1/ The 15 books about money that changed my life

and the key lessons from each of them (with graphics)

Who's up for a about improving your money mindset?

about improving your money mindset?

and the key lessons from each of them (with graphics)

Who's up for a

about improving your money mindset?

about improving your money mindset?

2/ Rich Dad, Poor Dad

Acquire assets, not liabilities

Acquire assets, not liabilities

A house is a liability

A house is a liability

You are in business for yourself

You are in business for yourself

Work to learn

Work to learn

Failure inspires winners

Failure inspires winners

Network

Network

Pay yourself first

Pay yourself first

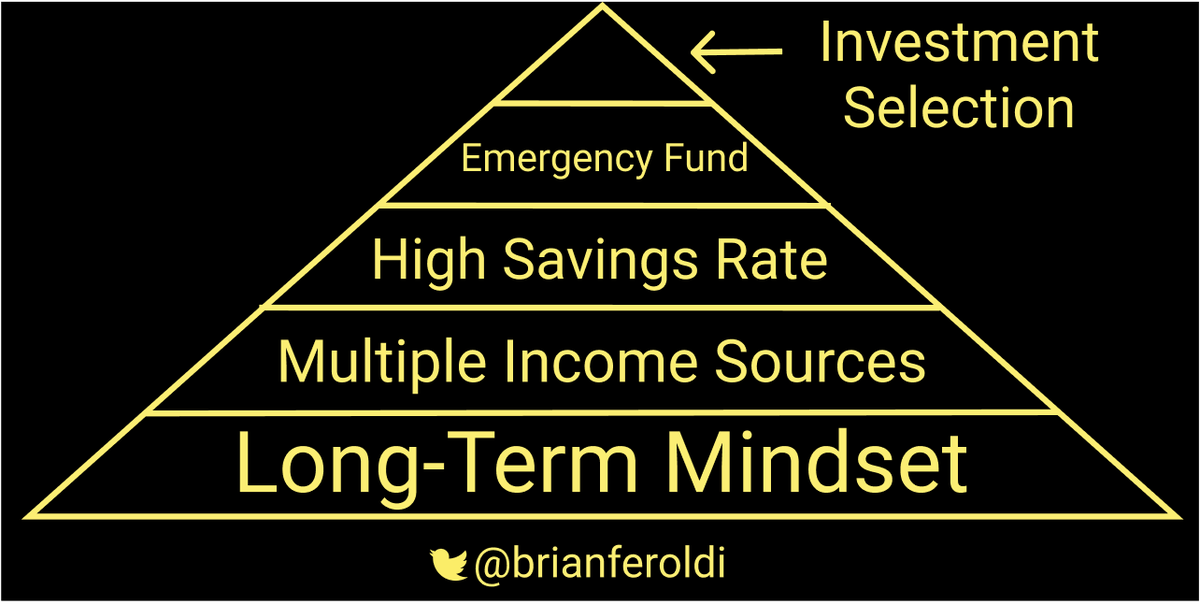

The rich don't work for money; money works for them

The rich don't work for money; money works for them

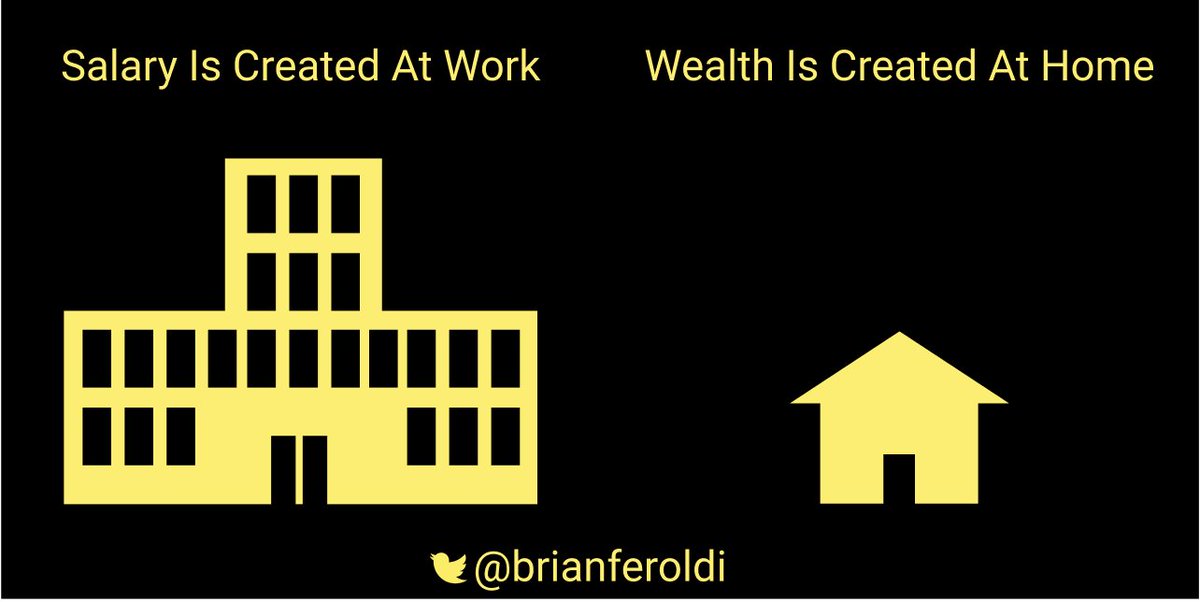

You get rich at home, not at work

You get rich at home, not at work

Acquire assets, not liabilities

Acquire assets, not liabilities A house is a liability

A house is a liability You are in business for yourself

You are in business for yourself Work to learn

Work to learn Failure inspires winners

Failure inspires winners Network

Network Pay yourself first

Pay yourself first The rich don't work for money; money works for them

The rich don't work for money; money works for them You get rich at home, not at work

You get rich at home, not at work

3/ The Wealthy Barber by @wealthy_barber

Pay yourself first

Pay yourself first

One dollar saved is two dollars earned

