The situation:

- Janet Yellen (former Fed Chair) is Treasury Secretary.

- Bernie Sanders is Chairman of the Senate Budget Committee.

- Jay Powell is Chairman of the Federal Reserve.

Meanwhile the Federal debt is a hockey stick graph...

Time to review where we stand

- Janet Yellen (former Fed Chair) is Treasury Secretary.

- Bernie Sanders is Chairman of the Senate Budget Committee.

- Jay Powell is Chairman of the Federal Reserve.

Meanwhile the Federal debt is a hockey stick graph...

Time to review where we stand

1/ Not only does the US Federal debt continues to climb, it is also at record high levels in terms of debt to GDP ratio.

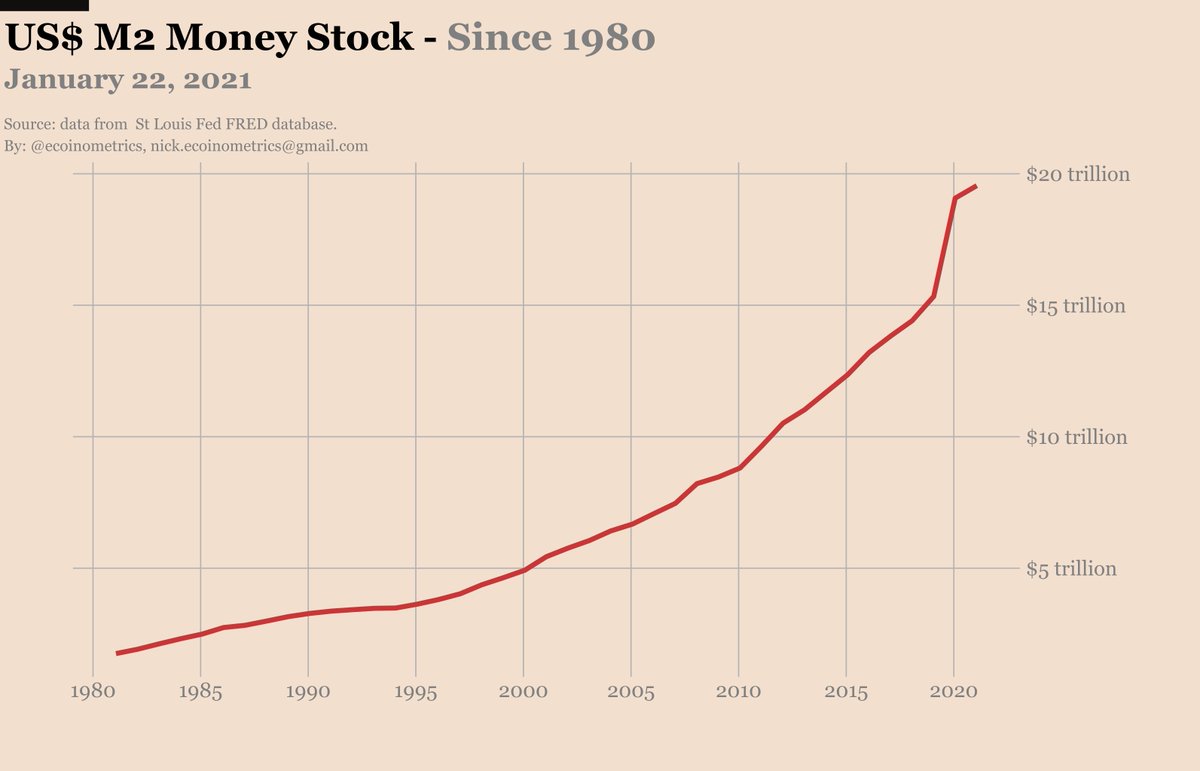

4/ If that sounds like debt monetization then you are probably right.

The Federal Reserve is financing the US debt with the money printer.

And it doesn’t look good for the debasement of the US$...

The Federal Reserve is financing the US debt with the money printer.

And it doesn’t look good for the debasement of the US$...

