Over the weekend, astounding NFT purchases hit the chain. But how do holders such as @FLAMINGODAO achieve liquidity on their assets?

Securitized NFT baskets are likely how most investors will get exposure and that’s why we invested in @NFTX_ https://twitter.com/cryptopunksbot/status/1353058374816944134?s=20

Securitized NFT baskets are likely how most investors will get exposure and that’s why we invested in @NFTX_ https://twitter.com/cryptopunksbot/status/1353058374816944134?s=20

One of the main issues with NFTs is access to liquidity. Many people would love exposure to NFTs but don’t know how to get from start to finish in building a portfolio

Successes such as @OnRallyRd and @StockX show that securitized solutions to this problem can be powerful

Successes such as @OnRallyRd and @StockX show that securitized solutions to this problem can be powerful

These marketplaces and @iearnfinance demonstrate that a simple interface for new users/investors to access markets with technical barriers to entry can expand network usage and improve economies of scale

Passive investment vehicles often have great liquidity network effects

Passive investment vehicles often have great liquidity network effects

Currently: NFTs only work for Veblen goods — goods whose demand increases with price (e.g. Supreme) — this is a function of the auction mechanisms used by NFT sellers.

Most people don’t want the hassle of exposure via auctions, which requires research and market monitoring

Most people don’t want the hassle of exposure via auctions, which requires research and market monitoring

An ideal NFT index, like a well-constructed hedge fund, adeptly balances LP liquidity needs with the capital reqs. of the highest earning assets. While this model will first be tested with art & other Veblen goods, it is applicable to legacy financial instruments (e.g. mortgages)

Moreover, individual NFTs can’t be used as collateral for a loan in any efficient manner. Securitization in the art market is necessary for art-backed collateralized lending to work as smoothly as @compoundfinance

It’s also a $20-25B market (Deloitte) https://www.artnews.com/art-news/news/art-finance-collectors-toolkit-1202690994/

It’s also a $20-25B market (Deloitte) https://www.artnews.com/art-news/news/art-finance-collectors-toolkit-1202690994/

In ‘17-’18, we were promised real world assets on-chain, yet most of what we saw was disappointing. This was because there was nothing you could do with a security token that you couldn’t do with an equity instrument. Has this changed in 2020?

The advent of crypto-only tools like flash loans (e.g. 0 duration liens) gives tokenized assets superpowers that their equity counterparts don’t have. Need to refinance loans within a REIT? Use an @Instadapp debt swap to swap collateral for a loan in NYC with one in Singapore

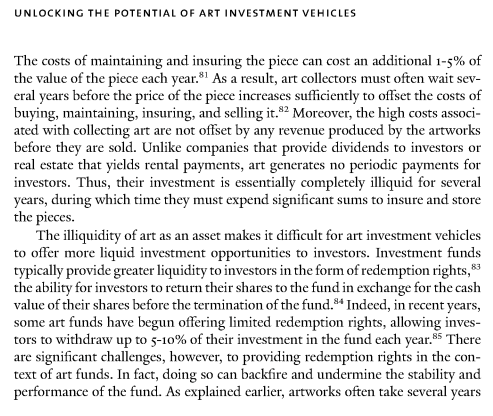

In crypto, there’s a chance to refine these vehicles to make the esoterica of the field more accessible. While art funds have notoriously difficult withdrawal conditions, NFT indices make it easier for smaller investors to participate in illiquid vehicles

https://digitalcommons.law.yale.edu/cgi/viewcontent.cgi?article=9289&context=ylj

https://digitalcommons.law.yale.edu/cgi/viewcontent.cgi?article=9289&context=ylj

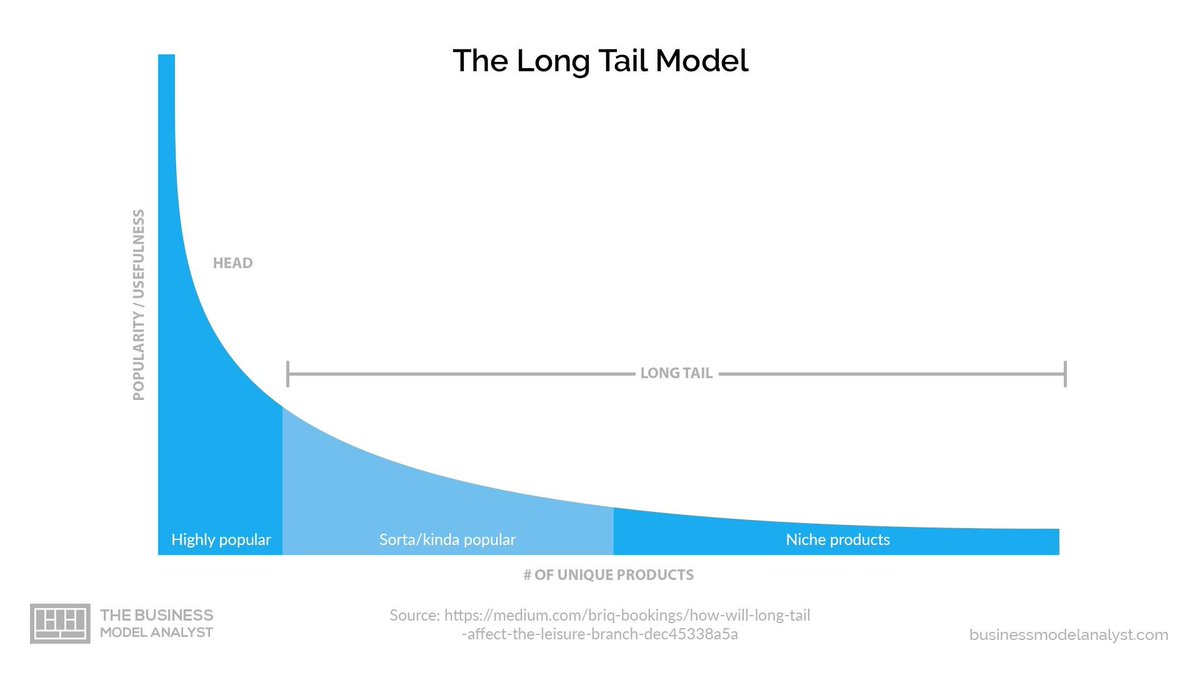

What seems like fun and games right now with NFTs could evolve into a series of stronger financial mechanisms for illiquid asset productivity. As Uniswap illustrated, servicing the long-tail of assets can be a net positive for all parties. But what about the long-tail of funds?

We are excited to be a part of the @NFTX_ community bootstrapped by @alexgausman, @scott_lew_is, and @0xChop and are looking forward to how the protocol will improve the future of finance

Read on Twitter

Read on Twitter