My Notes on Statistical Consequences of Fat Tails

Real World Preasymptotics, Epistemology, and Applications

By @nntaleb

Real World Preasymptotics, Epistemology, and Applications

By @nntaleb

"Insurance can only work in Mediocristan; you should never write an uncapped insurance contract if there is risk of catastrophe. The point is called the catastrophe principle."

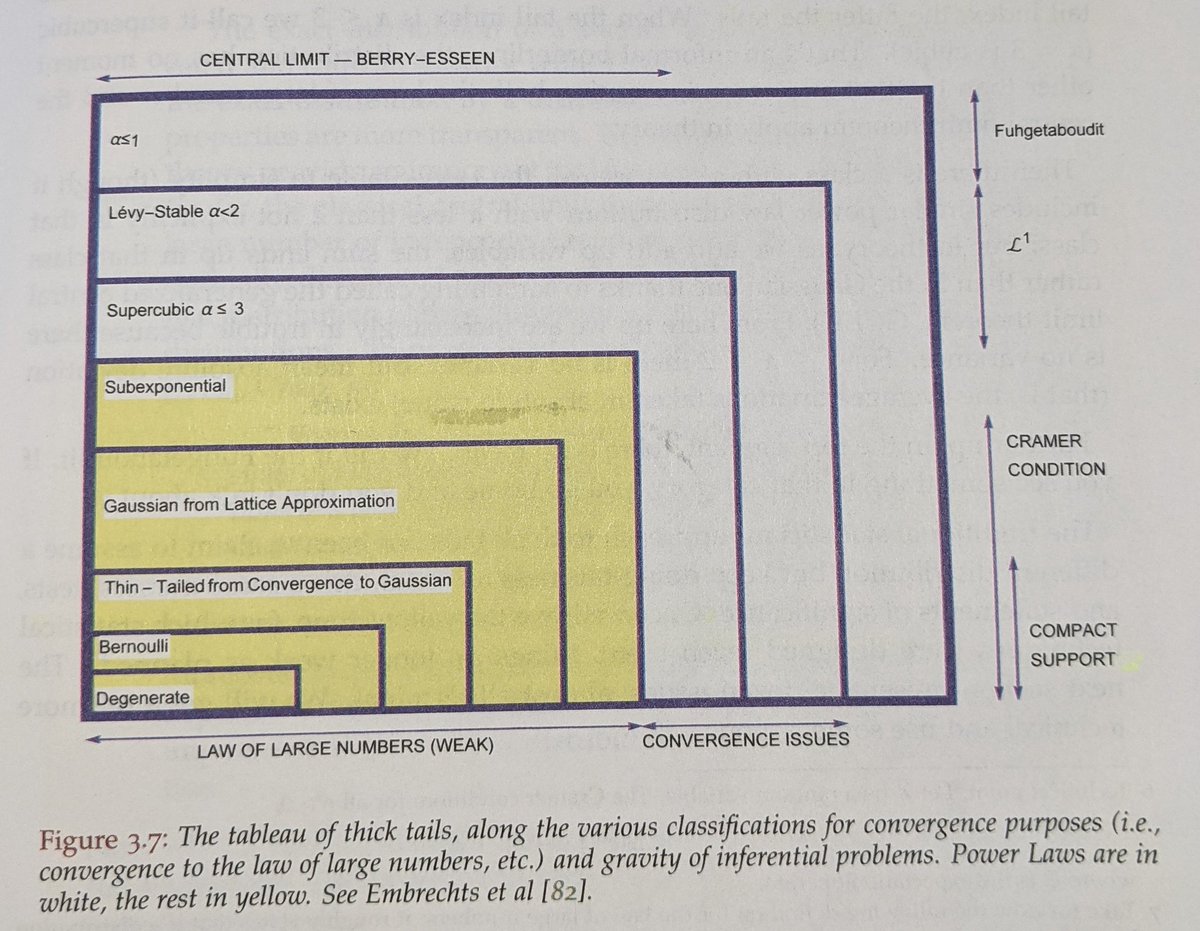

"{thick tailed}, extreme events away from the centre of the distribution play a very large role. Black Swans are not "more frequent", they are more consequential. The fattest tail distribution has just one very large extreme deviation, rather than many departures from the norm"

