$BLSA DD thread

BCLS Acquisition Corp.

Bain Capital Life Sciences SPAC

Currently: $11.10

52 wk high: $12.08

52 wk low: $10.15

Avg. volume: 46k

First of the 5 SPACs near NAV we tweeted on Sunday. We’re a big fan of this one, and we think it’s a super overlooked SPAC.

BCLS Acquisition Corp.

Bain Capital Life Sciences SPAC

Currently: $11.10

52 wk high: $12.08

52 wk low: $10.15

Avg. volume: 46k

First of the 5 SPACs near NAV we tweeted on Sunday. We’re a big fan of this one, and we think it’s a super overlooked SPAC.

Do your own research before buying or selling anything.

Let’s dive into it

Let’s dive into it

$BLSA raised $125 million by offering 12.5 million shares at $10.

You may ask yourself, why can’t I find the warrants for it?

“The SPAC did not offer warrants that would become exercisable following completion of the initial business combination.”

You may ask yourself, why can’t I find the warrants for it?

“The SPAC did not offer warrants that would become exercisable following completion of the initial business combination.”

$BLSA

The company plans to target the healthcare industry, particularly businesses primarily based in North America and Europe in the biopharmaceutical, specialty pharmaceutical, medical device, diagnostics, and enabling life science technology fields

This opens a ton of doors

The company plans to target the healthcare industry, particularly businesses primarily based in North America and Europe in the biopharmaceutical, specialty pharmaceutical, medical device, diagnostics, and enabling life science technology fields

This opens a ton of doors

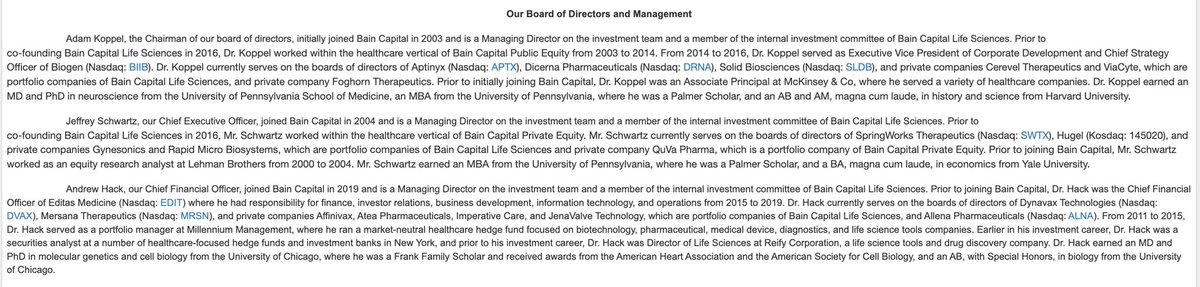

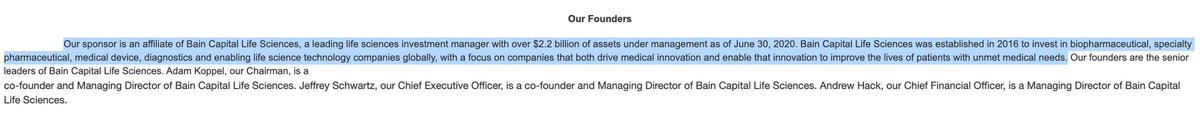

$BLSA is led by co-founders and managing directors of Bain Capital Life Sciences.

Chairman: Adam Koppel

CEO/Director: Jeffrey Schwartz.

CFO: Andrew Hack

Director: Allene Diaz

Director: Barry Greene

Director: Vikas Sinha

More about Bain Capital Life Sciences below

Chairman: Adam Koppel

CEO/Director: Jeffrey Schwartz.

