here is a great explanation of one of the funniest things to happen in the finance industry in quite some time https://twitter.com/ShaanVP/status/1353951035224694785

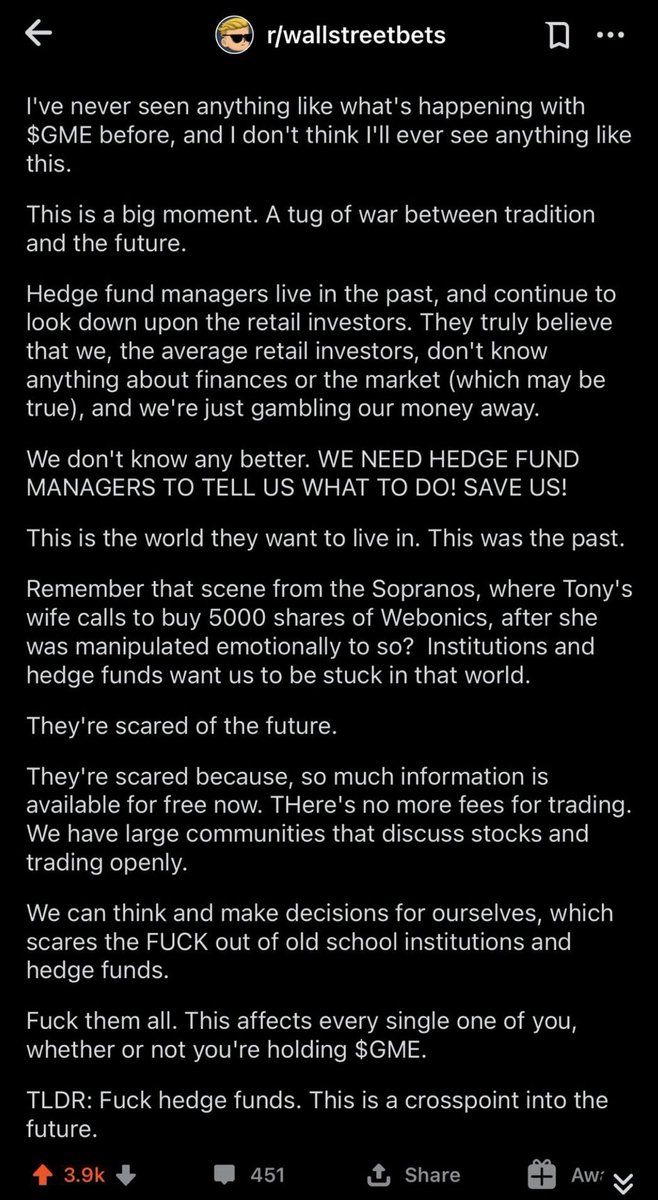

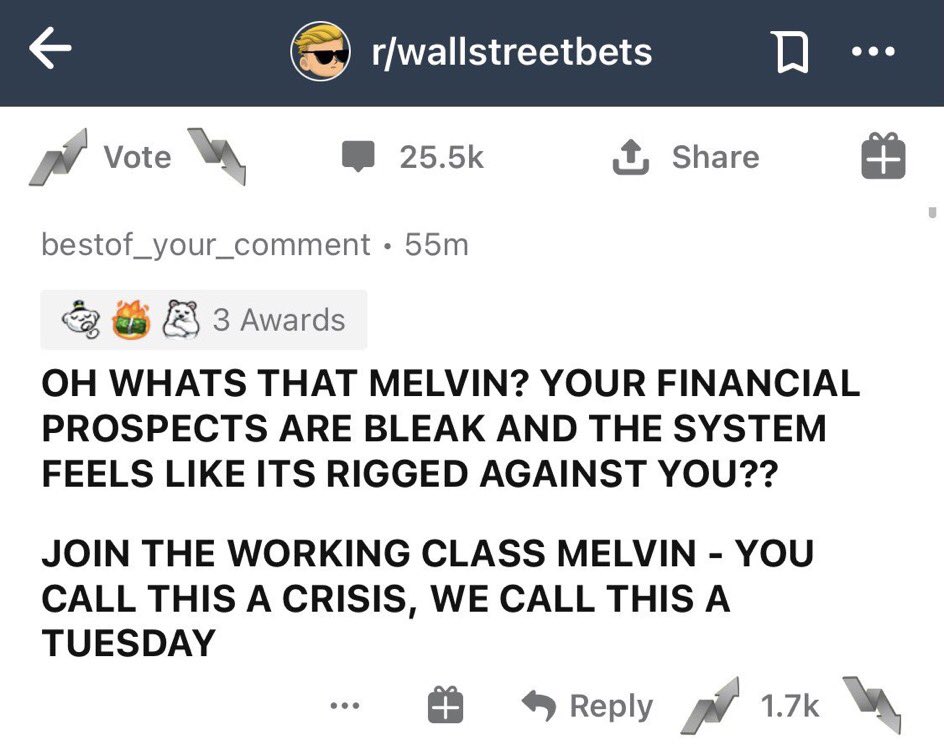

Gotta say.. seeing all these “professional” traders getting pissed off that a bunch of redditors played their precious market better than they did, not to mention all these hedge fund managers trying to elicit sympathy, is absolutely hilarious

So many interesting things about this story, including the fact the hedge funds shorting the stock were counting on bankruptcy & the loss of thousands of jobs, just to maximize their profits from rigging the system, and it got shoved right back in their faces

