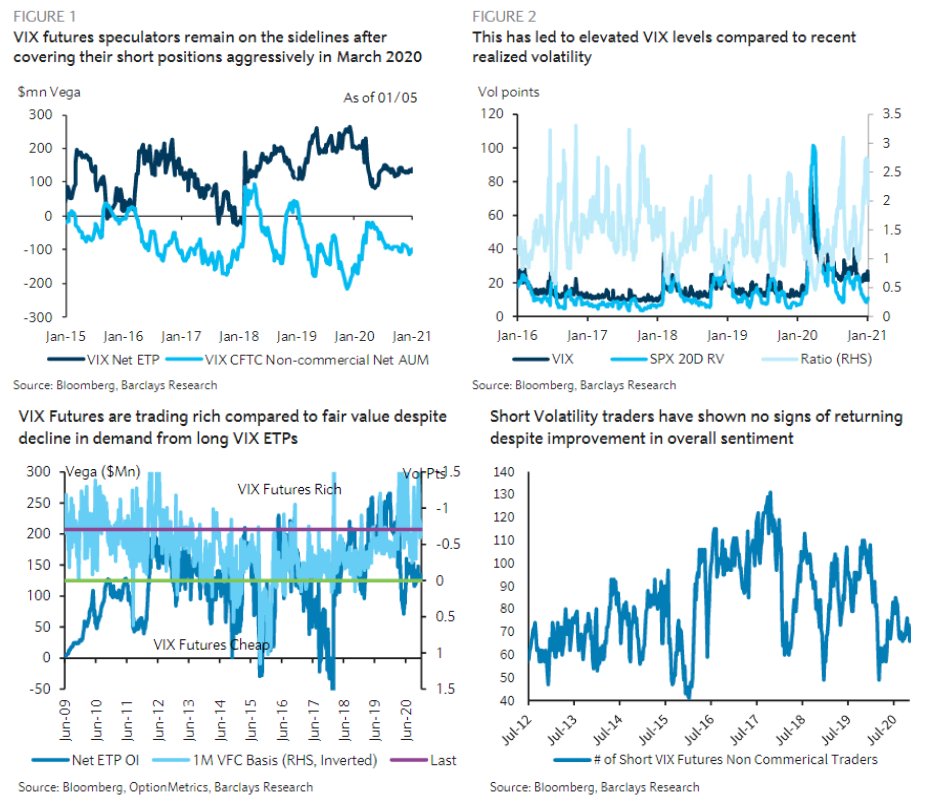

2/x The constant Vol supply from systematic Vol sellers, inverse $VIX ETPs, implicit short Vol, etc. was first significantly wiped on Volmageddon as short Vol blew up, and again during March 2020. The decline in VIX Futures outstanding Vega highlights the diminished Vol supply.

3/x While VIX Futs are only a fraction of the vol complex, Vega flows ultimately leak there. Then add banks/dealers' risk mgmt tightening post-March, supplying less at same price. Increased $VIX Put OI highlights reluctancy to short vol as Vol sellers shift to defined-risk strats

