UNDERSTANDING TESLA

Andrew Dickson is the chief investment officer of Albert Bridge Capital, a London-based fund manager

He has just made an excellent start at valuing Tesla’s shares

- but he needs a little help

Follow him on Twitter @albertbridgecap https://www.marketwatch.com/story/ive-pulled-out-all-the-stops-for-tesla-but-cant-find-the-upside-on-the-stock-11610117368

Andrew Dickson is the chief investment officer of Albert Bridge Capital, a London-based fund manager

He has just made an excellent start at valuing Tesla’s shares

- but he needs a little help

Follow him on Twitter @albertbridgecap https://www.marketwatch.com/story/ive-pulled-out-all-the-stops-for-tesla-but-cant-find-the-upside-on-the-stock-11610117368

Let’s take a look at where he got to

- and let’s just focus on the numbers

1. He uses 2035 as his valuation reference year, which is great

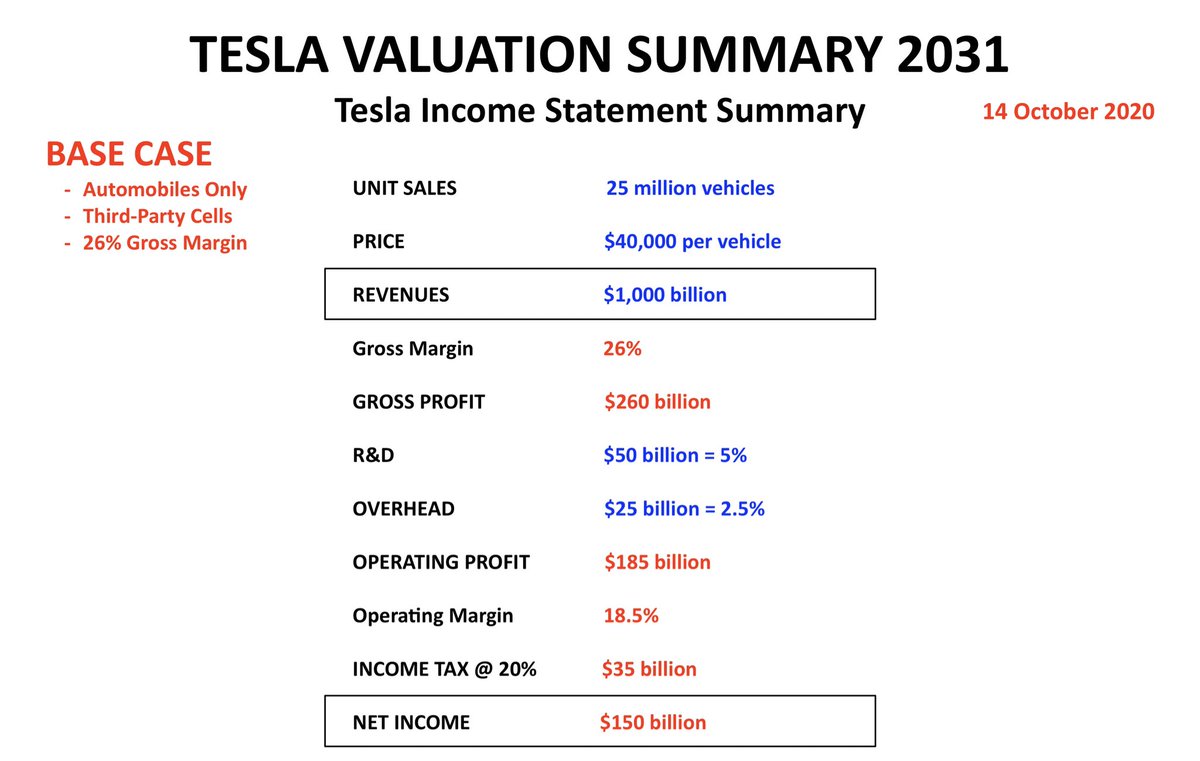

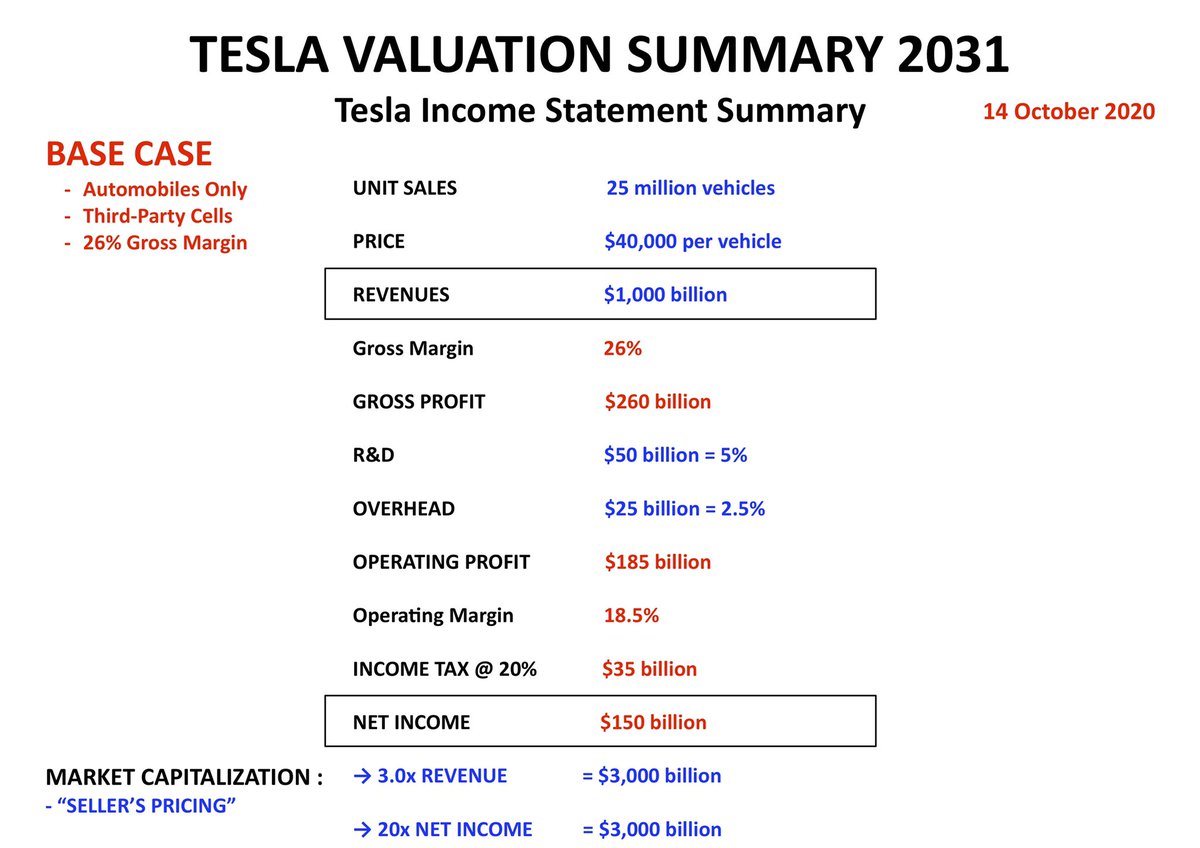

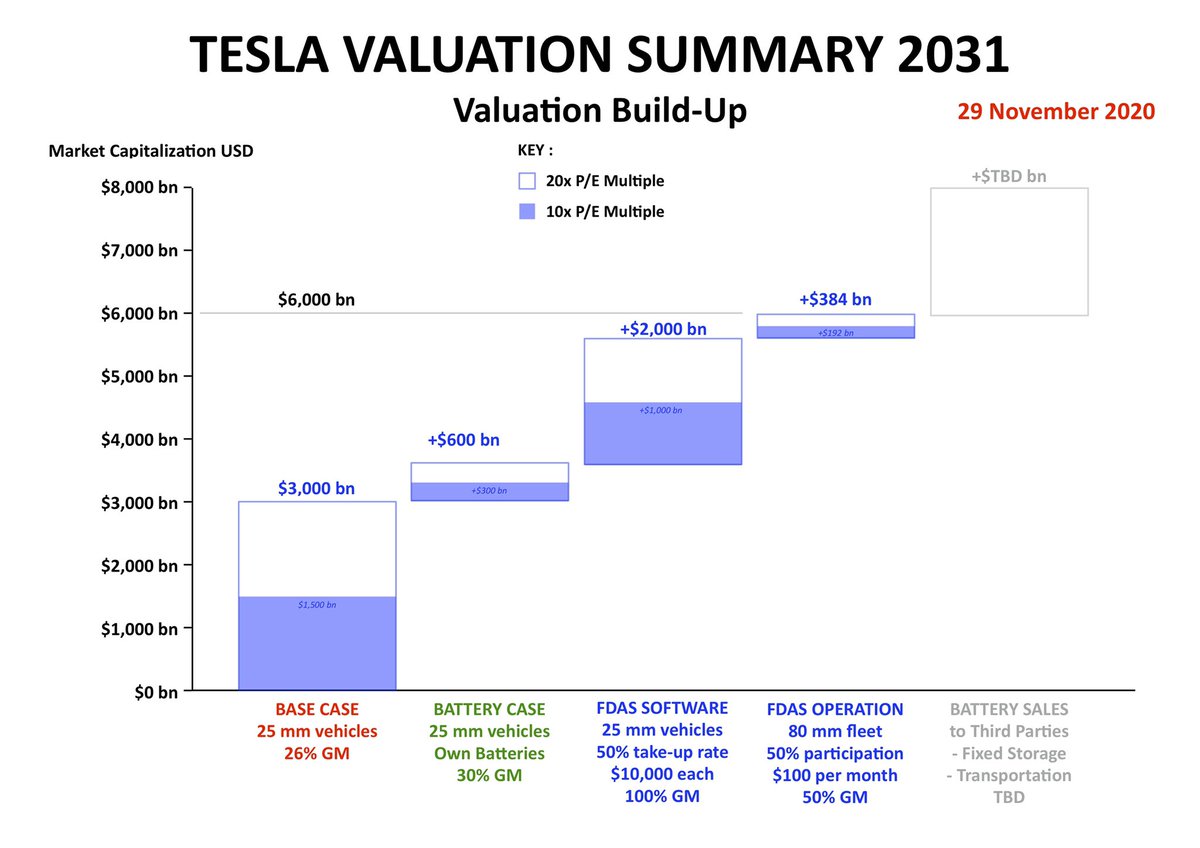

- we have used 2031 for our valuation of Tesla