Also somehow the Mets are involved https://twitter.com/mrsmcglover/status/1354252534534205440

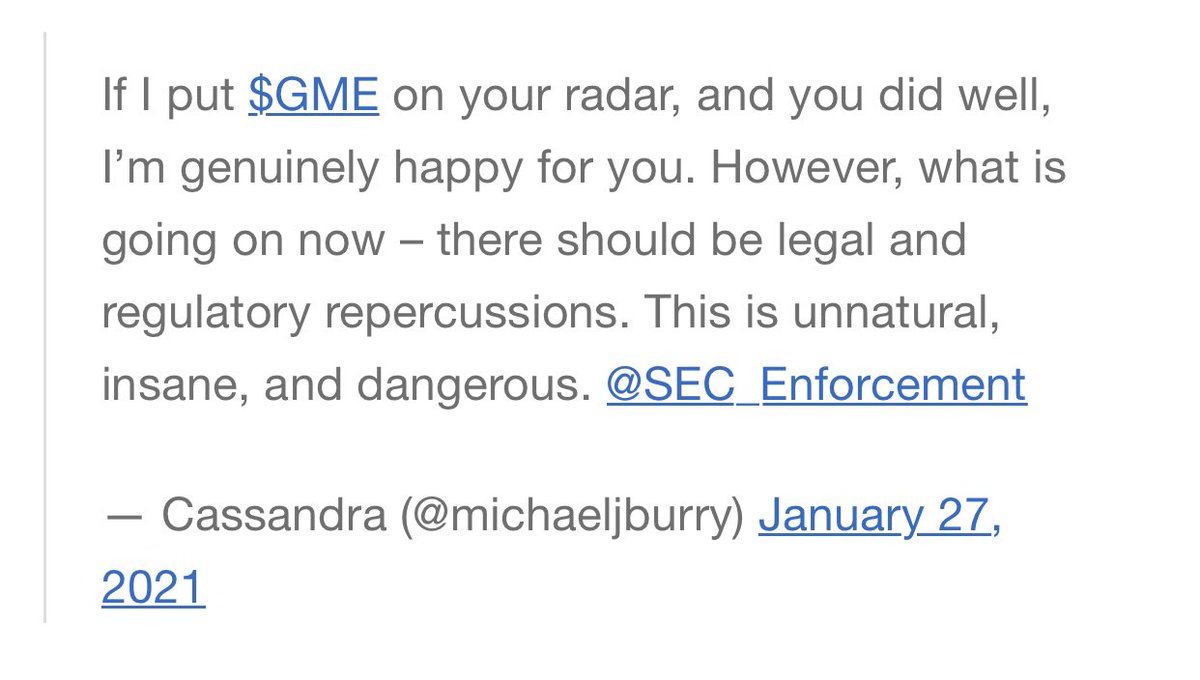

lol the guy who shorted the US housing market and was played by Christian Bale thinks this is bad (tweet since deleted)

the layers to all of this are truly incredible https://twitter.com/redditinvestors/status/1354289125210337290

The way some are framing this GameStop story — as if it was a bunch of teenage trolls randomly playing stonks, as opposed to what it actually is, which is amateur investors smartly playing the rigged game better than the parasitic pros — is disingenuous, to say the least..

