#LaurusLabs valuation 18th in the row, sorted by market cap.

Salient : has seen a sudden jump in sales (100%) over the past few years due to capacity expansion. Let's investigate https://twitter.com/techlunatic/status/1347578228722962433

https://twitter.com/techlunatic/status/1347578228722962433

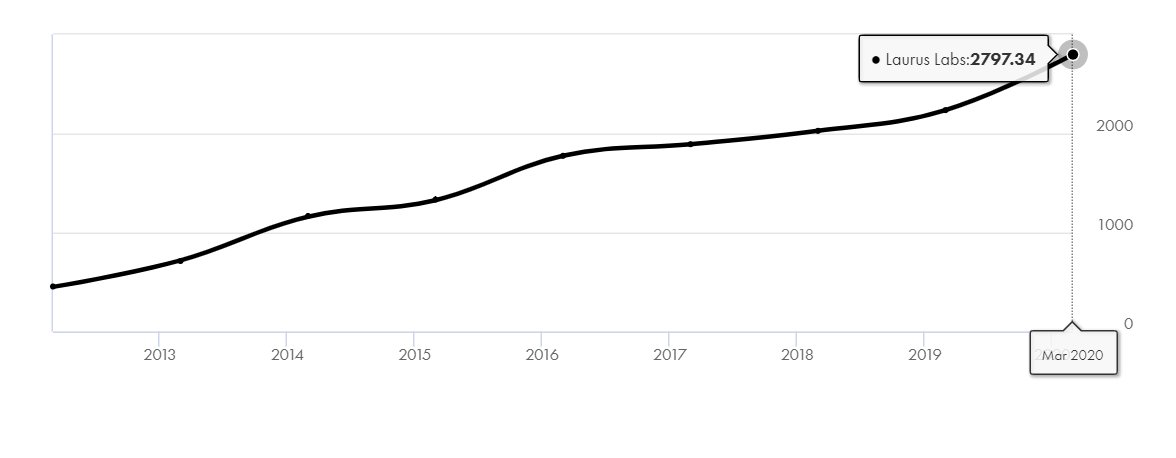

Salient : has seen a sudden jump in sales (100%) over the past few years due to capacity expansion. Let's investigate

https://twitter.com/techlunatic/status/1347578228722962433

https://twitter.com/techlunatic/status/1347578228722962433

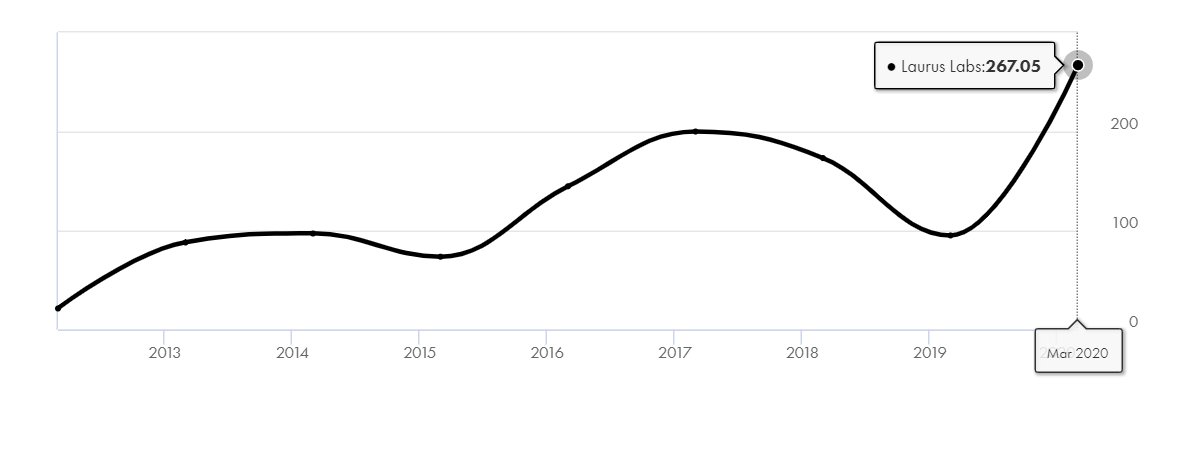

Prima facie, sales seems to be in a smooth uptick, and profits have been volatile but facing north, for now. Let's take a look at what tale EPS tells :

