Commercial Real Estate Money Reveal

Few people know just how much money flows through our ecosystem. Time to change that.

Follow me behind the scenes of a $10M apartment sale.

You won’t believe the number of parties involved or how much they earn.

Take the red pill

Few people know just how much money flows through our ecosystem. Time to change that.

Follow me behind the scenes of a $10M apartment sale.

You won’t believe the number of parties involved or how much they earn.

Take the red pill

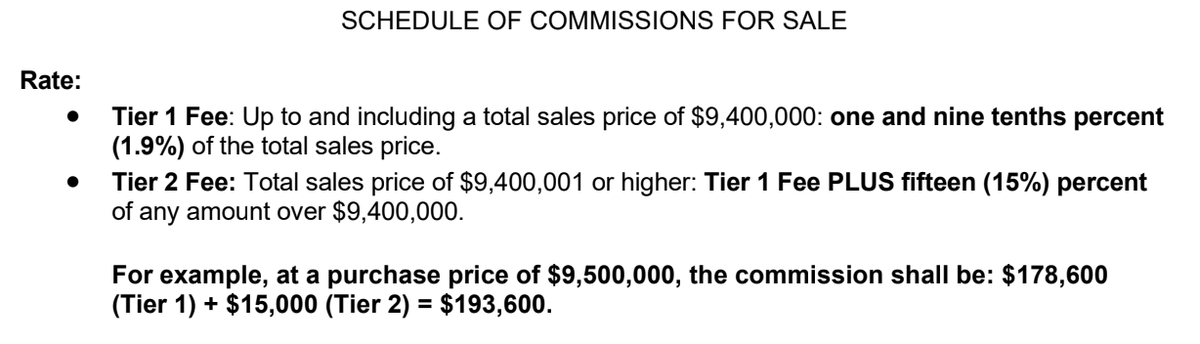

1) Listing brokers represent the seller and market the property to find a buyer.

Compensation is ~2% of sales price, with a bonus for exceeding the target sales price.

They can also represent the buyer to earn even more.

Comp: $200 - 250k

Compensation is ~2% of sales price, with a bonus for exceeding the target sales price.

They can also represent the buyer to earn even more.

Comp: $200 - 250k

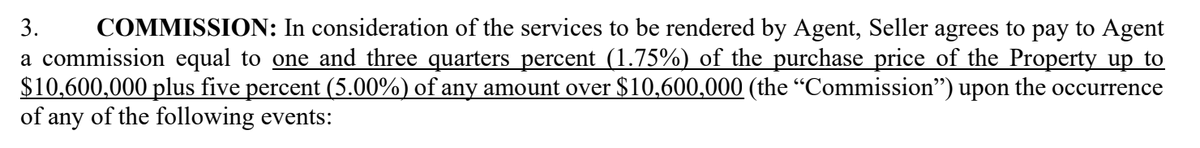

2) Buyer's agents are less common in commercial deals because

the buyers are more sophisticated

the buyers are more sophisticated

unlike the residential world, commercial brokers tend not to share fees

unlike the residential world, commercial brokers tend not to share fees

They can make 0.5 - 2%

Comp: $50 - 200k

the buyers are more sophisticated

the buyers are more sophisticated unlike the residential world, commercial brokers tend not to share fees

unlike the residential world, commercial brokers tend not to share feesThey can make 0.5 - 2%

Comp: $50 - 200k

3) Quick disclaimer

some roles are not present in every transaction

some roles are not present in every transaction

compensation numbers are approximate

compensation numbers are approximate

everything is negotiable

everything is negotiable

some roles are not present in every transaction

some roles are not present in every transaction compensation numbers are approximate

compensation numbers are approximate everything is negotiable

everything is negotiable

4) Loan brokers find the best financing options and negotiate with the lender.

They split an origination fee, ~1% of the loan, with the lender. Some also get paid on the back end when the loan is sold.

On a $10M deal, the loan would be ~$7.5M.