"As tails fatten, to mimic what happens in financial markets for example, the probability of a single event staying within one standard deviation rises... we get higher peaks, smaller shoulders, and a higher incidence of a very large deviation"

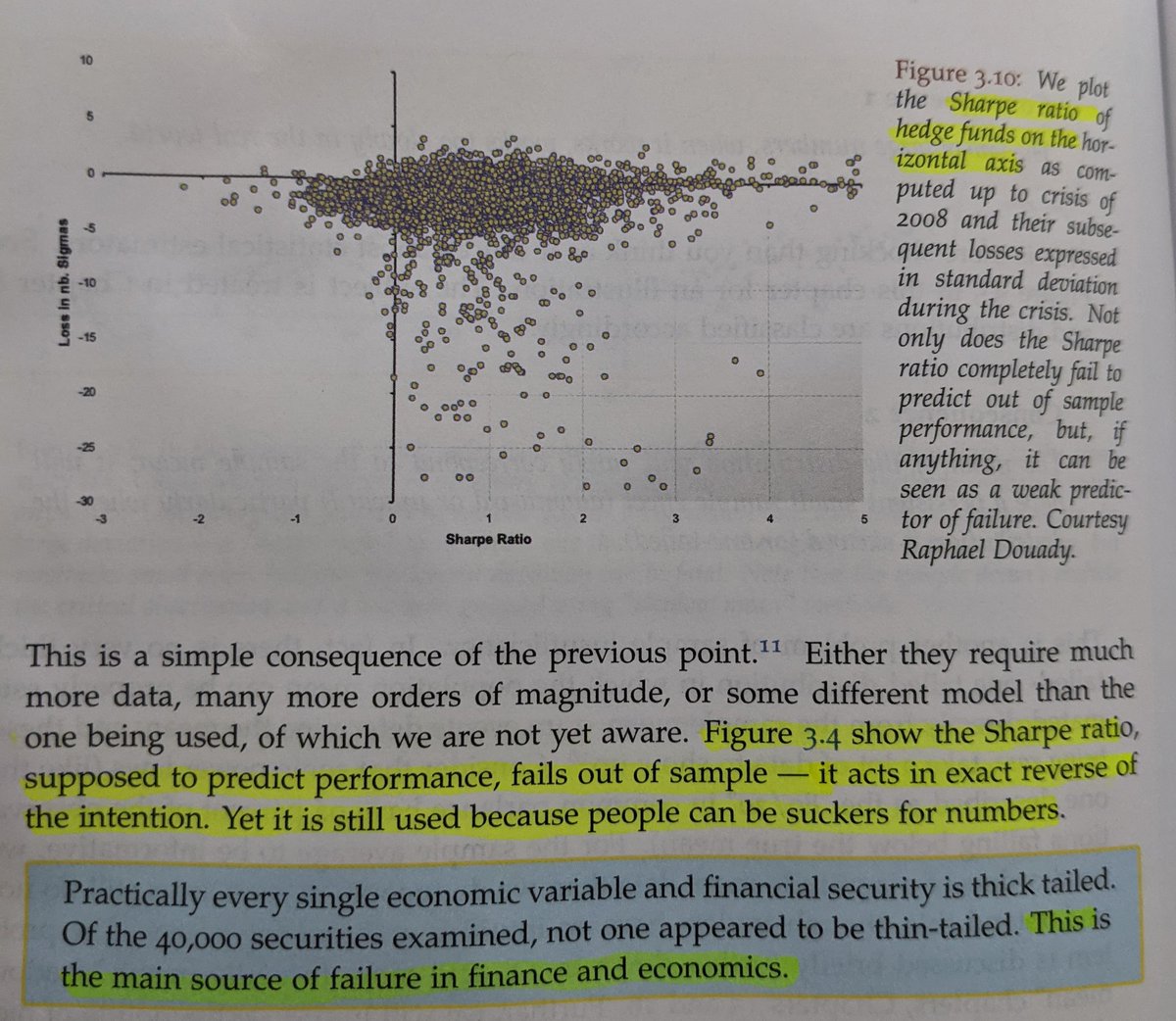

"When variance is infinite, R^2 should be 0. But because samples are necessarily finite, it will show, deceivingly, higher numbers than 0. Effectively, under thick tails R^2 is useless, uninformative, and often downright fraudulent"