- and let’s just focus on the numbers

1. He uses 2035 as his valuation reference year, which is great

- we have used 2031 for our valuation of Tesla

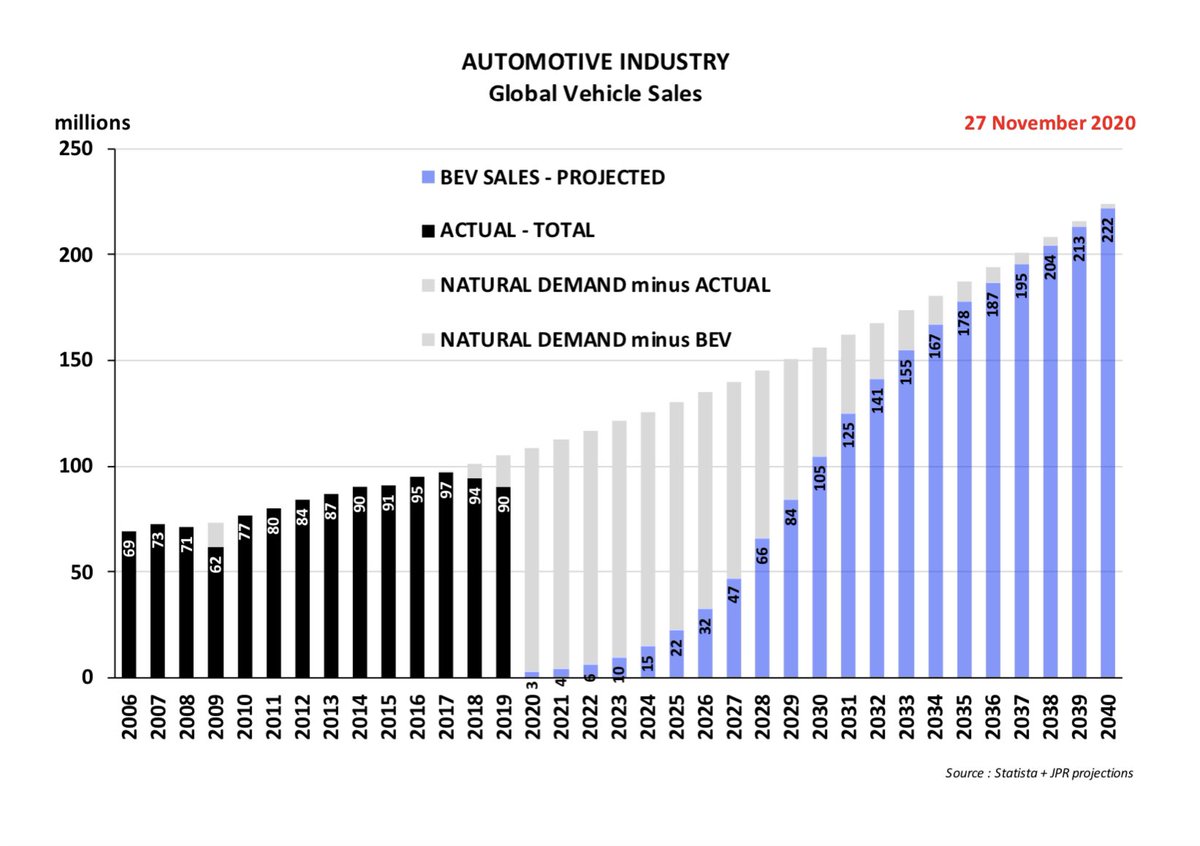

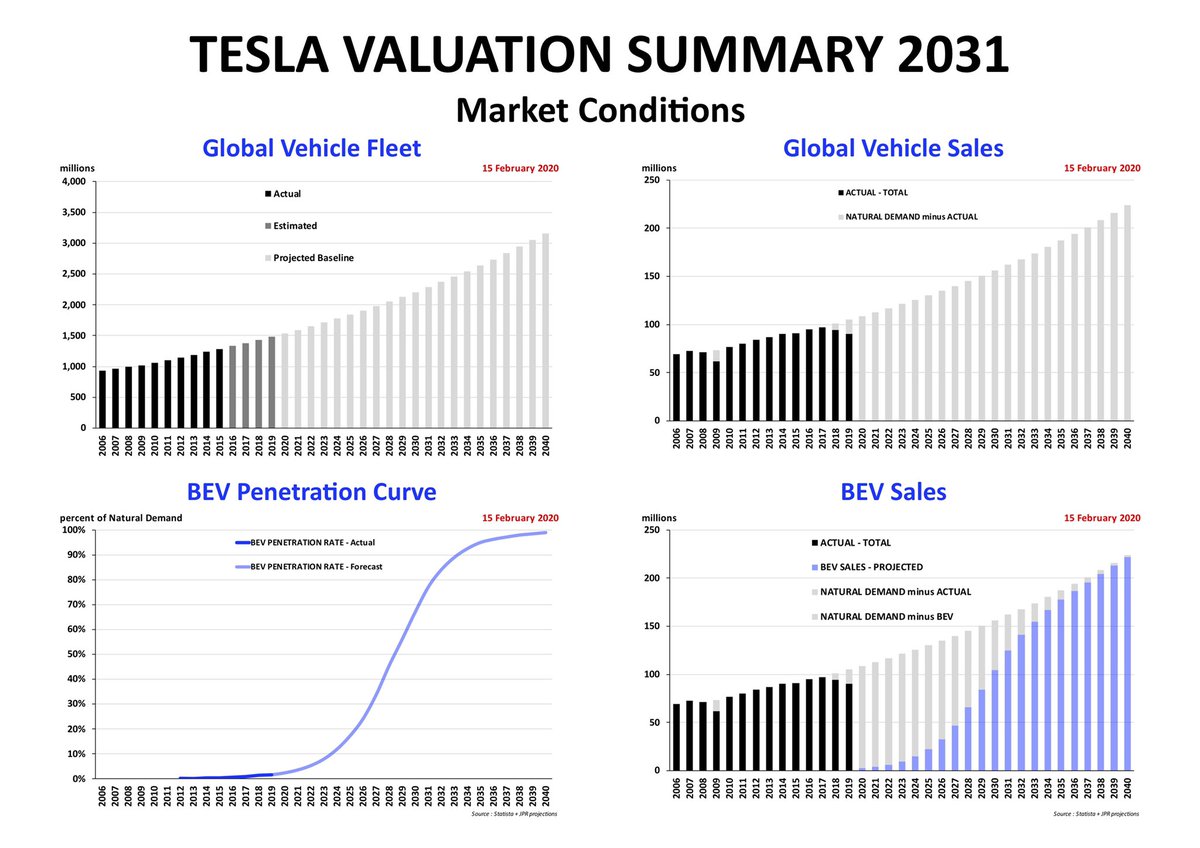

2. He sees 135 million cars and light trucks produced worldwide in 2035 and assumes that 90% of them will be fully electric