Comp: $37.5 - $75k

They split an origination fee, ~1% of the loan, with the lender. Some also get paid on the back end when the loan is sold.

On a $10M deal, the loan would be ~$7.5M.

Comp: $37.5 - $75k

5) The lender profits in three ways from the loan.

The first way is the origination fee mentioned above. When a loan broker brings in the business, this fee is shared.

Comp: $37.5 - $75k

The first way is the origination fee mentioned above. When a loan broker brings in the business, this fee is shared.

Comp: $37.5 - $75k

6) The second way the lender profits is by becoming the loan servicer. In exchange for

collecting mortgage payments

collecting mortgage payments

enforcing borrower compliance

enforcing borrower compliance

forwarding funds to the mortgage holder

forwarding funds to the mortgage holder

The servicer receives ~0.25% of the loan each year.

Comp: $19k/yr on a $7.5M loan

collecting mortgage payments

collecting mortgage payments enforcing borrower compliance

enforcing borrower compliance forwarding funds to the mortgage holder

forwarding funds to the mortgage holderThe servicer receives ~0.25% of the loan each year.

Comp: $19k/yr on a $7.5M loan

7) Finally, the lender profits from the yield spread premium.

The yield spread is a portion of the mortgage interest rate which is pure profit to the lender.

When the loan is sold, a 0.3% yield spread is worth ~2% of the loan.

Comp: $150k on a $7.5M loan

The yield spread is a portion of the mortgage interest rate which is pure profit to the lender.

When the loan is sold, a 0.3% yield spread is worth ~2% of the loan.

Comp: $150k on a $7.5M loan

8) The lender's attorney

prepares the loan documents

prepares the loan documents

makes sure the i's are dotted and t's crossed

makes sure the i's are dotted and t's crossed

vets and performs due diligence on the buyer

vets and performs due diligence on the buyer

The lender tends to have a volume agreement with the law firm. The buyer pays the fees.

Comp: $15 - 25k

prepares the loan documents

prepares the loan documents makes sure the i's are dotted and t's crossed

makes sure the i's are dotted and t's crossed vets and performs due diligence on the buyer

vets and performs due diligence on the buyerThe lender tends to have a volume agreement with the law firm. The buyer pays the fees.

Comp: $15 - 25k

9) The buyer and seller each have real estate attorneys who

help resolve title objections

help resolve title objections

assist through the closing process

assist through the closing process

negotiate the purchase agreement

negotiate the purchase agreement

review and prepare closing documents

review and prepare closing documents

help resolve title objections

help resolve title objections assist through the closing process

assist through the closing process negotiate the purchase agreement

negotiate the purchase agreement review and prepare closing documents

review and prepare closing documents

10) One side drafts the purchase agreement, giving them an anchoring advantage in negotiation.

Frequently, one of the attorneys acts as title & escrow. They do the legal work for free because the title company’s commission is more than the legal bill.

Comp: $15 - 50k each

Frequently, one of the attorneys acts as title & escrow. They do the legal work for free because the title company’s commission is more than the legal bill.

Comp: $15 - 50k each

11) A securities attorney helps the buyer raise money from investors in an SEC compliant manner. They

file regulatory documents

file regulatory documents

prepare legal operating agreements

prepare legal operating agreements

draft a private placement memorandum

draft a private placement memorandum

structure and create the buyer's legal entities

structure and create the buyer's legal entities

Comp: $15 - 75k

file regulatory documents

file regulatory documents prepare legal operating agreements

prepare legal operating agreements draft a private placement memorandum

draft a private placement memorandum structure and create the buyer's legal entities

structure and create the buyer's legal entitiesComp: $15 - 75k

12) The lawyers have left the room!

Time for a quick stretching break.

Lots more when we come back.

Time for a quick stretching break.

Lots more when we come back.

13) Most state and local governments tax real estate transactions by charging transfer taxes and recording fees.