One dollar saved is two dollars earned

Common sense + discipline is all you need

Common sense + discipline is all you need

Society doesn't want you to save

Society doesn't want you to save

Your "wants" will never be satisfied

Your "wants" will never be satisfied

6 month emergency fund = must

6 month emergency fund = must

Pay yourself first

Pay yourself first One dollar saved is two dollars earned

One dollar saved is two dollars earned Common sense + discipline is all you need

Common sense + discipline is all you need Society doesn't want you to save

Society doesn't want you to save Your "wants" will never be satisfied

Your "wants" will never be satisfied 6 month emergency fund = must

6 month emergency fund = must

4/ Millionaire Next Door

Ordinary people can become wealthy

Ordinary people can become wealthy

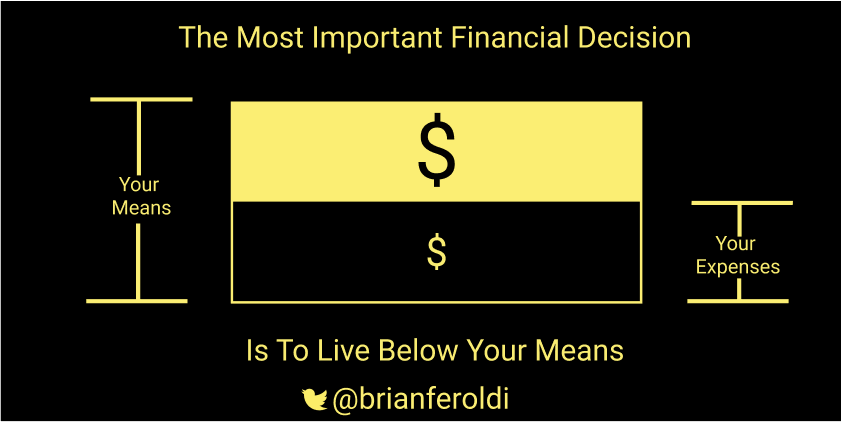

Live below your means

Live below your means

Age x (income/10). Compare this to your net worth

Age x (income/10). Compare this to your net worth

Don't subsidize your adult childrens' lifestyle

Don't subsidize your adult childrens' lifestyle

Use your time wisely

Use your time wisely

Pick the right occupation

Pick the right occupation

Minimize taxes

Minimize taxes

Avoid debt

Avoid debt

Invest

Invest

Ordinary people can become wealthy

Ordinary people can become wealthy Live below your means

Live below your means Age x (income/10). Compare this to your net worth

Age x (income/10). Compare this to your net worth Don't subsidize your adult childrens' lifestyle

