Paper alert!

In a new NBER WP, Tobias Broer, @KrusellPer and I present a simple model to investigate how the interaction of nominal rigidities and household heterogeneity shape fiscal multipliers.

https://www.nber.org/papers/w28366

Thread.

In a new NBER WP, Tobias Broer, @KrusellPer and I present a simple model to investigate how the interaction of nominal rigidities and household heterogeneity shape fiscal multipliers.

https://www.nber.org/papers/w28366

Thread.

The model extends the Heterogeneous-Agent New-Keynesian (HANK) model in Broer-Hansen-Krusell-Öberg (ReStud 2020). The key feature is that profit income accrues to a few capitalists, while the larger mass of workers only receive wage income.

The model is purposefully simple in all other regards. Balanced-growth-path (BGP) preferences. Wasteful spending financed by lump-sum taxes. No fiscal redistribution. Balanced government budget. Production is linear in labor, and the monetary policy rule reacts only to inflation.

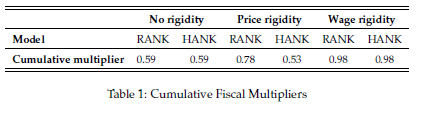

How are fiscal multipliers determined and how does it compare to the standard RANK model? Let’s think about how total hours, and therefore output, are determined in response to a government spending shock in three corner cases.

Consider first the case with no rigidities. When spending increases, so do taxes, which induces workers to work more. With linear production, real wages stay constant, so the story stops there. Hours worked rise, but less than the tax shock -> Flex price multiplier < 1.

Also, with constant real wages, worker income moves one-to-one with aggregate output. Implication: the shock has not distributional effects, and the fiscal multiplier in our HANK model equals that in a corresponding RANK model.

Consider next the case with rigid prices. There is the same negative income effect from taxes, but now we have a countercyclical markup, and wages rise in equilibrium.

With BGP preferences and lump-sum taxes, the income effect from a wage change dominates the substitution effect. The wage rise thus cause hours to fall. Therefore, Rigid price multiplier < flex price multiplier.

Wait a minute – doesn’t sticky prices amplify fiscal multipliers? Yes, this is true in the standard RANK model. The key difference between that model and our model is that in RANK, working households also receive profit income.

Profit income reduces the relative income effect of wages. Moreover, when wages rise, profits fall, inducing households to work more. If profit share<tax share of output, the countercyclical response of profits are necessary for amplification of fiscal multipliers in RANK.

Finally, consider the case with (fully) rigid nominal wages. Now, hours are ``demand-determined’’. So, how is demand determined? By assumption, nominal wages stay flat in response to the shock. With constant productivity, real wages and inflation must stay flat too.

MP rule then implies nominal interest rate, and therefore real rate, is constant. Ergo, private worker consumption is constant, so rigid wage multiplier = 1.

Again, with constant real wages, the fiscal multiplier in our HANK model equals that in a corresponding RANK model.

Again, with constant real wages, the fiscal multiplier in our HANK model equals that in a corresponding RANK model.

Summary:

a) Our model: 0<Rigid price multiplier<Flex price multiplier< (Fully) Rigid wage multiplier=1

b) Rigid price amplification of fiscal multipliers in RANK are due to the assumption that working households recieve profit income, and that profits respond countercyclically.

a) Our model: 0<Rigid price multiplier<Flex price multiplier< (Fully) Rigid wage multiplier=1

b) Rigid price amplification of fiscal multipliers in RANK are due to the assumption that working households recieve profit income, and that profits respond countercyclically.

These sharp predictions are of course only true in our simple framework. We believe, however, that they are useful for understanding how heterogeneity and nominal rigidities affect fiscal multipliers in larger quantitative models.

See, e.g., the super interesting work by Hagedorn-Manovskii- @SorryToBeKurt and Auclert-Rognlie- @ludwigstraub . In particular, our results point to that rigid wages are a key ingredient for generating large fiscal multipliers.

Also, check out the highly complementary work by @c_cantore- @_LukasFreund_ and Auclert- @BardoczyBence-Rognlie.

And please reach out if you have comments or questions!

Read on Twitter

Read on Twitter