CFO: Andrew Hack

Director: Allene Diaz

Director: Barry Greene

Director: Vikas Sinha

More about Bain Capital Life Sciences below

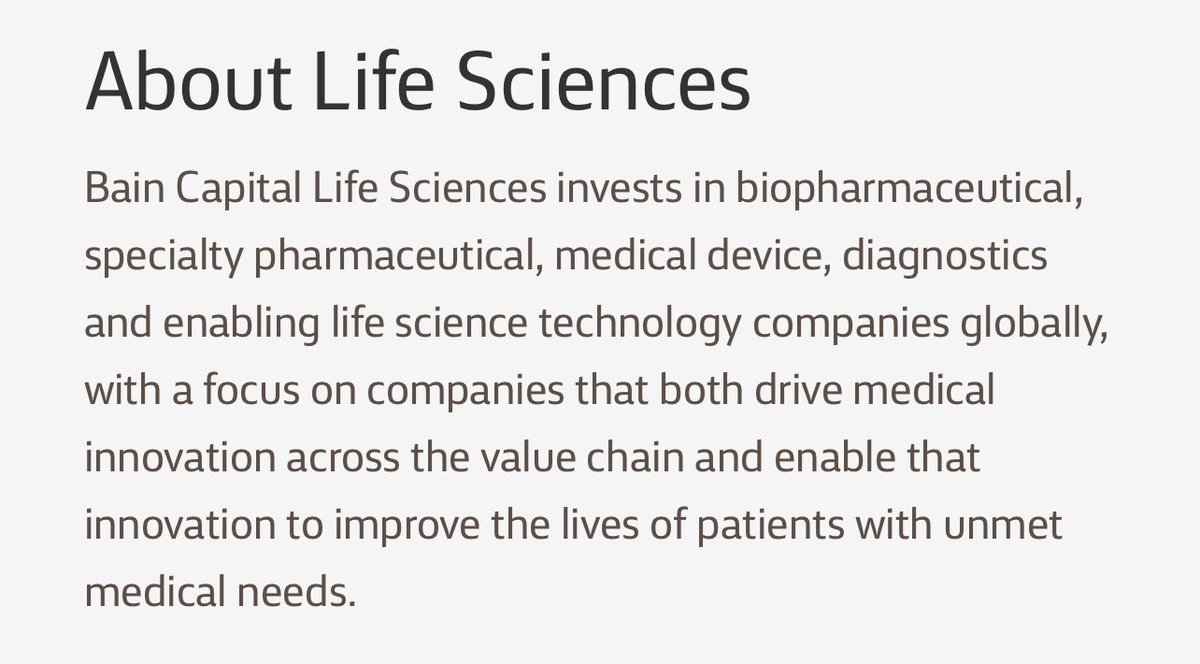

The capital group has the same focus as the SPAC.

Bain has deep expertise, global reach, and a proven track record in private equity, public equity (more on that in a few tweets), credit, and venture investments.

https://www.baincapital.com/businesses/scaling-innovation-life-sciences $BLSA

Bain has deep expertise, global reach, and a proven track record in private equity, public equity (more on that in a few tweets), credit, and venture investments.

https://www.baincapital.com/businesses/scaling-innovation-life-sciences $BLSA

Bain Capital Life Sciences has $2.2 billion assets under management as of late June 2020

They have been investors in lots of great projects since the fund was created by Bain Capital. (see next few tweets)

$BLSA

They have been investors in lots of great projects since the fund was created by Bain Capital. (see next few tweets)

$BLSA

Bain Capital Life Sciences has a strategy that is focused on four different themes of investments.

- Inflection Capital

- Growth Capital

- Fallen Angels

- Large Private Equity

As you’ll see in the next tweet, $BLSA has a lot of private investments (notable)

- Inflection Capital

- Growth Capital

- Fallen Angels

- Large Private Equity

As you’ll see in the next tweet, $BLSA has a lot of private investments (notable)

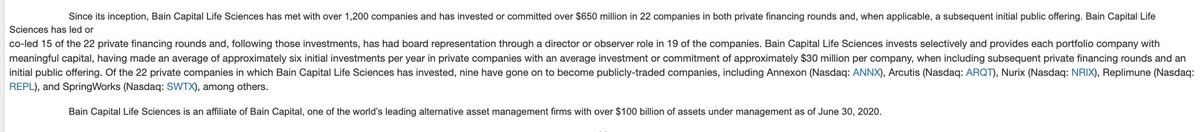

BCLS has a proven track record.

They’ve invested or committed over $650 million in 22 companies in private financing/IPOs.

Out of those 22 companies, 9 have gone on to become publicly traded.