- we see 125 million BEVs produced worldwide in 2031

- we see 125 million BEVs produced worldwide in 2031

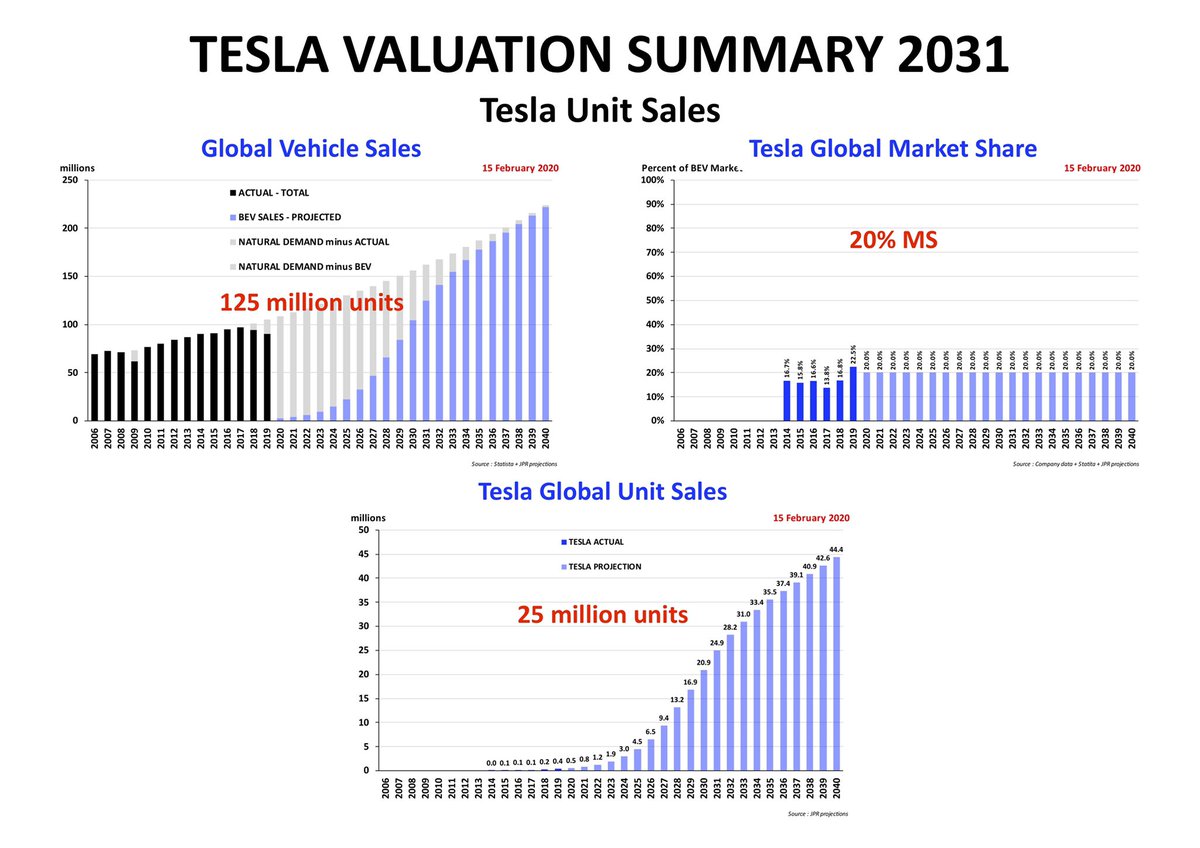

3. He assumes that Tesla will hold a 20% Global Market Share of all EVs produced around the world

- we agree

4. He sees Tesla producing 22 million vehicles in 2035

- we see Tesla selling 25 million vehicles in 2031

- we agree

4. He sees Tesla producing 22 million vehicles in 2035

- we see Tesla selling 25 million vehicles in 2031

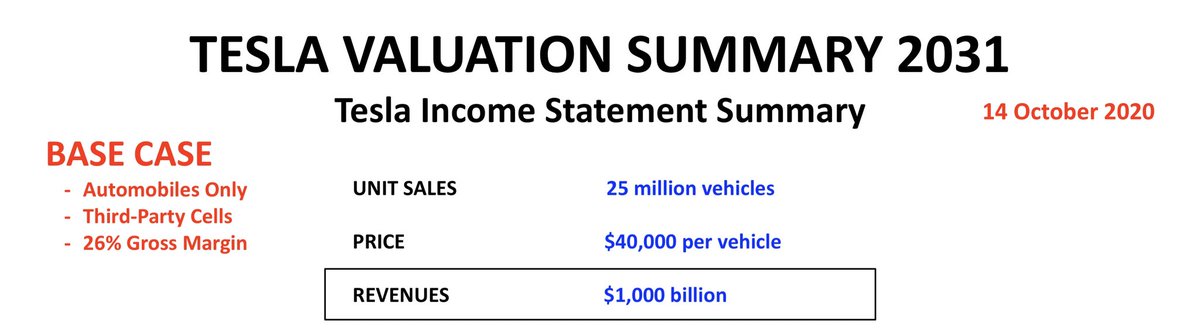

5. He assumes that Tesla will realize an average selling price of $50,000

- we are assuming $40,000 per vehicle

6. He figures that his pricing would result in Tesla having revenues of nearly $1.2 trillion dollars

- in our valuation Tesla has revenues of $1.0 trillion dollars

- we are assuming $40,000 per vehicle

6. He figures that his pricing would result in Tesla having revenues of nearly $1.2 trillion dollars

- in our valuation Tesla has revenues of $1.0 trillion dollars

7. He assumes that Tesla will realize a 9% Net Income Margin but skips over any cost breakdown to support that conclusion

- in our Base Case we see a 15% Net Income Margin based on a 26% Gross Margin and our assessment of very large scale R&D and Overhead costs

- in our Base Case we see a 15% Net Income Margin based on a 26% Gross Margin and our assessment of very large scale R&D and Overhead costs

