1/ Personal Income Tax: A thread for Entertainers.

Dear Entertainers, there's a trend where you are always owing the tax man & I want to help U understand why.

(This thread doesnt apply to entertainers who bill by invoicing through their company - this falls under company tax)

Dear Entertainers, there's a trend where you are always owing the tax man & I want to help U understand why.

(This thread doesnt apply to entertainers who bill by invoicing through their company - this falls under company tax)

2/ Firstly, PAYE (Pay As You Earn) in S.A. is calculated using one tax table for all workers of the country. Entertainers don’t have their own special tax table.

3/ Whatever your employer calls it - Salary, Overtime or Commission - it is taxed at the same rate according to the standard PAYE tax tables. The incomes will have different codes on the tax certificate, but they are taxed using the same rate.

4/ Secondly, SARS calculates tax on your ANNUAL income. Although you get paid monthly or per gig, your total tax is based on your TOTAL annual income. This is where many of you get confused with the “25% freelancer tax" and get shocked at the end of the tax year. Let me explain.

5/ So this is what happens to you guys:

Entertainer A has 3 jobs paying him/her R20 000 a month.

Each job deducts 25% tax (PAYE) therefore you get R15 000 from each job per month.

Entertainer A has 3 jobs paying him/her R20 000 a month.

Each job deducts 25% tax (PAYE) therefore you get R15 000 from each job per month.

6/ In total, R45 000 (R15 000 x 3) goes to your bank account and R15 000 (R5 000 x 3) is paid to SARS by your employer/contractor.

In total for the year, when it comes to tax, you’ve paid SARS R180 000: R15 000 x 12.

In total for the year, when it comes to tax, you’ve paid SARS R180 000: R15 000 x 12.

7/ At the end of the year, SARS does a reconciliation of your income. Based on your work, your GROSS income (i.e. your income before tax) is R60 000 per month (R20 000 x 3), therefore making it R720 000 a year.

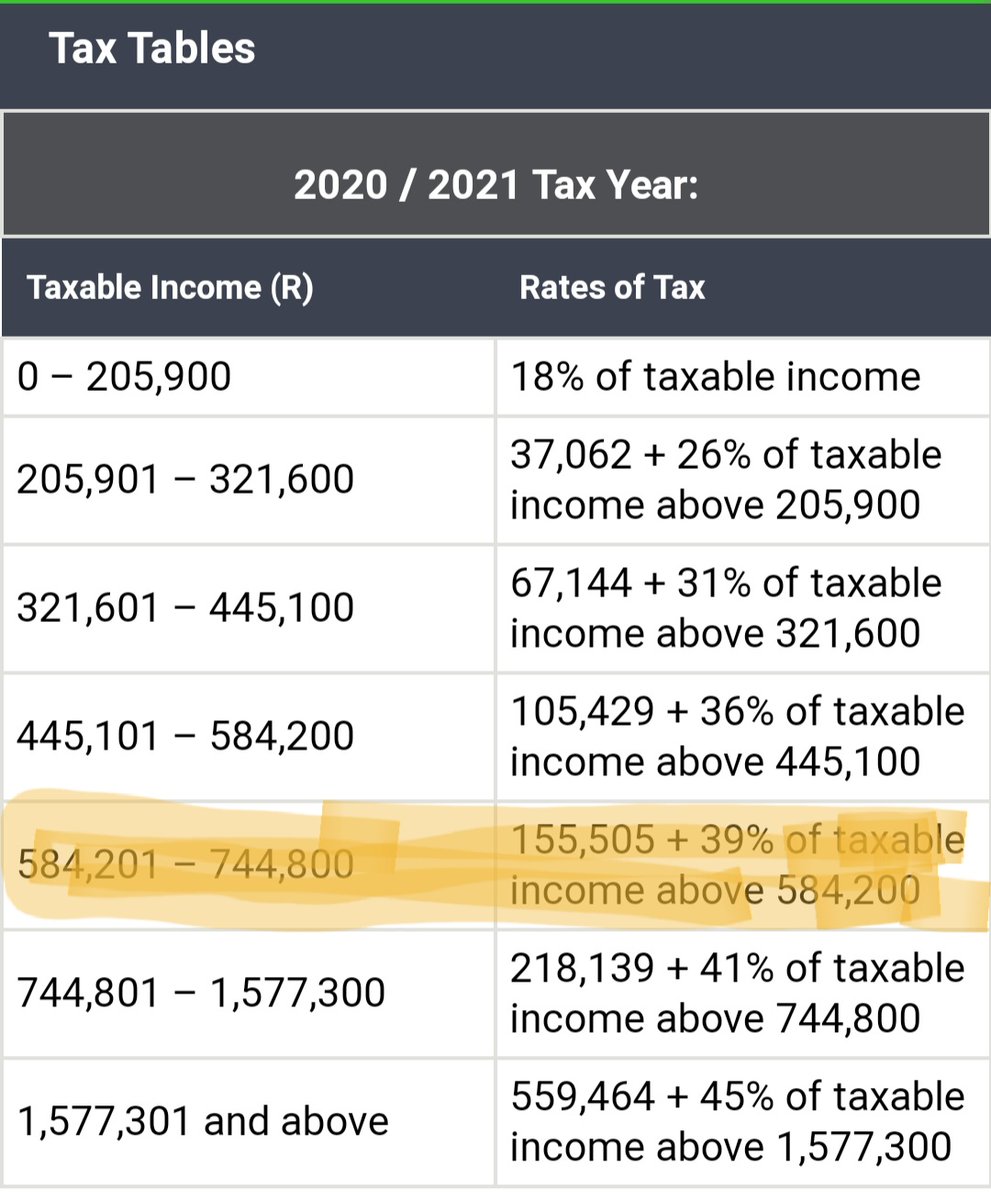

8/ Based on tax tables (see screenshot), the annual PAYE on your income is R203 035(Calculated as per tax table) because your TOTAL ANNUAL INCOME is R720 000. Therefore a total of R203 035 should have been paid to SARS in that year.

9/ Let’s go back to the 25% that each contract deducted each month & paid to SARS. You’ve cumulatively only paid R180 000 to SARS (see tweet 6). So, before taking into account any other income & deductions, you have already short paid SARS by R23 035 (i.e. R203 035 - R180 000)..

10/ Boom…you're in debt with SARS. If you can just start understanding that your 25% tax deducted per invoice/per gig/per job DOES NOT MEAN that you are in the 25% tax bracket, you will start managing your tax matters better.

Read on Twitter

Read on Twitter