Survivorship Bias and Investing

How studying World War II airplanes can make you a better investor

/THREAD/

How studying World War II airplanes can make you a better investor

/THREAD/

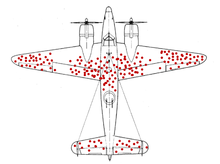

1/ During World War II, The US Army was trying to find ways to enhance the protection of their returning bomber planes that were punctured with bullet holes.

They didn't know where to put the additional armor so they tracked all the bullet holes in the returning planes.

They didn't know where to put the additional armor so they tracked all the bullet holes in the returning planes.

2/ When they plotted out the holes of all these planes, they were spread out, but largely concentrated around the tail, body, and wings.

So they decided that these plane parts needed to be retrofitted to sustain further damage.

So they decided that these plane parts needed to be retrofitted to sustain further damage.

3/ Abraham Wald, a statistician at the Statistical Research Group (SRG), had a different opinion though.

He thought that upgrading these parts would be a fatal mistake. The reason?

He thought that upgrading these parts would be a fatal mistake. The reason?

4/ The army hadn't taken into account the bullet holes from all the planes that were taken down by enemy fire and crashed.

The planes that didn’t return were damaged in different parts than those that did.

The planes that didn’t return were damaged in different parts than those that did.

5/ Specifically, the engine, which was extremely vulnerable compared to the other parts.

Once it was hit, the planes went down, and they didn’t return to their base to have their damage tracked.

Wald proposed reinforcing the areas where the returning aircrafts were untouched.

Once it was hit, the planes went down, and they didn’t return to their base to have their damage tracked.

Wald proposed reinforcing the areas where the returning aircrafts were untouched.

6/ In investing, survivorship bias is observed when failed companies are excluded from studies because they no longer exist.

It often causes the results to skew higher because only companies that were successful enough to survive until the end of the period are included.

It often causes the results to skew higher because only companies that were successful enough to survive until the end of the period are included.

7/ One example is the many investment firms that launch mutual funds only after they have been proven to be successful in-house for a few years.

8/ The rest that failed are excluded from the performance reviews and the public is not aware they even existed.

*For more on this check the thread below https://twitter.com/itsKostasWithK/status/1352952688405848064?s=20

*For more on this check the thread below https://twitter.com/itsKostasWithK/status/1352952688405848064?s=20

9/ Another example is when everyone thinks that investing in the tech sector will give you the highest returns compared to other sectors.

But that's because we take into account only the successful companies that survived and grew enormously.

But that's because we take into account only the successful companies that survived and grew enormously.

10/ For every $AMZN there are hundreds of Altavistas

For every $NFLX there are hundreds of Napsters

For every $AAPL there are hundreds of eToys

For every $NFLX there are hundreds of Napsters

For every $AAPL there are hundreds of eToys

If you liked this thread click below and retweet the first tweet, and follow to stay updated. https://twitter.com/itsKostasWithK/status/1353701165582659585?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

Read on Twitter

Read on Twitter