1/

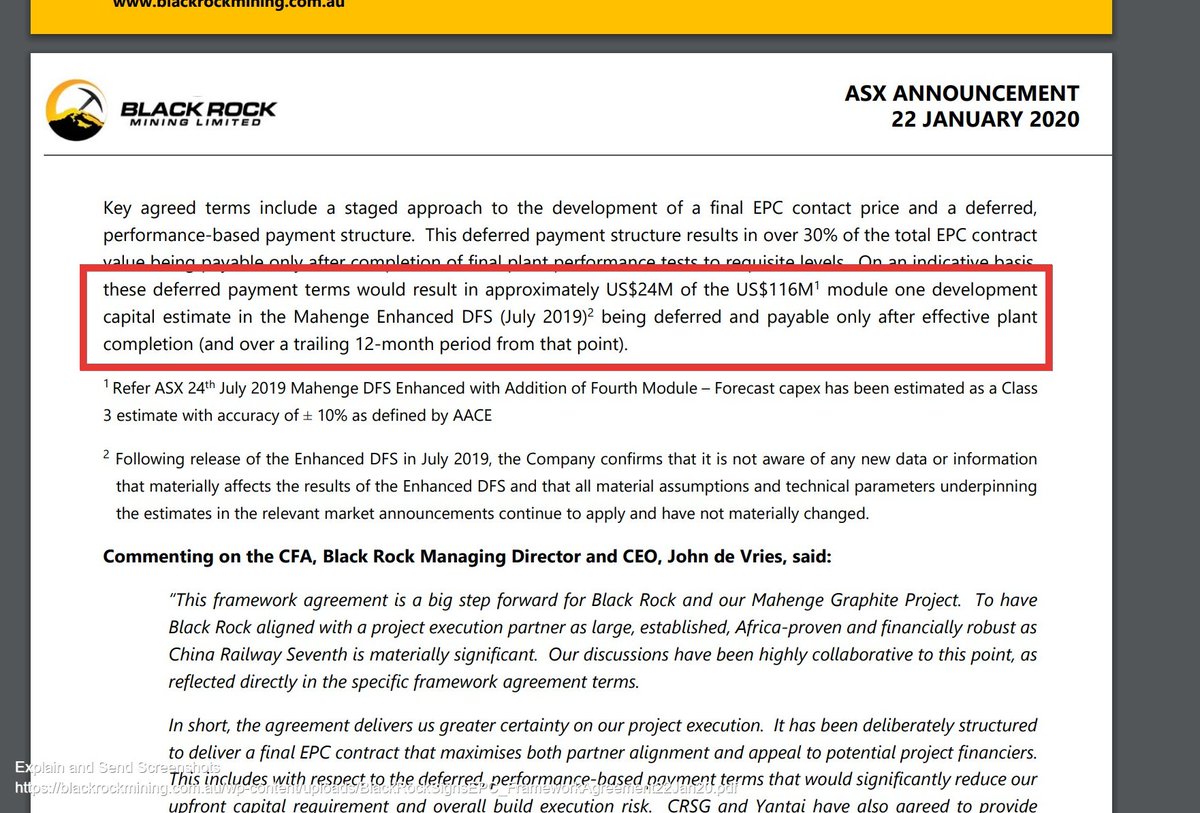

On 25th Sept 2018, BKT signed a Strategic Cooperation Agreement with Yantai Jinyuan Mining Machinery Ltd, which eventually led to an equipment supply contract, a tie up with China Railway Group, and a deferred US$24m in EPC CAPEX costs, over a trailing 12 month period.

#ACP

On 25th Sept 2018, BKT signed a Strategic Cooperation Agreement with Yantai Jinyuan Mining Machinery Ltd, which eventually led to an equipment supply contract, a tie up with China Railway Group, and a deferred US$24m in EPC CAPEX costs, over a trailing 12 month period.

#ACP

2/

Whilst ACP have signed up Xinhai Mineral EPC, what they've effectively done, is sign up Xinhai Mining Machinery Company.

https://www.xinhaimineral.com/en/about_3.html

So there's an argument to be had that they could well be going down the same route.