These range from 0 - 1% of the purchase price.

Comp: $0 - 100k

These range from 0 - 1% of the purchase price.

Comp: $0 - 100k

14) The escrow agent is a neutral party who

holds buyer funds

holds buyer funds

collects transaction-related bills

collects transaction-related bills

disburses payments to all parties

disburses payments to all parties

consummates the transaction and records the documents

consummates the transaction and records the documents

They often also perform title and earn the title commission.

Comp: $1 - 2k

holds buyer funds

holds buyer funds collects transaction-related bills

collects transaction-related bills disburses payments to all parties

disburses payments to all parties consummates the transaction and records the documents

consummates the transaction and records the documentsThey often also perform title and earn the title commission.

Comp: $1 - 2k

15) The title company issues an insurance policy to indemnify the buyer and the lender in the case of title defects.

Rates are regulated by the states, but ~0.3% of purchase price is typical.

Comp: ~$30k

Rates are regulated by the states, but ~0.3% of purchase price is typical.

Comp: ~$30k

16) The title agent, who is commonly escrow or one of the attorneys, binds the title policy.

Since title companies have notoriously low claims rates, they pay large commissions to the agent, as much as 70-85%.

Comp: $21 - 25k

Since title companies have notoriously low claims rates, they pay large commissions to the agent, as much as 70-85%.

Comp: $21 - 25k

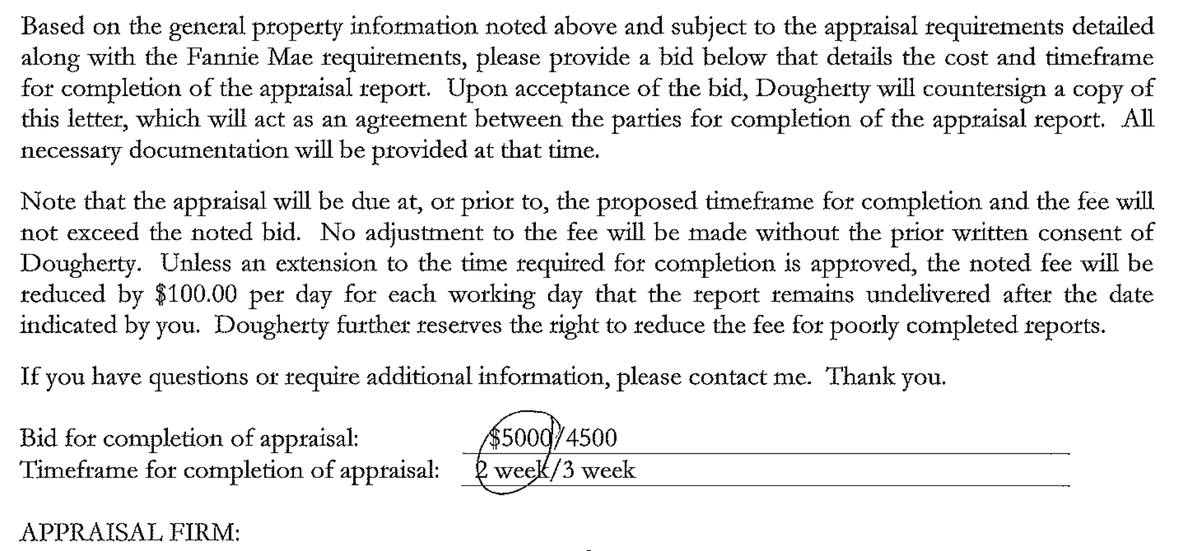

17) The appraiser independently values the property to

protect the lender from over-lending

protect the lender from over-lending

protect the buyer from overpaying

protect the buyer from overpaying

Comp: $5k

On deals that actually close, the appraisal tends to be a bit higher than the purchase price.

https://twitter.com/evanmr/status/1347287947708571656?s=20

protect the lender from over-lending

protect the lender from over-lending protect the buyer from overpaying

protect the buyer from overpayingComp: $5k

On deals that actually close, the appraisal tends to be a bit higher than the purchase price.

