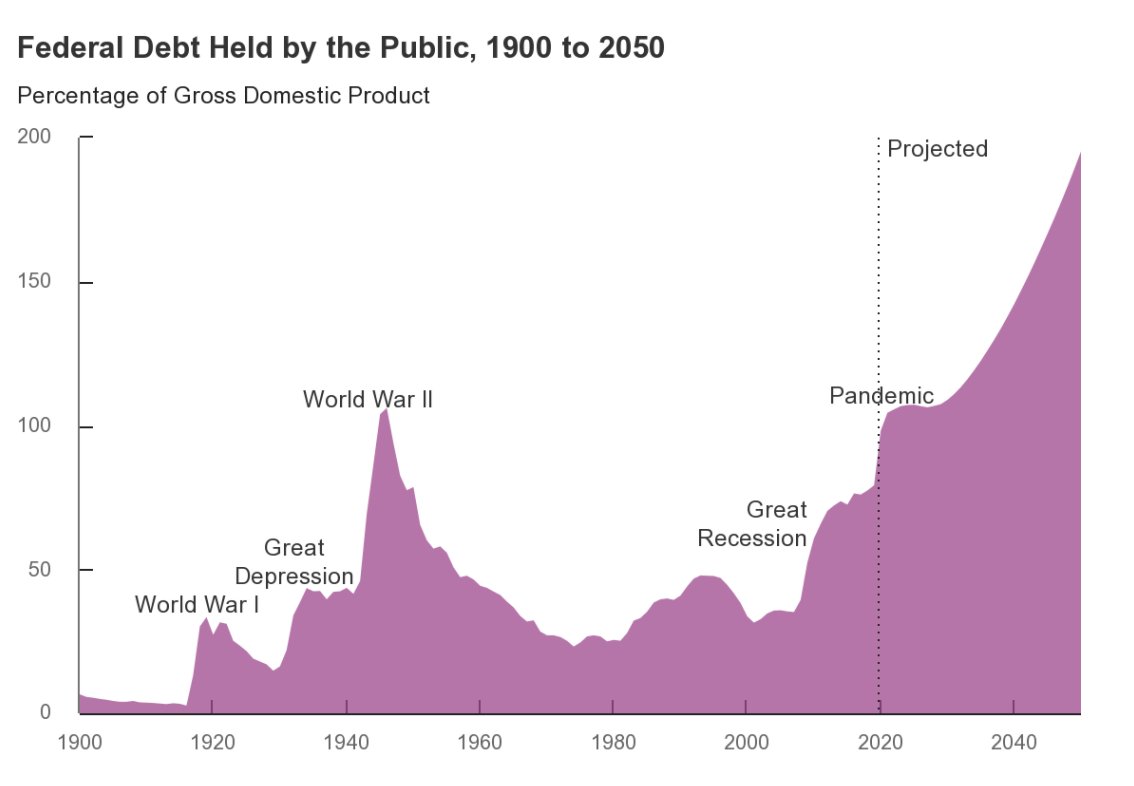

A thread on US debt levels and its risks. The debt stock is high, rates are low.

Was low debt pre 2007 an inefficient waste of fiscal space? Or should we thank those earlier policy makers for affording us the ability to spend in GFC and pandemic without worrying? 1/n

Was low debt pre 2007 an inefficient waste of fiscal space? Or should we thank those earlier policy makers for affording us the ability to spend in GFC and pandemic without worrying? 1/n