Whilst ACP have signed up Xinhai Mineral EPC, what they've effectively done, is sign up Xinhai Mining Machinery Company.

https://www.xinhaimineral.com/en/about_3.html

So there's an argument to be had that they could well be going down the same route.

3/

Here's how the BKT timeline developed ;

Bulk test work completed 1st March 2019

Pilot plant first run complete 3rd April

Pilot plant main completion 23rd April

2 binding agreements agreed 8th May, with pricing framework, which included Yantai Jinyuan, who undertook the work.

Here's how the BKT timeline developed ;

Bulk test work completed 1st March 2019

Pilot plant first run complete 3rd April

Pilot plant main completion 23rd April

2 binding agreements agreed 8th May, with pricing framework, which included Yantai Jinyuan, who undertook the work.

4/

A c. 2 month process once the initial bulk test work results were delivered.

The actual EPC agreement wasn't signed until 22nd Jan 2020, so 8 months later but I see 2 key differences here ;

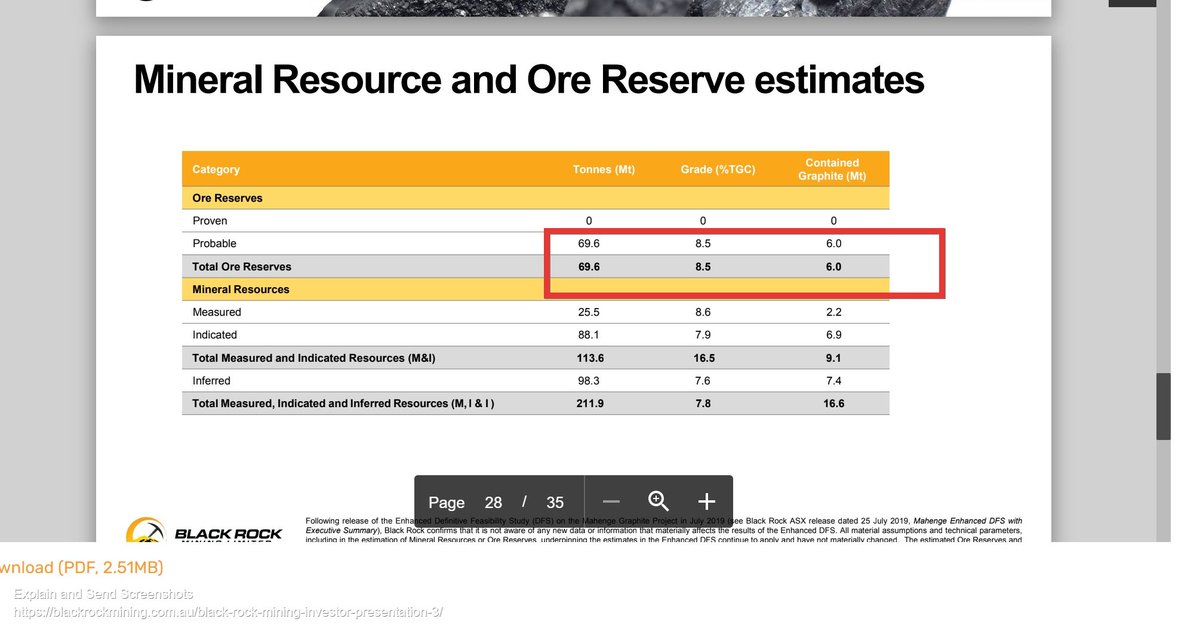

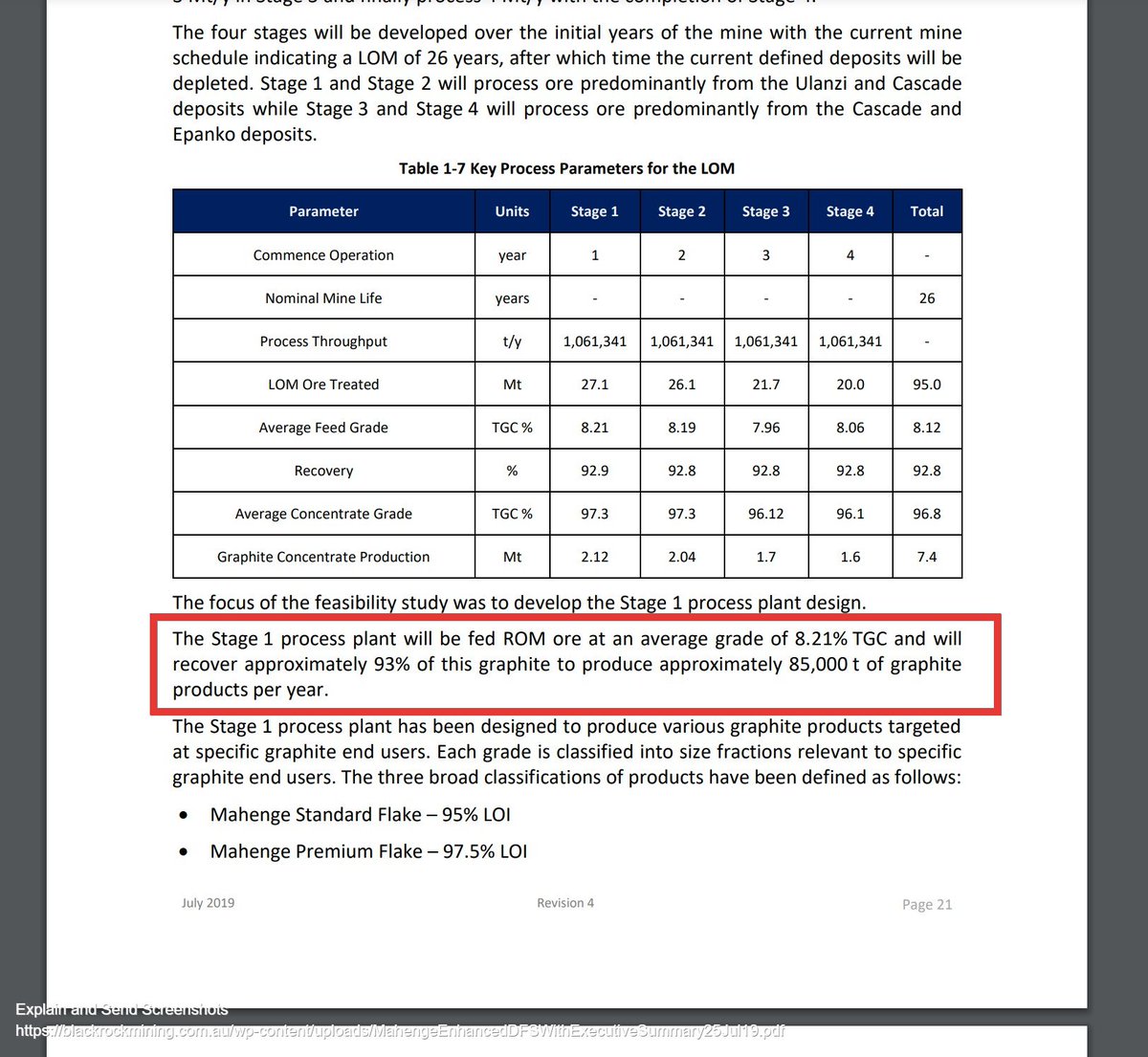

1. ACP Capex phase 1 $39.7m vs BKT $116m

2. Graphite market is strengthening in 2021,

A c. 2 month process once the initial bulk test work results were delivered.

The actual EPC agreement wasn't signed until 22nd Jan 2020, so 8 months later but I see 2 key differences here ;

1. ACP Capex phase 1 $39.7m vs BKT $116m

2. Graphite market is strengthening in 2021,

5/

which it wasn't in 2019, when it was more difficult to close such finance deals.

