/2 have heard anecdotes of participants losing large parts of their crypto holdings by chasing the bull market with mistimed leveraged longs and see thousands of nameless participants in the billions in notional that are liquidated on any material move in the markets.

/3 there are two enormous costs to engaging in this behavior:

1) poor traders tend to chase, margin longing after significant price moves up have already happened. combined with high leverage, this means they manage to lose money by being liquidated (force sold) on pullbacks.

1) poor traders tend to chase, margin longing after significant price moves up have already happened. combined with high leverage, this means they manage to lose money by being liquidated (force sold) on pullbacks.

This results in somehow losing money longing in a bull market.

2) Derivatives exchanges charge a maintenance margin when you are liquidated to give them a buffer to close losing positions prior to the bankruptcy price.

2) Derivatives exchanges charge a maintenance margin when you are liquidated to give them a buffer to close losing positions prior to the bankruptcy price.

Any excess goes to the insurance fund. This excess necessitates that margined positions do not capture their full EV.

/4 how can this EV loss be avoided while preserving the desired level of exposure?

One, don't be a fucking degenerate. The vast majority of people trading on leverage lose money, and this in a 10 year secular bull market that has minted everyone who has survived.

One, don't be a fucking degenerate. The vast majority of people trading on leverage lose money, and this in a 10 year secular bull market that has minted everyone who has survived.

But if you believe you have truly found a good spot to add exposure, add it in an asymmetric risk/reward fashion with options.

/5 Rather than a 10x long on ETHUSD, buy the appropriate expiry for your thesis and a strike that gives you the desired gearing to the capital you feel appropriate to risk.

You have now created leverage on your portfolio that cannot be liquidated by the volatility of the market but maintains capped downside and unlimited upside. You have solved problem 1 and 2 above.

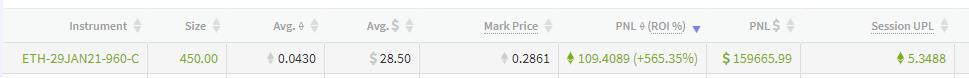

/6 An example trade on @deribitexchange taken near the $20,000 upside break in BTC and the simultaneous CME futures announcement. Naked long 450x ETH 1/29 calls at an average of $28.50 (capital risked $12,825). PnL ultimately reached ~$160,000.

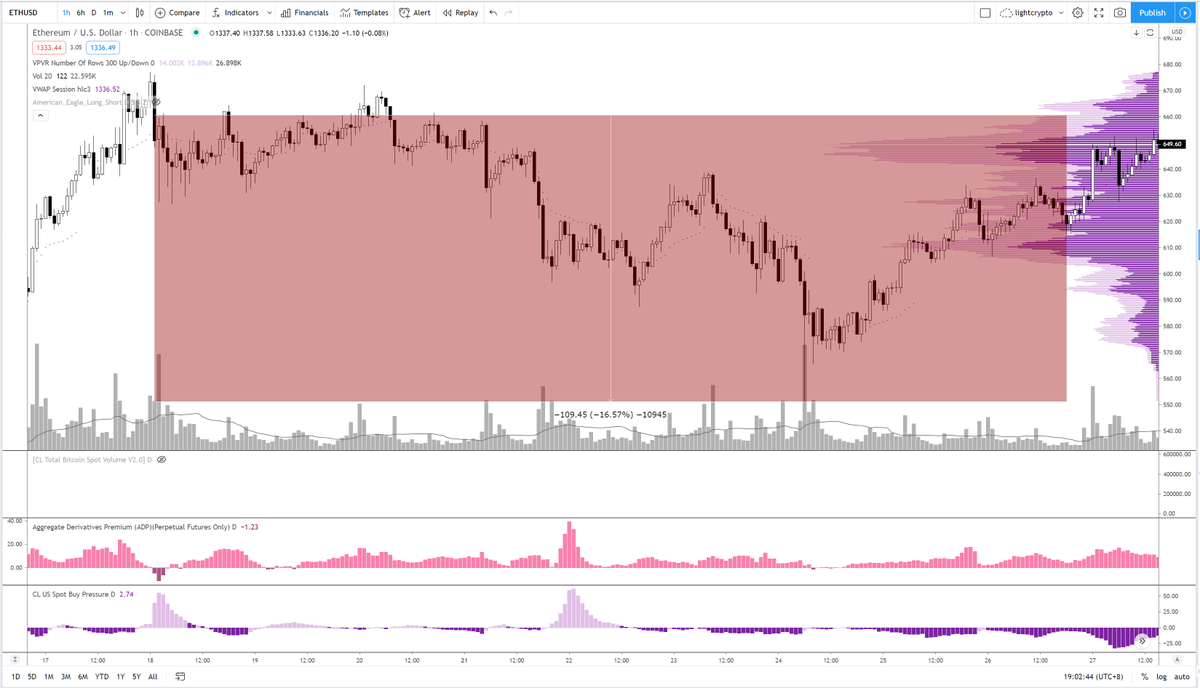

/7 Key to note - reference price on this was ~$660 on ETHUSD. The market dipped to as low as $550 shortly after the position was entered (-16.6%). If you had taken a 10x long on ETHUSD, you would have been liquidated & not realized the $160,000 PnL later as the trade played out.

/8 By using a call instead of a leveraged swap long, we have eliminated the path dependence of the trade (particularly valuable in an extremely volatile asset space) and instead replaced it with a durational limitation. For most in this space, I would guess this improves outcome.

/9 In the last year, options have finally become a viable instrument in this asset class. @deribitexchange volumes, OI, and liquidity are the best by a proverbial mile, and it is the platform I use. Punt on leveraged swaps and futures while ignoring options at your own peril.

Read on Twitter

Read on Twitter