Weekly Fundamental Analysis  : $DCBO

: $DCBO

58% CAGR Growth: High-quality Canadian company disrupting the enterprise and digital learning market. The YouTube

58% CAGR Growth: High-quality Canadian company disrupting the enterprise and digital learning market. The YouTube of Corporate learning.

of Corporate learning.

Gross margins at 80%

Top Clientele: Uber, Amazon, Walmart, Docusign

Thread analysis

: $DCBO

: $DCBO 58% CAGR Growth: High-quality Canadian company disrupting the enterprise and digital learning market. The YouTube

58% CAGR Growth: High-quality Canadian company disrupting the enterprise and digital learning market. The YouTube of Corporate learning.

of Corporate learning. Gross margins at 80%

Top Clientele: Uber, Amazon, Walmart, Docusign

Thread analysis

1/ $DCBO is a Canadian-based company that offers cloud-based e-learning mgmt platform across North America and Europe. They provide an easy-to-use customizable learning platform with the capabilities required to train internal and external workforces, partners and customers.

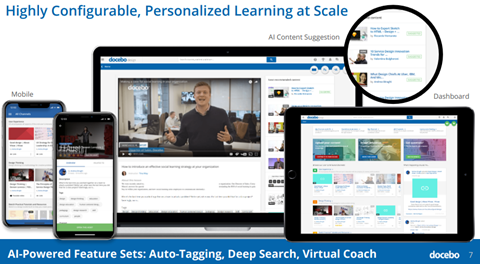

2/ $DCBO core cloud platforms

• Docebo Learn – This is their foundational module, helps org distribute learning content

– This is their foundational module, helps org distribute learning content

• Docebo Discover, Coach & Share – Experiential learning

– Experiential learning

• $DCBO Extended Enterprises - Multiple orgs

- Multiple orgs

• $DCBO AI Coach - Personalized content

- Personalized content

• Docebo Learn

– This is their foundational module, helps org distribute learning content

– This is their foundational module, helps org distribute learning content• Docebo Discover, Coach & Share

– Experiential learning

– Experiential learning• $DCBO Extended Enterprises

- Multiple orgs

- Multiple orgs• $DCBO AI Coach

- Personalized content

- Personalized content

3/Customer Growth:

• $DCBO.TO focuses on enterprise customers - Few include $AMZN $UBER $WMT $DOCU

• 2019: 1600 --> 2020: 2025 (27% )

)

• Avg. contract value of clients:

2016 (11K) --> Q1 2019: (21K) ---> Q2 2020 (32K) (48%)

• Consistent Net-Dollar Retention>100%

• $DCBO.TO focuses on enterprise customers - Few include $AMZN $UBER $WMT $DOCU

• 2019: 1600 --> 2020: 2025 (27%

)

)• Avg. contract value of clients:

2016 (11K) --> Q1 2019: (21K) ---> Q2 2020 (32K) (48%)

• Consistent Net-Dollar Retention>100%

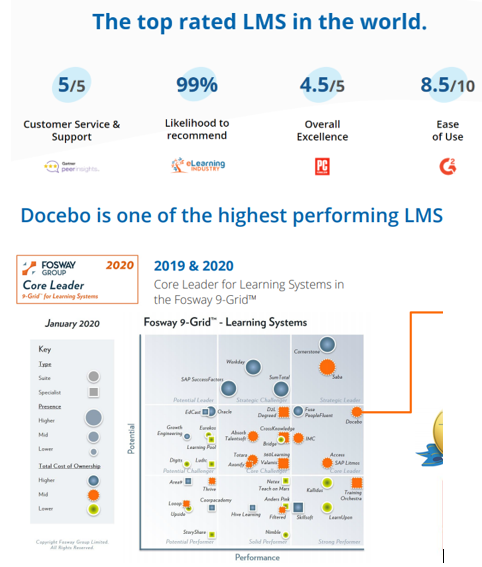

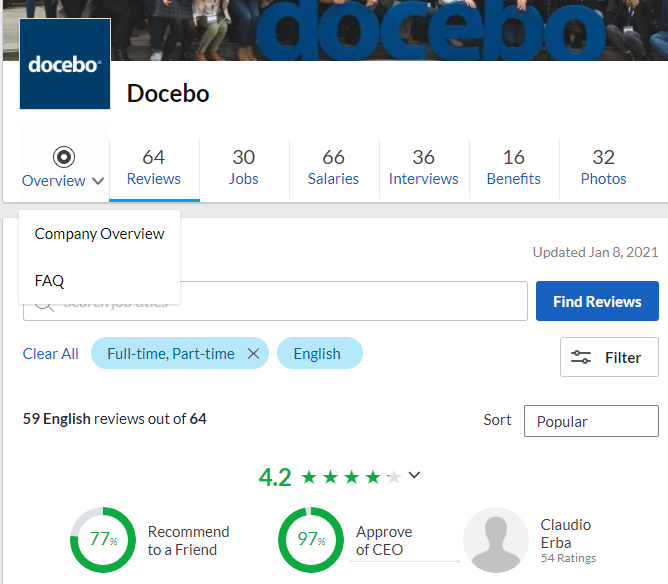

3b/ $DCBO Industry ratings:

Ranked their LMS System as a Core Leader for Learning systems.

