For a long time I thought computational drug modelling really had only one listed company: $SLP

Turns out maybe not: Physiomics #PYC could be a decent candidate for a comp.

Growth is inflecting, it has optionalities and thanks to AIM obscurity it's on a fwd EV/Sales of 6.5x

Turns out maybe not: Physiomics #PYC could be a decent candidate for a comp.

Growth is inflecting, it has optionalities and thanks to AIM obscurity it's on a fwd EV/Sales of 6.5x

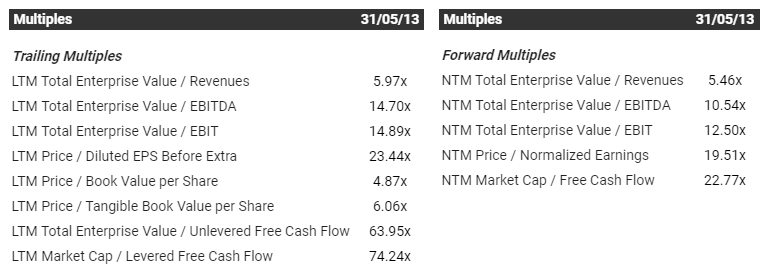

I first bought $SLP in April 2013. I mention this to make the point that was long before the current bubble in futuristic healthcare stocks, or before SaaS was a thing, this was already a punishingly expensive sector.

Here are the multiples you would've seen back then

Here are the multiples you would've seen back then

Now, $SLP and #PYC are similar but not the same.

SLP was pure software to model drug absorption, sold on licence. It had incredible margins but slow, steady growth. In 2013 it did $10M in revs and in the most recent like-for-like split, FY19, it did $20: ~+10% a year or so

SLP was pure software to model drug absorption, sold on licence. It had incredible margins but slow, steady growth. In 2013 it did $10M in revs and in the most recent like-for-like split, FY19, it did $20: ~+10% a year or so

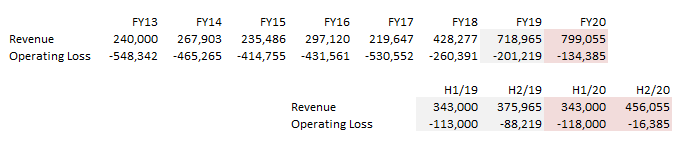

For most of the same period #PYC was flatlining. In 2018 an inflection appears to beging, growth picked up - all organic - and if we call it £1M for FY21 we get the 6.5x multiple from earlier and around a 4x in revenue during which time SLP will more or less have doubled.

#PYC works in modelling tumours and oncological drugs. Description below

Rather than sell software, they use it to consult w/ big pharma and this side of the business is responsible for the numbers above. Loss making, software + consulting project work deserves a lower multiple

Rather than sell software, they use it to consult w/ big pharma and this side of the business is responsible for the numbers above. Loss making, software + consulting project work deserves a lower multiple

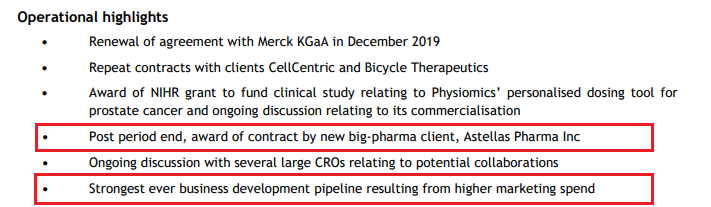

Things here are going well: new clients, business development is strong.

6.5x to me at least, already seems an attractive enough multiple for a decent little company on the up, reflecting some mix of software and consulting, the fact they work in oncology and a degree of growth

6.5x to me at least, already seems an attractive enough multiple for a decent little company on the up, reflecting some mix of software and consulting, the fact they work in oncology and a degree of growth

But the optionalities here may not be priced in at all.

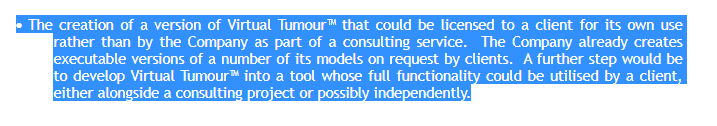

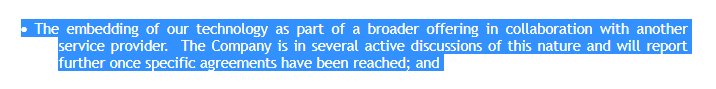

The most exciting is this below: the licencing out of the software they consult with. In short, they'd essentially move more towards a SLP type model and you'd imagine, much higher potential margins than consulting alone.

The most exciting is this below: the licencing out of the software they consult with. In short, they'd essentially move more towards a SLP type model and you'd imagine, much higher potential margins than consulting alone.

The second is this: the embedding of their software inside someone else's software.

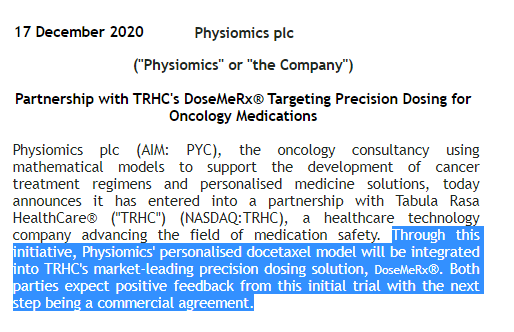

Post-period - one month ago - this has now happened.

