A short thread about GameStop and Populism and The Central Dogma of Derivatives.

The “populist” nature of the r/WSB pumping of GameStop that required SAC and Citadel “experts” to rescue Melvin Capital “experts” after the attack by the financial non-elite isn’t completely new.

1/

The “populist” nature of the r/WSB pumping of GameStop that required SAC and Citadel “experts” to rescue Melvin Capital “experts” after the attack by the financial non-elite isn’t completely new.

1/

In the 1980s LOR used Black-Scholes expertise to bring dynamic portfolio “hedging” to the masses with well-known consequences.

In the early 2000s the rise of CDS made it easy to trade credit, formerly the domain of experts too.

2/

In the early 2000s the rise of CDS made it easy to trade credit, formerly the domain of experts too.

2/

This ease of less sophisticated professional access to great power played a role in the GFC of 2008.

3/

3/

More recently the invention of VIX futures and options, and the notion of volatility targeting for protection, made it easy for relative amateurs to trade volatility too, formerly also a professional skill.

4/

4/

It’s all part of the trend of using derivatives that make it apparently easy to do difficult things which, which, when a few people do them, isn’t too bad, but which fail when everyone does them.

5/

5/

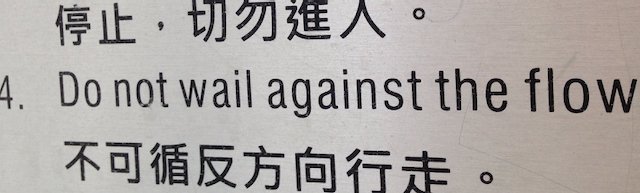

So, this isn’t new. As they say in the Hong Kong Mid-Level escalators, Do not wail against the flow.

The consequences of all of this supposed ease of doing complicated powerful things with derivatives reminds me of the Central Dogma of Molecular Biology which states that information is supposed to flow only from nucleic acids to proteins. Sometimes the reverse happens.

6/

6/

The Central Dogma of Derivatives is that causality flows from Underliers to Derivatives. But that hasn’t been true for a long time.

7///

7///

Read on Twitter

Read on Twitter