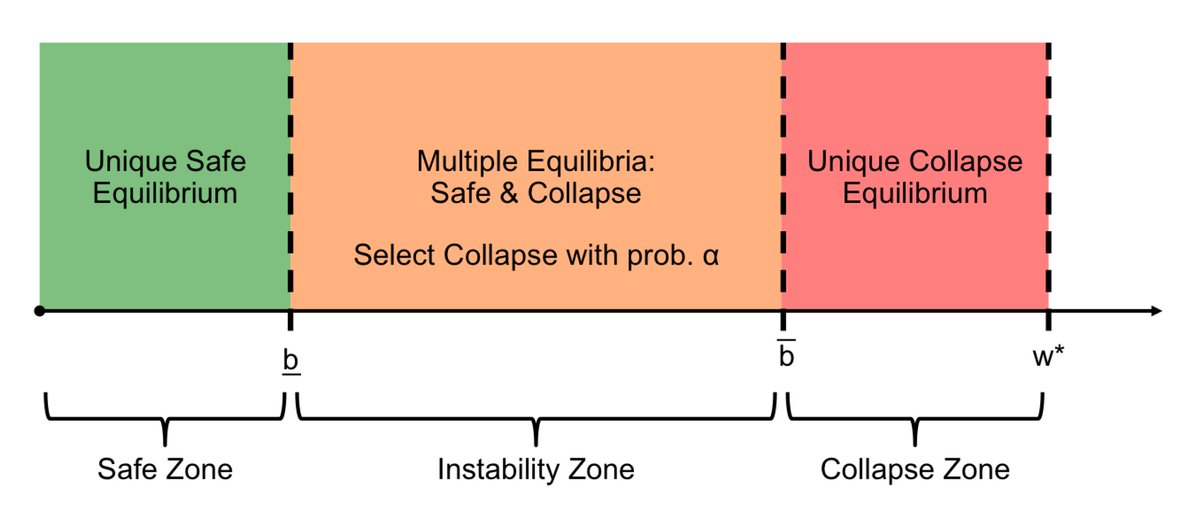

Suppose a country can issue debt at very low rates because the world thinks it will maintain the real value of the payoff stable in future crisis.

At low levels of debt, this is very stable. Once the debt is high enough, another possibility occurs. A crisis of confidence. 2/n

At low levels of debt, this is very stable. Once the debt is high enough, another possibility occurs. A crisis of confidence. 2/n

If investors think that faced with high rates, the repayment burden is too high for the government and it will prefer to resort to tricks to lower the burden (inflate, depreciate, repress)...then there is a self-fulfilling crisis. 3/n

These crises are like bank runs. Hard to predict, very sudden when they occur. Observing low interest rates in the safe equilibrium does not tells us much about the prob of a crisis.

The safe equilibrium can last a long time, breeding an expectation that it is forever. 4/n

The safe equilibrium can last a long time, breeding an expectation that it is forever. 4/n

Yet history is full of crises of this kind...also full of warnings about impending crises that never happened.

The point, at least for me, is not to predict crises or where interest rates are going to be in the future. The evidence is that we (certainly I) cant. 5/n

The point, at least for me, is not to predict crises or where interest rates are going to be in the future. The evidence is that we (certainly I) cant. 5/n

The useful part is to think about the risks and the logic. Faced with the world described above, how does a country decide how much debt to issue? Will it choose to always avoid the chance of a crisis? Do we have to worry about incentives to overissue? 6/n

If it issues more, and stay in the safe equilibrium, interest rate is low and the extra debt allows the government to pursue useful policies

But with some probability, maybe small, it faces a run on the debt and a crisis

The optimal choice trades off of these two scenarios

7/n

But with some probability, maybe small, it faces a run on the debt and a crisis

The optimal choice trades off of these two scenarios

7/n

A government is more likely to choose a high debt level and risk a crisis if:

The world demand for safe assets is high, because in the safe equilibrium rates are low

The crisis is perceived to be a low prob event

Are these conditions now present in the US?

8/n

The world demand for safe assets is high, because in the safe equilibrium rates are low

The crisis is perceived to be a low prob event

Are these conditions now present in the US?