https://twitter.com/evanmr/status/1347287947708571656?s=20

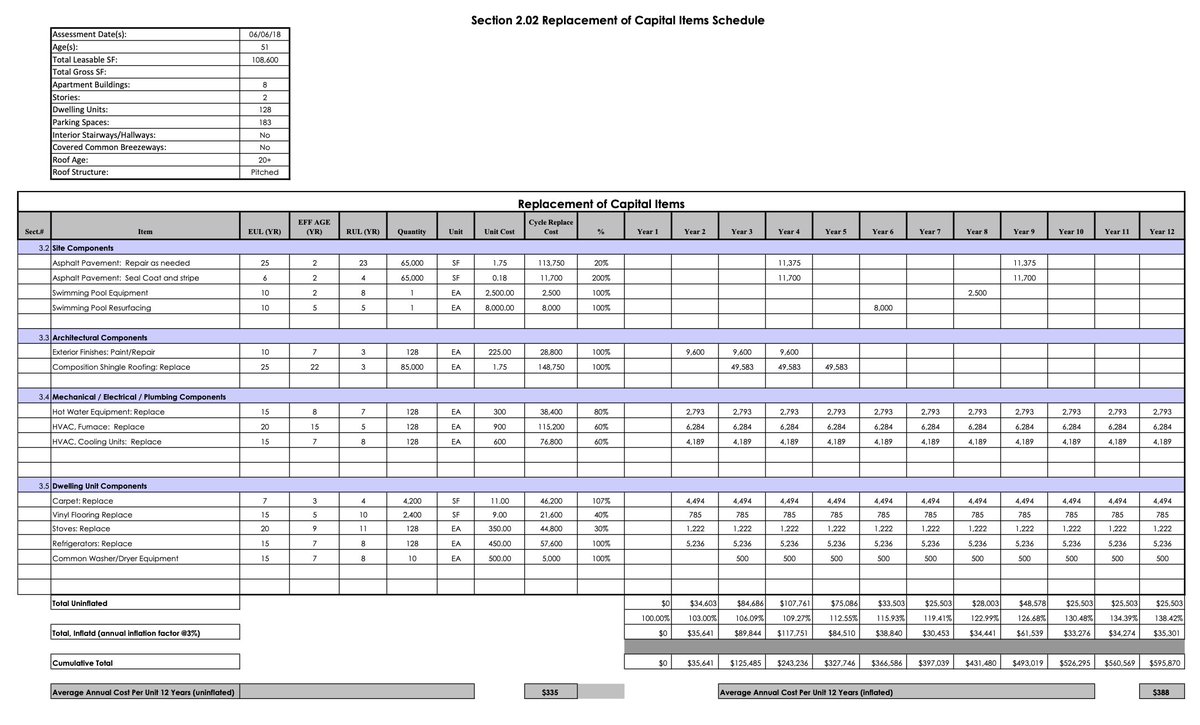

18) Building engineers inspect the property as part of a "PCA report" which is used to identify

safety hazards for immediate repair

safety hazards for immediate repair

deferred maintenance to be repaired

deferred maintenance to be repaired

ongoing maintenance needs of building over the ownership period

ongoing maintenance needs of building over the ownership period

Comp: $5k

safety hazards for immediate repair

safety hazards for immediate repair deferred maintenance to be repaired

deferred maintenance to be repaired ongoing maintenance needs of building over the ownership period