Don't subsidize your adult childrens' lifestyle Use your time wisely

Use your time wisely Pick the right occupation

Pick the right occupation Minimize taxes

Minimize taxes Avoid debt

Avoid debt Invest

Invest

5/ Your Money or Your Life

Find your level of "enough"

Find your level of "enough"

Calculate your "real" hourly wage

Calculate your "real" hourly wage

Track every cent

Track every cent

Cost of anything = life energy spent

Cost of anything = life energy spent

Align spending with values & purpose

Align spending with values & purpose

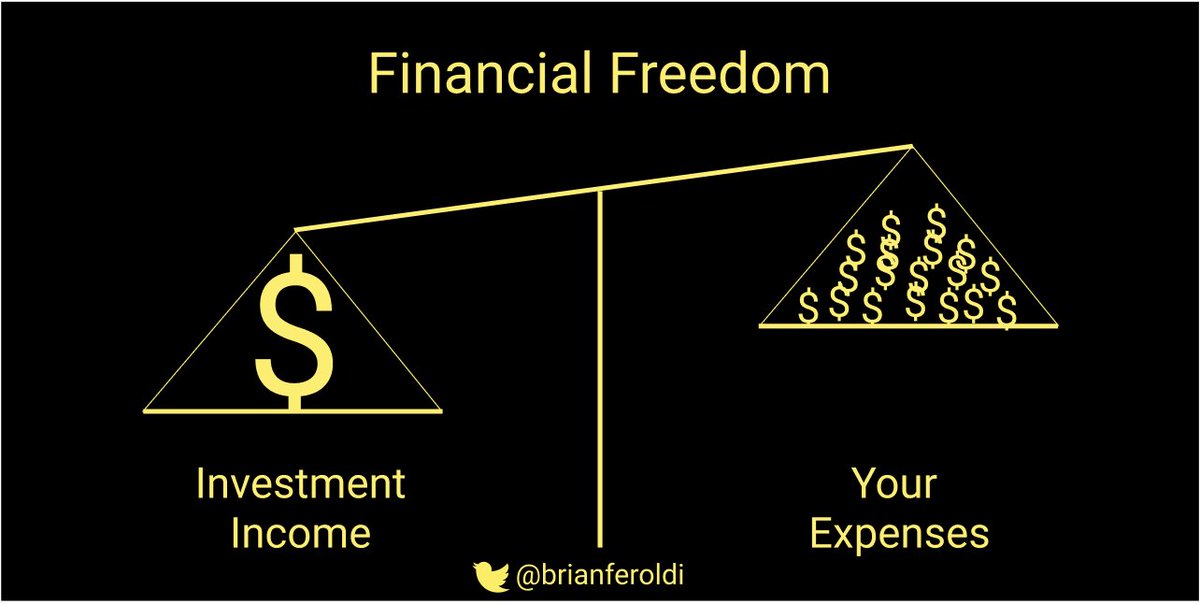

Financial independence = freedom

Financial independence = freedom

Find your level of "enough"

Find your level of "enough" Calculate your "real" hourly wage

Calculate your "real" hourly wage Track every cent

Track every cent Cost of anything = life energy spent

Cost of anything = life energy spent Align spending with values & purpose

Align spending with values & purpose Financial independence = freedom

Financial independence = freedom

6/ Choose FI by @ChooseFi

Start with "why"

Start with "why"

Develop a growth mindset

Develop a growth mindset

Become a "valuist"

Become a "valuist"

Hack college cost

Hack college cost

Build a network

Build a network

Invest simply

Invest simply

Travel hack

Travel hack

Start with "why"

Start with "why" Develop a growth mindset

Develop a growth mindset Become a "valuist"