One of the funniest elements of this whole thing though is definitely that it’s happening to one of the worst companies, almost universally loathed, the Comcast of video game retailers

Wow.. @TDAmeritrade putting artificial limits on legitimate trading just because their hedge fund cronies got caught with their pants down $GME $AMC $BB #wallstreetbets https://twitter.com/matthewklekner/status/1354488537828102146

man I remember seeing this plan being discussed & joked about for months and just kinda laughed it off, after all there are 100s of ridiculous stock threads on Reddit every week.. I am kicking myself for not at least buying like 20 shares or something just to see if it would work

hard same, there are countless examples like these https://twitter.com/joshuapotash/status/1354475998214021126

The redditor who shared his position, research, & initial $53K investment in $GME — now worth 8 figures — originally posted his plan back in Sept 2019 and has been posting regular updates since. Others took note and joined in. This is not some grand conspiracy or random trolling

Also worth noting that there is nothing even remotely illegal or even unethical about it, and anyone taking that approach should be mocked and never taken seriously again.

now this, on the other hand, is both extremely illegal and reprehensibly unethical and yet it happens all the time with little to no consequences because it's done by the rich & well-connected https://twitter.com/rudy_betrayed/status/1354485494445461510?s=20

particularly infuriating because, again, nothing illegal or unethical going on.. it was a high-risk bet, well-founded & well-executed, which picked up tag-a-longs..

Live by the free market, die by the free market.. unless you're wealthy already I guess https://twitter.com/APompliano/status/1354487225342439424

Live by the free market, die by the free market.. unless you're wealthy already I guess https://twitter.com/APompliano/status/1354487225342439424

Discord banned the wallstreetbets server under the guise of "hateful / discriminatory content".. I'm sure that content existed, because that content is what is in the majority of Discord servers.. but gee what a coincidental moment for them to take action https://twitter.com/TheStalwart/status/1354571825238466565

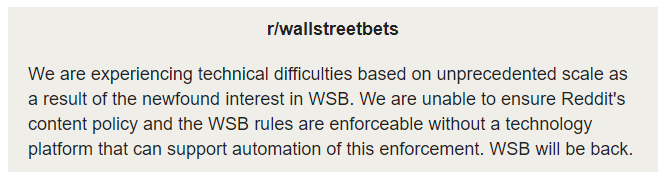

The #wallstreetbets subreddit, with over 3 million subs, has suddenly gone private.. this comes after being overloaded with shill posts from new accounts.. it's also happened before

Right now I believe the mods are cleaning up spam, shill bot content, etc. Again, this has happened before. As for the Discord.. what are the odds the Discord owners/buddies have been negatively effected by all this & someone wanted retaliation? Pretty high, I'd say..

This thread hasn't gone viral and I don't upload anything to my Soundcloud account, but if anyone is interested, here you go: http://join.robinhood.com/larryw564

#wallstreetbets subreddit updates their private message, they are not banned or taken down, but simply combatting spam, bots, and possible DDoS type posting.. not their first rodeo

Haha wow this statement from @discord offhandedly mentioning “financial fraud” is not only total bs, but is also a dead giveaway that their banning of the #wallstreetsbets server was not a coincidence & done for other reasons (also the subreddit is back up, as expected) https://twitter.com/slasher/status/1354570702448431109

This is absolutely unbelievable.. @RobinhoodApp has delisted certain stocks like $GME $AMC — again not a single element of this whole thing has been illegal or even unethical, and the system is responding by *actually* manipulating the “free market” back in their favor. Wow.