ongoing maintenance needs of building over the ownership periodComp: $5k

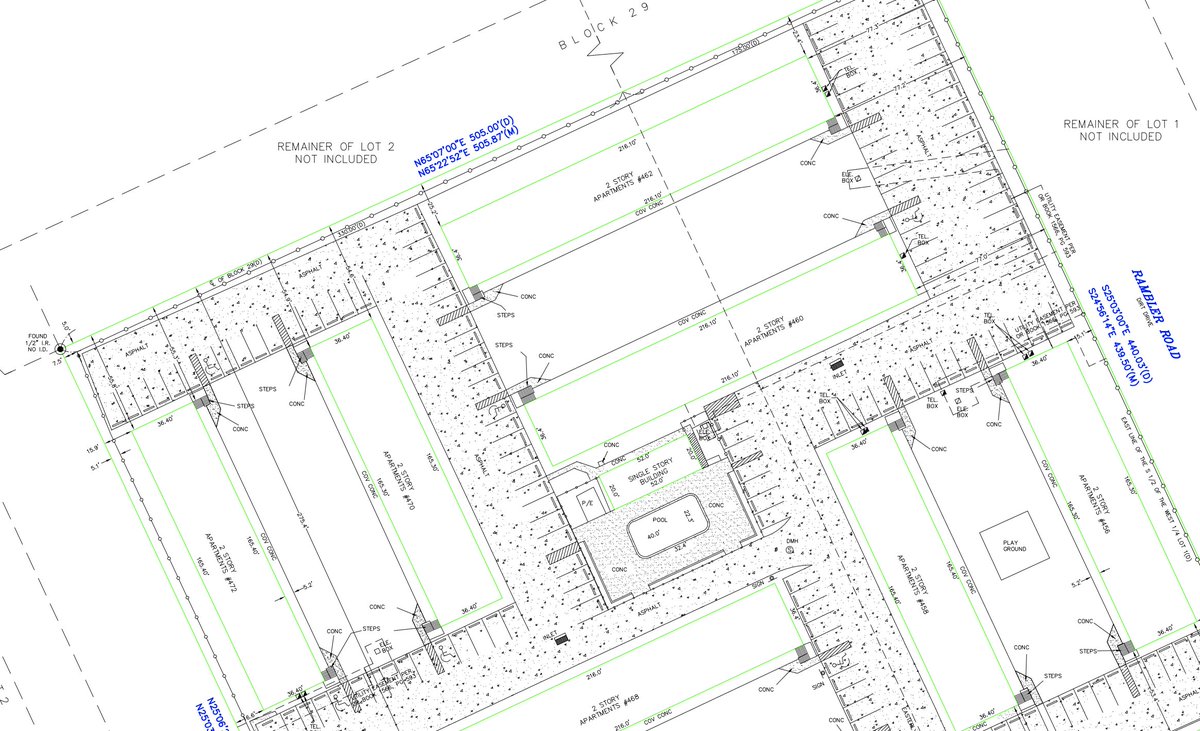

20) Surveyors map out the legal property lines along with

property improvements

property improvements

flood zones

flood zones

city streets

city streets

easements

easements

Their work is necessary in order to get title insurance and protects against encroachments and adverse possession claims.

Comp: $3 - 5k

property improvements

property improvements flood zones

flood zones city streets

city streets easements

easementsTheir work is necessary in order to get title insurance and protects against encroachments and adverse possession claims.

