Millions of people are turning to the benefits system to help them through the pandemic. But they are still falling into rent arrears. Why?

Here is a quick explanation of some of the major holes in the safety net (THREAD) https://www.insidehousing.co.uk/insight/69171

Here is a quick explanation of some of the major holes in the safety net (THREAD) https://www.insidehousing.co.uk/insight/69171

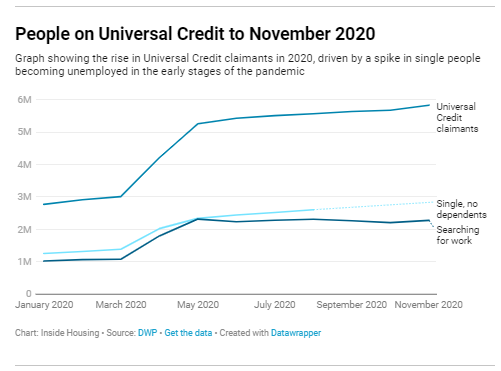

1. There has been an explosion in new claims for Universal Credit since the start of the pandemic, rising from below 3m in March to 5.8m at the start of November. The biggest rise has been among single people who have lost their jobs

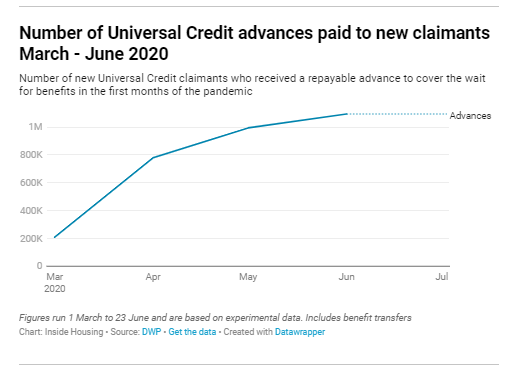

As is now widely known, these people would all have had a five week wait for their first payment. Between March and June, more than 1m of them applied for an 'advance' to help them through. This is a repayable loan, which will have reduced their benefits ever since

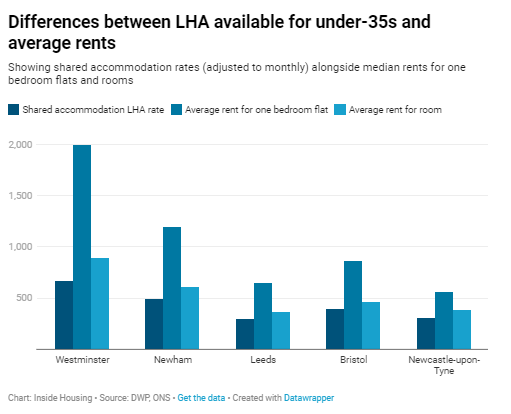

Once on Universal Credit, the amount they are given to cover housing costs is dictated by a formula called the Local Housing Allowance - which attempts to estimate the lowest 30% of rents in a particular area and awards a sum accordingly.

In March, Rishi Sunak boosted it - wiping out the effect of a four year freeze. But it remained limited: it still only covered the lowest 30% and under 35s with no children could only receive the 'shared room rate' (the estimated cost of a room in a communal flat).

Welfare experts say many new claimants since the start of the pandemic have been people who never expected to end up on benefits. So their housing costs are often well above these formula rates. This graph illustrates the potential shortfalls around the country:

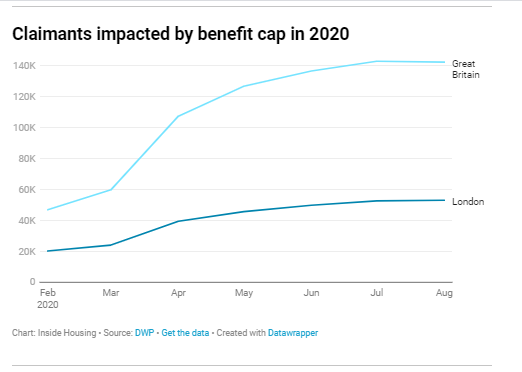

But there is more: even those who would have received enough UC to cover their rent have to contend with the overall benefit cap, which caps entitlement for families at £23,000 outside London, £20,000 within and far lower for single people

There's been a huge rise in people capped this year, with 170,000 having their benefits reduced up from 46,850 before the start of the pandemic. This is particularly true in London, where housing costs are highest.

This is set to get worse. In certain circumstances, new benefit claimants receive a nine month 'grace period' before the cap applies. But for the surge of people who came into the welfare system at the start of the pandemic this is set to run out in the next few weeks

Research by the Child Poverty Action Group estimates that between December 2020 and March 2021, a further 76,000 households will be capped – 63,000 by the end of January. Three-quarters of them are families with children and they face losing an average of £62 a week.

Those deemed to be 'over-occupying' will also have their benefits cut by the bedroom tax - a welfare policy which has been widely forgotten about but has never been scrapped. At least 250,000 housing benefit claimants remain affected.

For those in housing stress, they can apply to their local authority for a 'discretionary housing payment' - something the government places a lot of weight on to address the above described gaps. But this is very limited.

First getting one depends a lot on where you live. My research shows that in some relatively low demand areas like Gedling in Northamptonshire, 99% of applications are approved. But in some higher demand areas, more than 75% can be rejected.

Second, it is only a short term payment - rarely running for longer than 13 weeks. After this point, if your circumstances haven't changed you are back in trouble. And at the moment, it's particularly hard for circumstances to change.

In summary, people are getting into rent arrears because we have spent 10 years reducing the functionality of the welfare system as a genuine safety net. And now when demand on it has never been greater, it cannot cope.

An evictions ban has put a pause on the inevitable evictions that will result from this (but not stopped them completely). But that ends on March 8.

The government's promise that "no one will lose their home as a result of the pandemic" looks set to ring pretty hollow (ends)

The government's promise that "no one will lose their home as a result of the pandemic" looks set to ring pretty hollow (ends)

Read on Twitter

Read on Twitter