Become a "valuist" Hack college cost

Hack college cost Build a network

Build a network Invest simply

Invest simply Travel hack

Travel hack

7/ Richest Man in Babylon

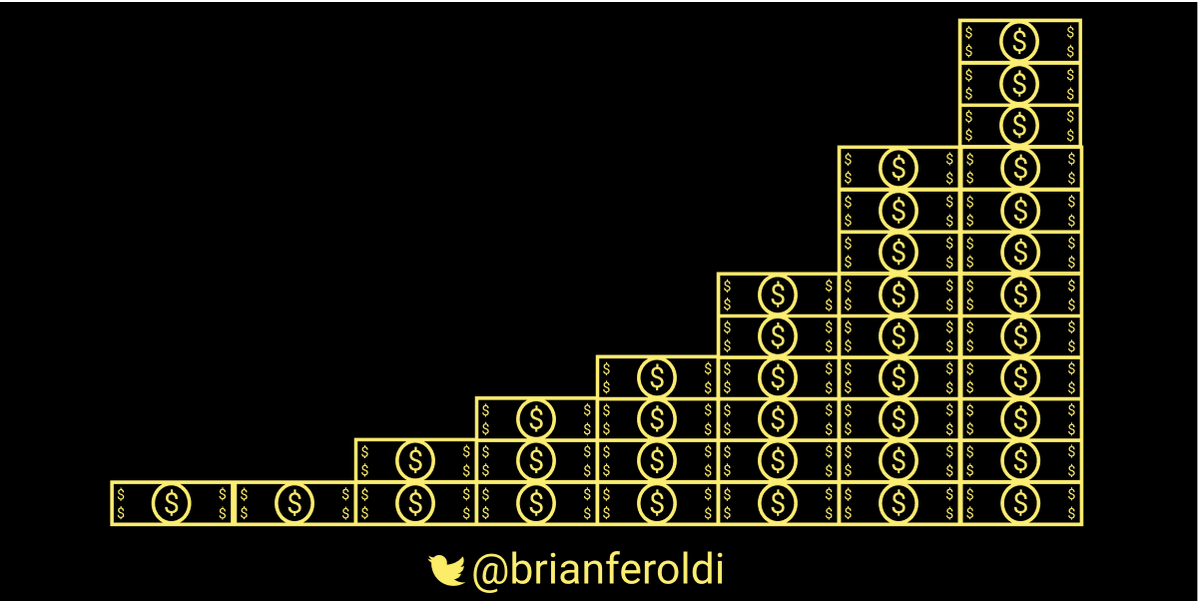

Save at least 10% of your income

Save at least 10% of your income

Don't confuse necessary expense w/ desires

Don't confuse necessary expense w/ desires

Invest wisely

Invest wisely

Own your home

Own your home

Improve your ability to earn

Improve your ability to earn

Save at least 10% of your income

Save at least 10% of your income Don't confuse necessary expense w/ desires

Don't confuse necessary expense w/ desires Invest wisely

Invest wisely Own your home

Own your home Improve your ability to earn

Improve your ability to earn

8/ The Psychology of Money by @morganhousel

No one is crazy

No one is crazy

Wealth is what you don't see

Wealth is what you don't see

Save like a pessimist, invest like an optimist

Save like a pessimist, invest like an optimist

Build in room for error

Build in room for error

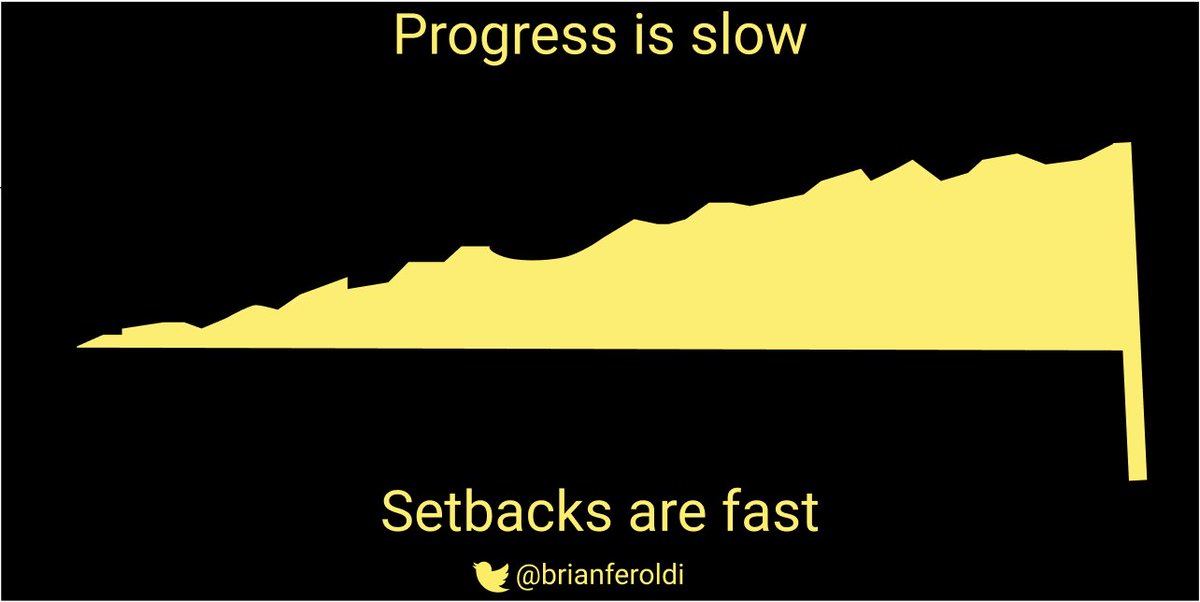

Progress is slow. Setbacks are fast.

Progress is slow. Setbacks are fast.

Bubbles form when investing horizons shorten

Bubbles form when investing horizons shorten

No one is crazy

No one is crazy Wealth is what you don't see

Wealth is what you don't see Save like a pessimist, invest like an optimist

Save like a pessimist, invest like an optimist Build in room for error

Build in room for error Progress is slow. Setbacks are fast.

Progress is slow. Setbacks are fast. Bubbles form when investing horizons shorten

Bubbles form when investing horizons shorten

9/ Rule Makers, Rule Breakers by @themotleyfool

Invest in "top dog and first-mover"

Invest in "top dog and first-mover"

Must have sustainable advantage

Must have sustainable advantage

Look for good management and smart backing

Look for good management and smart backing

Strong past price appreciation

Strong past price appreciation

Consumer appeal

Consumer appeal

Find companies that are "overvalued"

Find companies that are "overvalued"

Buy great companies

Buy great companies

Invest in "top dog and first-mover"

Invest in "top dog and first-mover" Must have sustainable advantage

Must have sustainable advantage Look for good management and smart backing

Look for good management and smart backing Strong past price appreciation

Strong past price appreciation  Consumer appeal

Consumer appeal Find companies that are "overvalued"