"What is called evidence based science, unless rigorously disconfirmatory, is usually interpolative, evidence-free, and unscientific"

"Stating 'violence has dropped' because the number of people killed in wars has declined from the previous year or decade is not a scientific statement"

Robust/Fragile/Antifragile

"Is robust what does not produce variability across perturbation of parameters of the probability distribution. If there is change, but with an asymmetry, concave or convex response to such perturbation, the classification is fragility/antifragility"

"Is robust what does not produce variability across perturbation of parameters of the probability distribution. If there is change, but with an asymmetry, concave or convex response to such perturbation, the classification is fragility/antifragility"

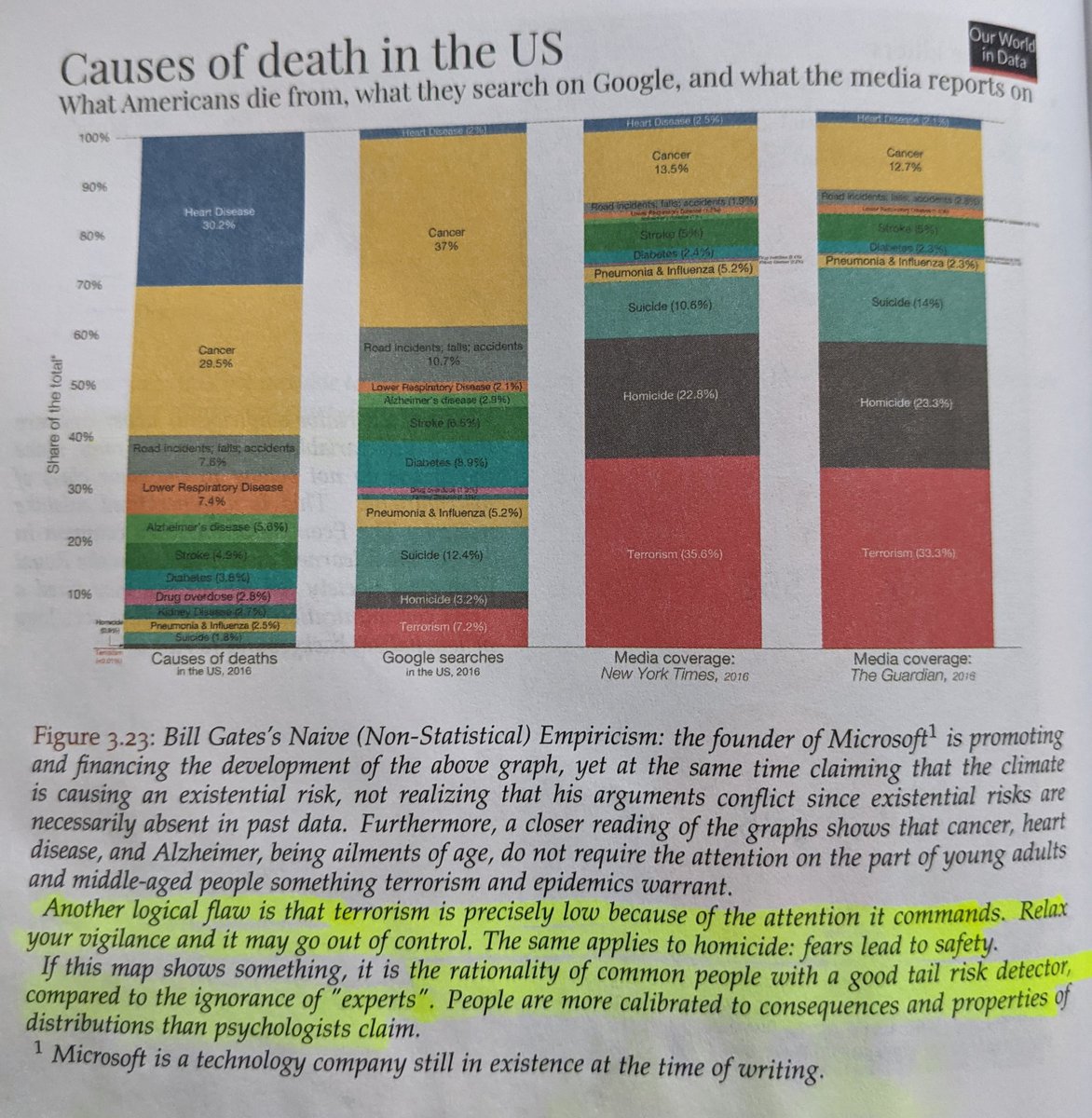

"The rationality of of common people with a good tail risk detector, compared to the ignorance of experts. People are more calibrated to consequences and properties of distributions than psychologists claim."

