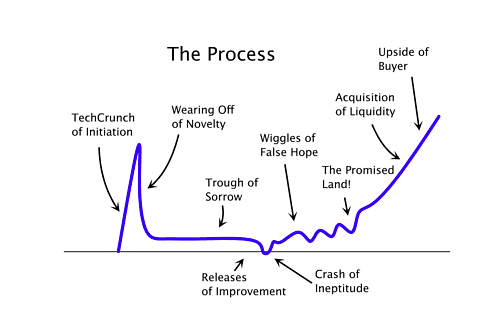

Sure many of you have seen this 'startup emotions' cycle based on Gartner's Hype Cycle. I believe that initial spike is especially misleading and potentially dangerous in for African startups. 1/

We invest pre-seed which means we talk about traction at its earliest glimpses - pilots, prototypes, first 100 users, etc. I often have founders showcasing their execution and unit economics of their first 100 users as evidence of PMF and beyond. It's oftentimes a mirage 2/

Early CAC can be especially dubious since there's plenty of selection bias involved. People tend to test with those users who are willing, able, and interested. They tend to know people who are also those things and so you get an initial burst of low-cost enthusiasm. 3/

As the userbase grows, one goes from delivering your product to the willing to selling your product to the dubious and/or uninformed. This means time, staff, strategy, and esp. $$$. This is especially shocking for O2O or products that need a ground game. 4/

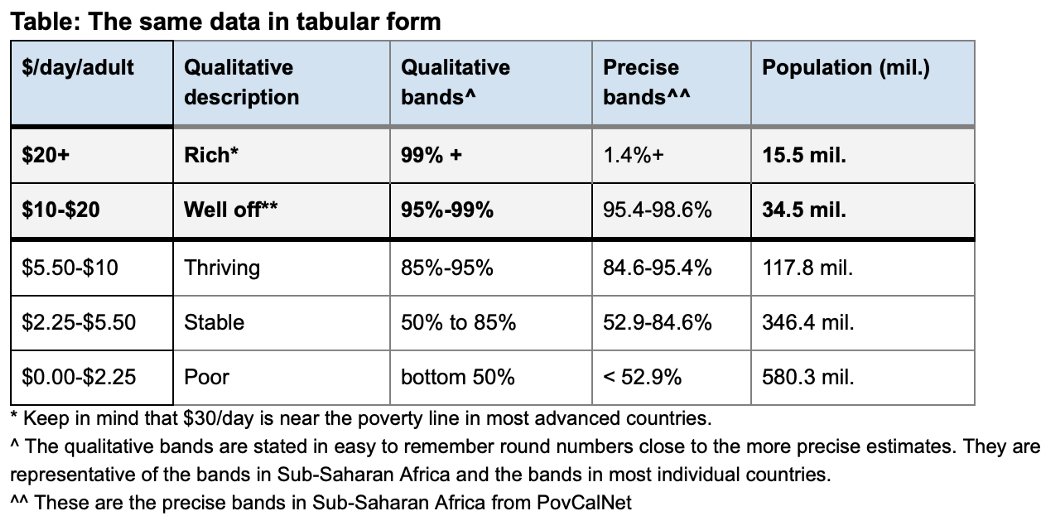

Even for those products that hit on PMF and some virality in customer acquisition, many will face the user consumption wall we detailed below. It's why we see international expansion so early for some African companies. 5/ https://medium.com/dfs-lab/fortune-at-the-middle-of-the-pyramid-3a6886eb97f3

All that said, the early-stage process requires compartmentalization of risks to stay focused. We get that. But just be aware that you may be standing at in front a cliff rather than a hockey stick. We're here to help you find out which it is and to keep on growing. 6/

Read on Twitter

Read on Twitter