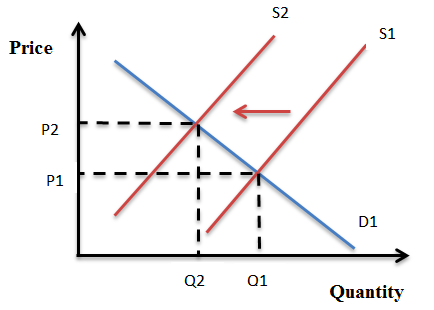

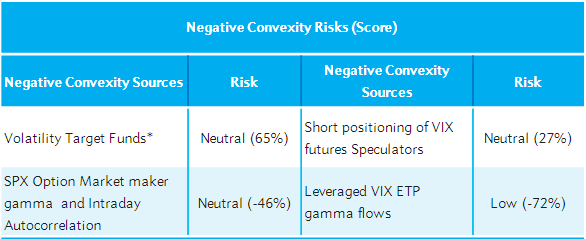

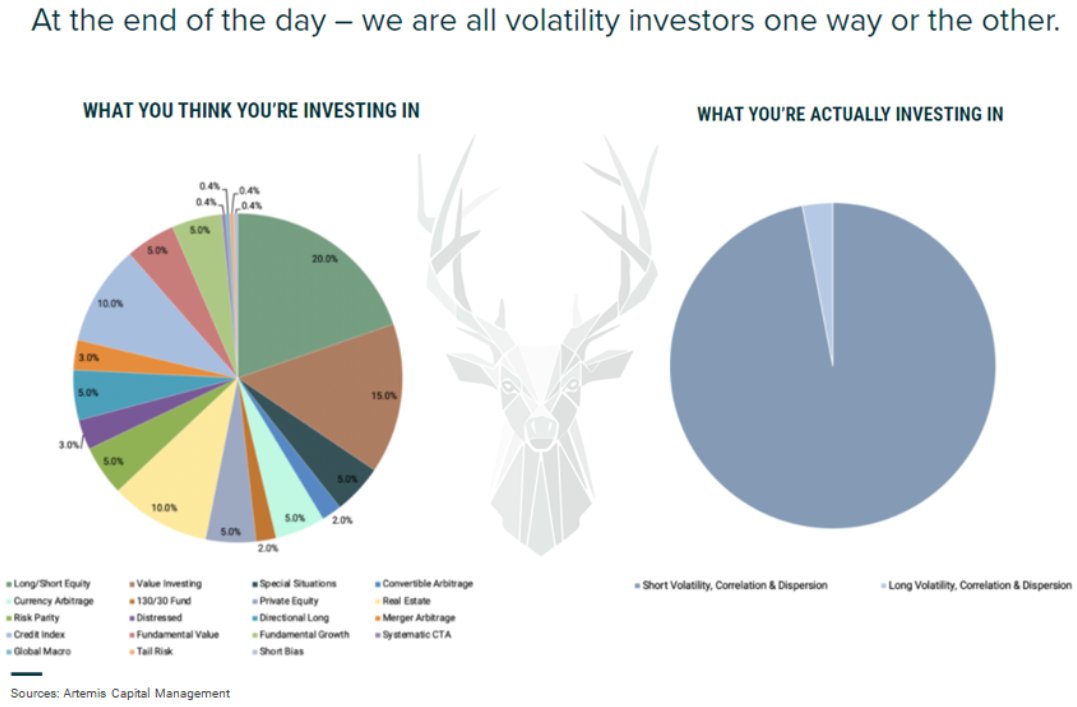

4/x Given reduced Vol supply, let's take a trip back to ECO101 supply & demand. For the sake of *utmost simplicity,* view this as, ceteris paribus, the supply curve shifting left, thus elevating Vol. Heavy short vol is a source of negative convexity, elevated vol has reduced this

5/x Since the systematic Vol selling is tied to the level of vol, there is a reflexive relationship between vol supply and it's level. Short vol is short convexity, so currently, as vol remains elevated due to less supply, there's less negative convexity from this source in mkts.

6/x So Vol, particularly on the front-end, is elevated due to a lack of supply over hedging demand, evident through less systematic Vol sellers, tightened dealer risk mgmt, etc.