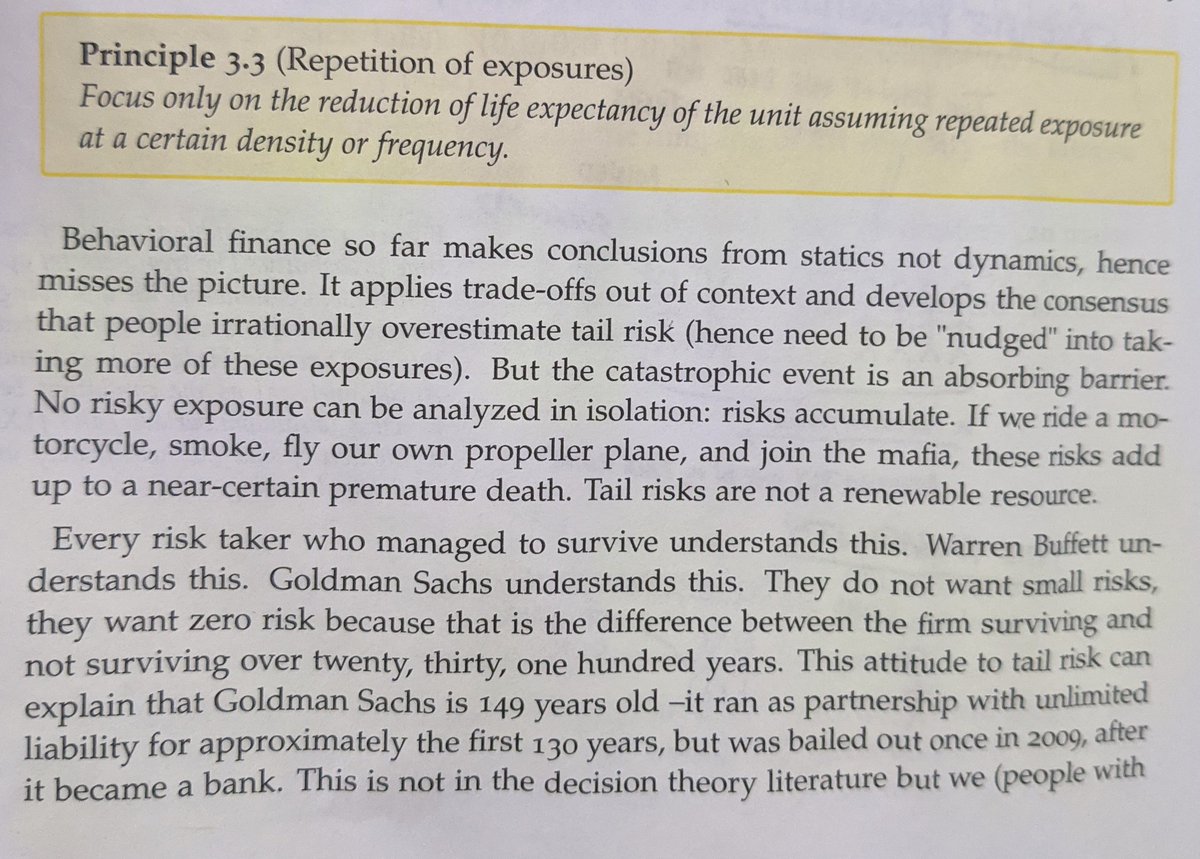

"If we visibly incur tiny risk of ruin, but have a frequent exposure, it will go to probability one over time."

