$OPRA is a Norwegian browser company that was acquired in 2016 for $600m by a Chinese syndicate with a majority % residing under Kunlun Tech Co and its CEO Yahui Zhou. The company has had a tumultuous 3 years as a public company but 2021 is looking to be a major inflection point.

Opera's goal isn't to challenge Chrome or Safari but rather address more niche market segments that incumbents wouldn't prioritize. These segments include built-in VPN centric browsing, & bandwidth-sensitive features that cater to emerging markets.

They then monetize these users via Google's ad partners platform and derive high margin EBITDA. Although they have steadily grown users by low teens percentages. Covid in 2020 drastically reduced monetization which has caused the stock to lag significantly since 2020.

This however in their most recent release looks to be changing as the world economy pulls itself out of the pandemic. $OPRA has managed to increase MAUs by 10-20% across related segments while monetization has steadily increased as the economy picks back up.

This should flow directly to their bottom line with 2021 seeing significantly increased EBITDA. In addition to the browser business, $OPRA is also building out related services in emerging markets. The top 2 that are most important for 2021 are Nano Bank & OPay.

In 2020 in the wake of Covid & a critical short report from Hindenburg $OPRA merged its microloan business with Mobimagic receiving a 42% stake for their assets. Although shareholders were initially critical of the move it actually was quite an accretive transaction.

In addition to the newly added scale, $OPRA no longer has to be tied to the poor optics of the business. In addition, the combined entity generated revenue of $209 million and pre-tax profits of $68 million (32% pre-tax margin) in 2019.

Now as emerging markets are re-opening in a new post-covid world. Nano Bank will be well-capitalized to take market share and expand against competitors in this lucrative business segment. I also confirmed with management today that they will hold their 42% stake in the JV.

The other venture OPay which is basically a WeChat-esq payments app has made significant strides in 2020. From Jan-Nov they have 4x their transaction volume surpassing a billion in monthly payments processing with plans to further expand into North Africa.

Additionally, OPay has suspended it's transportation & logistics services that were costing significant amounts of cash during the pandemic and refocusing on payments servicing. This should allow $OPRA to better maintain it's 13.1% stake in the company.

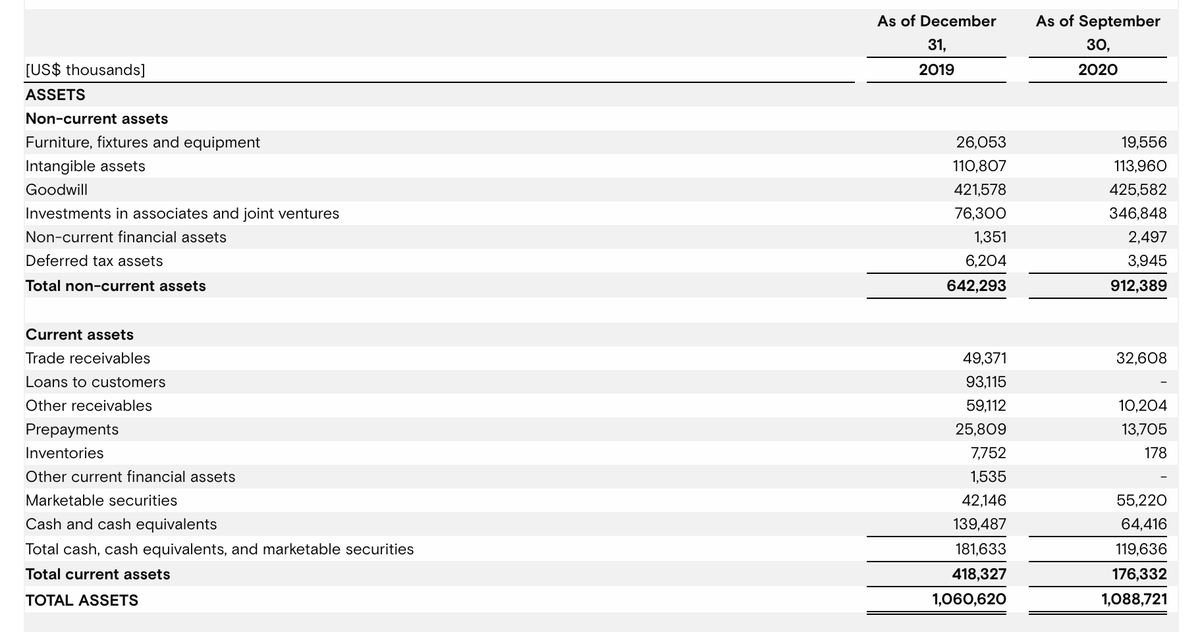

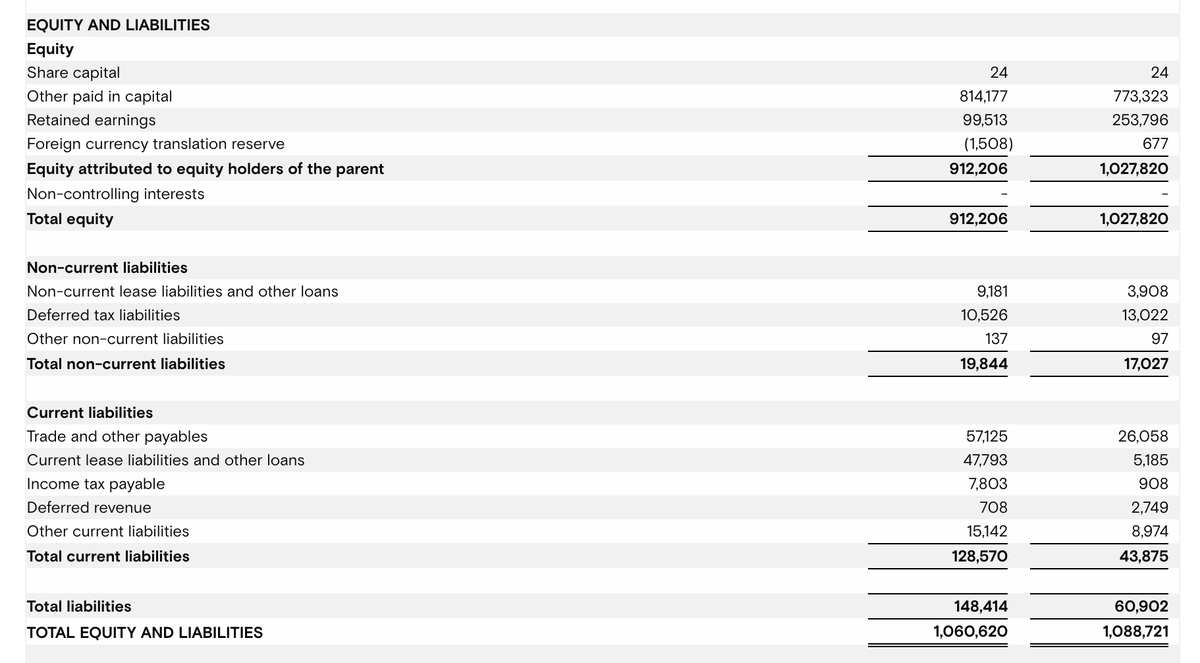

Valuing $OPRA with conservative metrics still makes the current price extremely cheap. A simple glance at their balance sheet shows they are pretty much trading at book value which has 0 growth assumptions for their current Joint Ventures & Search/Advertising business.

With 0 debt and a market cap $1.1 billion. You are getting a profitable browser/advertising company trading at 12-13x 2021 EBITDA and significant stakes in private enterprises that should grow significantly as emerging markets come back online from Covid.

Read on Twitter

Read on Twitter