Early investors in:

$ANNX

$ARQT

$NRIX

$REPL

(1/2) $BLSA

They’ve invested or committed over $650 million in 22 companies in private financing/IPOs.

Out of those 22 companies, 9 have gone on to become publicly traded.

Early investors in:

$ANNX

$ARQT

$NRIX

$REPL

(1/2) $BLSA

Take a minute to comprehend the growth displayed in those 5 charts.

$BLSA is the same team that who invested in those companies at a early stage. They’re invested in 13 private companies as well. Lots of opportunities.

They’ve met with over 1,200 companies.

$BLSA is the same team that who invested in those companies at a early stage. They’re invested in 13 private companies as well. Lots of opportunities.

They’ve met with over 1,200 companies.

$BLSA isn’t a super old SPAC by any means, but it has had some interesting price action in it’s few konths.

The jump to $12.09 one day on low volume is notable

The jump to $12.09 one day on low volume is notable

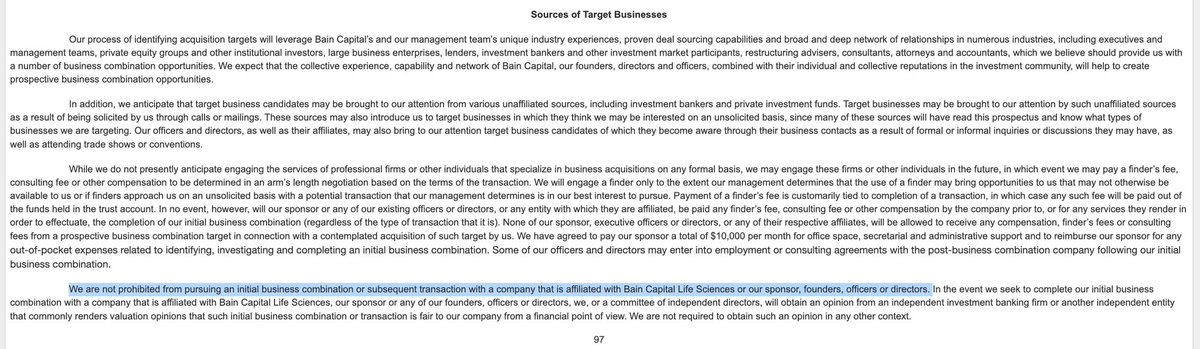

$BLSA is not prohibited from pursuing a merger with a company affiliated with Bain Capital Life Sciences.

They’ve had a lot of public investment success, we’re confident they have good private investments that they’re attempting to help bring public at some point soon.

They’ve had a lot of public investment success, we’re confident they have good private investments that they’re attempting to help bring public at some point soon.

