Electric Vehicles (EVs) are on the rise:

- cost of the passenger EV battery has dropped ~80% since 2015

- Li-ion batteries density double what we saw 10 years ago, and expected increase in battery density will open up new doors for trucking

- Betting on the new technology ...

- cost of the passenger EV battery has dropped ~80% since 2015

- Li-ion batteries density double what we saw 10 years ago, and expected increase in battery density will open up new doors for trucking

- Betting on the new technology ...

... surrounding the battery manufacturers and their ability to increase the duration, efficiency, and safety of the charge

Drivers:

- EVs are the future. Demand for the lithium battery industry is expected to increase over 5x in the next 10 years

- Battery manufacturers are ...

Drivers:

- EVs are the future. Demand for the lithium battery industry is expected to increase over 5x in the next 10 years

- Battery manufacturers are ...

... striving to own their own supply chain and many are engaging in strategic partnerships

- The Biden Administration is expected to give the EV industry a “jolt,” leading higher demand for batteries, lowering prices, and in turn driving the future of the li-ion revolution

- The Biden Administration is expected to give the EV industry a “jolt,” leading higher demand for batteries, lowering prices, and in turn driving the future of the li-ion revolution

-Expect announcements around battery awards to serve as short and long term catalysts to push stock higher, ultimately pushing revenue higher and increasing backlog for organic growth

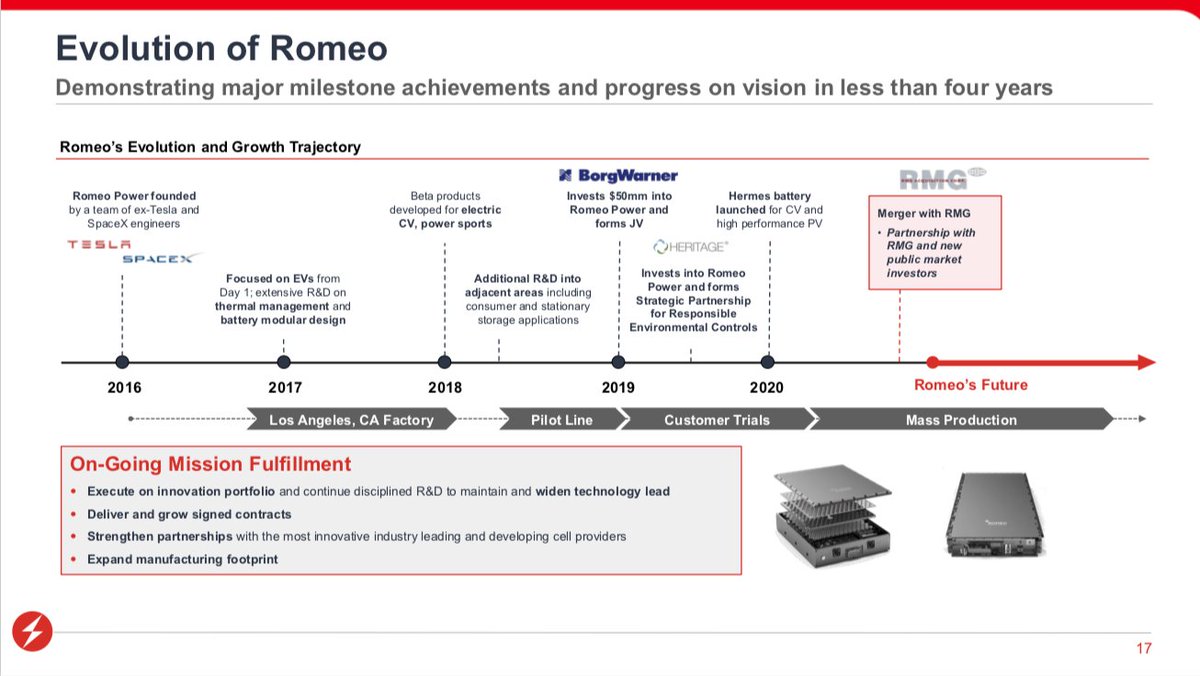

Now given that background, let’s jump into $RMO. Formerly known as RMG Acquisition Corp, Romeo Power is an industry leader in the design and manufacturing of energy-dense li-ion battery packs and modules focused on commercial vehicles globally