Find companies that are "overvalued" Buy great companies

Buy great companies

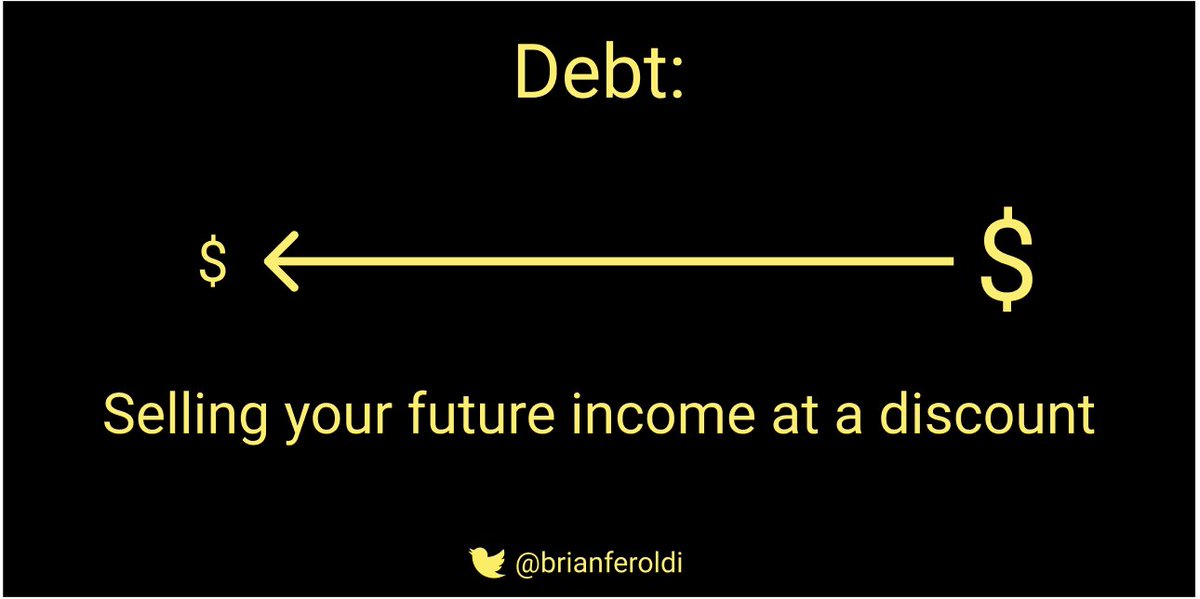

10/ The Simple Path to Wealth by @JLCollinsNH

Debt is a burden

Debt is a burden

You need "F-You money"

You need "F-You money"

Invest in index funds

Invest in index funds

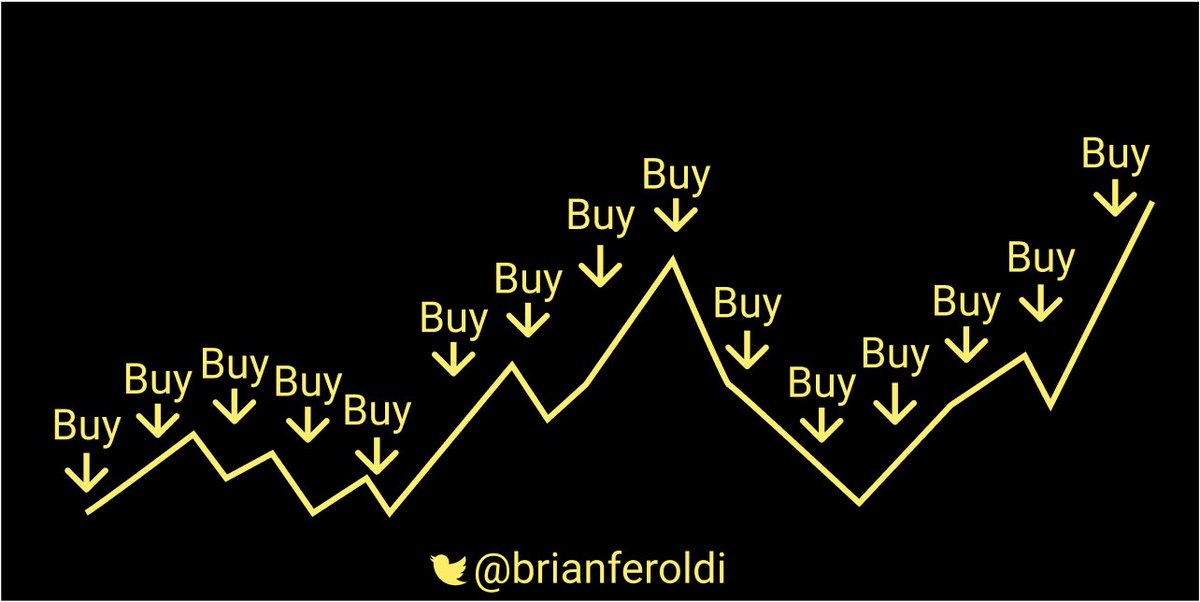

The market always goes up

The market always goes up

Expect crashes, they are normal

Expect crashes, they are normal

Withdraw 4%/year at "retirement"

Withdraw 4%/year at "retirement"

Debt is a burden

Debt is a burden You need "F-You money"

You need "F-You money" Invest in index funds

Invest in index funds The market always goes up

The market always goes up Expect crashes, they are normal

Expect crashes, they are normal Withdraw 4%/year at "retirement"

Withdraw 4%/year at "retirement"

11/ One Page Financial Plan by @behaviorgap

"Why is money important to you?"

"Why is money important to you?"