8/n

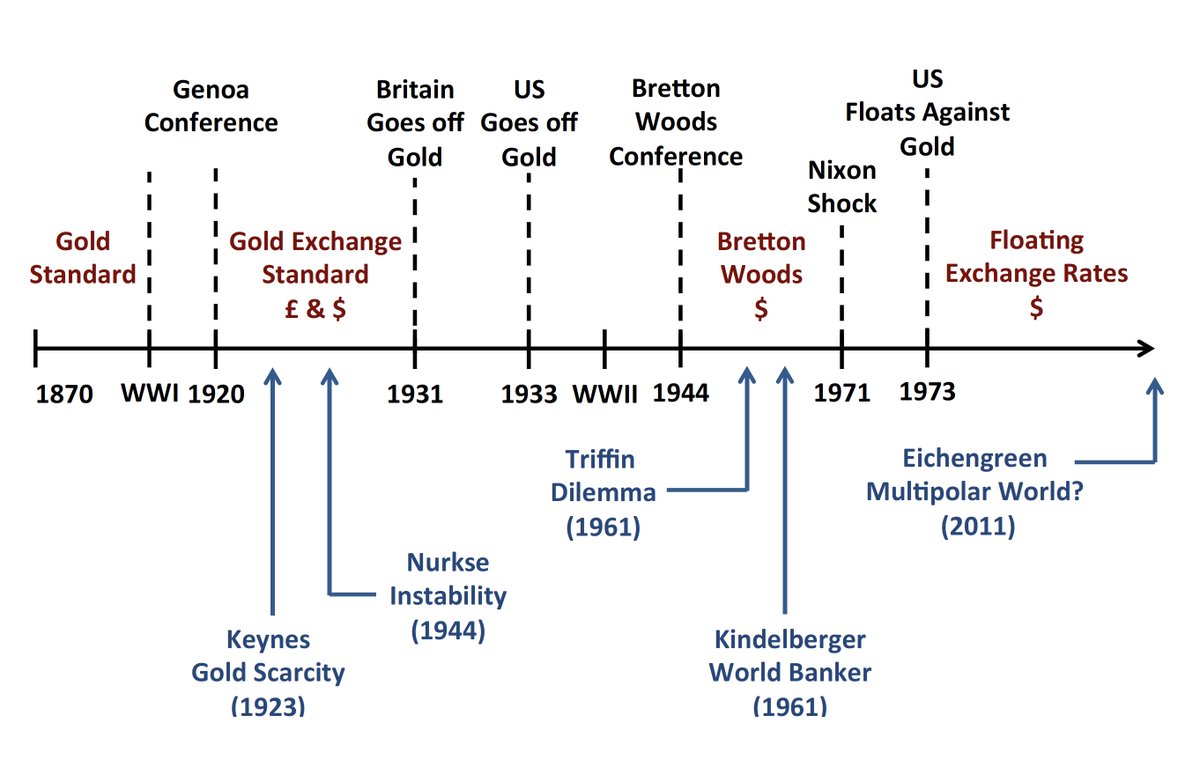

Is the government debt socially optimal at the world level? It depends. On the one had the issuer of safe assets has monopoly power (exorbitant privilege) and underissues. On the other, the issuer does not internalize the welfare lost to RoW by a crisis, leading to overissuance.

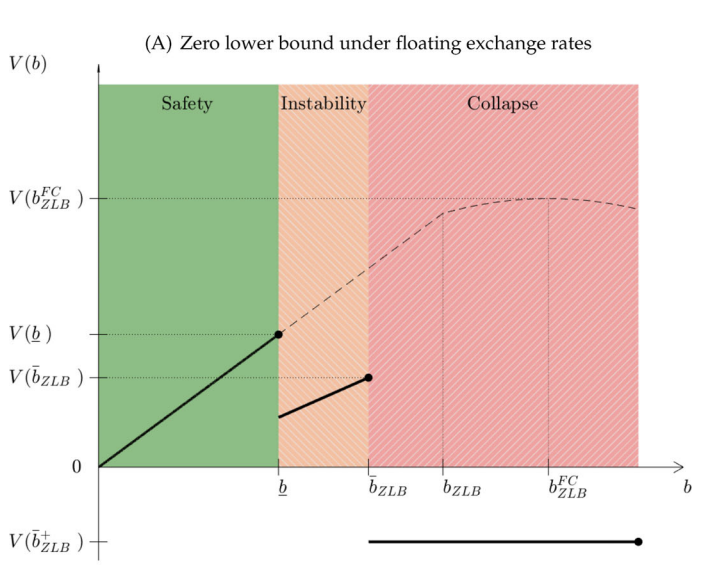

Being at the ZLB exacerbates the tradeoff (Triffin Dilemma) by removing the increase in interest rates that would normally come with higher debt even in the safe equilibrium. 10/n

If safe assets are "scarce" isn't more issuance always good, and the debt pays for itself? Yes and no. Even in a Keynesian model this is true only in the safe equilibrium. If a debt crisis occurs, the Keynesian mechanism bites in reverse..no safe assets left, worse recession 11/n

Side considerations:

Am I saying a dollar crisis is imminent? No. I am saying that thinking it is impossible and there is no fiscal constraint is the best way to end up in a crisis.

Am I saying we shouldnt spend in a pandemic? No. Not spending would get us a crisis now 12/n

Am I saying a dollar crisis is imminent? No. I am saying that thinking it is impossible and there is no fiscal constraint is the best way to end up in a crisis.

Am I saying we shouldnt spend in a pandemic? No. Not spending would get us a crisis now 12/n

Details and more (China?) are here:

…https://matteomaggiori.s3.us-east-2.amazonaws.com/fm_ims.pdf

We wrote this paper in 2016. Some people thought it was crazy to model a US treasury/dollar crisis...kind of a historical curiosity. Many still do, they might be right. I'd prefer we don't end up testing the theory

…https://matteomaggiori.s3.us-east-2.amazonaws.com/fm_ims.pdf

We wrote this paper in 2016. Some people thought it was crazy to model a US treasury/dollar crisis...kind of a historical curiosity. Many still do, they might be right. I'd prefer we don't end up testing the theory

Read on Twitter

Read on Twitter