Ranked their LMS System as a Core Leader for Learning systems.

$DCBO.TO was named one of Deloitte's 2020 Enterprise Fast 15 for the Technology Fast 50™ and Fast 500™ Winners. The program recognizes Canada’s fastest-growing tech companies.

$DCBO.TO was named one of Deloitte's 2020 Enterprise Fast 15 for the Technology Fast 50™ and Fast 500™ Winners. The program recognizes Canada’s fastest-growing tech companies.

Ranked their LMS System as a Core Leader for Learning systems.

Ranked their LMS System as a Core Leader for Learning systems.  $DCBO.TO was named one of Deloitte's 2020 Enterprise Fast 15 for the Technology Fast 50™ and Fast 500™ Winners. The program recognizes Canada’s fastest-growing tech companies.

$DCBO.TO was named one of Deloitte's 2020 Enterprise Fast 15 for the Technology Fast 50™ and Fast 500™ Winners. The program recognizes Canada’s fastest-growing tech companies.

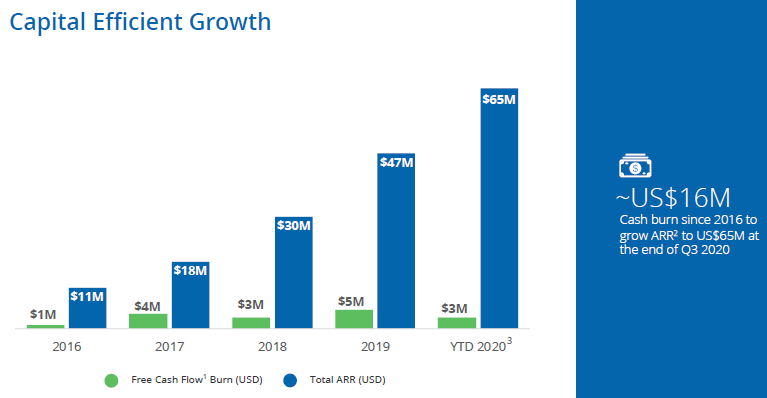

4a/ $DCBO Financials:

•Revenue is generated on annual subscription fee and prepaid on annual basis (94% ARR over 3-year)

•Revenue Growth Rate:

- 2017: 74%

- 2018: 58%

- 2019: 53%

- 2020 (TTM): 54%

Analysts Sales growth forecast for 2021: 45%

•Revenue is generated on annual subscription fee and prepaid on annual basis (94% ARR over 3-year)

•Revenue Growth Rate:

- 2017: 74%

- 2018: 58%

- 2019: 53%

- 2020 (TTM): 54%

Analysts Sales growth forecast for 2021: 45%

4b/ Financials-2:

• Gross Margins: 2017: 75% ---> 82%!

82%!

• Valuations: EV/ Sales NTM: 12.5X, P/B: 35.4

• FCF Margins: 2017: (21%) ---> (1%) while driving Cash flow growth from 405%. chart shows the efficiency.

• Once profitability sets in – I expect in 2021 I expect

• Gross Margins: 2017: 75% --->

82%!

82%!

• Valuations: EV/ Sales NTM: 12.5X, P/B: 35.4

• FCF Margins: 2017: (21%) ---> (1%) while driving Cash flow growth from 405%. chart shows the efficiency.

• Once profitability sets in – I expect in 2021 I expect

5/ Learning Mgmt Industry  – What's changed?

– What's changed?

Today, learning is no longer about bringing an expert or employees having travel to a city. It is digital. This trend has been accelerated by the Virus since companies are not sending employees travelling.

Trend is changing (Contd)

– What's changed?

– What's changed?Today, learning is no longer about bringing an expert or employees having travel to a city. It is digital. This trend has been accelerated by the Virus since companies are not sending employees travelling.