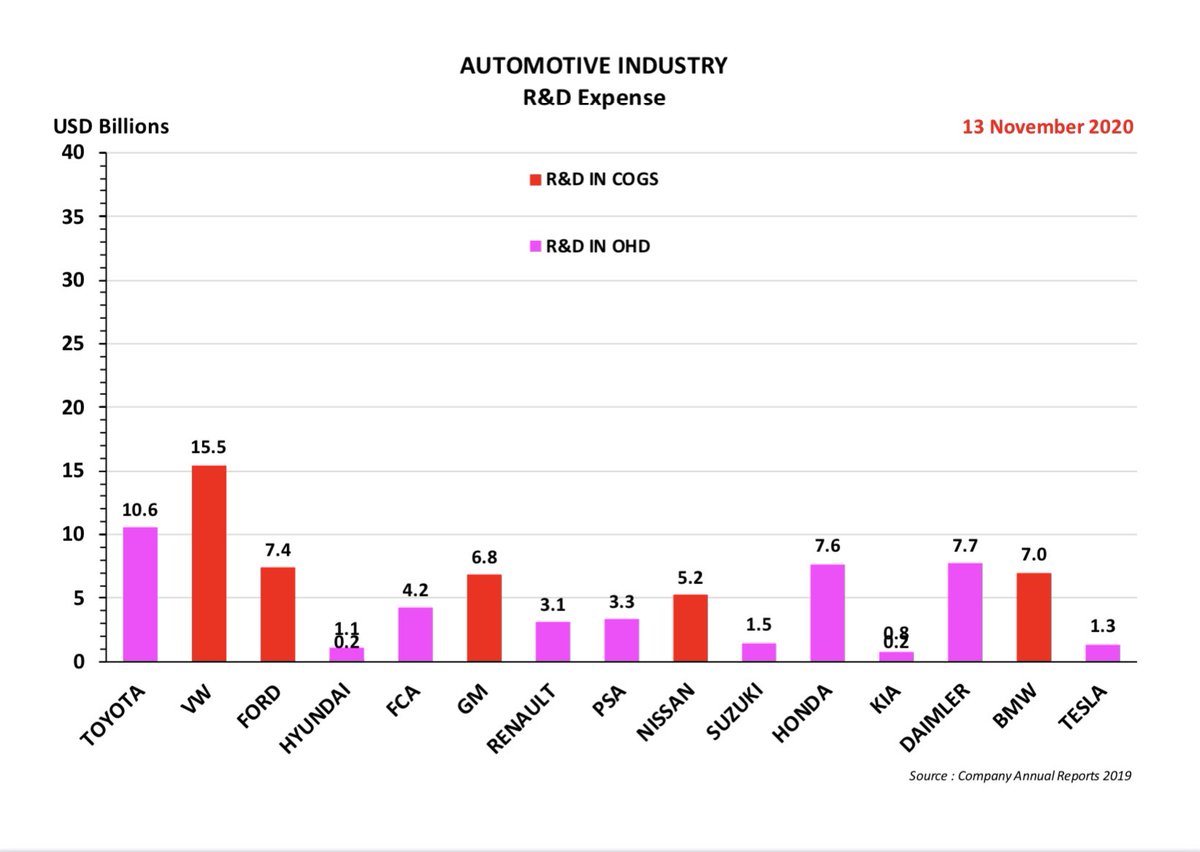

8. Our valuation allows for $50 billion of R&D spending + $25 billion of Overhead costs = $75 billion total

- Toyota currently spends $10.6 billion + $17.6 billion = $28.2 billion total

- VW currently spends $15.5 billion + $36.0 billion = $51.5 billion total

- Toyota currently spends $10.6 billion + $17.6 billion = $28.2 billion total

- VW currently spends $15.5 billion + $36.0 billion = $51.5 billion total

9. He assume that the market will value this stock with a P/E Multiple of 20x

- we agree

10. He gets a valuation of $2.2 trillion

- we get a valuation of $3.0 trillion

- we agree

10. He gets a valuation of $2.2 trillion

- we get a valuation of $3.0 trillion