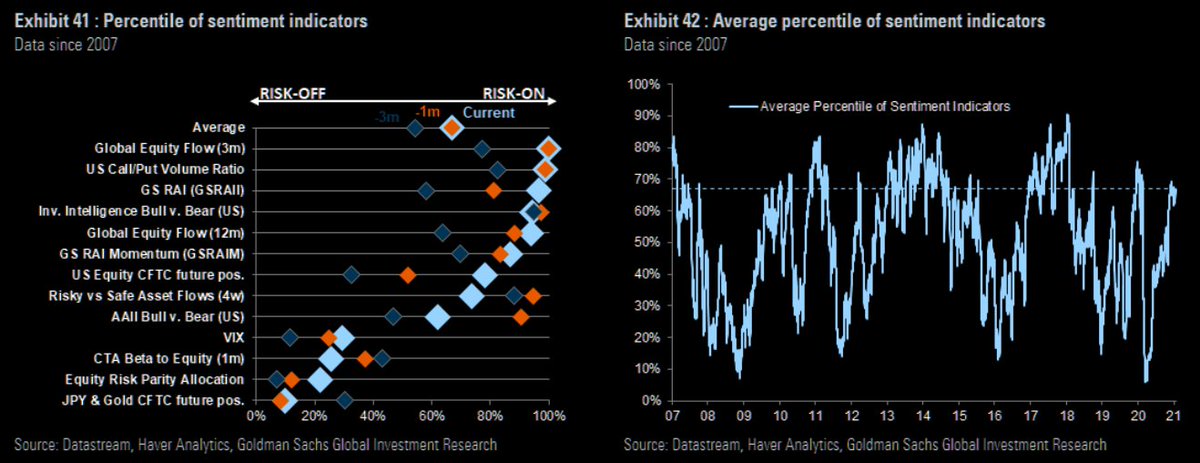

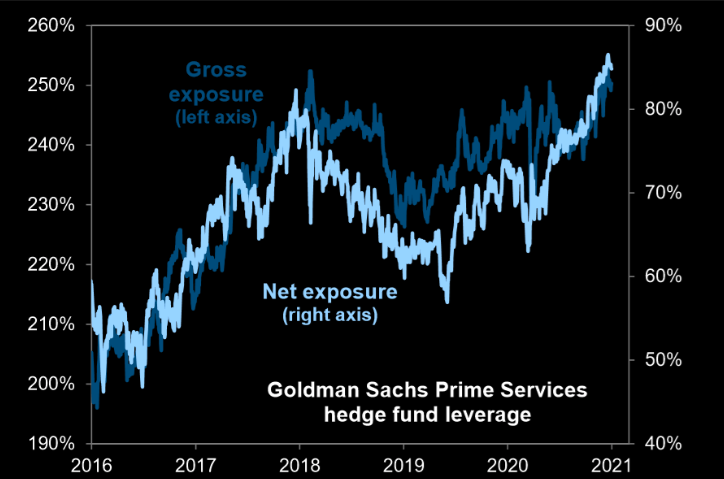

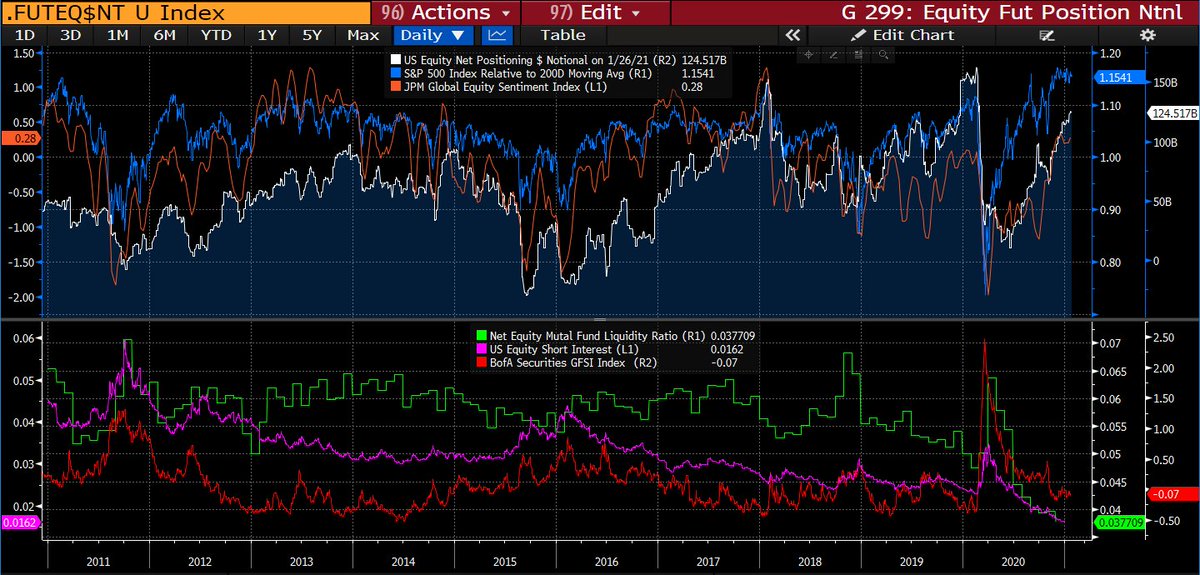

What does this mean? Sentiment & positioning at extremes, yet there's a meaningful lack of hedging...

What does this mean? Sentiment & positioning at extremes, yet there's a meaningful lack of hedging...

7/x With institutions & retail suddenly piling into equities chasing gains, you might say "look at the elevated $VIX, there's plenty of hedging." Well, there isn't. Though I will admit the M4-7 VIX Futures curve has been very sticky, evident of more 'real hedging' occurring there

Read on Twitter

Read on Twitter