Completely outrageous & unacceptable @RobinhoodApp you just threw your reputation down the drain https://twitter.com/alexjamesfitz/status/1354797994055499781

This might explain why, Citadel has both a controlling interest in RobinHood and is also involved with a large number of firms that have been losing money on this short squeeze. Again, this is *actual* market manipulation on behalf of Wall Street and its cronies. https://twitter.com/scottmilleratx/status/1354798811277877251

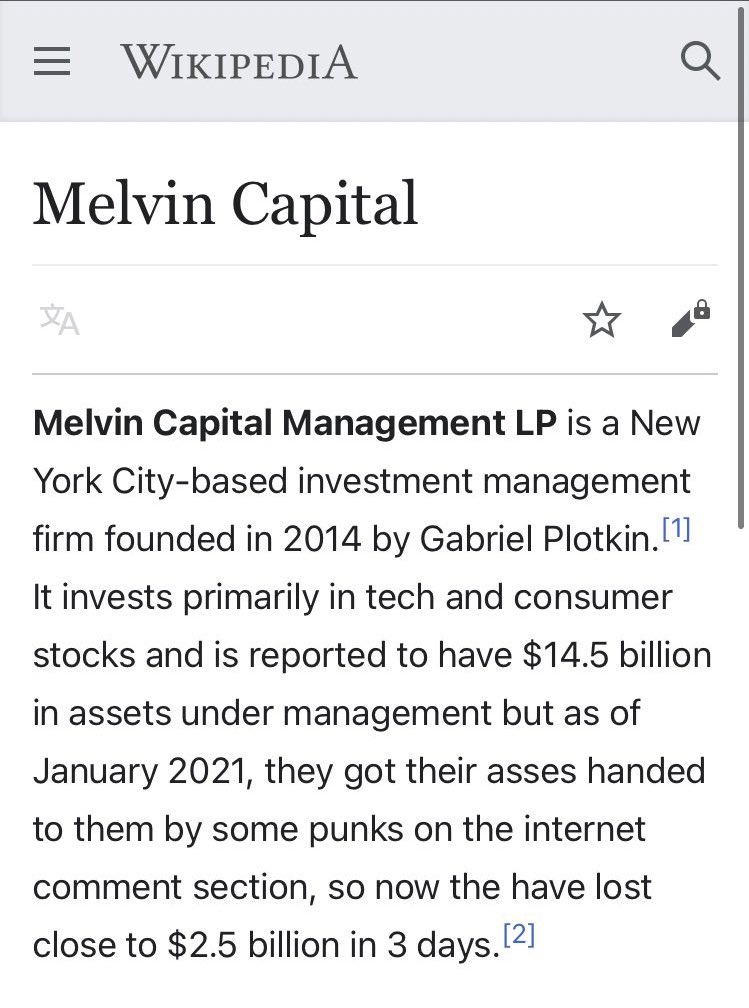

For reference, Citadel is one of the firms which helped bail out Melvin Capital earlier this week, and is likely involved with other large clients who have been on the losing end of this short squeeze https://twitter.com/claritytoast/status/1354791950369628164

After reaching this and other highs, the stock price is crashing. I believe this was somewhat expected today, but has very likely been exacerbated by the scare tactics & clear market manipulation being employed by those in power on the losing end https://twitter.com/refocusedmedia/status/1354806274286751756

When brokers restrict buying & only allow selling, panic can set in with those trying to hold their position. The more people sell, the less valuable the stock becomes, and — more importantly — the more damage is mitigated to hedge funds & their shorts.. that is their endgame https://twitter.com/stoolpresidente/status/1354822798674259970

Look, this was never a long-term plan. It was always going to come crashing down at some point. But if this is the end, make no mistake that it is not due to the "free market", rather as a result of corruption and manipulation in service of protecting billion-dollar suits & firms

Worse still is that, if it does end like this, people will be handing out told-you-so's like candy without acknowledging that A) this entire thing was legitimate & yet B) the ending was artificially manufactured (see above). However, there is still hope https://twitter.com/theWalrusStreet/status/1354828953404411904

So the SEC and brokers ignore the unethical practices of their billionaire firms & hedge fund buddies, not to mention all the insider trading, and yet take action within 72 hours of standard, legal, ethical tactics taken by regular investors. Insanity. https://twitter.com/RevShark/status/1354838035007987714?s=20

Regular investors don't short-sell companies (or if they do it's in marginal/irrelevant quantities). Hedge funds do this. This is spectacular and is exactly why all the suits are calling in favors from Big Tech and brokerage firms. https://twitter.com/Reuters/status/1354843006197755906?s=20

If you want the real backstory on reddit and $GME -- the one most are unaware of or willfully ignoring, the one the media isn't even capable of reporting -- check out this great thread. This was not random trolling, and it's been brewing for over a year https://twitter.com/endtwist/status/1354547622133051393

Read on Twitter

Read on Twitter