Confirmation Bias and Investing

How this behavioral fallacy affects your investing decisions

/THREAD/

How this behavioral fallacy affects your investing decisions

/THREAD/

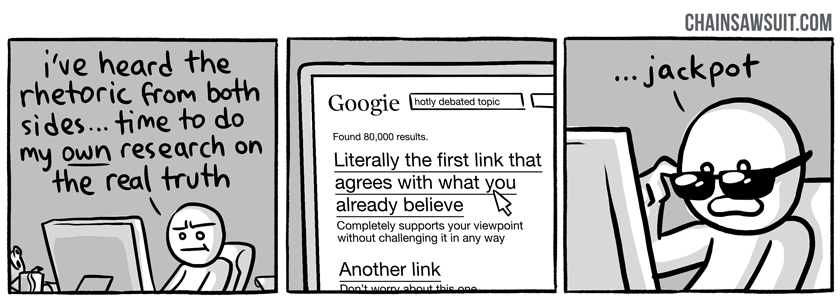

1/ Confirmation bias is a behavioral fallacy from the field of cognitive psychology.

It is attributed to people who have a natural inclination towards favoring opinions and news that confirm their pre-existing beliefs and ignore those that contradict them.

It is attributed to people who have a natural inclination towards favoring opinions and news that confirm their pre-existing beliefs and ignore those that contradict them.

2/ It has also been described as a natural tendency to test a hypothesis in a one-sided way, focusing on one outcome and ignoring other possible results.

There are two primary cognitive mechanisms through which we express this principle.

There are two primary cognitive mechanisms through which we express this principle.

3/

1. Challenge Avoidance

Most people are afraid to find out that they are wrong.

2. Reinforcement Seeking

Most people want to find out that they are right.

1. Challenge Avoidance

Most people are afraid to find out that they are wrong.

2. Reinforcement Seeking

Most people want to find out that they are right.

4/ The biological hardwiring of our brain makes it easier to understand confirming data, particularly when the contradictory data is negatively presented.

Let’s see a confirmation bias example.

Let’s see a confirmation bias example.

5/ You are presented with four cards.

Each has a number on one side and a letter on the other side.

The one side of the cards you are shown has an A, a T, a 6, and a 9.

You are told that a card with a vowel on one side must have an even number on the other side.

Each has a number on one side and a letter on the other side.

The one side of the cards you are shown has an A, a T, a 6, and a 9.

You are told that a card with a vowel on one side must have an even number on the other side.

6/ You are presented with the following question.

"Which card(s) do you need to turn over to see if the statement is true?

And what’s the minimum number of cards you need to turn over in order to conclude that the statement is true?"

What did you choose?

"Which card(s) do you need to turn over to see if the statement is true?

And what’s the minimum number of cards you need to turn over in order to conclude that the statement is true?"

What did you choose?

7/ Most people would choose the A and the 6.

Unfortunately, that’s not the correct answer.

The correct answer is actually 9.

Most people choose A and 6 because these are the cards capable of confirming the statement, but confirming evidence doesn’t prove anything.

Unfortunately, that’s not the correct answer.

The correct answer is actually 9.

Most people choose A and 6 because these are the cards capable of confirming the statement, but confirming evidence doesn’t prove anything.

8/ The 6 card has no ability to invalidate the hypothesis, only to confirm it.

However, flipping the 9 card could provide valuable contradictory evidence, if a vowel is on the other side.

However, flipping the 9 card could provide valuable contradictory evidence, if a vowel is on the other side.

9/ A vowel on the other side means not all cards with vowels have an even number on the other side.

But how does confirmation bias apply to investing?

But how does confirmation bias apply to investing?

10/ Investors tend to look for confirming evidence when making investment decisions rather than evaluate all available information.

For existing investments, they search for confirming evidence and quickly dismiss data confronting their investment thesis.

For existing investments, they search for confirming evidence and quickly dismiss data confronting their investment thesis.

11/ When researching after getting a stock tip from a source considered reliable, they tend to gather data in a biased way.

This often makes them feel overconfident because they keep receiving information that appears to confirm their investing decisions.

This often makes them feel overconfident because they keep receiving information that appears to confirm their investing decisions.

12/ This makes investors focusing only on specific companies and sectors making them vulnerable to downturns in the company or sector.

However, there are solutions to counter the confirmation bias.

However, there are solutions to counter the confirmation bias.

13/

1. Develop an alternative investment thesis and search for disconfirming evidence

If you are very bullish on a stock, pretend you are a short-seller and try to find evidence to contradict your bullish theory.

1. Develop an alternative investment thesis and search for disconfirming evidence

If you are very bullish on a stock, pretend you are a short-seller and try to find evidence to contradict your bullish theory.

14/ Warren Buffett invited hedge fund trader Doug Kass to participate in a Berkshire Hathaway annual meeting.

Kass is a critic of Buffett and his investment style and is actually betting against Berkshire Hathaway stock by shorting it.

Kass is a critic of Buffett and his investment style and is actually betting against Berkshire Hathaway stock by shorting it.

15/

2. Avoid confirming questions

Let's say, for example, you want to invest in a company that you deem undervalued because of a low P/E ratio.

Don't ask someone else if they think the P/E ratio is low as well.

2. Avoid confirming questions

Let's say, for example, you want to invest in a company that you deem undervalued because of a low P/E ratio.

Don't ask someone else if they think the P/E ratio is low as well.

16/ Ask a more general question about the company's valuation and financial situation.

Maybe there is a reason the P/E is low and you are missing it.

Maybe there is a reason the P/E is low and you are missing it.

17/

3. Set your self accountable by sharing your investment thesis and be open to criticism by others

It's more difficult to exhibit confirmation bias when you have to present and justify your decisions to others.

3. Set your self accountable by sharing your investment thesis and be open to criticism by others

It's more difficult to exhibit confirmation bias when you have to present and justify your decisions to others.

18/ “Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire.

You must force yourself to consider arguments on the other side.”

-Charlie Munger

/END/

You must force yourself to consider arguments on the other side.”

-Charlie Munger

/END/

If you liked this thread click below and retweet the first tweet, and follow to stay updated. https://twitter.com/itsKostasWithK/status/1354059390576427010?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

I hope you find my content on finance and investing for F.I.R.E. insightful and valuable

Feel free to support my efforts on financial education by buying me a slice of pizza here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Feel free to support my efforts on financial education by buying me a slice of pizza

here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Read on Twitter

Read on Twitter