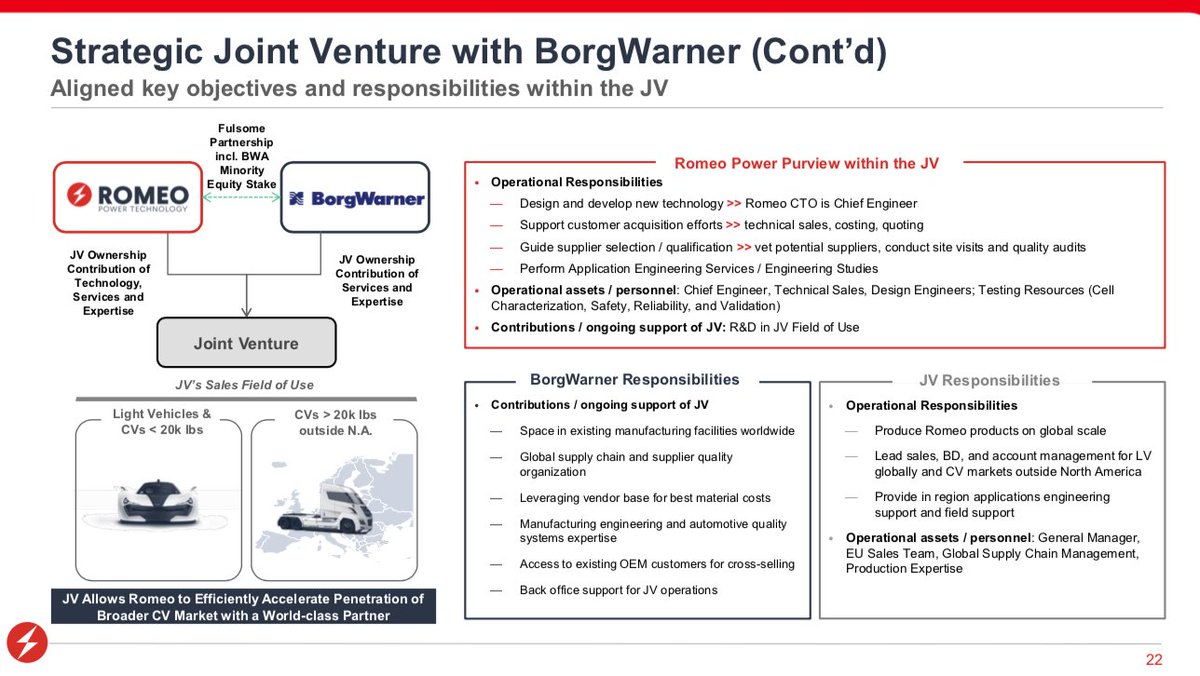

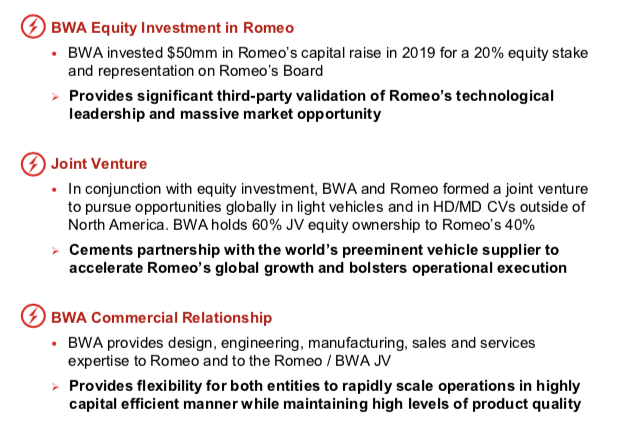

- Current partnership with BorgWarner (BWA) JV: allows RMO international exposure where RMO gets a royalty and service & support fees on their batteries. Future plans to eventually set up battery manufacturing hubs at existing BWA locations

- Market is oversupplied with ...

