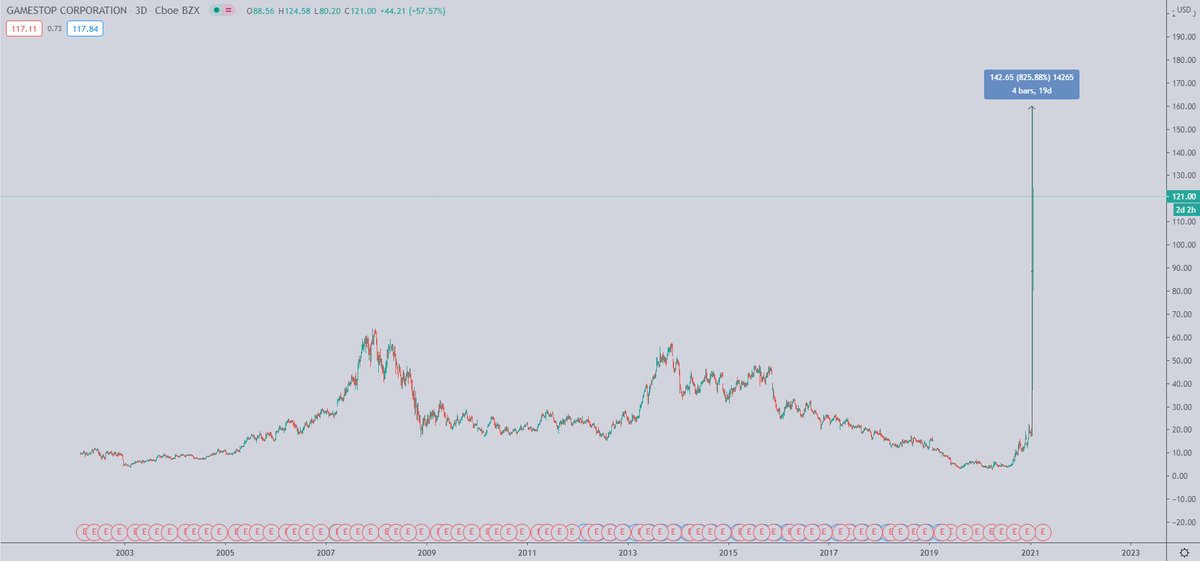

A thread on Gamestop, Gamma Squeezes, and Order Flow:

If you've seen the price of $GME the past several days, you've probably thought to yourself "There's no fundamental reason it 𝒅𝒆𝒔𝒆𝒓𝒗𝒆𝒔 to be this high. Thus, it must go down."

You're right, but you're also wrong.

If you've seen the price of $GME the past several days, you've probably thought to yourself "There's no fundamental reason it 𝒅𝒆𝒔𝒆𝒓𝒗𝒆𝒔 to be this high. Thus, it must go down."

You're right, but you're also wrong.

Does giving Ryan Cohen a seat on the board increase the intrinsic value of the company so much that it deserves to jump 800% in less than three weeks?

No.

Have they announced a strategic partnership with any big companies or released plans to unveil cutting edge tech?

No.

No.

Have they announced a strategic partnership with any big companies or released plans to unveil cutting edge tech?

No.

So in one sense, you're right. $GME doesn't 𝒅𝒆𝒔𝒆𝒓𝒗𝒆 its ridiculous valuation - no matter what overnight loyalists might declare trying to justify it.

Then why does it keep going higher?

It's a function of market mechanics. This is where WallStreetBets comes into play.

Then why does it keep going higher?

It's a function of market mechanics. This is where WallStreetBets comes into play.

WallStreetBets is a popular subreddit where participants discuss stock and options trading. By themselves, this group of retail traders doesn't have the capital necessary to drive the price as high as they have.

What's happening then?

It's a phenomenon known as a Gamma Squeeze.

What's happening then?

It's a phenomenon known as a Gamma Squeeze.

A Gamma Squeeze is a transient increase in the price of a stock driven by investors buying a large number of out of the money call options. When these calls are purchased, the options sellers will buy shares of the stock to cover themselves in case the calls ever get exercised.

( It's important to emphasize the term transient. This 𝙬𝙤𝙣'𝙩 last forever. There will eventually be a correction, and it'll be brutal. )

Gamma squeezes can trigger short squeezes, which are similar, but driven by shorts covering their positions.

Gamma squeezes can trigger short squeezes, which are similar, but driven by shorts covering their positions.

The age of smart phones and Robinhood has made trading options easier than ever for the average person. Combine that with how quickly group think can spread on forums like Reddit, Twitter, etc. and you have a recipe for explosive squeezes like we're seeing right now w/ $GME.

It's also a reason why paying attentions to options order flow platforms like @cheddarflow is more interesting and useful than ever.

There's no guarantee we ever see anything as crazy as $GME again, but it's a great example that shows how options order flow 𝗗𝗢𝗘𝗦 matter.

There's no guarantee we ever see anything as crazy as $GME again, but it's a great example that shows how options order flow 𝗗𝗢𝗘𝗦 matter.

It can have a significant influence on the direction of a stock. And as @altcoinpsycho has pointed out multiple times - it will continue to weigh heavier on the crypto market as well as popularity and volume increases for #Bitcoin  , $ETH, and others.

, $ETH, and others.

, $ETH, and others.

, $ETH, and others.

A few lessons:

1) If something is going higher, and you don't think it 𝒅𝒆𝒔𝒆𝒓𝒗𝒆𝒔 to go higher, it 𝗗𝗢𝗘𝗦 𝗡𝗢𝗧 mean it's a good idea to try and short it!

2) Be careful. Don't chase after "the next GME." Odds are you won't find it, & you might get burnt in the process.

1) If something is going higher, and you don't think it 𝒅𝒆𝒔𝒆𝒓𝒗𝒆𝒔 to go higher, it 𝗗𝗢𝗘𝗦 𝗡𝗢𝗧 mean it's a good idea to try and short it!

2) Be careful. Don't chase after "the next GME." Odds are you won't find it, & you might get burnt in the process.

3) Learn about options, and take some time to understand order flow.

Like I mentioned previously, @cheddarflow is a great tool I've used that provides more in depth market insight.

Feel free to give it a try . http://www.cheddarflow.com?afmc=3rcheddarflow.com/?afmc=3r

. http://www.cheddarflow.com?afmc=3rcheddarflow.com/?afmc=3r

Like I mentioned previously, @cheddarflow is a great tool I've used that provides more in depth market insight.

Feel free to give it a try

. http://www.cheddarflow.com?afmc=3rcheddarflow.com/?afmc=3r

. http://www.cheddarflow.com?afmc=3rcheddarflow.com/?afmc=3r

I know there's a lot I missed here, but I'm not Sam and I don't have it in me to do a 40 tweet thread lol. If you have any useful information you feel deserves to be said, feel free to share it below and if relevant I'll quote it and add it to the thread.

One other thing to add about avoiding buying puts on GME -

1) It's basically knife catching at this point, but instead of trying to nail the bottom you're trying to nail the top. This just isn't a sustainable way to trade.

2) The premiums are SO RIDICULOUSLY EXPENSIVE...

1) It's basically knife catching at this point, but instead of trying to nail the bottom you're trying to nail the top. This just isn't a sustainable way to trade.

2) The premiums are SO RIDICULOUSLY EXPENSIVE...

There are better, safer options out there that don't have to move nearly as much for you to make similar $$!

Read on Twitter

Read on Twitter