Comp: $3 - 5k

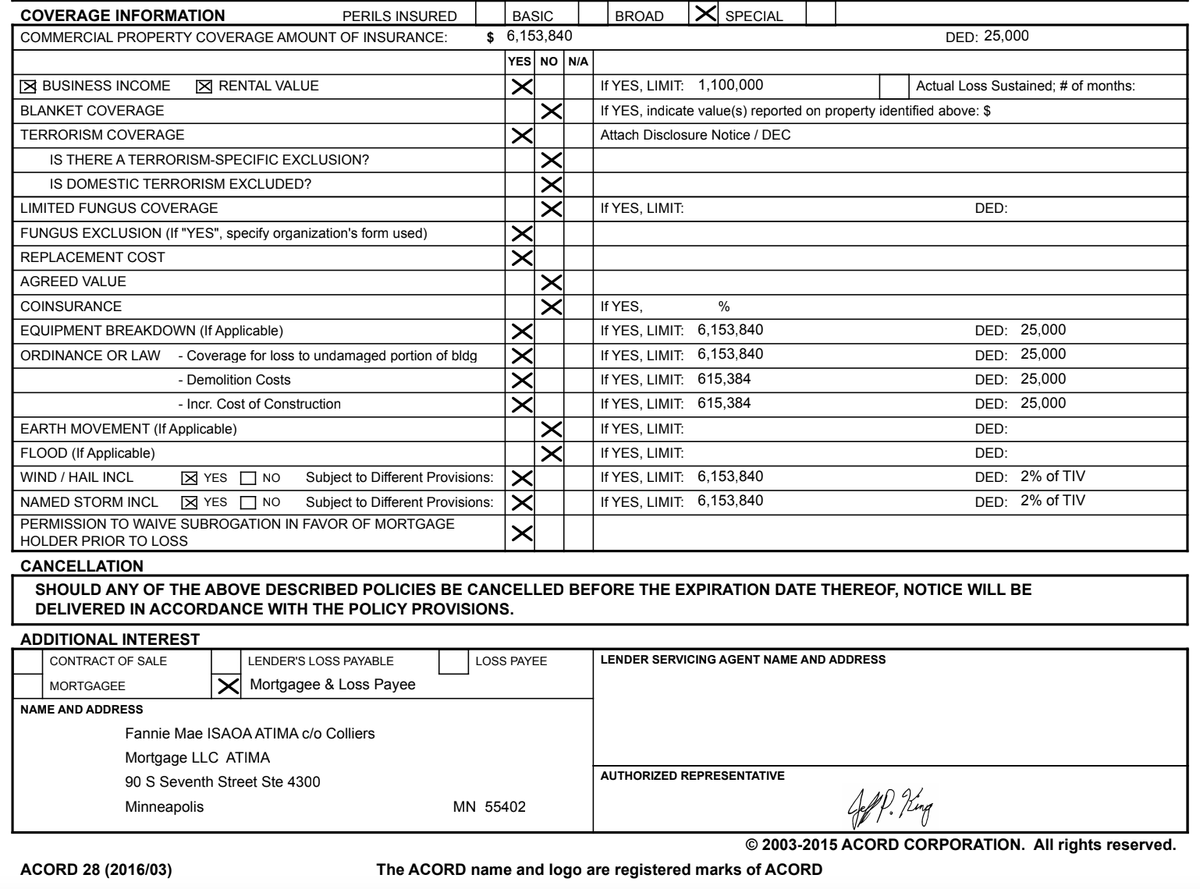

21) The insurance company protects the buyer and lender against excess loss from property damage and legal liability.

They receive a full year of premium at closing.

The cost to insure habitational property has been rising rapidly. Current market is ~$500/unit/yr.

Comp: $50k

They receive a full year of premium at closing.

The cost to insure habitational property has been rising rapidly. Current market is ~$500/unit/yr.

Comp: $50k

22) Insurance agents help the buyer locate the best policy options and bind coverage