11. He uses a discount rate of 10% per annum to bring this valuation back to the present

- we use a much stricter Equity Discount Rate of 15%

12. But in principle we are not that far apart on this “first cut” or Base Case analysis

- we use a much stricter Equity Discount Rate of 15%

12. But in principle we are not that far apart on this “first cut” or Base Case analysis

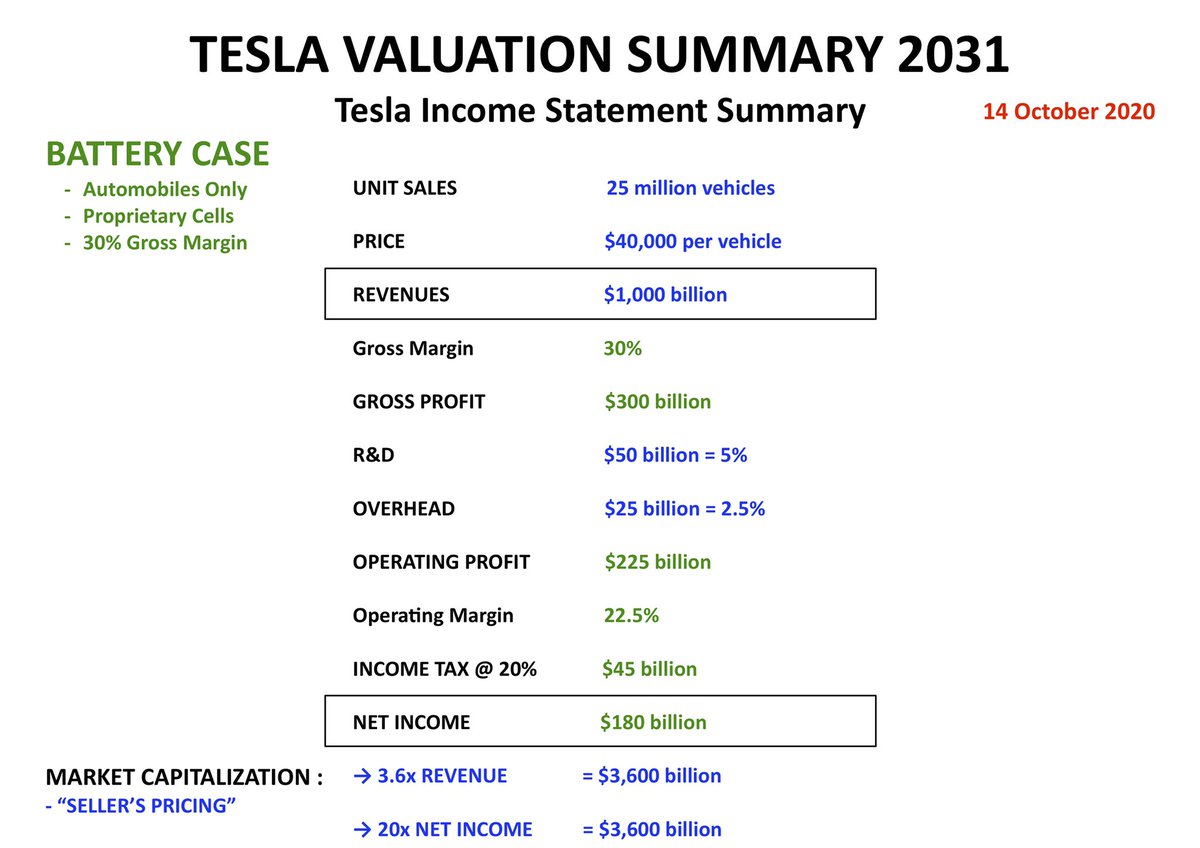

13. However, we believe there are still several other things to be recognized

- and the first is a Gross Margin enhancement from 26% to 30% as Tesla starts to use its own proprietary battery designs and manufacturing processes, which adds another $0.6 trillion to the valuation