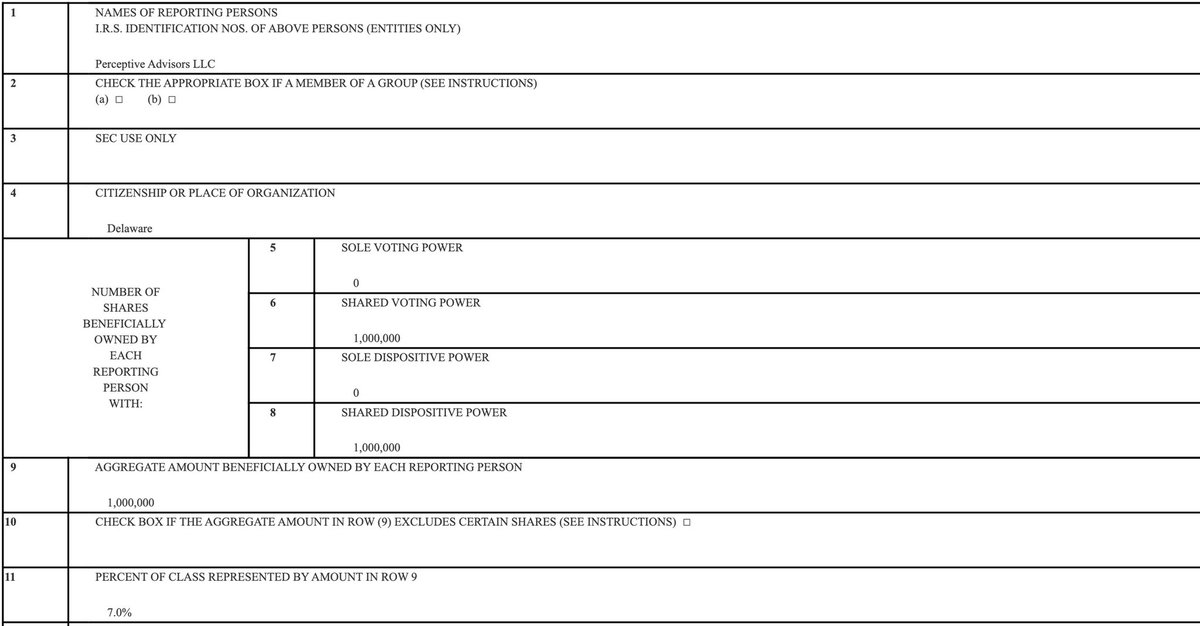

$BLSA 13G #1:

10/28/2020

Perceptive Advisors bought 1 mil shares (7.0%).

They are another big life sciences investing firm.

- over 18 years of investments

- invest throughout a company’s lifecycle

- focus on medical devices, diagnostics, digital health, biotech and pharmas.

10/28/2020

Perceptive Advisors bought 1 mil shares (7.0%).

They are another big life sciences investing firm.

- over 18 years of investments

- invest throughout a company’s lifecycle

- focus on medical devices, diagnostics, digital health, biotech and pharmas.

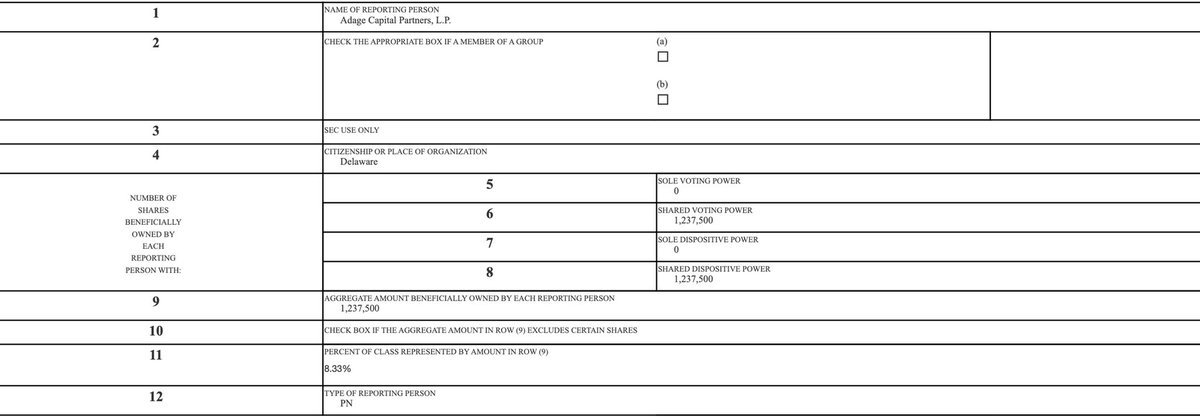

$BLSA 13G #2:

11/05/2020

Adage Capital Partners bought 1,237,500 shares (8.33%).