They typically get ~15% commission on a commercial policy

Comp: $7.5k

They typically get ~15% commission on a commercial policy

Comp: $7.5k

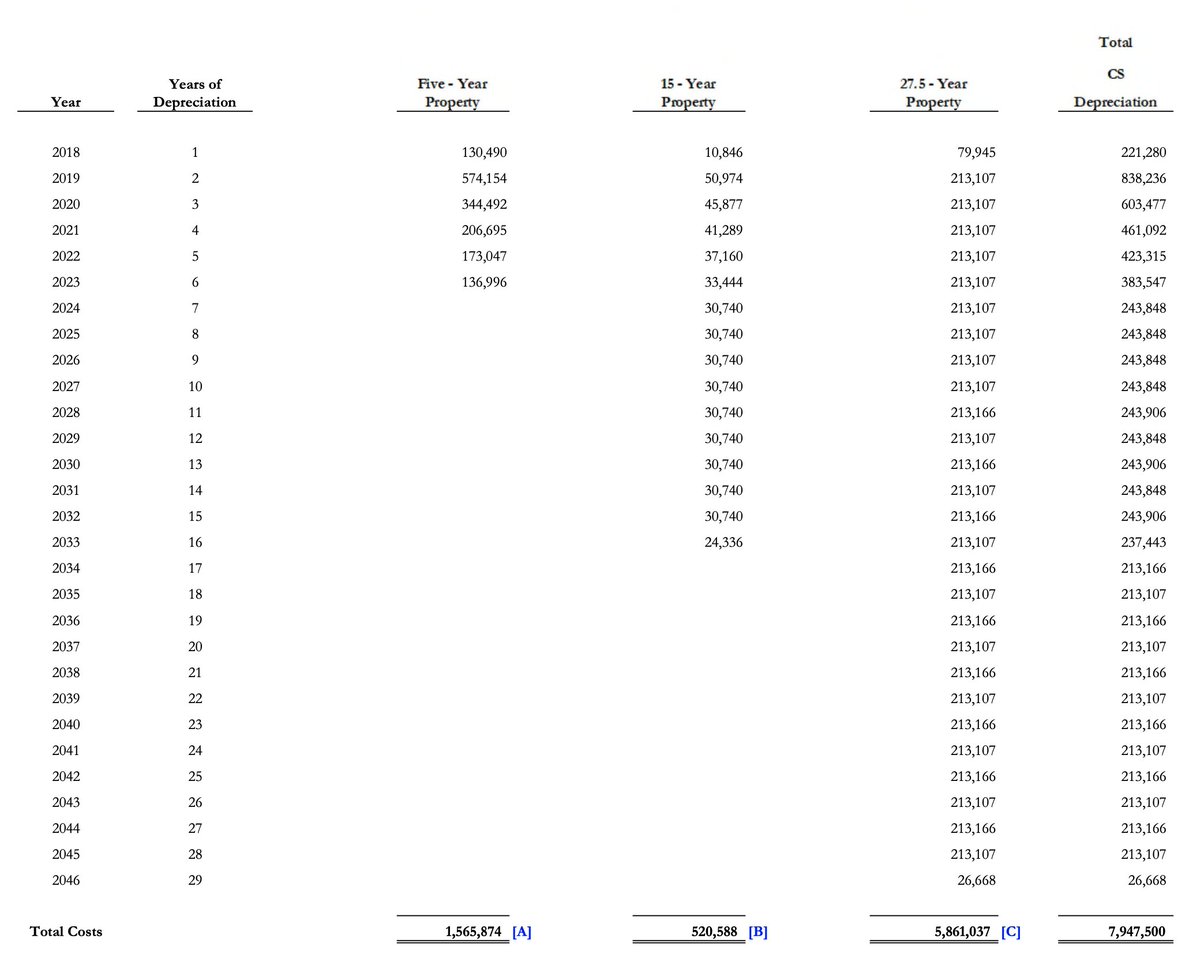

23) Cost segregation engineers catalog the different components of the building and their useful life. Their report helps the buyer be more tax efficient.

Comp: $5k

Comp: $5k

24) One final break to let off some steam. Trust me, you'll need it.

Despite everyone's best intentions, there will come a point (or many) in the contract period where you need a punching bag.

Despite everyone's best intentions, there will come a point (or many) in the contract period where you need a punching bag.

25) The seller's lender gets a fee when the seller's loan is paid off early, especially the money will be re-lent at a lower interest rate.