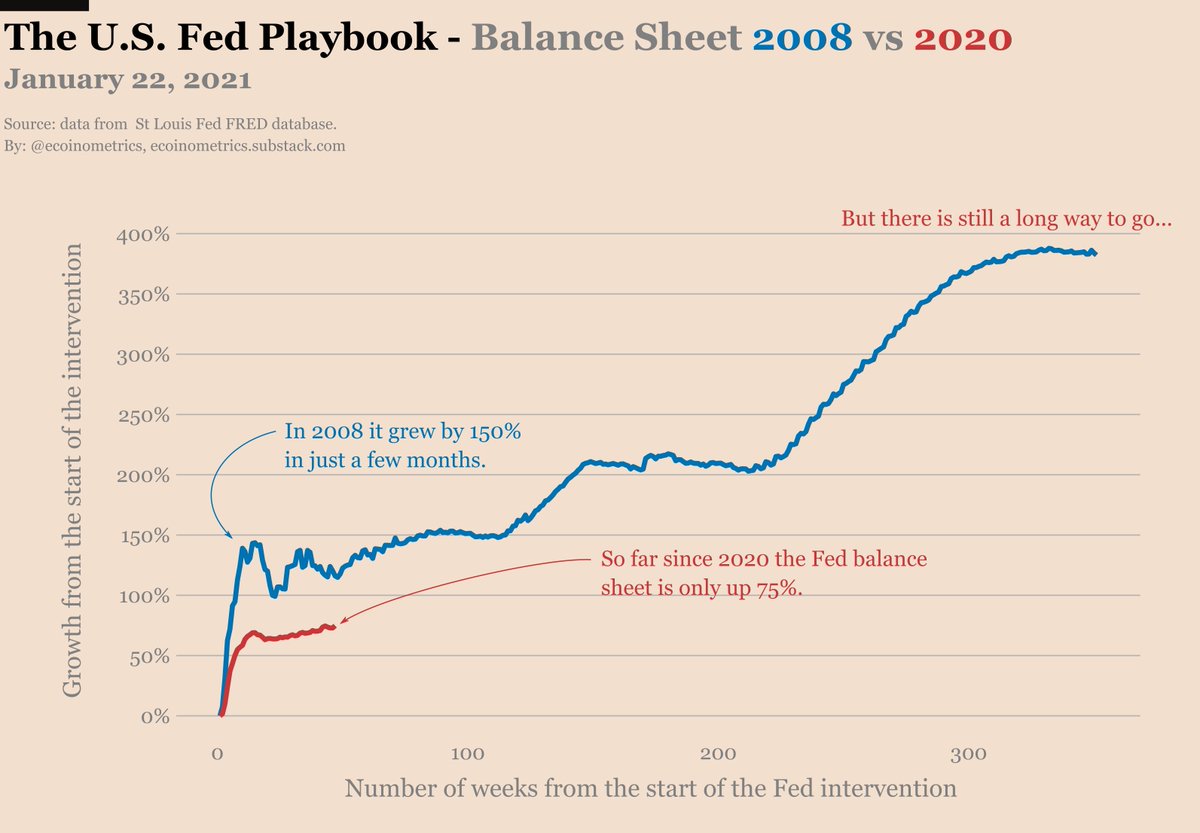

6/ This is not going to stop now. As we have seen in the aftermath of the 2008 financial crisis, the initial emergency measures of the Fed are just an appetizer...

8/ One reason things are likely to continue as they are is that the Federal Reserve needs to manage the debt.

The bonds yields have been in a 40 years downtrend…

The bonds yields have been in a 40 years downtrend…

10/ With a 130% debt to GDP ratio the US cannot afford to see a spike in bonds yields:

- A low Fed funds rate keeps the short end of the curve in check.

- Massive purchase of newly issued Treasury bonds will take care of the rest.

- A low Fed funds rate keeps the short end of the curve in check.

- Massive purchase of newly issued Treasury bonds will take care of the rest.

11/ This is why the US can’t escape a process of debt monetization:

- The US Congress will decide how much stimulus to create.

- The US Treasury will issue bonds to finance this stimulus.

- The US Federal Reserve will print money to buy those bonds.

- The US Congress will decide how much stimulus to create.

- The US Treasury will issue bonds to finance this stimulus.

- The US Federal Reserve will print money to buy those bonds.

12/ That creates a backdrop of:

- Fear of inflation.

- Currency debasement.

- Negative real yields.

Tl;dr this is good for #Bitcoin .

.

- Fear of inflation.

- Currency debasement.

- Negative real yields.

Tl;dr this is good for #Bitcoin

.

.

13/ If you have learned something in this thread go checkout the extended version in the latest issue of the Ecoinometrics newsletter  https://ecoinometrics.substack.com/p/ecoinometrics-january-25-2021

https://ecoinometrics.substack.com/p/ecoinometrics-january-25-2021

https://ecoinometrics.substack.com/p/ecoinometrics-january-25-2021

https://ecoinometrics.substack.com/p/ecoinometrics-january-25-2021

Read on Twitter

Read on Twitter