Know where you are today

Know where you are today

Save as much as you reasonably can

Save as much as you reasonably can

Avoid big mistakes

Avoid big mistakes

Hire a "real" financial advisor

Hire a "real" financial advisor

Behave for a long, long time

Behave for a long, long time

"Why is money important to you?"

"Why is money important to you?" Know where you are today

Know where you are today Save as much as you reasonably can

Save as much as you reasonably can Avoid big mistakes

Avoid big mistakes Hire a "real" financial advisor

Hire a "real" financial advisor Behave for a long, long time

Behave for a long, long time

12/ 7 Habits of Highly Effective People

Be Proactive

Be Proactive

Begin with the end in mind

Begin with the end in mind

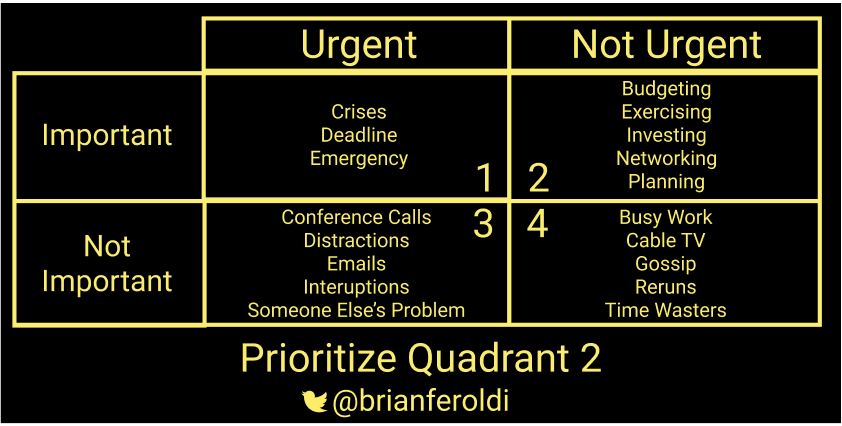

Put first things first

Put first things first

Think Win-Win

Think Win-Win

First seek to understand, then be understood

First seek to understand, then be understood

Synergize

Synergize

Sharpen the Saw

Sharpen the Saw

Be Proactive

Be Proactive Begin with the end in mind

Begin with the end in mind  Put first things first

Put first things first Think Win-Win

Think Win-Win First seek to understand, then be understood

First seek to understand, then be understood Synergize

Synergize Sharpen the Saw

Sharpen the Saw

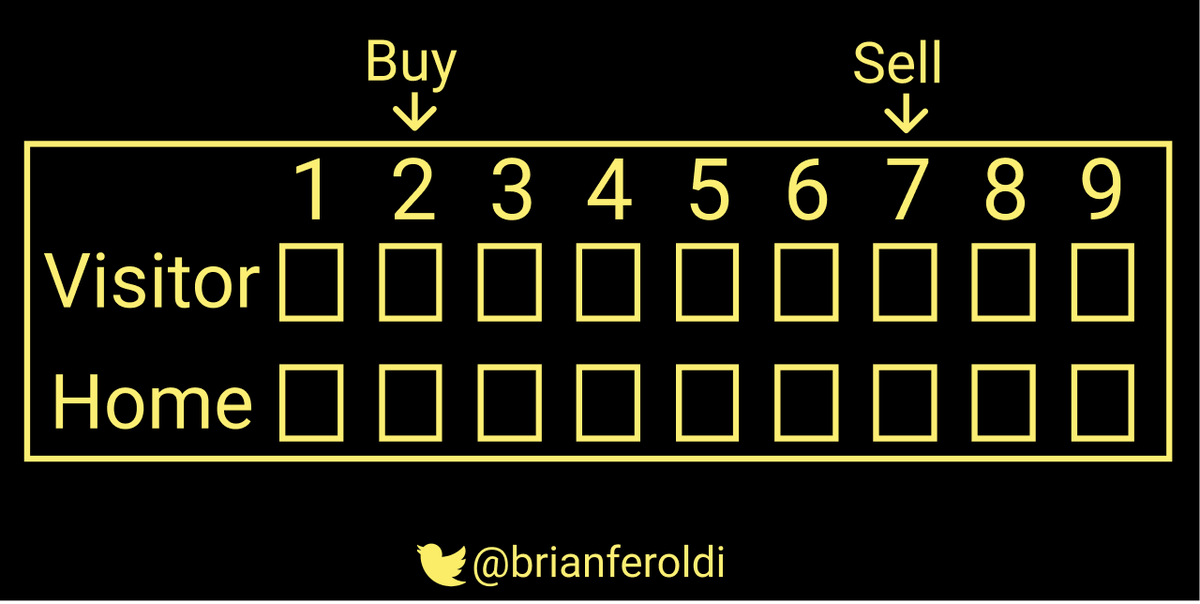

13/ One Up On Wall Street

Everyone has the brainpower to pick stocks

Everyone has the brainpower to pick stocks

Buy what you know

Buy what you know

Buy in the 2nd, exit in the 7th

Buy in the 2nd, exit in the 7th

There's only 1 reason stocks go up

There's only 1 reason stocks go up

Don't predict stock market

Don't predict stock market