Post-period - one month ago - this has now happened.

PYC also have been working on a side-gig which hasn't yet been monetised - it's the modelling of personalised medicine dosing for oncology and this has found its way into a trial of $1.3B cap $TRHC Tabula Rasa's own dosing software.

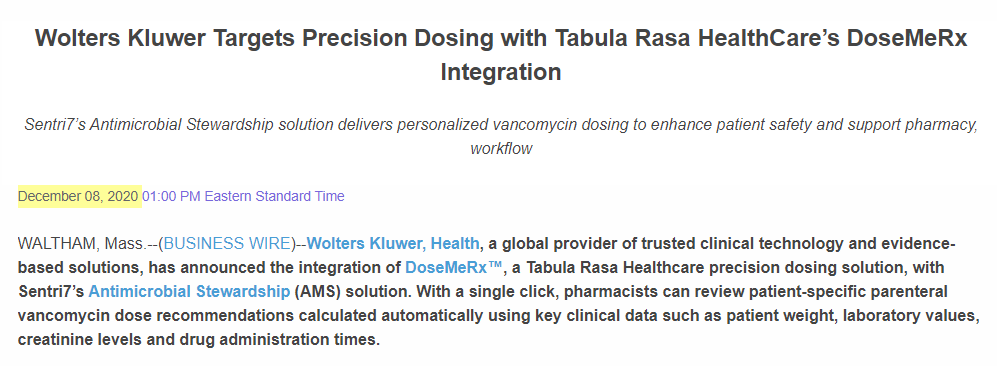

..which in turn has found its way into €18B cap Wolters Kluwer's software.

It's only a tiny cog amongst bigger cogs but a £7M cap has to start somewhere and it looks like they're executing.

As Corero and Trackwise in the UK show, little co's riding on big ones: good thing

It's only a tiny cog amongst bigger cogs but a £7M cap has to start somewhere and it looks like they're executing.

As Corero and Trackwise in the UK show, little co's riding on big ones: good thing

What's the Tabula-Wolters thing worth in terms of revenue? I don't know. Initially, not much I suspect.

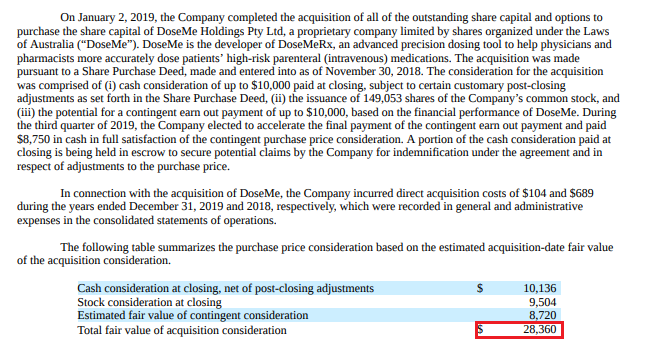

However, here's an interesting thing: THRC acquired their dosing software side of things for $30M, quickly paid the earn-out and the T9M revs from it? $226K.

Expensive sector

However, here's an interesting thing: THRC acquired their dosing software side of things for $30M, quickly paid the earn-out and the T9M revs from it? $226K.

Expensive sector

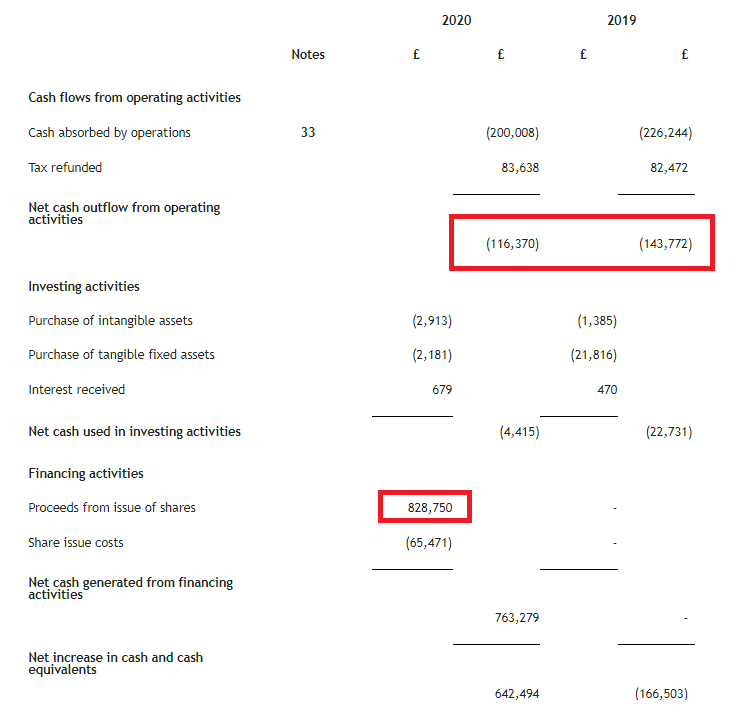

#PYC has £1M in cash, nil debt and recently placed for far more than their annual cash burn. They'll expand operationally and in sales. I'd be pleasantly surprised if they allow themselves to run to breakeven but I doubt they will. I imagine they'll place again in future.

It's by no means anywhere close to the finished article but to me it looks like they're doing everything right. If they keep on executing I wouldn't be surprised if they're a substantially larger and more valuable company in a few years. 6.5x doesn't seem so much to pay for that.

Read on Twitter

Read on Twitter