Trend is changing (Contd)

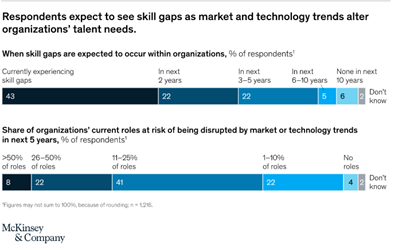

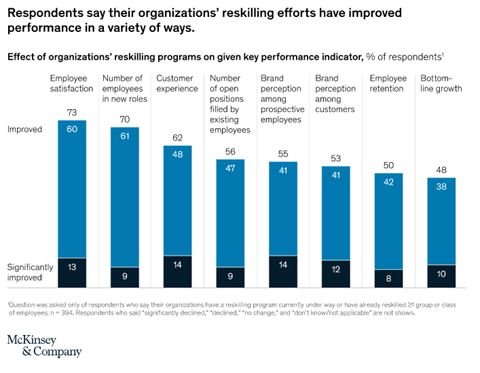

5b/ By 2031, the World Economic Forum estimates that 80% of new jobs will require AI-literacy. How can institutions get ready to fill these digital roles?

In 2018, the WEC forum estimated that more than half of employees would need significant reskilling or upskilling by 2022.

In 2018, the WEC forum estimated that more than half of employees would need significant reskilling or upskilling by 2022.

5c/

Mckinsey top 2021 trends - Workforce development was a priority even before the pandemic. In their survey conducted in 2019, almost 90% of the executives and managers surveyed said their companies faced skill gaps or expected to.. Increasing need for $DCBO platform

Mckinsey top 2021 trends - Workforce development was a priority even before the pandemic. In their survey conducted in 2019, almost 90% of the executives and managers surveyed said their companies faced skill gaps or expected to.. Increasing need for $DCBO platform

6/ Management Team

• Jason Chapnik, who founded the company is now the Chair of the Board and CEO of Intracap who majority owner of the company.

• There is a 55% of Leadership Ownership into the company!

Solid with Glassdoor Reviews

• Jason Chapnik, who founded the company is now the Chair of the Board and CEO of Intracap who majority owner of the company.

• There is a 55% of Leadership Ownership into the company!

Solid with Glassdoor Reviews

7/ Risks/Competition  :

:

• Up selling: How much they can expand amongst their customer base.

• Direct comps against Blackboard Comm. and Canvas Learning

• In-direct Comp from other learning platforms – Udemy, Coursera i.e. If employees decide to use another platform.

:

: • Up selling: How much they can expand amongst their customer base.

• Direct comps against Blackboard Comm. and Canvas Learning

• In-direct Comp from other learning platforms – Udemy, Coursera i.e. If employees decide to use another platform.

8/ My analysis shows these competitive advantage

User-Generated Content & Empowering user: YouTube giant’s success is based on the premise that all visitors can contribute content

User-Generated Content & Empowering user: YouTube giant’s success is based on the premise that all visitors can contribute content

Social collaboration element

Social collaboration element

Industry ratings

Industry ratings

Ease

Ease

The AI algorithm personalization

The AI algorithm personalization

User-Generated Content & Empowering user: YouTube giant’s success is based on the premise that all visitors can contribute content

User-Generated Content & Empowering user: YouTube giant’s success is based on the premise that all visitors can contribute content  Social collaboration element

Social collaboration element Industry ratings

Industry ratings Ease

Ease The AI algorithm personalization

The AI algorithm personalization

9/ Future Growth Driver:

• Grow enterprise customer base and expand

• New product launches

• Expansion across Europe and Asia

• Expand on this AWS Contract…. As more companies adopt the cloud Opportunities for increased business in Amazon department or Walmart.

• Grow enterprise customer base and expand

• New product launches

• Expansion across Europe and Asia

• Expand on this AWS Contract…. As more companies adopt the cloud Opportunities for increased business in Amazon department or Walmart.

10/ Bottom Line:

• All Org's & Enterprise – have important learning goals for employees because of tech acceleration b'cos it is only human for employees to seek growth and it leads to career satisfaction below

• The virus has reduced travelling hence digital learning

• All Org's & Enterprise – have important learning goals for employees because of tech acceleration b'cos it is only human for employees to seek growth and it leads to career satisfaction below

• The virus has reduced travelling hence digital learning

11/ At $2B Market Cap - $DCBO has begun building an important moat. The potential is the sky.

Current stock status: It is coming out of a consideration.

A full comprehensive analysis can be found below:

Subscribers receive these reports first. https://investianalystnewsletter.substack.com/p/docebo-inc-leading-the-organizational

Current stock status: It is coming out of a consideration.

A full comprehensive analysis can be found below:

Subscribers receive these reports first. https://investianalystnewsletter.substack.com/p/docebo-inc-leading-the-organizational

This was one of @InvestiAnalyst Top Picks for 2021 as seen below.

As we go along, we will covering all of them. Kindly follow and share information if you appreciate. Thank you!

Let me know if your feedback! https://twitter.com/InvestiAnalyst/status/1348367429584343040

As we go along, we will covering all of them. Kindly follow and share information if you appreciate. Thank you!

Let me know if your feedback! https://twitter.com/InvestiAnalyst/status/1348367429584343040

Read on Twitter

Read on Twitter