Do the homework

Do the homework

If your right 60% of the time, you're doing great

If your right 60% of the time, you're doing great

Everyone has the brainpower to pick stocks

Everyone has the brainpower to pick stocks Buy what you know

Buy what you know Buy in the 2nd, exit in the 7th

Buy in the 2nd, exit in the 7th There's only 1 reason stocks go up

There's only 1 reason stocks go up Don't predict stock market

Don't predict stock market Do the homework

Do the homework If your right 60% of the time, you're doing great

If your right 60% of the time, you're doing great

14/ My Total Money Makeover by @DaveRamsey

Save $1,000

Save $1,000

Eliminate Debt

Eliminate Debt

Build an emergency fund

Build an emergency fund

Invest

Invest

Save for college

Save for college

Eliminate mortgage

Eliminate mortgage

Give!

Give!

Save $1,000

Save $1,000 Eliminate Debt

Eliminate Debt Build an emergency fund

Build an emergency fund Invest

Invest Save for college

Save for college Eliminate mortgage

Eliminate mortgage Give!

Give!

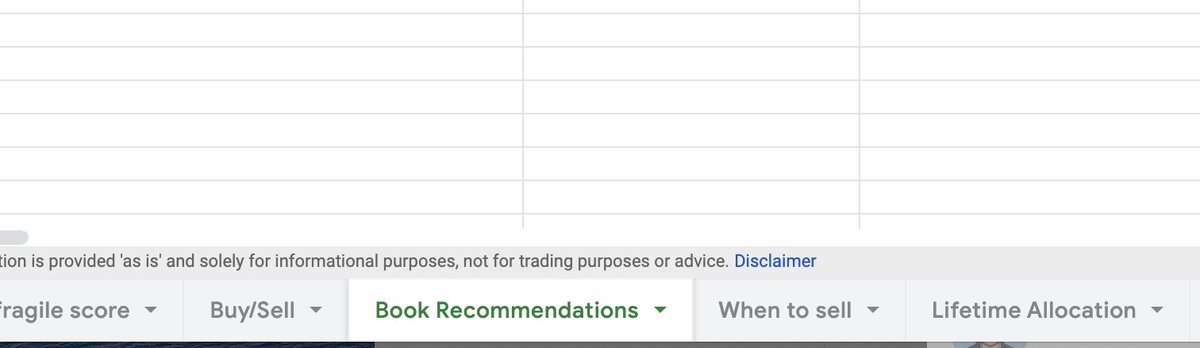

16/ There are TONS of other great books about money

I keep a list in my "Book recommendations" tab of my public investing checklist

https://docs.google.com/spreadsheets/d/1y8quPLqAwNsBGvNUrJuMTqVwz-P59ms1A8ZDLE8Dc24/edit?usp=sharing

I keep a list in my "Book recommendations" tab of my public investing checklist

https://docs.google.com/spreadsheets/d/1y8quPLqAwNsBGvNUrJuMTqVwz-P59ms1A8ZDLE8Dc24/edit?usp=sharing

17/ If you like these simple graphics,

I email them daily for free

Interested? https://brianferoldi.substack.com/

I email them daily for free

Interested? https://brianferoldi.substack.com/

Read on Twitter

Read on Twitter