Biden's COVID relief package includes a significant expansion of the Child Tax Credit—a move that would reach more than 83 million children, give the biggest boost to low-income families and dramatically reduce child poverty. https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

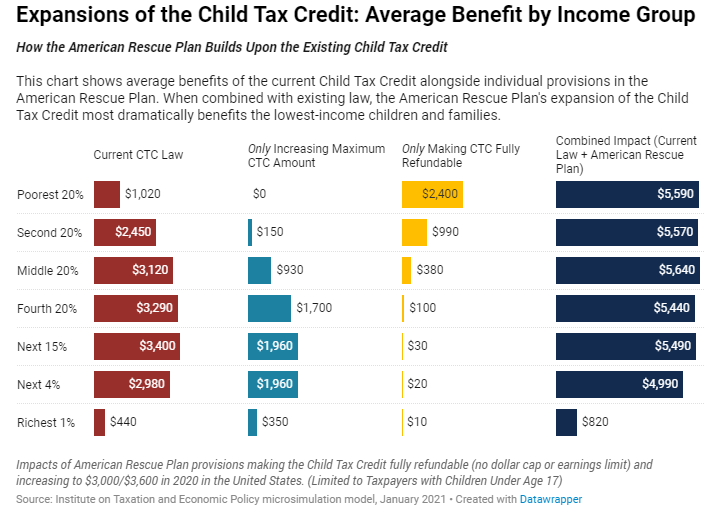

Essentially none of the lowest-income families receive full benefits of the existing Child Tax Credit.

NEW from @iteptweets: How the American Rescue Plan would extend CTC reach to 83M+ children, including 33M+ too poor to qualify for the full credit. https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

NEW from @iteptweets: How the American Rescue Plan would extend CTC reach to 83M+ children, including 33M+ too poor to qualify for the full credit. https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

NEW from @iteptweets: How the American Rescue Plan would extend CTC reach to 83M+ children, including 33M+ too poor to qualify for the full credit. https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

NEW from @iteptweets: How the American Rescue Plan would extend CTC reach to 83M+ children, including 33M+ too poor to qualify for the full credit. https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

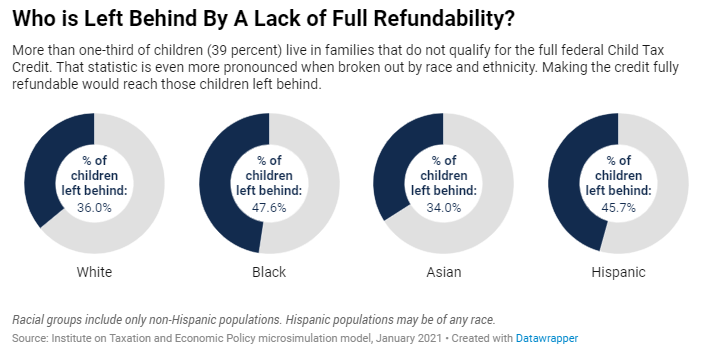

The pandemic has cast a floodlight on myriad structural inequities. The Child Tax Credit—a credit *designed* to help families w/children—leaves out nearly 4 in 10 children, including more than a third of white children and nearly half of Black and Hispanic children.

Combined with current law, the American Rescue Plan adds full refundability and increases maximum credit amounts. Together these improvements would boost incomes for the nation's poorest families by a dramatic 37%.

These changes would increase average benefits significantly for those with children earning <$65K and reach 100% of kids in households in the bottom 60%.

Find your state's numbers here https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

Find your state's numbers here

https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

https://itep.org/child-tax-credit-enhancements-under-the-american-rescue-plan/

Biden's plan would remedy the federal flaws, but states can act, too. A 2019 @iteptweets @CPSPPoverty report found bold state-level options could lift up to 4.5 million children out of poverty. https://itep.org/the-case-for-extending-state-level-child-tax-credits-to-those-left-out-a-50-state-analysis

Read on Twitter

Read on Twitter