1/ Need to keep this short as I'm between medical tests, but we are in a rhythm right now, pumping during Asian trading hours and even into the start of NA trading hours, but then a steady dump throughout the day.

2/ This pattern has repeated itself for most of the past week, including the weekend, which is somewhat surprising because weekends often diverge in PA from the greater trend. But the trend is unequivocal. The question is why? Why pump during Asia hrs and then dump during NA hrs?

3/ I of course don't know with certainty, but given the bullish whale accumulation that continues unabated, this is by best guess: the dump is occurring mostly among mid-size players (10-100 coins), and I suspect they are comprised mostly of two types:

4/

a. Traders

b. Would-be HODLers who FOMOed in right before the correction and are now thrilled to just cut their losses at $34K, $35K, etc.

a. Traders

b. Would-be HODLers who FOMOed in right before the correction and are now thrilled to just cut their losses at $34K, $35K, etc.

5/ Both of these groups, for different reasons, are driving price back down during NA trading hrs, which is when most of the whales are adding to their bags (or emerging as new whales, like Marathon).

6/ The bad news is that this mid-tier selling will keep a lid on price for a while, until volatility calms (driving away traders) and/or those who FOMOed in either sell their bags at a loss or trust that price will eventually go higher and decide to hang on.

7/ The good news is that whales are still gobbling up every coin they can find, which is very bullish over the mid-term. Moreover, multiple measures of the SOPR (an on-chain profit ratio) indicate that most profit that is to be taken has been taken. Which means...

8/ Once we clear out the final mid-tier sellers - both FUDers and traders, we should begin climbing again, and potentially quite rapidly. How long will it take to clear the sell-side pressure? Hard to say, but one indication of it subsiding will be reduced intraday volatility.

As shown on the attached chart, the daily is calming down and we seem to be finding a bottom, but the intraday volatility is simply too tasty for traders to pass up. With $2000 swings a day, especially in a predictable pattern, why NOT trade?

10/ Long and short, we need to see reduced intraday volatility, and then we should resume our climb north. And assuming new institutional $ continues entering the space, the climb could be quite rapid. BUT, we first need to reduce intraday volatility AND I want to see...

11/ ...the 5DMA and 20DMA resume their upward trends. When that happens, not only will we get a traditionally good/safe buy signal for those looking to re(enter) the market, but we'll also start climbing again fairly regularly.

12/ In the meantime, if it were me, I'd continue to hold off before (re)entering the market, especially given the continuous dumps during NA hours. And if still long as I am, just continue to be patient. The mid-tier selling will eventually relent, volatility will drop, and ...

13/ ...once it does, we should be off to the races shortly thereafter. As frustrating and/or boring this period of time may be, the longer we consolidate, the healthier and more robust the subsequent rally will be. Just need to be patient.

Go #BTC

.

.

Go #BTC

.

.

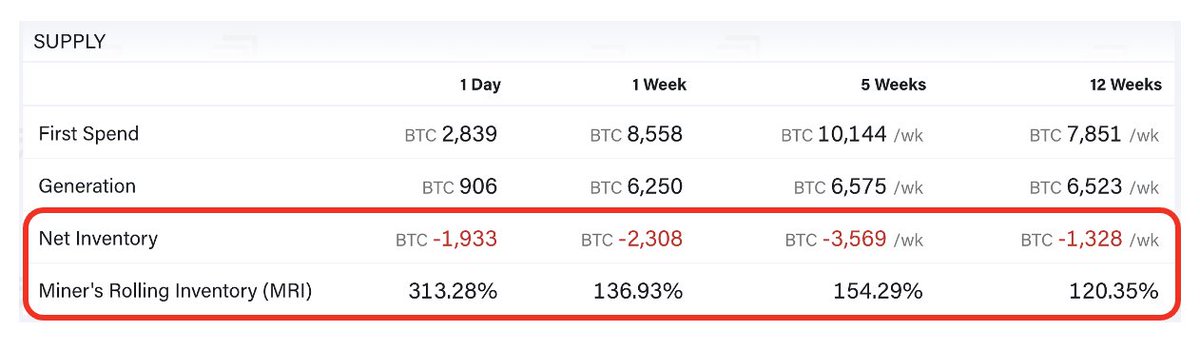

P.S. Miners are unloading their bags, too. Could be interpreted as bearish, but I don't think it is; instead, I think a lot of miners are upgrading their gear. Hash rate has been rocking, so they all need to keep up with each other to stay competitive.

Read on Twitter

Read on Twitter