3. ACP's project, be it further behind in development, is better.

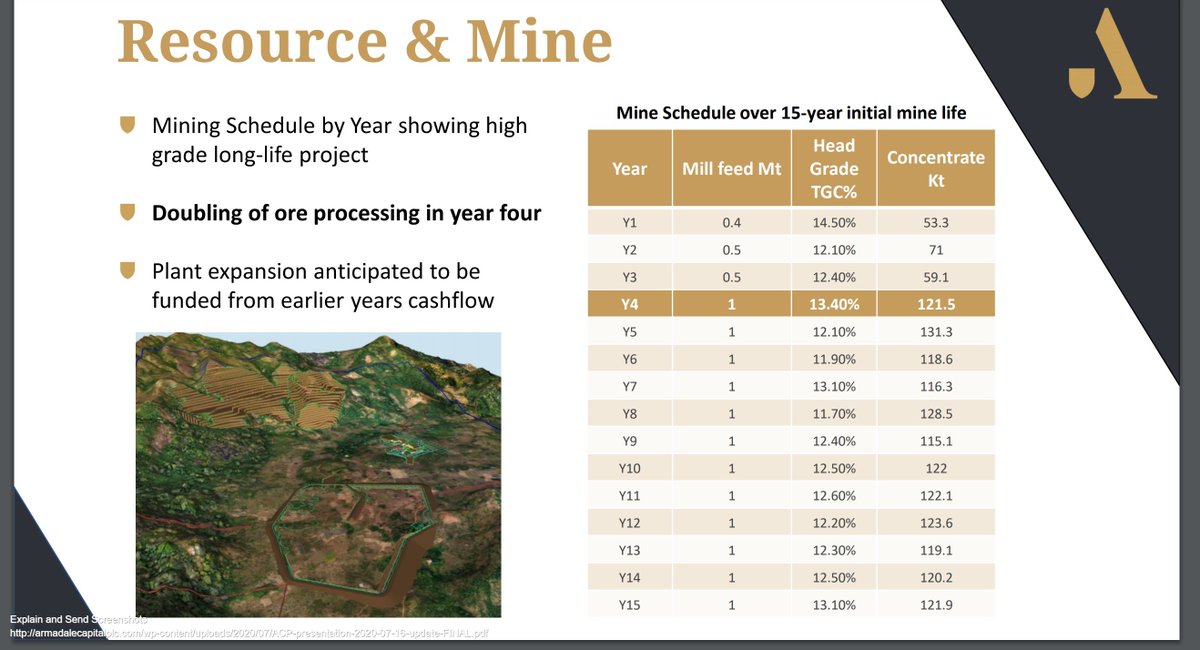

Here's BKT vs ACP on contained graphite head grade,which lends itself to a stronger outcome, when the same bulk test works etc..

which it wasn't in 2019, when it was more difficult to close such finance deals.

3. ACP's project, be it further behind in development, is better.

Here's BKT vs ACP on contained graphite head grade,which lends itself to a stronger outcome, when the same bulk test works etc..

6/

are completed.

So I am very much in the shorter time frames camp and expect these agreements to begin to gather pace (be it that nobody can say be sure), because the graphite demand profile is taking real shape, boosted in no small part by Biden's presidency, so expedited...

are completed.

So I am very much in the shorter time frames camp and expect these agreements to begin to gather pace (be it that nobody can say be sure), because the graphite demand profile is taking real shape, boosted in no small part by Biden's presidency, so expedited...

7/

development programmes, where possible, are to be expected.

That aside, the binding off-take and any CAPEX investment agreements, be they deferred or not, look certain be driven in part, by this latest relationship.

After all, these Chinese partners, aren't doing all of...

development programmes, where possible, are to be expected.

That aside, the binding off-take and any CAPEX investment agreements, be they deferred or not, look certain be driven in part, by this latest relationship.

After all, these Chinese partners, aren't doing all of...

6/

this for the good of their health.

So potentially a substantial trigger coming there over the next few months.

Much of which isn't Mining Right related because like ACPs bulk test work, the deal was signed by BKT, many months before their Mining Right was granted...

this for the good of their health.

So potentially a substantial trigger coming there over the next few months.