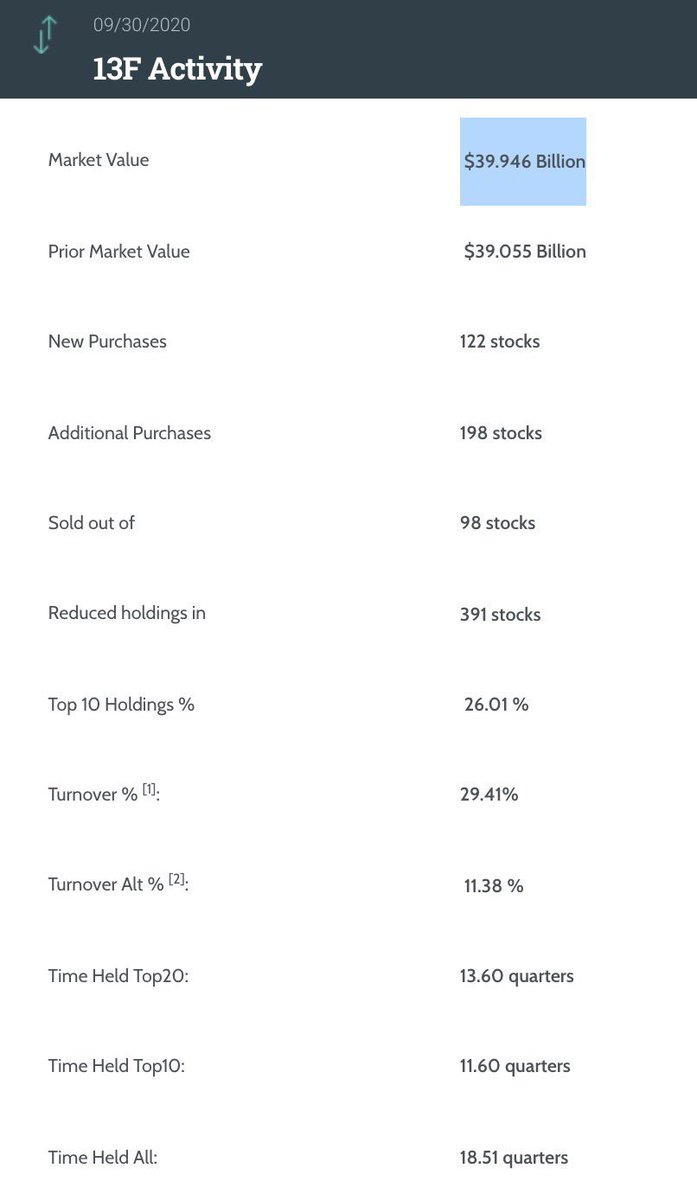

Adage Capital Partners is a common investor in SPACs we like, they’re in $SPRQ and $BOAC (mentioned in our threads on those)

They have a good reputation, for a reason.

11/05/2020

Adage Capital Partners bought 1,237,500 shares (8.33%).

Adage Capital Partners is a common investor in SPACs we like, they’re in $SPRQ and $BOAC (mentioned in our threads on those)

They have a good reputation, for a reason.

That pretty much sums up our $BLSA thread. It’s a super overlooked SPAC (judging by volume). New DD thread coming tomorrow, will be one of the 4 remaining SPACs from the list.

We’re a big fan of this one, and we hope people see why. We have a position and plan (1/2)

We’re a big fan of this one, and we hope people see why. We have a position and plan (1/2)

to hold until a deal is announced, and potentially longer (will re evaluate on announcement). $BLSA

If you found this useful, please feel free to RT / share the thread with others. Feedback in general is always appreciated. Let us know what you think

If you found this useful, please feel free to RT / share the thread with others. Feedback in general is always appreciated. Let us know what you think

sources:

https://www.baincapital.com/businesses/scaling-innovation-life-sciences

https://www.fiercebiotech.com/biotech/bain-creates-1-1b-fund-for-fresh-round-life-science-bets

https://sec.report/Document/0001193125-20-275508/#rom14929_10

https://whalewisdom.com/filer/perceptive-advisors-llc

https://www.perceptivelife.com/life-sciences/

https://sec.report/Document/0001193125-20-279951/

https://sec.report/Document/0000902664-20-003827/

https://whalewisdom.com/filer/adage-capital-partners-gp-llc

We also want to thank everyone for the constant support!

https://www.baincapital.com/businesses/scaling-innovation-life-sciences

https://www.fiercebiotech.com/biotech/bain-creates-1-1b-fund-for-fresh-round-life-science-bets

https://sec.report/Document/0001193125-20-275508/#rom14929_10

https://whalewisdom.com/filer/perceptive-advisors-llc

https://www.perceptivelife.com/life-sciences/

https://sec.report/Document/0001193125-20-279951/

https://sec.report/Document/0000902664-20-003827/

https://whalewisdom.com/filer/adage-capital-partners-gp-llc

We also want to thank everyone for the constant support!

Read on Twitter

Read on Twitter