- and the first is a Gross Margin enhancement from 26% to 30% as Tesla starts to use its own proprietary battery designs and manufacturing processes, which adds another $0.6 trillion to the valuation

14. And then there are the revenues and profits from the activation of the Full Driver Assistance Systems that are already built into the cost of each car

- using the current price of $10,000 per vehicle and a 50% takeup rate we see this adding another $2.4 trillion of value

- using the current price of $10,000 per vehicle and a 50% takeup rate we see this adding another $2.4 trillion of value

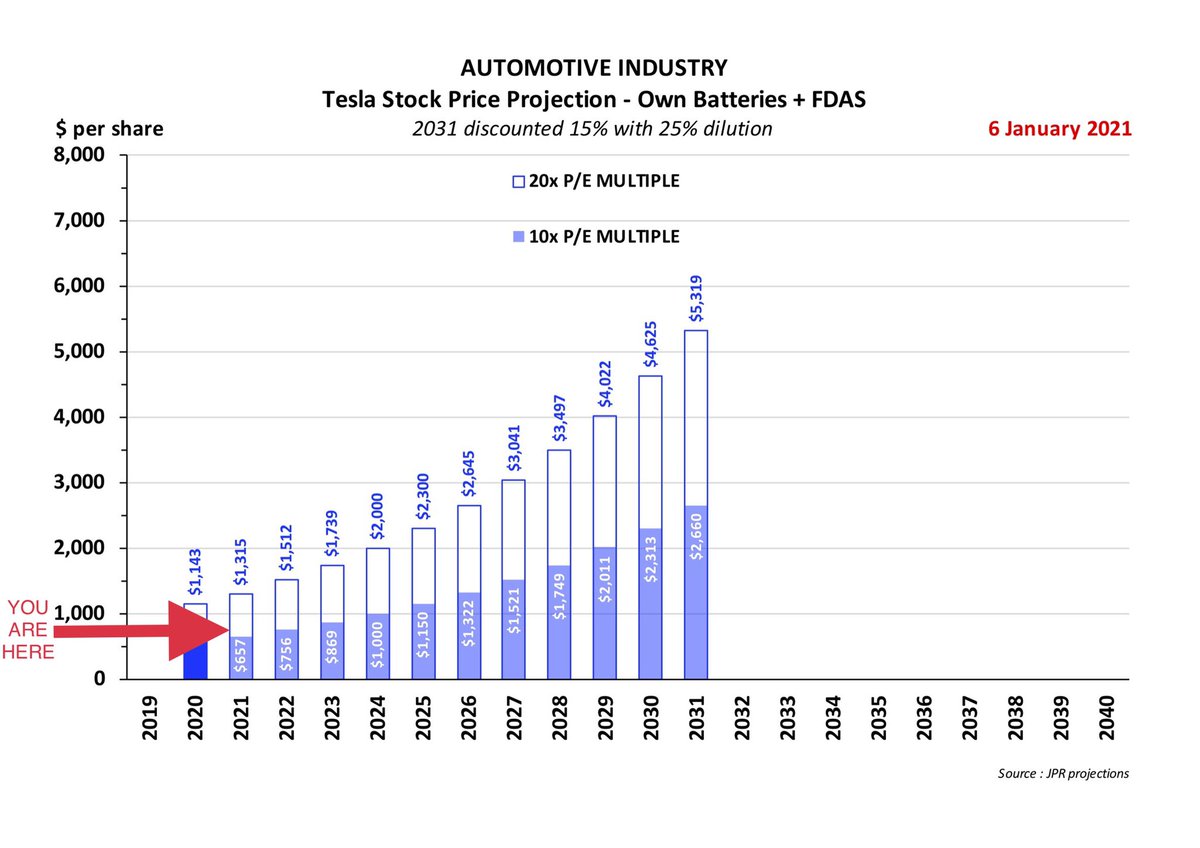

15. All of which gives us this value projection for 2031 and the discounted values for the intervening years

16. While we should note that we have included NOTHING for the existing Battery Energy Storage Systems BESS business

- nor have we allowed for any other types of Third-Party Battery Sales

- nor any of the other supporting business that are currently in their developing stages

- nor have we allowed for any other types of Third-Party Battery Sales

- nor any of the other supporting business that are currently in their developing stages

Read on Twitter

Read on Twitter