"This attitude to tail risk can explain that $GS is 149 years old - and it ran as a partnership with unlimited liability for 130 years, but was bailed out once on 2009, after it became a bank"

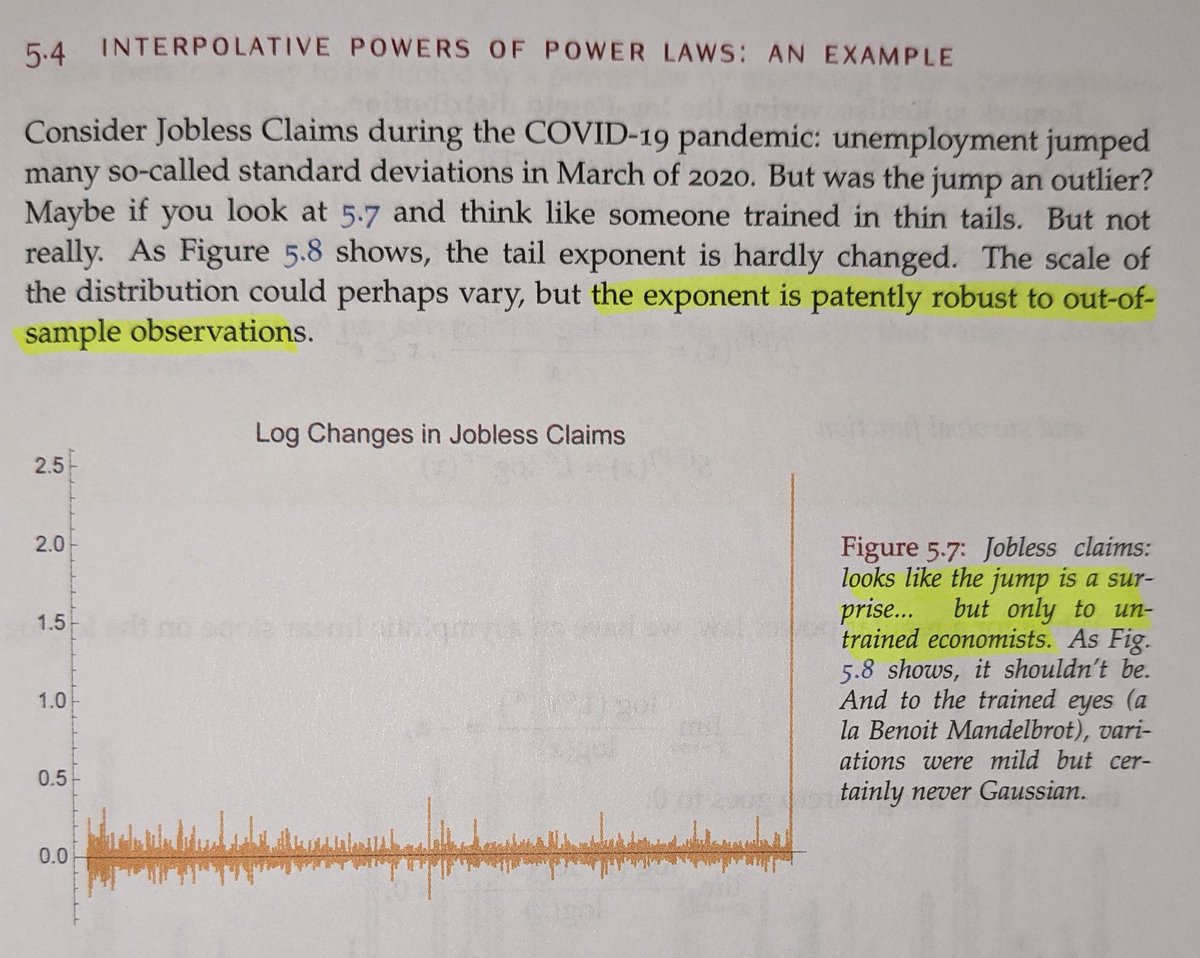

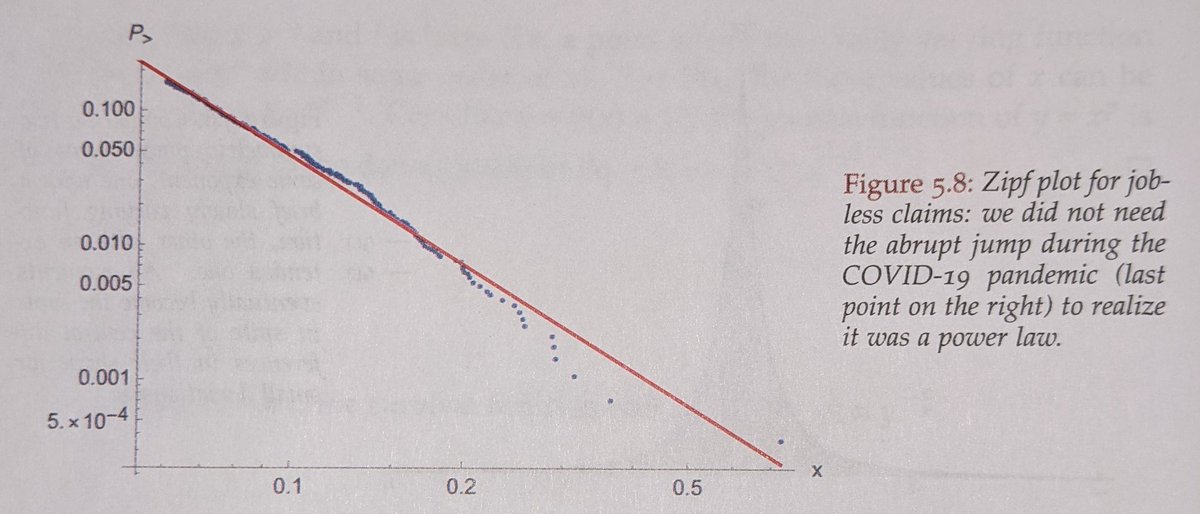

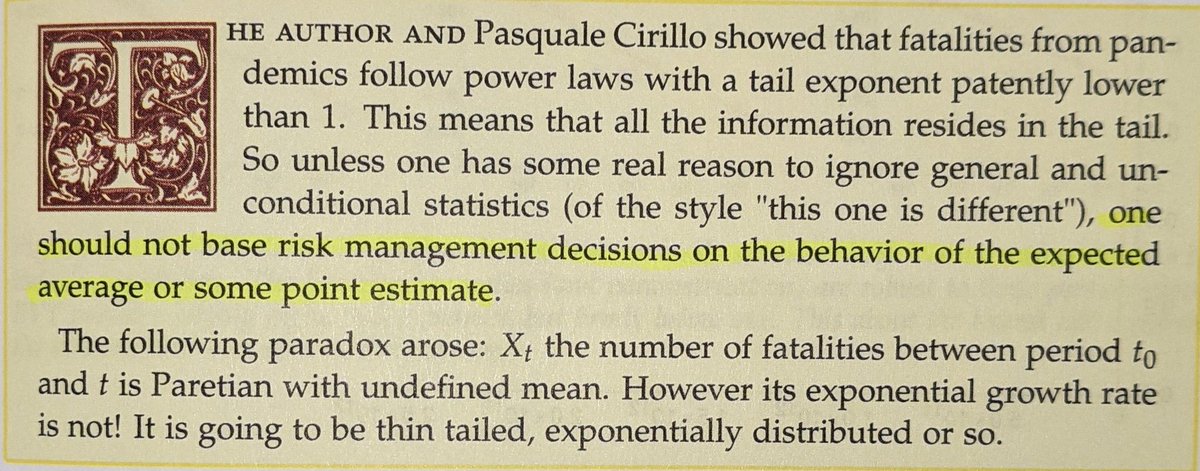

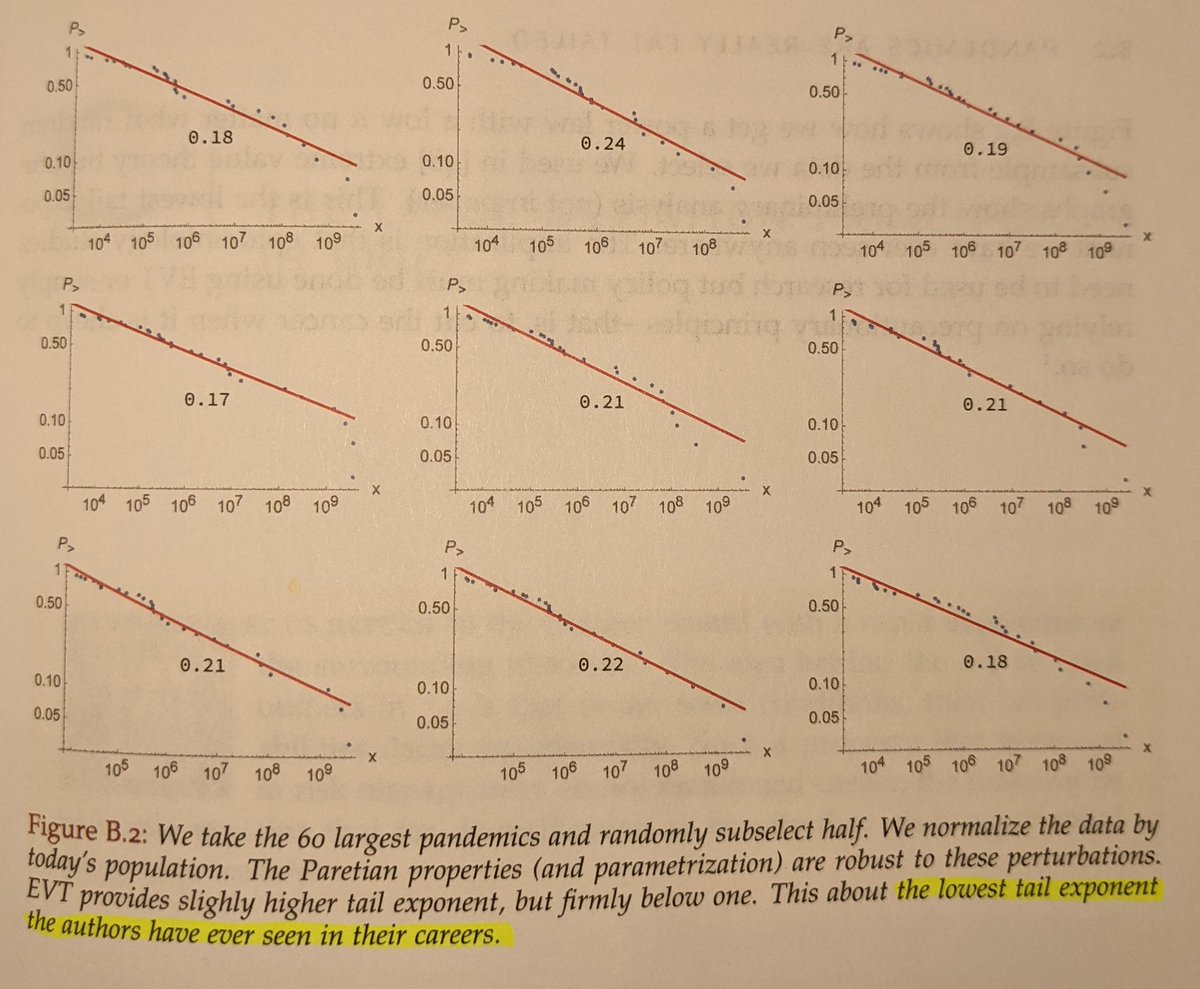

"The tail exponent is rather hard to guess, and it's calculation marred with errors, owning to the insufficiency of data in the tails. In general, the data will show thinner tail than it should"

"Bonds don't just default "a little bit". Note the divergence, the probability of the realization being at or close to the mean is about nil."

"what can break and is irreversible will eventually break"

"Just like the FAA and the FDA who deal with safety by focusing on catastrophe avoidance, we will through away the ordinary under the rug and retain extreme as the sole sound approach to risk management"

"Under fat tails there is no "typical" disaster or collapse... Verbal binary predictions or beliefs cannot be used as guages... Binary bets can never represent *skin in the game* under fat tailed distributions"

Why you know nothing about wealth inequality

"we can easily get a historical illusion of rise, in let's say, wealth concentration"

"we can easily get a historical illusion of rise, in let's say, wealth concentration"

"Violence is much more severe than it seems from conventional analyses and the prevailing "long peace" theory... The risk of violent conflict has not been decreasing, but rather is underestimated... "

Read on Twitter

Read on Twitter