A quick #Thread inspired by @MoneyRehab_ breaking down the Regulation 28 commitments for RAs that I described in my most recent podcast episode.

EP27: Should You Invest In A Retirement Annuity? https://www.buzzsprout.com/1158398/7451434

EP27: Should You Invest In A Retirement Annuity? https://www.buzzsprout.com/1158398/7451434

1. I noted the following limitations in the episode:

Equities: 75%

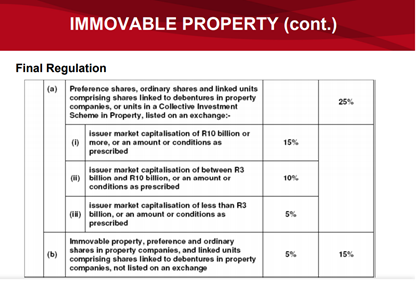

Listed Property: 25%

Offshore Exposure: 25%

Hedge Funds (HF): 10%

Private Equity (PE): 10%

Combination of HF & PE: 15%

Unlisted Equities: 10%

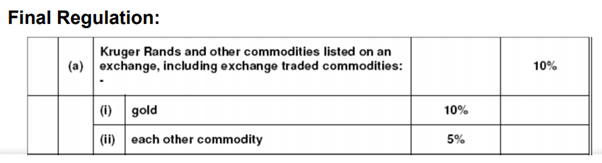

Commodities: 10%

*These are maximum limits of total fund assets.

Equities: 75%

Listed Property: 25%

Offshore Exposure: 25%

Hedge Funds (HF): 10%

Private Equity (PE): 10%

Combination of HF & PE: 15%

Unlisted Equities: 10%

Commodities: 10%

*These are maximum limits of total fund assets.

2. These limitations won’t really cross your mind or your decision-making process, because these are rules that RA fund providers must follow, however, it’s good to know the rules that they must play by.

3. So quickly, let’s just discuss the sub-limitations within each asset class (for you geeks who really want to get into the weeds).

All this info can be found on National Treasury’s’ website: http://www.treasury.gov.za/publications/other/Reg28/

All this info can be found on National Treasury’s’ website: http://www.treasury.gov.za/publications/other/Reg28/

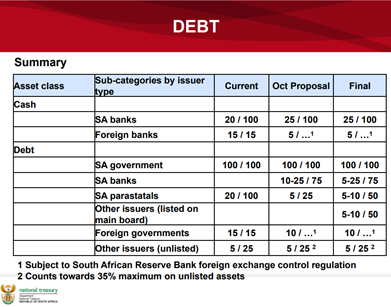

4. Firstly, let’s look at limitations on cash, cash equivalents, and debt instruments. This just regulates how much of a portfolio can be kept in certain debt instruments, ie. a fund could hold 100% in SA Government Treasuries.

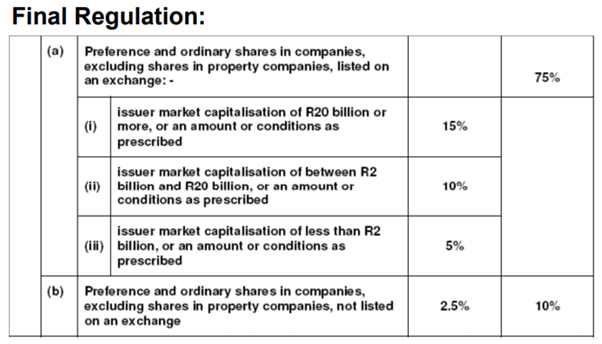

5. Now the one that most people actually care about: Equities (or stocks).

Now, Reg 28 defines equities as preference and ordinary shares so anything outside of that definition will fall into the “other asset” category.

Now, Reg 28 defines equities as preference and ordinary shares so anything outside of that definition will fall into the “other asset” category.

6. So you can see in the picture below, total funds can be allocated to a maximum of 75% but with sub-criteria.

I’m not going to explain each 1, but you can see the percent 1 single equity can take up of the allocation depending on its market cap.

I’m not going to explain each 1, but you can see the percent 1 single equity can take up of the allocation depending on its market cap.

7. For example, Naspers is valued at about R1.5 trillion, but it can only be allocated up to a maximum of 15% of the equity exposure.

But a company like Santova valued at R450 million could only be allocated up to 5%.

*In reality most funds just track an index.

But a company like Santova valued at R450 million could only be allocated up to 5%.

*In reality most funds just track an index.

9. Commodities are limited to 10% exposure overall with Gold being able to be the full 10%.

However, if other commodity exposure is desired, each commodity is limited to a maximum of 5% of the 10% allocation.

However, if other commodity exposure is desired, each commodity is limited to a maximum of 5% of the 10% allocation.

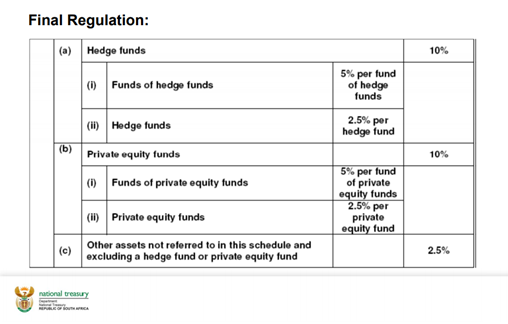

10. Then the more infamous “other asset” category can be seen below.

The difference being here that it’s possible to buy shares in an issuer investing in hedge fund funds or buy a direct stake in a hedge fund.

The difference being here that it’s possible to buy shares in an issuer investing in hedge fund funds or buy a direct stake in a hedge fund.

11. Again, whichever way the fund manager wants to spin his/her asset allocation, they must remain within the overall domestic vs foreign asset limitations and overall asset limitations.

12. You won’t really come into contact with this stuff, apart from knowing for example if a fund only has 50% equity exposure that they could go up to 75% and you want to know why it’s so low.

13. Other than that, you cannot “build” your own RA fund (apart from having a whole bunch of different funds with different assets but that sounds like a lot of admin), so these are just the rules RA fund providers must stick to.

14. Since I have to say this, I’m not a qualified financial advisor so none of this should be taken as investment advice. I’m also not a pension fund manager so take this info as my understanding of Reg 28, not the be-all-end-all.

I might be wrong, but here's a smiling dog.

I might be wrong, but here's a smiling dog.

Here's the slide deck I worked from on the National Treasury website.

http://www.treasury.gov.za/publications/other/Reg28/reg%2028%20Public%20forums%20rev%202.pdf

http://www.treasury.gov.za/publications/other/Reg28/reg%2028%20Public%20forums%20rev%202.pdf

Read on Twitter

Read on Twitter