Much of which isn't Mining Right related because like ACPs bulk test work, the deal was signed by BKT, many months before their Mining Right was granted...

7/

and the initial results (1st March 2019), came just 5 days after the actual award (26th Feb 2019).

That's not to say that the Mining Right isn't also key here, it absolutely is but its not preventing the key line of progress towards finance.

On that note, the ESIA is first..

and the initial results (1st March 2019), came just 5 days after the actual award (26th Feb 2019).

That's not to say that the Mining Right isn't also key here, it absolutely is but its not preventing the key line of progress towards finance.

On that note, the ESIA is first..

8/

and really should be imminent. Once that's received, then then the Mining Right shouldn't be all that far behind because unlike BKT, ACP have already filed their Mining Right application and so the authorities have had, upwards of 6 months to review.

and really should be imminent. Once that's received, then then the Mining Right shouldn't be all that far behind because unlike BKT, ACP have already filed their Mining Right application and so the authorities have had, upwards of 6 months to review.

9/

To place that in context, for BKT they needed 3 months post submission, a submission that came after their ESIA was already signed off because their DFS wasn't already complete.

To place that in context, for BKT they needed 3 months post submission, a submission that came after their ESIA was already signed off because their DFS wasn't already complete.

9A

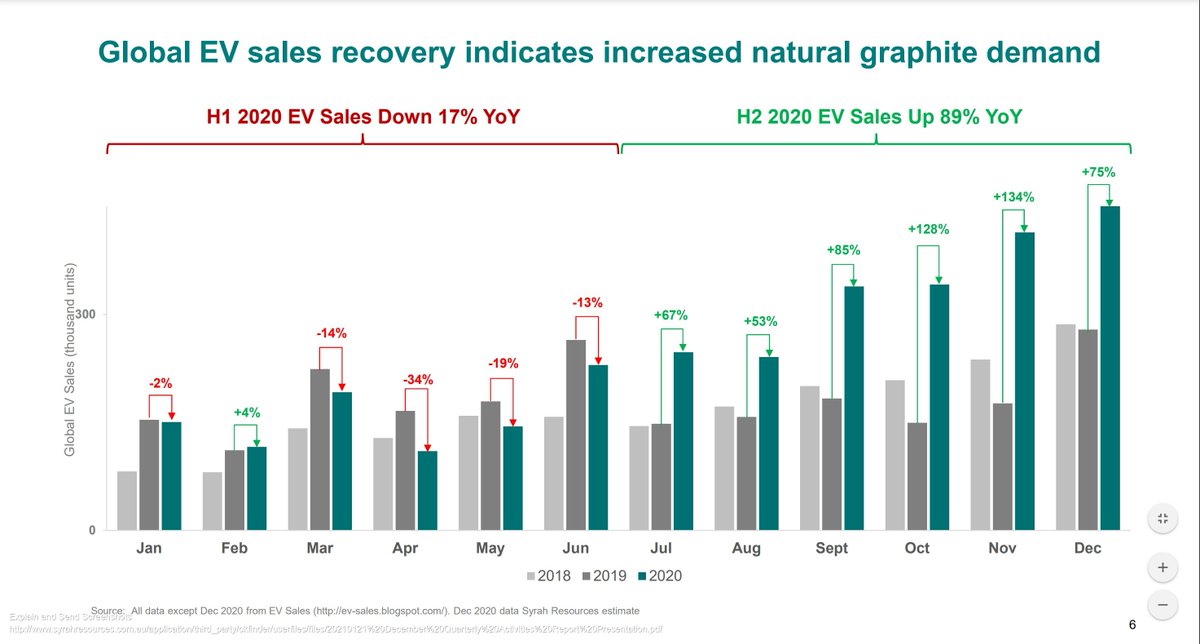

One last point on #ACP today.

Here's a really great graph from Syrah Resources, whose Balama project by the way, is still suspended and requires 2-3 month ramp up, once given the green light.

One last point on #ACP today.

Here's a really great graph from Syrah Resources, whose Balama project by the way, is still suspended and requires 2-3 month ramp up, once given the green light.

Read on Twitter

Read on Twitter