Big commodity data

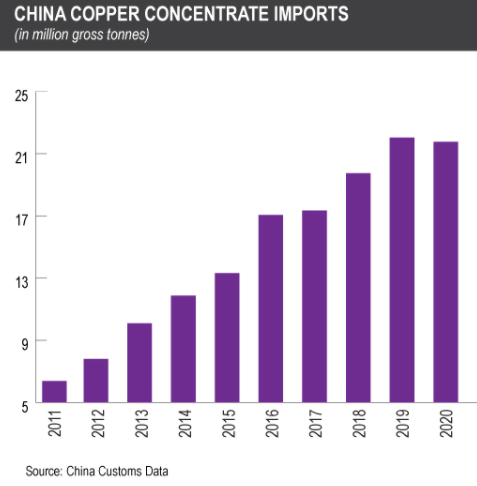

China's imports of mined copper dropped last year for the first time in almost a decade. Why?

Well it wasn't down to demand…

China's imports of mined copper dropped last year for the first time in almost a decade. Why?

Well it wasn't down to demand…

Chinese smelting capacity continues to grow.

China Copper and Tongling Nonferrous ramping up expansions / new projects in Inner Mongolia last year and into 2021

https://www.metalbulletin.com/Article/3932809/Tonglings-new-400ktpy-copper-smelter-to-debut-in-September---sources.html

China Copper and Tongling Nonferrous ramping up expansions / new projects in Inner Mongolia last year and into 2021

https://www.metalbulletin.com/Article/3932809/Tonglings-new-400ktpy-copper-smelter-to-debut-in-September---sources.html

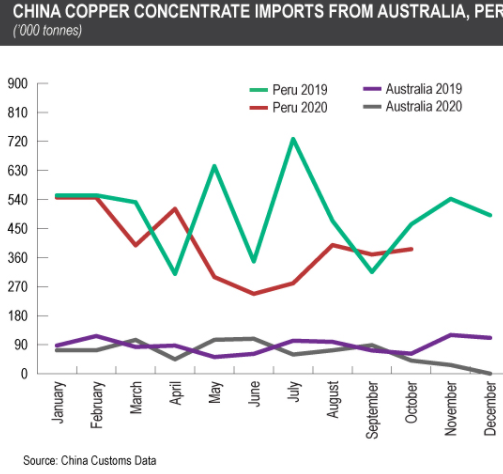

And what a time to be ramping up - supply from Peru was down 19% in 2020 – in part due to Covid-19 related lockdowns, but also a seemingly neverending dispute at Las Bambas (majority owned by MMG / Minmetals) with local stakeholders.

On its own that's a big loss – almost 1mill tonnes of copper concs, but that has been compounded by recent events.

As political tensions between Australia and China heated up last year, Chinese authorities responded last Novr by verbally ordering smelters not to buy Aussie mined copper.

https://www.metalbulletin.com/Article/3965141/Australian-copper-cargoes-stranded-at-Chinese-ports-under-unofficial-ban.html

https://www.metalbulletin.com/Article/3965141/Australian-copper-cargoes-stranded-at-Chinese-ports-under-unofficial-ban.html

So what does it all mean? In the end Australian miners have been able to sell their concentrates to Europe, Japan and The Philippines, but Chinese buyers are struggling to find alternative sources.

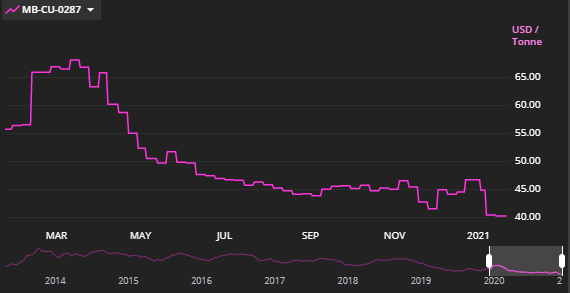

This is playing out in the markets – TC/RC fees to smelters have dropped to the lowest since Fastmarkets started tracking the market in 2013.

Full story by yours truly and the incomparable Julian Luk here:

Australia, Peru copper supply gap leaves Chinese smelters short of options

https://www.metalbulletin.com/Article/3972188/Home/FOCUS-Australia-Peru-copper-supply-stops-Chinese-smelters-short-of-options.html

Australia, Peru copper supply gap leaves Chinese smelters short of options

https://www.metalbulletin.com/Article/3972188/Home/FOCUS-Australia-Peru-copper-supply-stops-Chinese-smelters-short-of-options.html

Read on Twitter

Read on Twitter