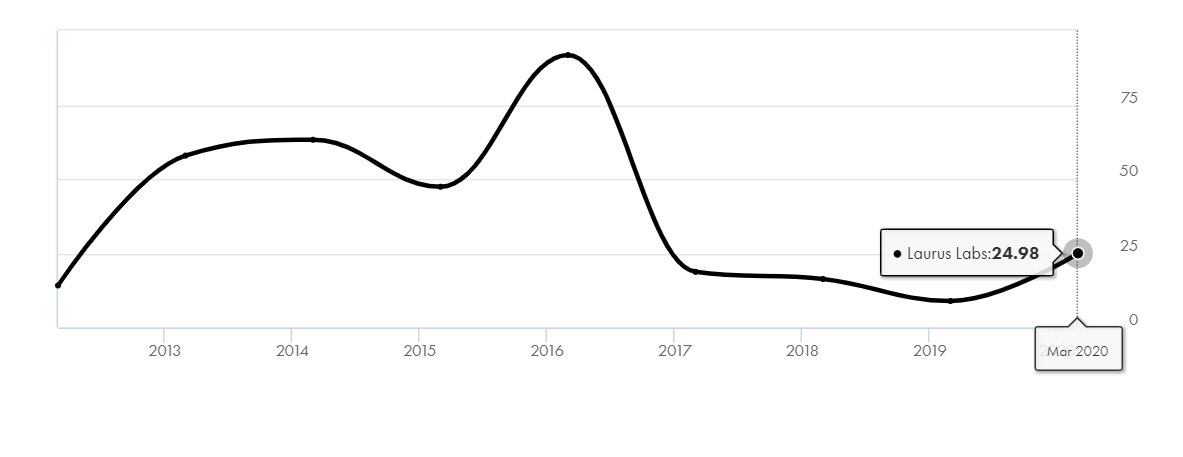

Why the sudden dip in EPS?

Laurus Labs Ltd. had last split the face value of its shares from Rs 10 to Rs 2 in 2016.

Laurus Labs Ltd. had last split the face value of its shares from Rs 10 to Rs 2 in 2016.

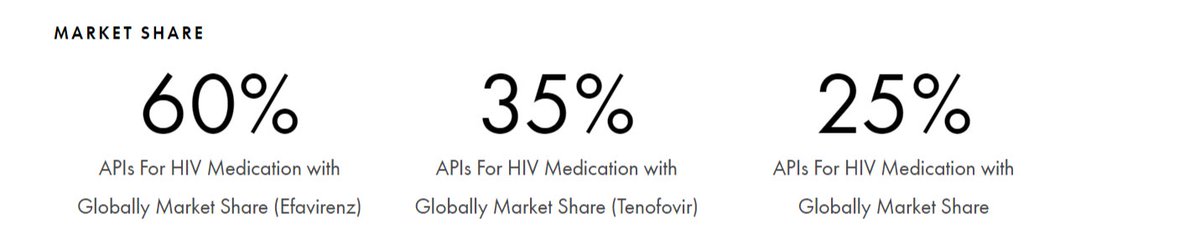

Company has a dominant share in HIV APIs

35% revenue comes from India, 65% from the rest of the world.

35% revenue comes from India, 65% from the rest of the world.

A suitable coffee-can candidate? NO.

Profits are volatile & the recent rise in sales appears to be a one-off effect of capacity expansion. Will the current rate of growth (22% sales || 31% CAGR profit) continue? unlikely. Use the status quo as a new base instead of extrapolating

Profits are volatile & the recent rise in sales appears to be a one-off effect of capacity expansion. Will the current rate of growth (22% sales || 31% CAGR profit) continue? unlikely. Use the status quo as a new base instead of extrapolating

#Laurus has a debt of 1,029 cr.

The market will ignore the debt as long as RBI keeps interest rates low. If interest rates rise, this 1k cr debt will become a pain point.

The market will ignore the debt as long as RBI keeps interest rates low. If interest rates rise, this 1k cr debt will become a pain point.

Read on Twitter

Read on Twitter