- Market is oversupplied with ...

... battery cells, but with increased demand in future years, established and existing companies like Romeo should perform well

- The company has around ~$350mm cash which will be used as growth capital to fund expansion in production, working capital, and R&D

- The company has around ~$350mm cash which will be used as growth capital to fund expansion in production, working capital, and R&D

- $993mm Enterprise value with no outstanding debt

- Experienced management team and founded by former leaders at Tesla, SpaceX, Amazon, Apple, and Samsung

- Through partnerships, the company now gains access to a high-quality customer base

- Experienced management team and founded by former leaders at Tesla, SpaceX, Amazon, Apple, and Samsung

- Through partnerships, the company now gains access to a high-quality customer base

ESG:

- Key strategic partnerships include The Heritage Group which is a recycle partner of RMO

- EU and USA pushing for regulations around life-cycle of batteries, pushing for more regulations in environmental governance (already established)

- Key strategic partnerships include The Heritage Group which is a recycle partner of RMO

- EU and USA pushing for regulations around life-cycle of batteries, pushing for more regulations in environmental governance (already established)

- Possible partnership with Republic Services as it electrifies its waste services and disposal vehicles

What is their Competitive Advantage?

What is their Competitive Advantage?

Market Opportunity:

- Early stage product company in EV space, with expected increase in demand for passenger and commercial vehicle growth

- Romeo offers 6 different packs with different voltage variants which allows for ease of accessibility in a variety of different EVs

- Early stage product company in EV space, with expected increase in demand for passenger and commercial vehicle growth

- Romeo offers 6 different packs with different voltage variants which allows for ease of accessibility in a variety of different EVs

- The Company expects to increase capacity to ~14GWh over the next 5 years at around ~$105mm; expect new incentives at state level which lead to increased facilities

- NKLA focused on Nikola Tre for 2H21, and $RMO is providing batteries for the alpha and beta testing of the Tre

- NKLA focused on Nikola Tre for 2H21, and $RMO is providing batteries for the alpha and beta testing of the Tre

Company, Valuation, and Comps:

- RMO has secured around $550mm in contracts (~15% of revenue through 2025)

- $64mm order with Lightening Systems, a $210mm order with NKLA; NKLA and RMO are currently in advanced discussions on up to $2.2bn in orders

- RMO has secured around $550mm in contracts (~15% of revenue through 2025)

- $64mm order with Lightening Systems, a $210mm order with NKLA; NKLA and RMO are currently in advanced discussions on up to $2.2bn in orders

- Management predicts revenue of $1.7bn in 2025 and 40% of JV’s revenue of $710mm

- Significant dry powder moving into 2023, cutting out unnecessary spending

- $134.4mm shares outstanding, 12.3mm warrants with strike of $11.50

- Significant dry powder moving into 2023, cutting out unnecessary spending

- $134.4mm shares outstanding, 12.3mm warrants with strike of $11.50

Risks:

- Inability to secure capital for future needs of the business

- Poor performance of battery packs

- Failure to scale business and outperform alternate battery providers (which include high competition of other established companies)

- EU & USA (state and federal) laws

- Inability to secure capital for future needs of the business

- Poor performance of battery packs

- Failure to scale business and outperform alternate battery providers (which include high competition of other established companies)

- EU & USA (state and federal) laws

Please do your own research before buying. I hope this gives some background to my investment thesis.

Long term hold - all credit to @MattCoiante for showing me $RMO

Read on Twitter

Read on Twitter