Fees are based on unpaid principal balance and can be

fixed (1 - 5%)

fixed (1 - 5%)

yield maintenance (complex formula, 10%+)

yield maintenance (complex formula, 10%+)

Comp: $100 - $200k

Fees are based on unpaid principal balance and can be

fixed (1 - 5%)

fixed (1 - 5%) yield maintenance (complex formula, 10%+)

yield maintenance (complex formula, 10%+)Comp: $100 - $200k

26) Property management companies are key to a smooth closing. The seller's manager helps

respond to many requests

respond to many requests

prepare due diligence materials

prepare due diligence materials

coordinate tours and inspections

coordinate tours and inspections

keep the property running smoothly

keep the property running smoothly

Many companies charge $3 - 5k for this extra burden

respond to many requests

respond to many requests prepare due diligence materials

prepare due diligence materials coordinate tours and inspections

coordinate tours and inspections keep the property running smoothly

keep the property running smoothlyMany companies charge $3 - 5k for this extra burden

27) The buyer's property manager helps

perform due diligence

perform due diligence

prepare a property budget

prepare a property budget

develop a strategy for operations

develop a strategy for operations

line up contractors for capital improvements

line up contractors for capital improvements

Many companies charge a $3 - 5k onboarding fee to cover these services.

perform due diligence

perform due diligence prepare a property budget

prepare a property budget develop a strategy for operations

develop a strategy for operations line up contractors for capital improvements

line up contractors for capital improvementsMany companies charge a $3 - 5k onboarding fee to cover these services.

28) Trade contractors help perform physical due diligence, identifying unknown issues and scoping out improvements. Specialists are commonly called to focus is on

the roof

the roof

the foundations

the foundations

inspecting for termites

inspecting for termites

scoping the sewer lines

scoping the sewer lines

Comp: $5 - 15k total

the roof

the roof the foundations

the foundations inspecting for termites

inspecting for termites scoping the sewer lines

scoping the sewer linesComp: $5 - 15k total

29) The sponsor of the buyer side typically earns a 1% acquisition fee on purchase.

Likewise, the sponsor of the seller side may earn a 1% disposition fee on sale.

Comp: $100k each

Likewise, the sponsor of the seller side may earn a 1% disposition fee on sale.

Comp: $100k each

30) If the project was a success, the sponsor of the seller side will earn their carry.

This is commonly 30% of profits, after investors receive all of their initial investment back.

Depending on how long the project was held, this could be $500k - $1.5M.

This is commonly 30% of profits, after investors receive all of their initial investment back.

Depending on how long the project was held, this could be $500k - $1.5M.

31) I'm zapped, time to call for reinforcements. Some great ReTwit follows are

@moseskagan

@fortworthchris

@sweatystartup

@Keith_Wasserman

@ChrisJBakke

@bobbyfijan

@MattLasky

@MarcSGIlbert

@TheRealEstateG6

@laughridge

@jayvasdigital

Friends, what roles did I miss?

@moseskagan

@fortworthchris

@sweatystartup

@Keith_Wasserman

@ChrisJBakke

@bobbyfijan

@MattLasky

@MarcSGIlbert

@TheRealEstateG6

@laughridge

@jayvasdigital

Friends, what roles did I miss?

32) You've now met the cast of supporting players and seen the sums of money involved.

We've barely scratched the surface of each role, but I hope you've begun to sense opportunities to improve and innovate.

Are you going down this path? Keep me posted.

We've barely scratched the surface of each role, but I hope you've begun to sense opportunities to improve and innovate.

Are you going down this path? Keep me posted.

If you enjoyed this thread and want more content like this

Follow me

Follow me

Subscribe to my newsletter. I'll be posting my best threads on tech, real estate, and business. https://bytestobricks.substack.com/embed

Subscribe to my newsletter. I'll be posting my best threads on tech, real estate, and business. https://bytestobricks.substack.com/embed

Follow me

Follow me Subscribe to my newsletter. I'll be posting my best threads on tech, real estate, and business. https://bytestobricks.substack.com/embed

Subscribe to my newsletter. I'll be posting my best threads on tech, real estate, and business. https://bytestobricks.substack.com/embed

Read on Twitter

Read on Twitter